I post a lot about why I think Opportunity Zone investing is by far the most tax efficient method of investing in Real Estate. The incentives were meant to be powerful.

The goal of the legislation was to bring a wave of patient money into left-behind communities

Thread below:

The goal of the legislation was to bring a wave of patient money into left-behind communities

Thread below:

There are blighted areas of most cities and towns. Unemployment, lack of access to healthcare, education, groceries, and general disinvestment

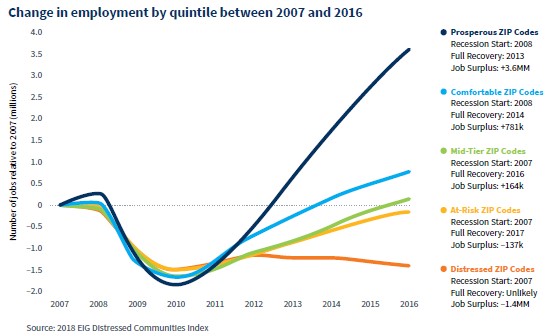

The big economic growth since 2010 has been uneven and that disparity can be stratified clearly by zip code (and census tract)

The big economic growth since 2010 has been uneven and that disparity can be stratified clearly by zip code (and census tract)

In 2015, Jared Bernstein, then VP Biden’s chief economic advisor, & Kevin Hassett, Trump’s future chief economic advisor, began advocating long-term private-sector investments in low-income areas as the solution to the reality that American communities were being left behind

This led to the bipartisan Investing in Opportunity Act, introduced in April 2016 and championed by Sens. Tim Scott (R-S.C.) and Cory Booker (D-N.J.) and Reps. Ron Kind (D-Wis.) and Pat Tiberi (R-Ohio), who led a coalition of nearly 100 cosponsors from both parties

Nearly 2 years after passage, and after 2 rounds of regulations – the U.S. Dept of the Treasury and IRS released final OZ regulations in December 2019, which was the real starting gun for this new marketplace.

Many OZ investments require substantial risk. Such as ground-up real estate developments in communities that have often faced decades of economic strain – developed, stabilized, and managed over a decade.

How will we know that OZs have achieved their purpose of spurring economic development and job creation in distressed communities?

More investment activity into a broad mix of asset classes in places that have suffered from years of little or no investment.

More investment activity into a broad mix of asset classes in places that have suffered from years of little or no investment.

Early indications are that the OZ marketplace is accomplishing its objectives.

A group of researchers from three leading universities in WI, NC, and NJ found “a positive impact of OZs on employment and establishment growth” across a variety of industries and skill levels

A group of researchers from three leading universities in WI, NC, and NJ found “a positive impact of OZs on employment and establishment growth” across a variety of industries and skill levels

While no public reporting requirements are in place for the OZ program, several databases are tracking QOF investments.

The White House Council of Economic Advisers’ August 2020 report estimated that in just the program’s first 2 years, QOFs had raised $75 billion in private capital, with $52 billion being new investment.

CBRE analysis of development site investment volumes in OZs published in November 2019 compared to the 18 months prior to their designations as Qualified Opportunity Zones (QOZs), Baltimore was seeing nearly 900% growth, Birmingham 728%, Philadelphia 479%, and Detroit over 200%

From personal experience, we are taking on deals that we would not have but for the Opportunity Zone program.

My long-term goal is to create a well educated gang of QOF investors who want to compound tax efficiently

I will continue posting threads with OZ content. If you want to get engaged with the OZ content (or other Apartment Related tweets)

Follow along

@DallasAptGP

I will continue posting threads with OZ content. If you want to get engaged with the OZ content (or other Apartment Related tweets)

Follow along

@DallasAptGP

If you want to get even more engagement with OZ operators, I have also put together a list of #RETwit Opportunity Zone GP’s and vendors.

If you think you should be on this list then just let me know.

twitter.com/i/lists/148358…

If you think you should be on this list then just let me know.

twitter.com/i/lists/148358…

• • •

Missing some Tweet in this thread? You can try to

force a refresh