If you look on-chain, you might begin to notice some unexpected things.

I’m not talking about any of the latest scams, exploits, or spontaneous events that occur every day…

I’m talking about something much bigger. 𝘚𝘵𝘢𝘣𝘭𝘦𝘤𝘰𝘪𝘯𝘴.

I’m not talking about any of the latest scams, exploits, or spontaneous events that occur every day…

I’m talking about something much bigger. 𝘚𝘵𝘢𝘣𝘭𝘦𝘤𝘰𝘪𝘯𝘴.

Stablecoins have taken the entire space by force, sucking up tens of billions of dollars worth of value in DeFi with them.

They are becoming the one giant elephant in the room.

It’s the qualities of the blockchain which make them so attractive to users.

They are becoming the one giant elephant in the room.

It’s the qualities of the blockchain which make them so attractive to users.

They are propelled in market cap by pure forces of nature thanks to their high demand, interoperability, and ease of use.

& there are now many iterations of these tokens, most home to ETH, all using different mechanisms to remain stable.

Examples: DAI, MIM, USDC + many others.

& there are now many iterations of these tokens, most home to ETH, all using different mechanisms to remain stable.

Examples: DAI, MIM, USDC + many others.

Where it gets even more interesting although, is when looking at the economies they empower.

Complete economies are forming, varying in both span and size, with no central location & a mind blowing number of real world use cases.

Some are even entirely different than others…

Complete economies are forming, varying in both span and size, with no central location & a mind blowing number of real world use cases.

Some are even entirely different than others…

Take for example DAI, a stablecoin for MakerDAO. DAI is pegged to $1, and it can be minted by depositing collateral in smart contracts.

Users will typically deposit ether, borrow DAI, & then put it to use for yield in DeFi.

Since last year, DAI has increased $8B in market cap.

Users will typically deposit ether, borrow DAI, & then put it to use for yield in DeFi.

Since last year, DAI has increased $8B in market cap.

Then there’s things like MIM, which compounds existing DeFi legos for its stablecoin.

MIM takes an interesting approach, accepting interest-bearing tokens from CVX, CRV, or YFI as collateral to mint it.

This lets users get a loan while retaining exposure to high DeFi yields.

MIM takes an interesting approach, accepting interest-bearing tokens from CVX, CRV, or YFI as collateral to mint it.

This lets users get a loan while retaining exposure to high DeFi yields.

There are also more specific protocols like sUSD.

sUSD is a synthetic stablecoin from synthetix which can be obtained by staking SNX in smart contracts.

This stablecoin can then be used to trade synths on the market, with the token acting as debt obligation on the protocol

sUSD is a synthetic stablecoin from synthetix which can be obtained by staking SNX in smart contracts.

This stablecoin can then be used to trade synths on the market, with the token acting as debt obligation on the protocol

& if we 𝘳𝘦𝘢𝘭𝘭𝘺 wanted to experiment with it, we could try out RAI.

Take any basket of assets & shock volatility with the protocol founded by Reflexer Labs.

The framework aims to remove the governance aspect entirely, relying on nothing but code and a PID controller.

Take any basket of assets & shock volatility with the protocol founded by Reflexer Labs.

The framework aims to remove the governance aspect entirely, relying on nothing but code and a PID controller.

But my point of this thread wasn’t to go over the basic designs of existing stablecoins, it was to point out the unique qualities of these digital tokens.

We’re talking about thousands of project-specific (or generalized), digital currencies, that may change things forever.

We’re talking about thousands of project-specific (or generalized), digital currencies, that may change things forever.

The underlying equation changes significantly when users 𝘢𝘳𝘦𝘯’𝘵 𝘭𝘰𝘰𝘬𝘪𝘯𝘨 𝘵𝘰 “𝘤𝘢𝘴𝘩 𝘰𝘶𝘵.”

Stables essentially allow for a closed-loop ecosystem.

Hypothetically speaking:

If everyone in the world used DAI, no one would ever feel the need to settle in fiat.

Stables essentially allow for a closed-loop ecosystem.

Hypothetically speaking:

If everyone in the world used DAI, no one would ever feel the need to settle in fiat.

So… We’ve established that ETH has a bunch of stablecoins… Now what?

Well, on top of double digit yields, what if we then threw virtual items, digital scarcity, & ownership into the mix?

Ethereum can tokenize real life items, services, & many previously intangible items…

Well, on top of double digit yields, what if we then threw virtual items, digital scarcity, & ownership into the mix?

Ethereum can tokenize real life items, services, & many previously intangible items…

I mean- people are even spending hundreds of thousands on virtual land in the Metaverse.

This will eventually expand to services, commodities, & things people aren’t even looking at as an investment.

It’s just another way to transact with currency, in a digital native way.

This will eventually expand to services, commodities, & things people aren’t even looking at as an investment.

It’s just another way to transact with currency, in a digital native way.

In fact, its an even better way of doing so than any traditional method.

All the younger generations are familiar with PayPal, Venmo, and CashApp.

This time, it’s not limited to people in the United States, or just those with a bank account.

All the younger generations are familiar with PayPal, Venmo, and CashApp.

This time, it’s not limited to people in the United States, or just those with a bank account.

Anyone with access to the internet is able to transact with value across the world in a matter of seconds.

No middlemen, no routing numbers, no bank accounts, no social security numbers.

For all of these reasons, you’ll note something distinct in the top stable coin protocols.

No middlemen, no routing numbers, no bank accounts, no social security numbers.

For all of these reasons, you’ll note something distinct in the top stable coin protocols.

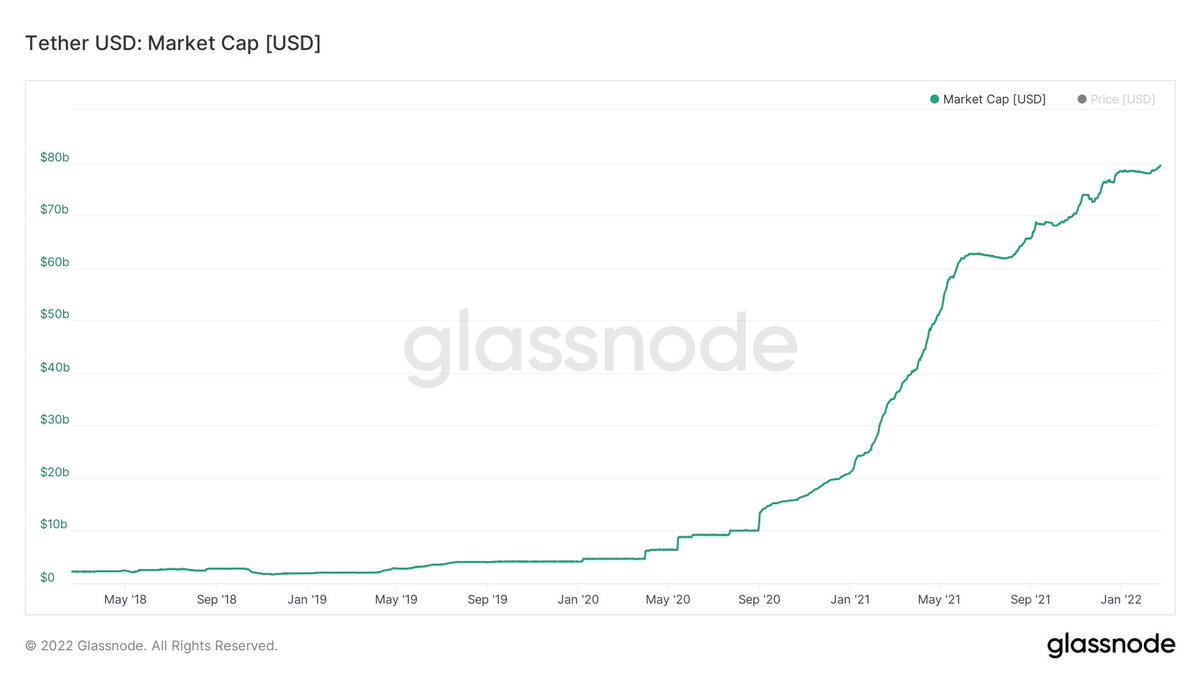

The market capitalization and exponential growth of these charts look like something out of every trader’s dream.

It’s only up, even after a 50%+ dump across the market…

Meanwhile, the percent of supply locked in different smart contracts increases or stays the same.

It’s only up, even after a 50%+ dump across the market…

Meanwhile, the percent of supply locked in different smart contracts increases or stays the same.

From the statistics above, I hope at least one thing is clear.

We have severely underestimated the power of stablecoins and their characteristics.

It’s no longer about “cashing out”, it’s about transacting with digital value on the internet.

I hope you all enjoyed! 🥐

We have severely underestimated the power of stablecoins and their characteristics.

It’s no longer about “cashing out”, it’s about transacting with digital value on the internet.

I hope you all enjoyed! 🥐

• • •

Missing some Tweet in this thread? You can try to

force a refresh