#SanseraEngineering

Would like to cover a newly listed Auto Anc co, which is unique in the sense, that all the technology used, is inhouse by its ingenious founder S Sekhar Vasan who made Sansera What it is today.

Let's start

(1/N)

Would like to cover a newly listed Auto Anc co, which is unique in the sense, that all the technology used, is inhouse by its ingenious founder S Sekhar Vasan who made Sansera What it is today.

Let's start

(1/N)

Co manufactures complex & critical precision engineered components & caters to both Automotive & Non Auto sector including offroad, agriculture & Aerospace sector.

(2/N)

(2/N)

Co is the largest supplier of connecting rods, rocker arms & gear shifter forks for 2W Vehicles & largest supplier of connecting rods & rocker arms for light vehicles.

(3/N)

(3/N)

S Shekhar Vasan is the founder of the co, An IITian who developed process for rocker arms for Maruti during Maruti’s entrance in India.

Co is niche in a way, all tech to develop these auto components is inhouse, with no tie up with any co, all the genius of S Shekhar Vasan

(4/N)

Co is niche in a way, all tech to develop these auto components is inhouse, with no tie up with any co, all the genius of S Shekhar Vasan

(4/N)

Interesting Fact:

Toyota wanted to have inhouse plant in India for connecting rods, when they learnd abt an existing facility in India making these rods, a team of 200 executives visited this facility (Sansera Engineering), & decided to source the rods frm Sansera.

(5/N)

Toyota wanted to have inhouse plant in India for connecting rods, when they learnd abt an existing facility in India making these rods, a team of 200 executives visited this facility (Sansera Engineering), & decided to source the rods frm Sansera.

(5/N)

Co has a pretty diverse mix of segments it operates in. 82 pct sales come from Auto ICE, 7 pct from Auto Tech Agnostic & EV & 11 pct from Non Auto including offroad, Agriculture & Aerospace

Around 65 pct biz comes from India & rest from Exports

(6/N)

Around 65 pct biz comes from India & rest from Exports

(6/N)

Let's see how future looks like for Sansera:

Over the next five years, the company is targeting an enhanced revenue base with Auto-ICE contributing about 60%, Auto tech agnostic and xEV growing to about 15% and Non-Auto growing to about 25%

(7/N)

Over the next five years, the company is targeting an enhanced revenue base with Auto-ICE contributing about 60%, Auto tech agnostic and xEV growing to about 15% and Non-Auto growing to about 25%

(7/N)

Co is putting up a new facility dedicated for both hybrid & electric component in one of their current plants & expect it to commission during FY22.

(8/N)

(8/N)

Co is planning a GF manu facility in B'lore, dedicated to Aero and Defense and expect it to be commissioned during the next financial year.

Co expects to have substantial orders from the defense sector by the time they complete this facility and get ready fr production

(9/N)

Co expects to have substantial orders from the defense sector by the time they complete this facility and get ready fr production

(9/N)

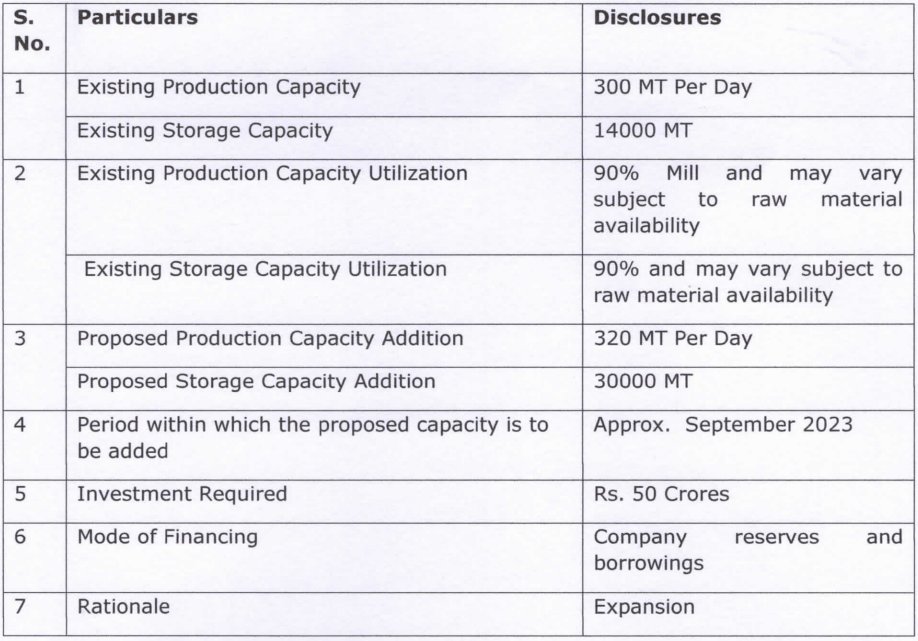

Co is planning a capex of 250 crores in next 3 years, out of which 25 pct will go into existing legacy components, 60 pct would go into EV, Non Auto Tech Agnostic & Non Auto biz & rest for tech enhancement & maintenance

(10/N)

(10/N)

Most of the capacities of the co are fungible, which allows the co to use their facilities as per the demand in the respective segments they operate in.

On EVs: Co is already having multiple order with 2W EV OEMs & 3W.

(11/N)

On EVs: Co is already having multiple order with 2W EV OEMs & 3W.

(11/N)

Hope you liked the info on this very niche co in Auto Anc space.

Please like & retweet the top tweet if you feel the info is helpful.

@AnishA_Moonka

@aditya_kondawar

@nid_rockz

@Shashank1171

@shubhfin

@Fibonalysis

@JstInvestments

Please like & retweet the top tweet if you feel the info is helpful.

@AnishA_Moonka

@aditya_kondawar

@nid_rockz

@Shashank1171

@shubhfin

@Fibonalysis

@JstInvestments

• • •

Missing some Tweet in this thread? You can try to

force a refresh