(1/?) Are any of you sick of trying 2 make sense of $MMAT's SI%, Insider Ownership and Float data on platforms like Fintel and Ortex? Yeah me 2 so I decided 2 sift all of the data I could find on the EDGAR (US Reporting), SEDI (CA Reporting) 2 try 2 make sense of it all.

(2/?) Before I get into it, I want 2 mention that I am not a financial expert and that I'm adding all the links 2 the information presented here so you can do your own research and make decision for yourself. $MMAT #METAfam

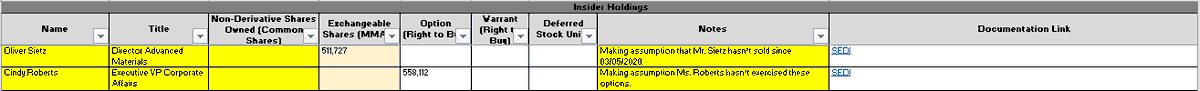

(3/?) I started by reviewing every SEC filing for all the Insiders listed on the EDGAR website. Although there are a bunch of names listed on that website, the names in the grid below are those that have actually submitted a filing after the merger. $MMAT

sec.gov/cgi-bin/own-di…

sec.gov/cgi-bin/own-di…

(4/?) I noticed that a lot of names missing so I decided 2 go back and look at the Proxy from before the merger and found pages 348/349 (linked below) to be helpful. I'm making some assumptions that these people have not sold and converted to $MMAX. $MMAT

app.quotemedia.com/data/downloadF…

app.quotemedia.com/data/downloadF…

(5/?) From there I searched the SEDI for any $MMAT Insider I may not have accounted for. I was able 2 find the 2 filings below and have made the assumption that these 2 have not sold and Mr. Sietz's shares were converted to $MMAX.

sedi.ca/sedi/SVTReport…

sedi.ca/sedi/SVTReport…

(6/?) 2 round out Insider ownership I made a couple more assumptions based on what GP mentioning that McCabe & Brda had not sold shares since the merger. Note, their holdings represent what they would have after the 2/1 Reverse Split based on their most recent filing. $MMAT

(7/?) I couldn't find any filings of ownership for the three names below however I added them 2 my list with the assumption that they will buy and I will update it at that time. You can see the estimated Insider Holding at the bottom but this doesnt tell the whole story. $MMAT

(8/?) I've come 2 find out through emails with Fintel & Ortex that the service that provides them with their data don't consider Innovacorp (CA Govt. angel investor) and Lamda Guard (subsidiary of $MMAT) Insiders. That seems kind of crazy right? GP holds a majority stake in LG.

(9/?) I've also been tracking Institutional holding via NASDAQ.com and update my spreadsheet daily. I don't trust Fintel so I feel like NASDAQ might be the lessor of 2 evils. Gotta take it for what it's worth. $MMAT

nasdaq.com/market-activit…

nasdaq.com/market-activit…

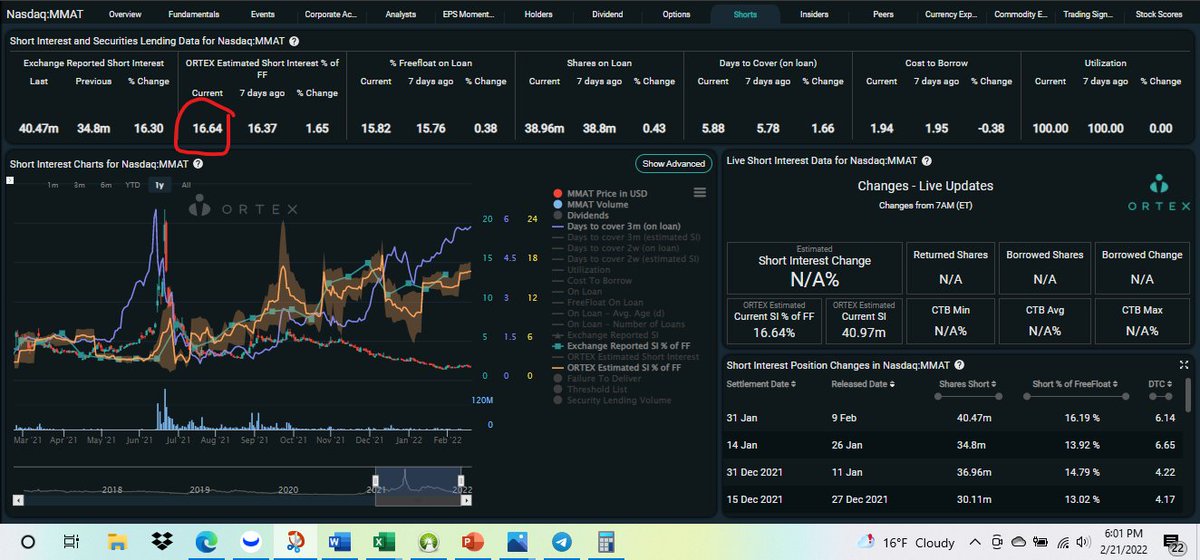

(10/?) So here is where we stand (if assumptions above are true). Platforms like Fintel and Ortex would like you to believe that SI % of the Free Float is somewhere between 16 - 17%. And that may be true if you don't count $MMAX, Lamda Guard/Angel investor shares. $MMAT

(11/?) But if you do take those into account (why wouldn't you?) You are left with this (doesnt include the millions of synthetic shares out there). My gut tells me we'll actually fall somewhere between the 33 & 65% range once all $MMAX is transferred over. $MMAT

(12/?) Again, I am not a financial advisor but I provided you with link to my sources so you can do your own research. I hope this helps! $MMAT #METAfam @IamWedge @SterlingStocks6 @SmokeyStock @tonys_twits @perspective508 @BAMinvestor @TradesTrey

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh