On Feb 17-18 many Eurozone companies reported numbers.

Let's do a quick recap of 6 of them:

1) Airbus

2) Hermès

3) Kering

4) Kingspan

5) Ubisoft

6) Teleperformance

(CSS=Consensus estimate)

🧵

Let's do a quick recap of 6 of them:

1) Airbus

2) Hermès

3) Kering

4) Kingspan

5) Ubisoft

6) Teleperformance

(CSS=Consensus estimate)

🧵

1) AIRBUS $AIR.PA $AIR $EADSY

4Q21

· Sales €16.9bn (€16.88bn CSS)

· EBIT adj. €1.49bn (€1.36bn CSS)

· EBIT Mgn 8.8% (8.1% CSS)

· FCF €1.2bn (€0.9bn CSS)

FY21

· Sales €52.1bn

· EBIT adj. €4.865bn (guided €4.5bn)

· FCF €3.5bn (guided €2.5bn)

4Q21

· Sales €16.9bn (€16.88bn CSS)

· EBIT adj. €1.49bn (€1.36bn CSS)

· EBIT Mgn 8.8% (8.1% CSS)

· FCF €1.2bn (€0.9bn CSS)

FY21

· Sales €52.1bn

· EBIT adj. €4.865bn (guided €4.5bn)

· FCF €3.5bn (guided €2.5bn)

🗣️

· Comercial Aviation EBIT was in line. Beat came from Defence&Space and Helicopters.

· FCF was helped by WC movements.

. Use of cash: increased dividends, support customer financing and may put money aside to reduce the €7bn pension deficit.

· Cautions on challenging ramp-up.

· Comercial Aviation EBIT was in line. Beat came from Defence&Space and Helicopters.

· FCF was helped by WC movements.

. Use of cash: increased dividends, support customer financing and may put money aside to reduce the €7bn pension deficit.

· Cautions on challenging ramp-up.

· Outlook 2022 below CSS:

720 deliveries (+20%), adj.EBIT €5.5bn (-4% vs CSS) and FCF €3.5bn (flat)- challenging comps and supply chain volatility during the early stage of production ramp-up. WC will be more neutral: higher prepayments, rising inventories and more accruals.

720 deliveries (+20%), adj.EBIT €5.5bn (-4% vs CSS) and FCF €3.5bn (flat)- challenging comps and supply chain volatility during the early stage of production ramp-up. WC will be more neutral: higher prepayments, rising inventories and more accruals.

Surprise in Defence and Helicopters margin not expected to be repeated in 22E.

Margin at Airbus Commercial to be affected by non repeat of €0.4bn boost from provision released, €0,5bn increase in R&D and Digitisation as well as €0.5bn adverse FX hedging costs.

Margin at Airbus Commercial to be affected by non repeat of €0.4bn boost from provision released, €0,5bn increase in R&D and Digitisation as well as €0.5bn adverse FX hedging costs.

2) HERMÈS $RMS.PA $RMS $HESAY

· Sales (1% above CSS)

· Top line growth exceeding expectations in Europe, Japan and APAC ex Japan, while growth in the US came in below market expectations (growth of only c.+11% 2 year stack).

· Sales (1% above CSS)

· Top line growth exceeding expectations in Europe, Japan and APAC ex Japan, while growth in the US came in below market expectations (growth of only c.+11% 2 year stack).

· Group EBIT 5% above CSS in 2H21, likely a function of strong operating leverage.

· EBIT margin 39% for FY21, up 500 basis points vs. 2019, despite Hermes implementing very limited price increases over the period

· EBIT margin 39% for FY21, up 500 basis points vs. 2019, despite Hermes implementing very limited price increases over the period

Overall, solid performance in 4Q/2H, although in line with market expectations. This is in contrast with peers, which nearly all beat very solidly expectations.

Hermes is the only luxury group facing significant supply shortages in 4Q (leather goods sales contracted -5% YoY).

Hermes is the only luxury group facing significant supply shortages in 4Q (leather goods sales contracted -5% YoY).

