Can Europe live without Russian gas right now?

(Let’s ignore for a second whether this is a good political weapon—as in, do you think Putin will pull rethink the war if Europe stops buying Russian gas? I doubt it).

Let’s just focus on numbers.

(Let’s ignore for a second whether this is a good political weapon—as in, do you think Putin will pull rethink the war if Europe stops buying Russian gas? I doubt it).

Let’s just focus on numbers.

Europe imports around 400 bcm each year (using an expansive definition of “Europe”). Russia supplies around 175 to 200 bcm.

The basic question is: can Europe find another 175-200 bcm in alternative gas supplies and/or reduced gas use?

tl;dr: It's very tough.

The basic question is: can Europe find another 175-200 bcm in alternative gas supplies and/or reduced gas use?

tl;dr: It's very tough.

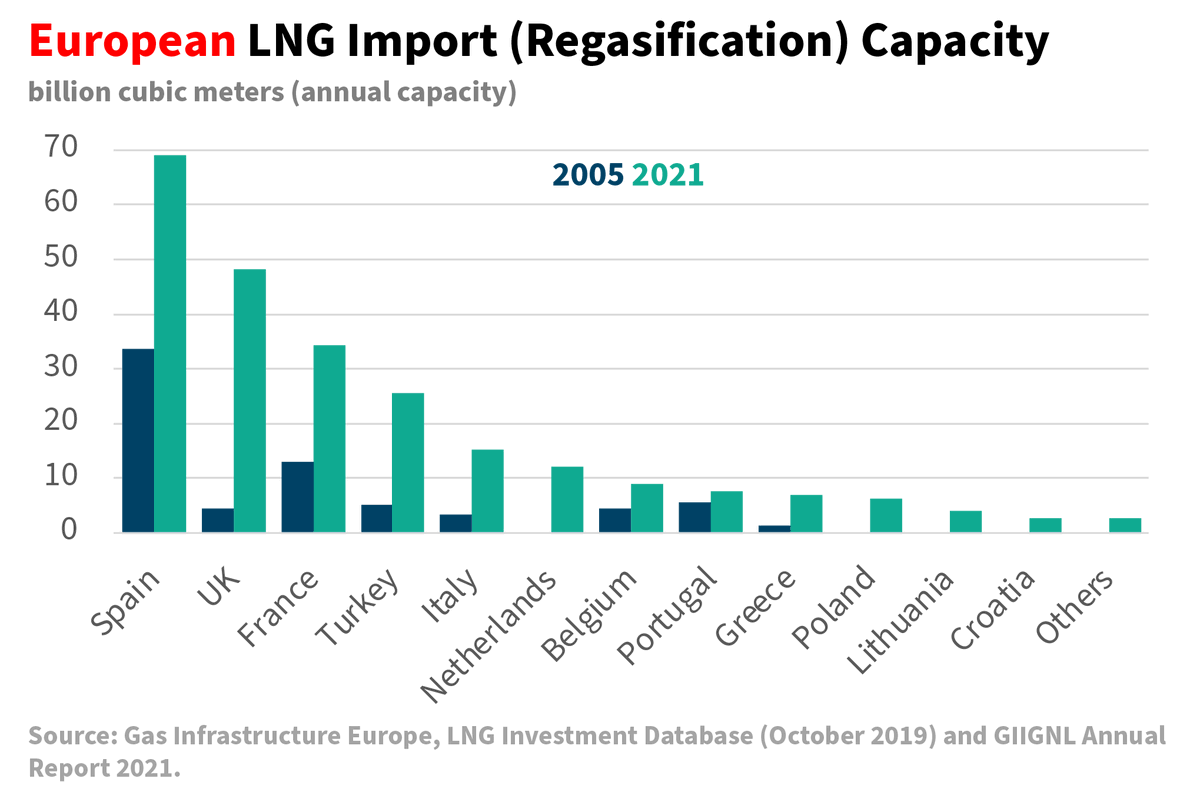

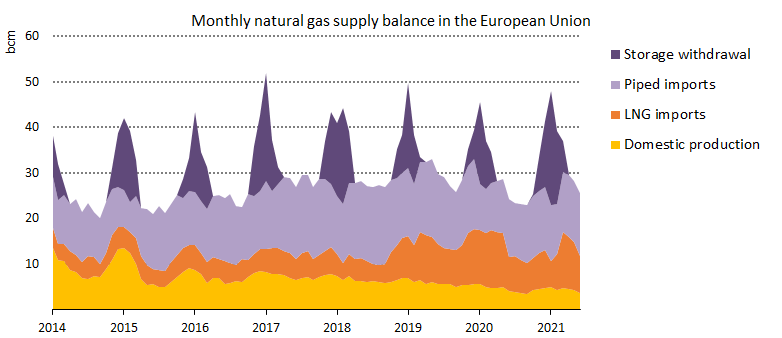

European LNG import capacity is ~240 bcm. But a lot of that capacity is in Spain (disconnected from the rest of Europe). In some places, LNG capacity is enough to offset the Russian gas; in most places, it is not.

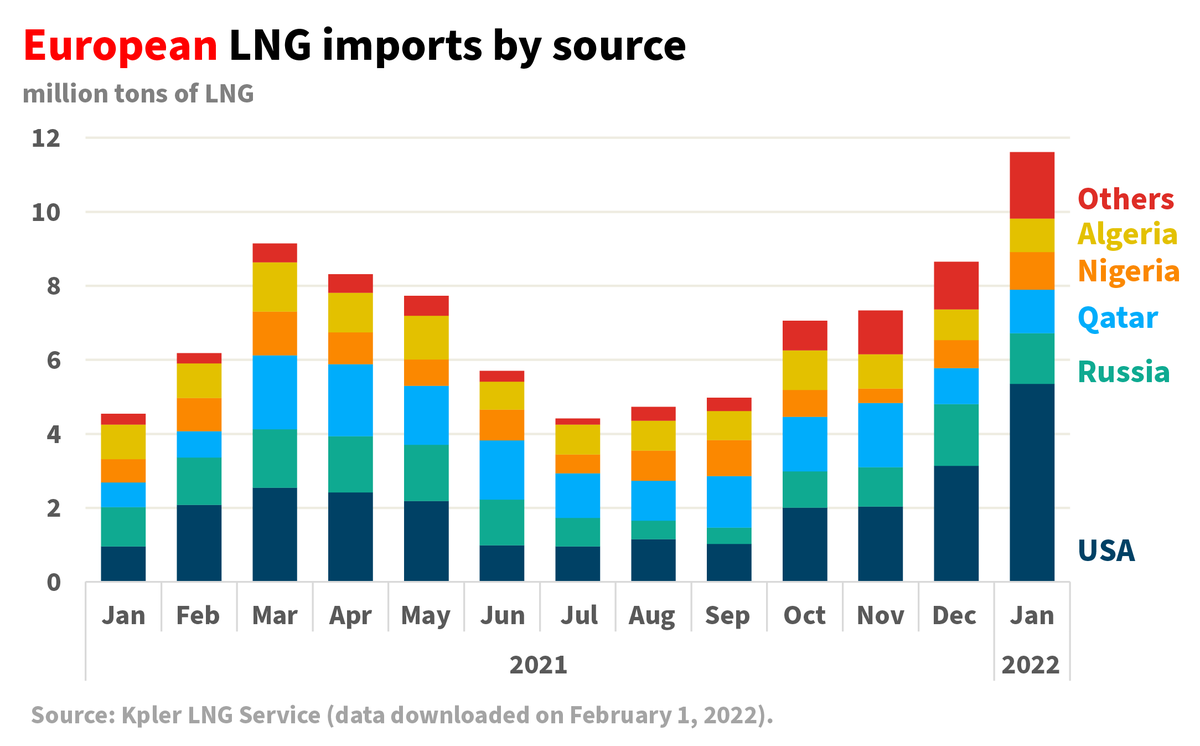

In Europe imported 108 bcm of LNG in 2021. Even if you ignore the Spain angle, you have about 130 bcm of spare LNG capacity. Not enough to offset ~175 bcm in Russian exports. And European LNG imports were already ~16 bcm in Jan (12 mmtons). The system is at near full speed.

