1/ Somany Home Innovation Limited

Proxy play company to real estate

#SHIL #HINDWARE

Attempt to analyse the company as a movie rather than a static picture.

Motivated by @ishmohit1.

"Legacy business nurturing the baby segments"

Proxy play company to real estate

#SHIL #HINDWARE

Attempt to analyse the company as a movie rather than a static picture.

Motivated by @ishmohit1.

"Legacy business nurturing the baby segments"

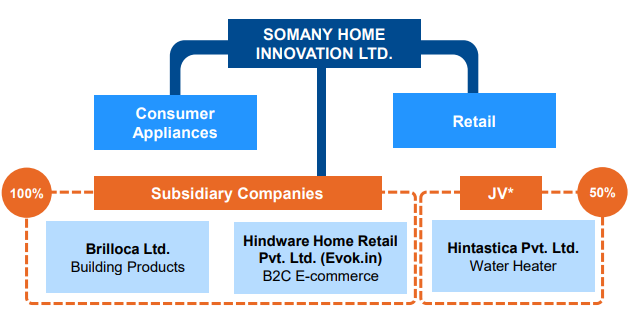

2/ About the Company

SHIL was formed after the demerger of HSIL to separate retail and customer products by the end of CY19. Brilloca is a fully owned subsidiary.

SHIL was formed after the demerger of HSIL to separate retail and customer products by the end of CY19. Brilloca is a fully owned subsidiary.

3/ Careful to keep business asset-light and prefers to act as contract manufacturer so that management can focus to improve distribution and marketing.

4/ SHIL's legacy business is building material (sanitaryware) under the famous brand HINDWARE. HINDWARE is one of the oldest and most famous brands in this industry.

6/ -[1]- 🚽🛁 🧱Building materials ~70% 🚽🛁 🧱

They operate in this segment for more than 60 years and excelled to gain a major market share of 40%. The market size of sanitaryware is considered to be 4000Cr among the organised players.

They operate in this segment for more than 60 years and excelled to gain a major market share of 40%. The market size of sanitaryware is considered to be 4000Cr among the organised players.

7/ CERA, KAJARIA CERAMICS, and SHIL cater to the most organised players market.

8/ Apart from HINDWARE SHIL managed to build brands among other brands across different price segments.

Luxury: #QUEO

Premium: #HINDWARE

Economical: #BENELAVE

Luxury tiles: #NEOM

Luxury: #QUEO

Premium: #HINDWARE

Economical: #BENELAVE

Luxury tiles: #NEOM

9/ - This vertical has an EBIT margin of 8~10% and runs profitable but the growth seems to flattish for the last 2 years.

10/ - Distribution reach:

Retail outlets >7000.

Indirect reach >20,000.

Distribution partners >220

Brand outlets >250

Institutional clients >1100

Retail outlets >7000.

Indirect reach >20,000.

Distribution partners >220

Brand outlets >250

Institutional clients >1100

11/ -[2]-📺🔌💡🖥️ Consumer Appliances 📺🔌💡🖥️

Leveraging the brand HINDWARE, SHIL successfully launched sub-brands in household appliances.

Leveraging the brand HINDWARE, SHIL successfully launched sub-brands in household appliances.

12/ - Aggressive investments for product design, branding, and innovations have already been done during the past 2-3 years.

- Managed to get significant market share.

#2 Player in the kitchen chimney

#5 Player in Air Cooler

#6 Player in Water heater

- Managed to get significant market share.

#2 Player in the kitchen chimney

#5 Player in Air Cooler

#6 Player in Water heater

13/ - Entered into kitchen fitting and furniture segment via marketing tie-up with Forementi & Giovenzana. (brand FGV powered by Hindware)

14/ -[2]-🚿🛋️🛏️Pipe Fitting and Furniture 🚿🛋️🛏️

- #TRUFLO by Hindware is the brand operating in the pipe fitting segment.

- Able to make own grip in the segment despite newly entered.

- EBIT margins are standing at the lower end still, 9%.

- #TRUFLO by Hindware is the brand operating in the pipe fitting segment.

- Able to make own grip in the segment despite newly entered.

- EBIT margins are standing at the lower end still, 9%.

15/ - Brand #EVOK operates in the furniture retail segment.

- Still in the early stages of the segment.

- Looking forward to focusing on the franchise model and e-commerce.

- Still in the early stages of the segment.

- Looking forward to focusing on the franchise model and e-commerce.

16/ 👁️👁️Promoter Guidance for next 8-14 Quarters 👁️👁️

- Building Material 🚽🛁 🧱

Expand EBITDA Margins to 15% from 9%

Growth of 10% in revenue.

- Building Material 🚽🛁 🧱

Expand EBITDA Margins to 15% from 9%

Growth of 10% in revenue.

17/ - 📺🔌💡🖥️ Consumer Appliances

- EBIT just turned positive in recent quarters.

- Asset light business model might help them to improve the EBITDA and EBITDA Margins once reached critical mass.

- EBITDA growth 30%.

- EBIT just turned positive in recent quarters.

- Asset light business model might help them to improve the EBITDA and EBITDA Margins once reached critical mass.

- EBITDA growth 30%.

18/ - Pipe Fitting and Retail 🚿🛋️🛏️

- EBIT Margins will be expanded as they reach the critical mass.

- Revenue growth of 26% expected.

- EBIT Margins will be expanded as they reach the critical mass.

- Revenue growth of 26% expected.

19/ Conclusion:

- SHIL identified the growth potential of the legacy vertical (sanitaryware) is getting limited due to the consolidated nature of the organised market.

- SHIL identified the growth potential of the legacy vertical (sanitaryware) is getting limited due to the consolidated nature of the organised market.

20/ Being the leader of the segment with a successful business model, growth may get limited to (+-2%) of market growth.

21/ - Gradually entering into the new segments leveraging the leading brand name HINDWARE and existing distribution network is perfect combincation to scale up those verticals as well.

22/ - Focused to keep the business model asset-light might benefit in the long run.

- Building Material vertical's profitability at the moment nurturing the new segments.

- Building Material vertical's profitability at the moment nurturing the new segments.

23/ - Initial quarter suppressed the return ratios, but, now, start to improve as the new segments achieve the critical mass.

24/ - The decision made by SHIL is actually building the business vertical around their competency by perfectly leveraging their advantages in the industry and allocating capital in a significantly good manner.

25/ Technical View

Currently in consolidation mode.

Resistance zone marked in Red Line (470-480).

The best way to enter is a buy now is via staggered manner.

Currently in consolidation mode.

Resistance zone marked in Red Line (470-480).

The best way to enter is a buy now is via staggered manner.

• • •

Missing some Tweet in this thread? You can try to

force a refresh