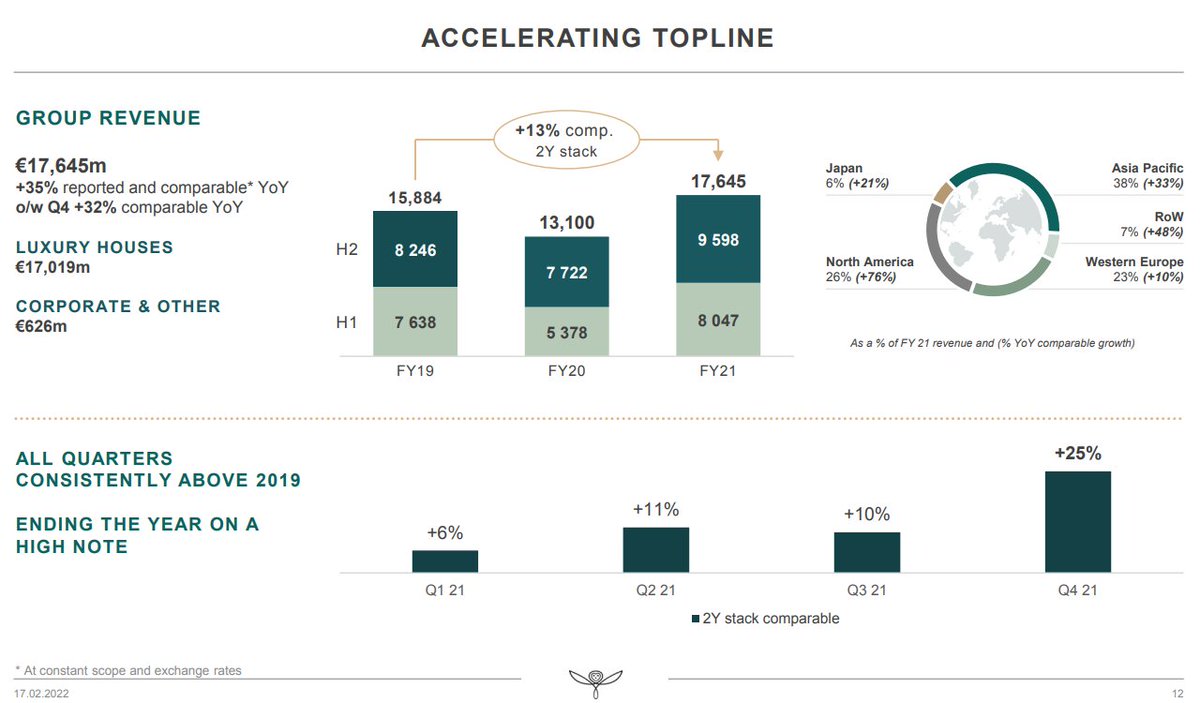

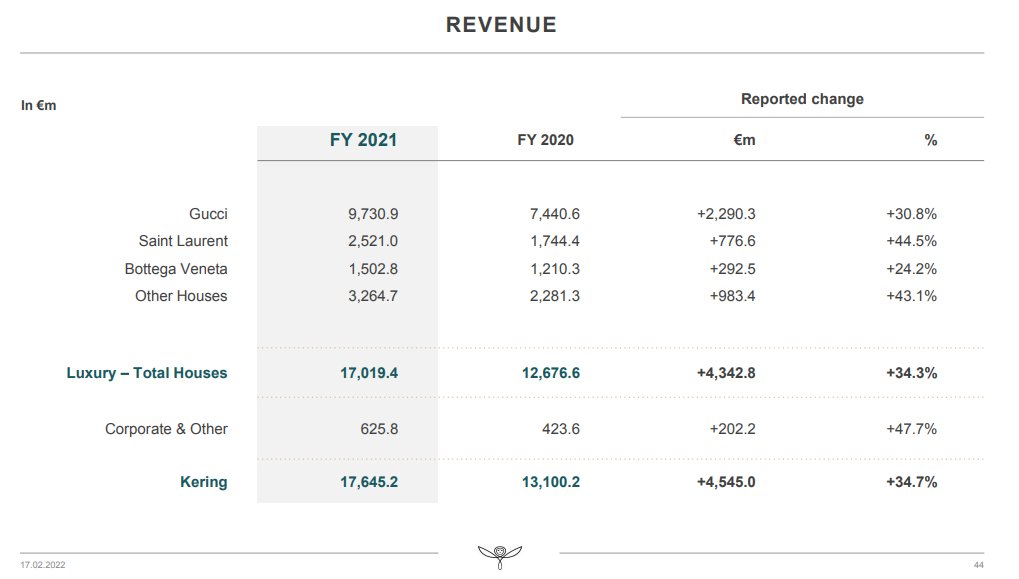

3) KERING $KER.PA $KER $PPRUY

FY2021

· Sales €17.6bn (beat CSS by 3%), +13% LFL vs 2019.

