Airdrop is life, airdrop is love

🧵Thread on @fraxfinance and their upcoming, very awaited $FPI airdrop🪂. We'll cover:

• What is @fraxfinance

• $FRAX: A fractional-algorithmic stablewhat?

• $FXS

• 1st ever crypto native CPI

• $FPI Airdrop details👀

Let's do this

(1/22 )

🧵Thread on @fraxfinance and their upcoming, very awaited $FPI airdrop🪂. We'll cover:

• What is @fraxfinance

• $FRAX: A fractional-algorithmic stablewhat?

• $FXS

• 1st ever crypto native CPI

• $FPI Airdrop details👀

Let's do this

(1/22 )

2/ @fraxfinance - 1st frictional-algorithmic stablecoin protocol. It is currently implemented in ETH, with cross-chain integrations already underway

The protocol's goal is to create & provide scalable, decentralized, algorithmic money instead of fixed-supply digital assets.

The protocol's goal is to create & provide scalable, decentralized, algorithmic money instead of fixed-supply digital assets.

3/@fraxfinance has fully on-chain oracles from @uniswap & @chainlink .

Its structure consists on 2 (now 3) native tokens:

• $FRAX

• $FXS

Very soon:

• $FPI

Its structure consists on 2 (now 3) native tokens:

• $FRAX

• $FXS

Very soon:

• $FPI

4/ $FRAX & Arbitrage

$FRAX: 1st fractional-algorithmic stablecoin, meaning part of the supply is backed by collateral & part of the supply is algorithmic (floating or unbacked)

$FRAX was named after the fractional algorithmic mechanism (sounds complicated; it isn't)

$FRAX: 1st fractional-algorithmic stablecoin, meaning part of the supply is backed by collateral & part of the supply is algorithmic (floating or unbacked)

$FRAX was named after the fractional algorithmic mechanism (sounds complicated; it isn't)

5/ The ratio of both collateralized & algo supply depends on the market's pricing of $FRAX:

•If $FRAX is trading >$1, collateral ratio decreases

•If $FRAX is trading <$1, collateral ratio increases

How is this achieved?

• Creating arbitrage opportunities for users & more

•If $FRAX is trading >$1, collateral ratio decreases

•If $FRAX is trading <$1, collateral ratio increases

How is this achieved?

• Creating arbitrage opportunities for users & more

6/ $FRAX can ALWAYS be minted or redeemed from the system for $1 value.

This creates an opportunity for artibtrage traders to:

• cop some $FRAX @ discount and redeem' em for $1 value

• mint some $FRAX when @ premium by only placing $1 of value

This creates an opportunity for artibtrage traders to:

• cop some $FRAX @ discount and redeem' em for $1 value

• mint some $FRAX when @ premium by only placing $1 of value

7/ $FXS: Frax Shares

$FXS is a non-stable, governance and utility token in @fraxfinance

The initial supply of $FXS is set at 100 million tokens, but the amount in circulation will be deflationary as long as the demand for $FRAX grows (similarish to $LUNA & $UST)

$FXS is a non-stable, governance and utility token in @fraxfinance

The initial supply of $FXS is set at 100 million tokens, but the amount in circulation will be deflationary as long as the demand for $FRAX grows (similarish to $LUNA & $UST)

8/ Why similarish to $LUNA and $UST?

Higher demand for $FRAX = Higher price for $FXS

Simultaneously, the higher $FXS market cap's grows, the higher the ability of @fraxfinance to keep $FRAX stable grows as well.

⚠️Buckle up, we're about to get to the interesting stuff

Higher demand for $FRAX = Higher price for $FXS

Simultaneously, the higher $FXS market cap's grows, the higher the ability of @fraxfinance to keep $FRAX stable grows as well.

⚠️Buckle up, we're about to get to the interesting stuff

9/ This is where $FXS gets really sexy.

$veFXS: You can lock your $FXS and get $veFXS, which earns special boosts, governance rights, and last but DEFINITELY not least...

Them AMO profits, BABY

$veFXS: You can lock your $FXS and get $veFXS, which earns special boosts, governance rights, and last but DEFINITELY not least...

Them AMO profits, BABY

10/ What are AMO's tho?

AMOs are "Algorithmic Market Operations Controller", which can sounds a bit confusing but is just an autonomous contract that enables strategies for the use of $FXS collateral as follows👇

AMOs are "Algorithmic Market Operations Controller", which can sounds a bit confusing but is just an autonomous contract that enables strategies for the use of $FXS collateral as follows👇

11/ Every AMO has 4 properties:

• BuyBack: Lowers the CR when there's overcollateralization

• Market Ops: Doesn't change the already-in-equilibrium CR

• Recollateralization: Increases the CR when undercollateralized

• FXS1559: Defines how much $FXS can be burned with.....

• BuyBack: Lowers the CR when there's overcollateralization

• Market Ops: Doesn't change the already-in-equilibrium CR

• Recollateralization: Increases the CR when undercollateralized

• FXS1559: Defines how much $FXS can be burned with.....

