The gas that transits Ukraine today mostly ends up in Italy. Here are some numbers I'm looking at when thinking about Italian energy security.

tl;dr: Italy's strategic stocks would be a lifesaver if gas flows through Ukraine were interrupted.

tl;dr: Italy's strategic stocks would be a lifesaver if gas flows through Ukraine were interrupted.

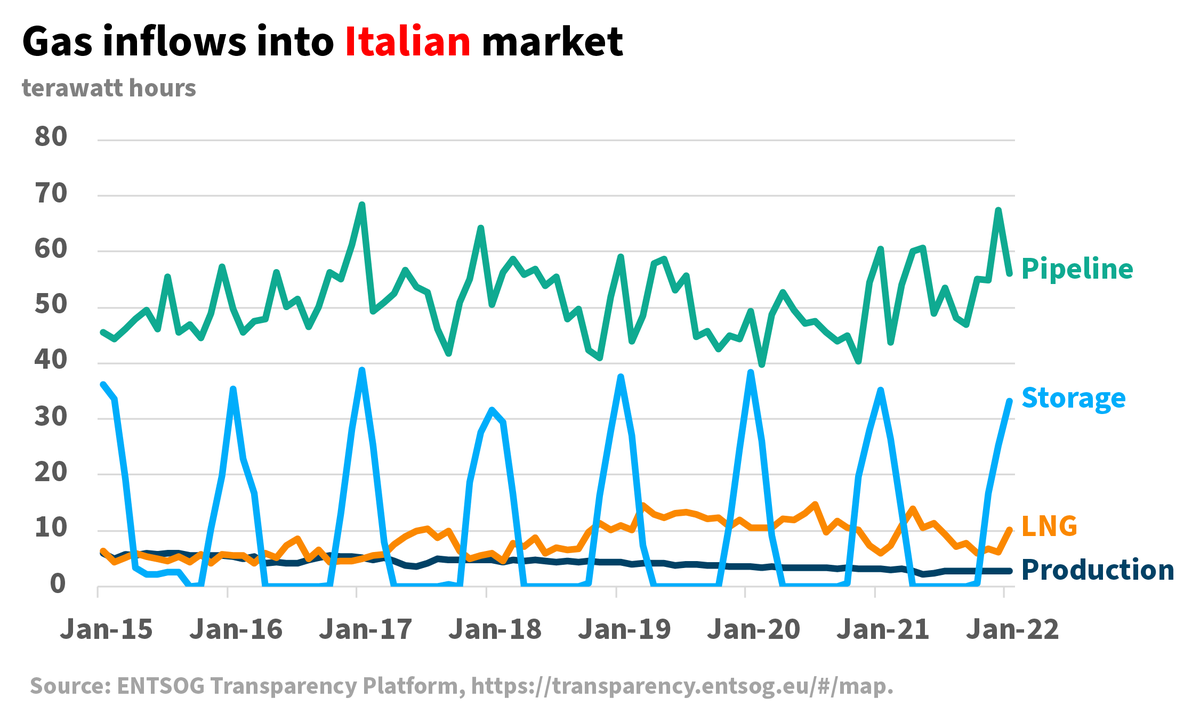

Italy meets winter demand through storage and pipeline imports. LNG is important but small relative to those other flows. Storage, in particular, is key. At times, storage has delivered almost as much as international pipelines.

Russia is Italy's largest supplier but Algeria is not far behind. In January 2022, in fact, Algeria delivered more gas than Russia (as flows from Russia declined). Other supply sources are important too, but no source, on its own, can match what Russia and Algeria deliver.

Russia delivers anywhere from 15 to 30 TWh per month to Italy. LNG was already at 10 TWh in January, and has only ever reached 14 TWh. The key to offsetting a loss in Russian supples will be storage. Commercial stocks are only about 30TWh—the balance is strategic stocks.

In short, Italy is demonstrating the wisdom and power of strategic gas storage. At this moment, strategic reserves would be essential in offsetting a loss in Russian gas flows when alternatives are more limited. A real lesson for energy security. Fin.

• • •

Missing some Tweet in this thread? You can try to

force a refresh