· EBIT €5,017bn (beat CSS by 4%) is at ATH, up 60% reflecting a 450bps margin improvement to 28.4%.

· FCF generation was solid at EUR3.2bn, a 3x YoY increase.

4Q Sales 11% beat on sales

FY2021

· Sales €17.6bn (beat CSS by 3%), +13% LFL vs 2019.

· EBIT €5,017bn (beat CSS by 4%) is at ATH, up 60% reflecting a 450bps margin improvement to 28.4%.

· FCF generation was solid at EUR3.2bn, a 3x YoY increase.

4Q Sales 11% beat on sales

· Gucci has grown almost +32% LFL in 4Q21 (vs +18% CSS).

· YSL +47% LFL and good growth rates in ‘Other Houses’ (likely Balenciaga and McQueen).

· The EBIT margin positive evolution have been across the board.

· YSL +47% LFL and good growth rates in ‘Other Houses’ (likely Balenciaga and McQueen).

· The EBIT margin positive evolution have been across the board.

· Overal a solid performance with top and bottom line coming ahead of expectations.

· Improvement diversified by geo/brand.

· Management is confident that the solid momentum will stretch through 2022 and the coming years.

· Kering flags possible M&A thanks to solid balance sheet.

· Improvement diversified by geo/brand.

· Management is confident that the solid momentum will stretch through 2022 and the coming years.

· Kering flags possible M&A thanks to solid balance sheet.

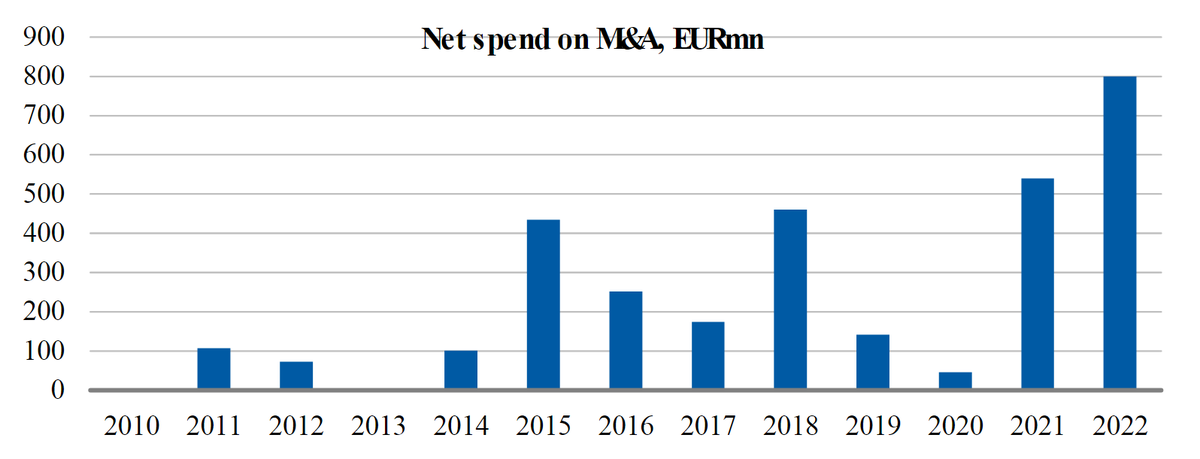

4) KINGSPAN $KGP.L $KGP $KGSPF

Kingpsan FY21 results were in line:

· Revenue €6.5bn +42% YoY (vs €6.5bn CSS). LFL Top line growth was +30%.

· Trading profit €755m +49% YoY (vs €756M CSS) for a margin of 11.7%.

· EPS €3.06, +50% YoY (in line with CSS).

Kingpsan FY21 results were in line:

· Revenue €6.5bn +42% YoY (vs €6.5bn CSS). LFL Top line growth was +30%.

· Trading profit €755m +49% YoY (vs €756M CSS) for a margin of 11.7%.

· EPS €3.06, +50% YoY (in line with CSS).

Outlook: limited specifics given. Management sees a strong start to 2022 with a solid order backlog, Panels order backlog ended 2021 up 28%. Limited visibility beyond Q1 yet outlook is optimistic. On raw materials, these remain at elevated levels, supportive of pricing into 2022.