12/ profits above the target Collateral Ratio (CR)

These AMOs use protocols where funds can be withdrawan at any time & at a 1:1 ratio

Some of the investment alteratives employed by AMOs are @CurveFinance , @Uniswap , hedge against formers, Frax Lending, and more

These AMOs use protocols where funds can be withdrawan at any time & at a 1:1 ratio

Some of the investment alteratives employed by AMOs are @CurveFinance , @Uniswap , hedge against formers, Frax Lending, and more

13/ $FPI: Frax Consumer Index

$FPI aims to be the first crypto native version of the CPI (Consumer Price Index)

Basically, a stablecoin that enables a stable standard of living.

Unlike the USD, $FPI aims to never lose purchasing power relative to the cost of living

$FPI aims to be the first crypto native version of the CPI (Consumer Price Index)

Basically, a stablecoin that enables a stable standard of living.

Unlike the USD, $FPI aims to never lose purchasing power relative to the cost of living

14/ Just holding $FPI in your wallet (any wallet) will have the same effect as staking stablecoins for yield at the guaranteed inflation rate.

According to @samkazemian there will also be places to stake your $FPI in order to get more yield on top.

According to @samkazemian there will also be places to stake your $FPI in order to get more yield on top.

15/ Now, the reason why you're probably reading this thread...

$FPI AIRDROP DETAILZ

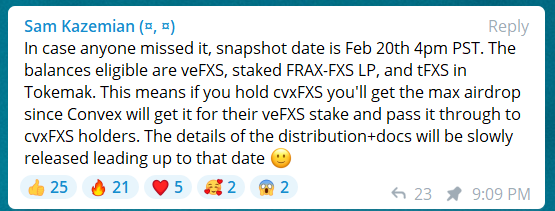

SNAPSHOT DATE: FEB 20th

HOW TO GET THE AIRDROP?

- You need to hold any of the following:

• $cvxFXS

• $veFXS

• $FRAX - $FXS LP

• $tFXS

$FPI AIRDROP DETAILZ

SNAPSHOT DATE: FEB 20th

HOW TO GET THE AIRDROP?

- You need to hold any of the following:

• $cvxFXS

• $veFXS

• $FRAX - $FXS LP

• $tFXS

16/ We already know what's $veFXS, but what the heck are the others?

$cvxFXS: This is what you get in return of locking your $FXS in @ConvexFinance

Since Convex will lock any deposited FXS 4 years, $cvxFXS holders will be eligible 4 the $FPI airdrop at the max. pos. multiplier

$cvxFXS: This is what you get in return of locking your $FXS in @ConvexFinance

Since Convex will lock any deposited FXS 4 years, $cvxFXS holders will be eligible 4 the $FPI airdrop at the max. pos. multiplier

17/ $cvxFXS staking will not be immediately live, nor will staking LP tokens from @fraxfinance

$cvxFXS tokens won't be convertible back 2 $FXS on Convex. There'll be a liquidity pools avble on Curve 2 swap between them. Conversion rates will fluctuate based on demand for either

$cvxFXS tokens won't be convertible back 2 $FXS on Convex. There'll be a liquidity pools avble on Curve 2 swap between them. Conversion rates will fluctuate based on demand for either

18/ $FRAX - $FXS LPs

Liquidity provider tokens that allow you provide liquidity to the pools in return of $FXS rewards

** $veFXS holders will get an additive boost to their weight when farming

Liquidity provider tokens that allow you provide liquidity to the pools in return of $FXS rewards

** $veFXS holders will get an additive boost to their weight when farming

19/ $tFXS

$tFXS is @TokenReactor 's locked version of $FXS

All Token Reactor deposits give you 1:1 tABC assets that are a claim on the underlying deposited assets

Here's their platform: tokemak.xyz

$tFXS is @TokenReactor 's locked version of $FXS

All Token Reactor deposits give you 1:1 tABC assets that are a claim on the underlying deposited assets

Here's their platform: tokemak.xyz

20/ Details about the distribution haven't been shared yet, but even during this lil TVL bloodbath, $FRAX TVL numbers for the day, week, and month all in green🟢🟢🟢

We could assume the disconnection bw the other protocols' TVL net flow & $FRAX's is due to interest in $FPI's AD

We could assume the disconnection bw the other protocols' TVL net flow & $FRAX's is due to interest in $FPI's AD

21/ If this model reminds u of the Curve Wars, is bc @fraxfinance was/is indeed in it. That's a thread for another day, but here's a very short insight on Frax's position in the Curve Wars, shared by @Snowsledge0x

https://twitter.com/Snowsledge0x/status/1457526482201288707

22/ If you liked this thread, don't forget to hit RT, Like, or to follow @josefabregab

Shoutout to @DefiMoon for the remindoooor‼️

✌️

Shoutout to @DefiMoon for the remindoooor‼️

✌️

• • •

Missing some Tweet in this thread? You can try to

force a refresh