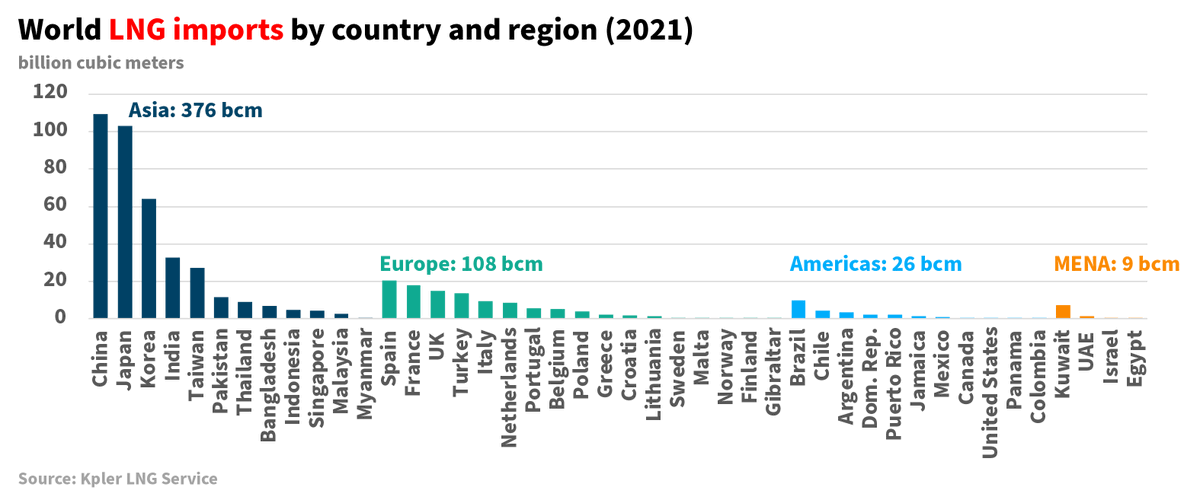

Europe is a small part of the LNG market, but the LNG market is not very big. If you wanted, say, 100 bcm of extra LNG for Europe, that's hard to find. China could forgo *all* LNG imports for a year and that wouldn't be enough to cover what Europe needs to replace Russia.

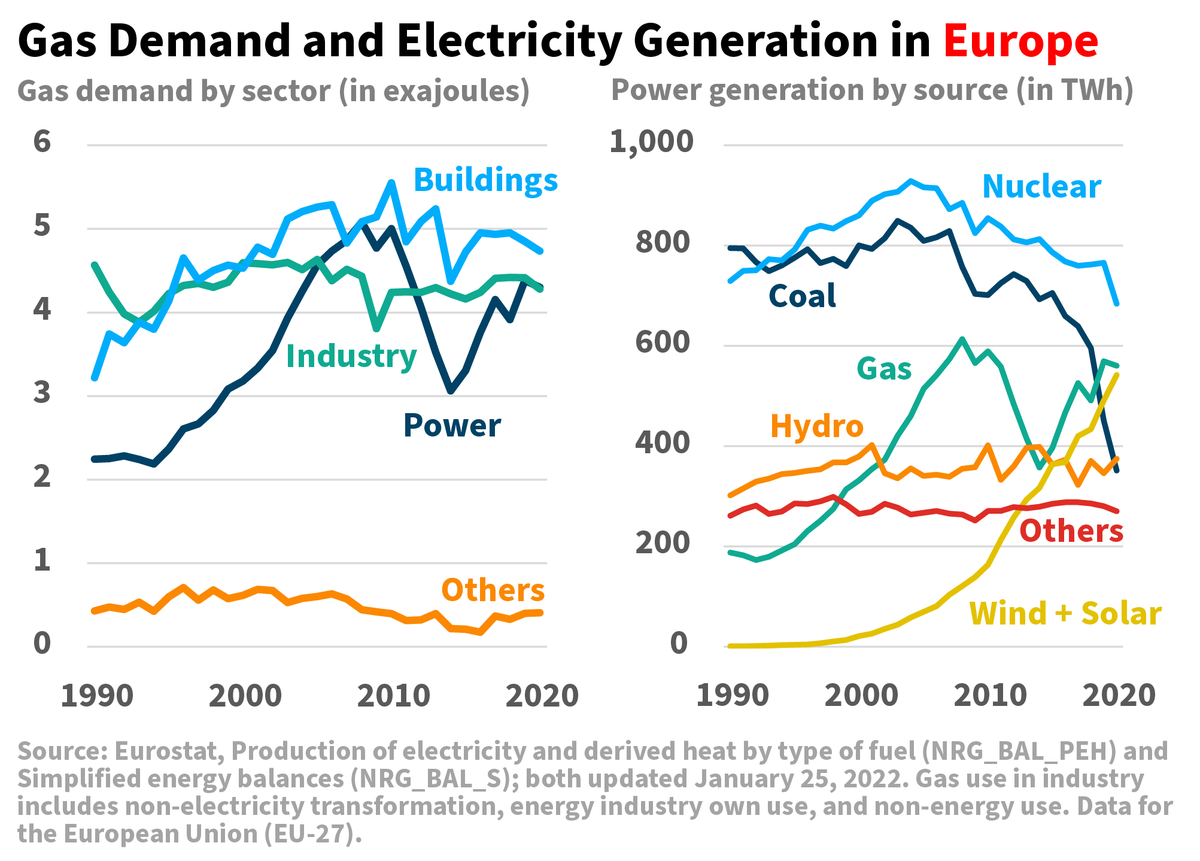

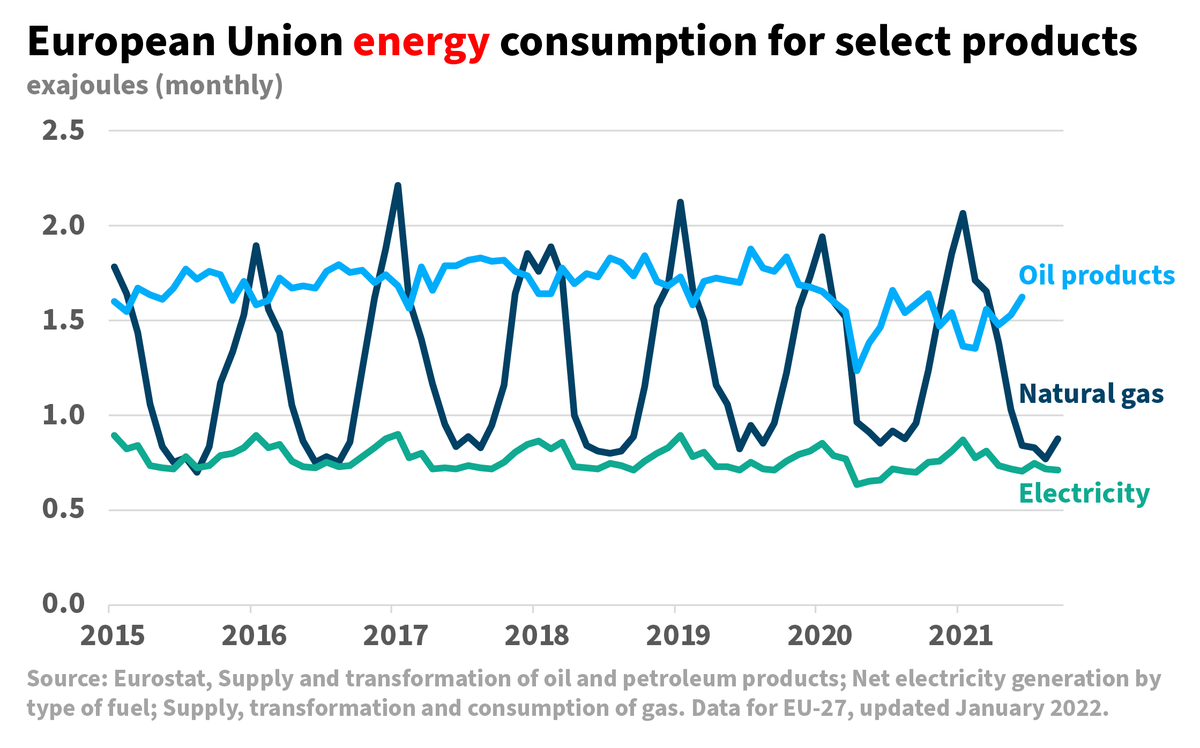

Let's talk demand. Super rough, EU gas demand is 1/3 buildings, 1/3 industry, 1/3 power. Each sector has different response systems—alternative fuels, conservation, etc. Could you pay industry to shut down? Sure. Could people buckle up? Sure. Fire up coal? Yes. But it's not easy.