Kingspan has a track record in growing via M&A (contribution to revenue was 10% CAGR over last 10 years). After a relative quiet 2020 and 1H21 (Covid linked), Kingspan is clearly prioritising M&A with €540m spent in 2021 and 3 agreed acquisitions YTD for a total spend of €800m.

5) UBISOFT $UBI.PA $UBI $UBSFY

Ubi reported 3QFY22 net bookings €746m (in line with CSS at €750m).

-25% y/y against a tough comp from the prior year when the quarter included the release of Assassin's Creed Valhalla, which performed extremely well in net bookings and PRI.

Ubi reported 3QFY22 net bookings €746m (in line with CSS at €750m).

-25% y/y against a tough comp from the prior year when the quarter included the release of Assassin's Creed Valhalla, which performed extremely well in net bookings and PRI.

UBI reiterated its full year revenue/EBIT guidance, while highlighting "we are currently operating at the lower end of our targets", also in line with CSS.

"next fiscal year will include the releases of Avatar, Mario + Rabbids, Skull & Bones as well as

more exciting games".

"next fiscal year will include the releases of Avatar, Mario + Rabbids, Skull & Bones as well as

more exciting games".

Ubi looks on track to make its FY'22 guidance. There is a strong pipeline of upcoming content, but the stock (trading with a 20% discount vs peers) is waiting for signals of successful execution. Ubi could be the target of a takeover.

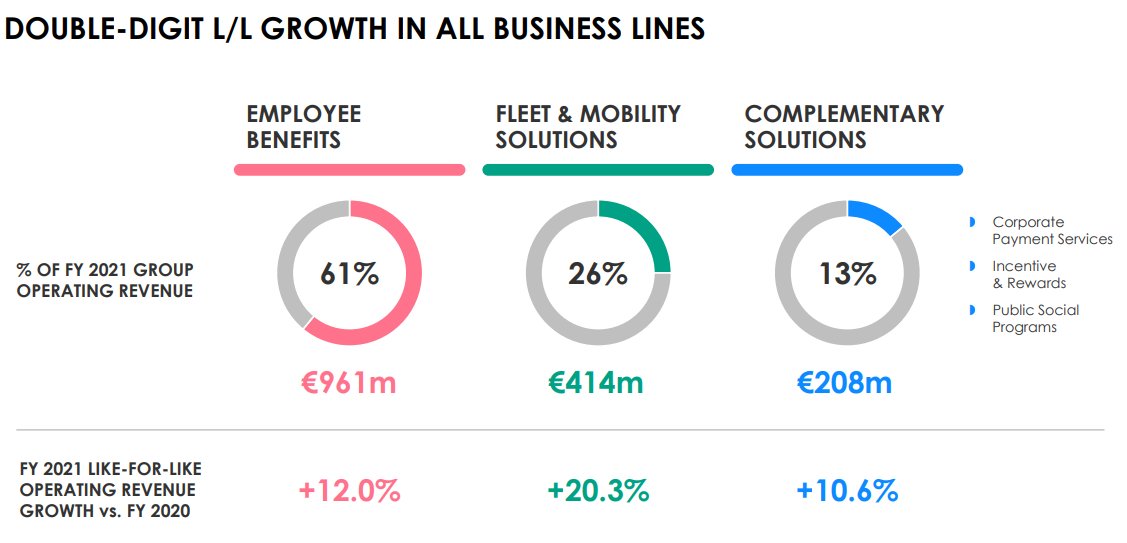

6) TELEPERFORMANCE $TEP.PA $TEP $TLPFY

· Q4 LFL growth of +13.3% (6.7% above CSS).

· EBITA of €1,071m (2% above CSS), with margins of 15.1%, 10bps better.

· Growth in DIBS was strong across geos, except for Ibero-LatAm. Specialised service was supported by LLS and TLS recovery.

· Q4 LFL growth of +13.3% (6.7% above CSS).

· EBITA of €1,071m (2% above CSS), with margins of 15.1%, 10bps better.

· Growth in DIBS was strong across geos, except for Ibero-LatAm. Specialised service was supported by LLS and TLS recovery.

Guidance 2022: LFL growth of >10%, ex-COVID revenue impact, and 30bps of margin improvement YoY.

This and new 2025 objectives offer limited upgrades, but TEP has a track record of guiding conservatively.

This and new 2025 objectives offer limited upgrades, but TEP has a track record of guiding conservatively.

• • •

Missing some Tweet in this thread? You can try to

force a refresh