Now add seasonality. Being able to live without Russian gas in April or June says very little. That's not when you need gas. You need gas in January. Deliverability in January is what matters.

To meet demand in the winter you need storage. Lots of it. And you need it to be full (aka not a repeat of 2021). Annual averages are almost meaningless when it comes to European gas security. What really matters is winter demand. So that's the math.

(graph from @PZeniewski)

(graph from @PZeniewski)

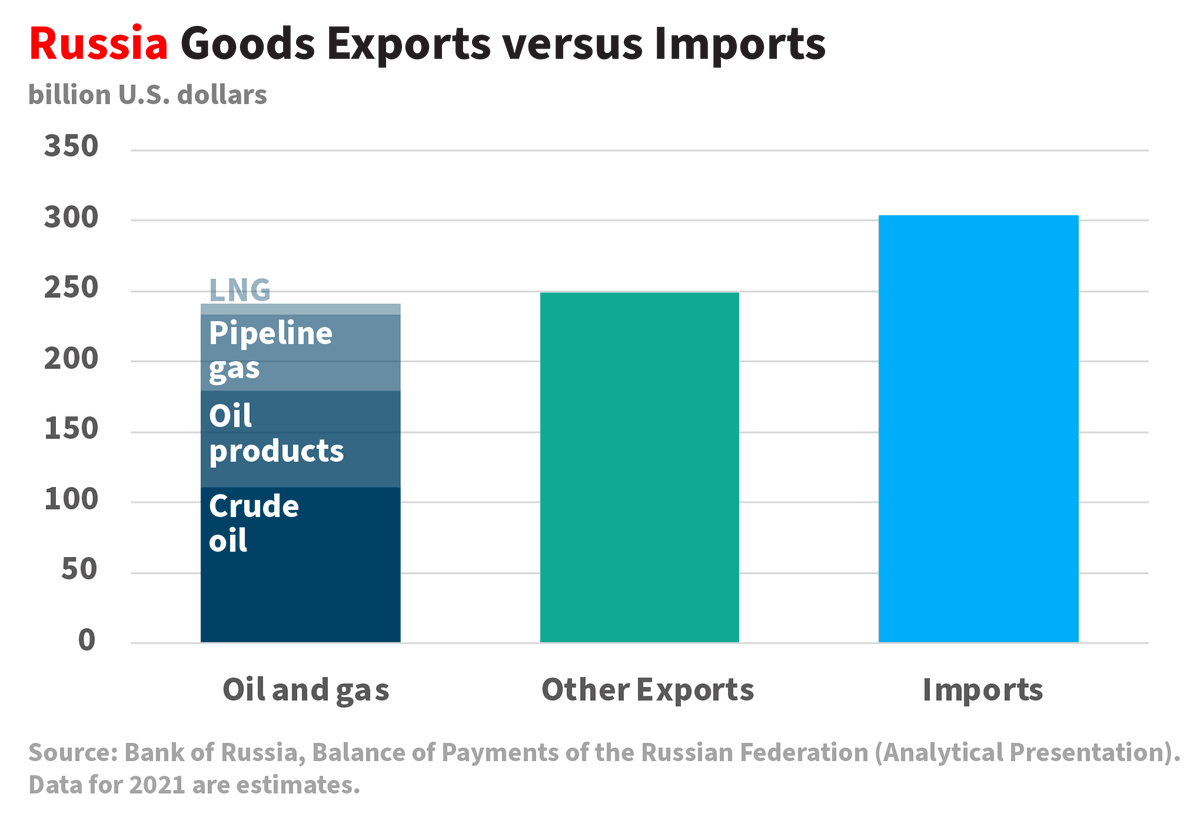

Remember that revenues from gas are a small part of the Russian foreign balance. Even if you hit *all* energy exports, Russia has enough non-energy exports to cover most of their import needs—before dipping into reserves. You're not inflicting *that* much pain.

Final thought. We can sanction Russia up the wazoo. I doubt it will be enough to turn them around. For more on that, I recommend this piece by my former professor and colleague @EliotACohen: theatlantic.com/ideas/archive/…

• • •

Missing some Tweet in this thread? You can try to

force a refresh