$CCC.ja reported their full year 2021 earnings. Here's a #SOTRSummary:

- Sales ⬆️ 18%

-Net Income ⬆️ 34%

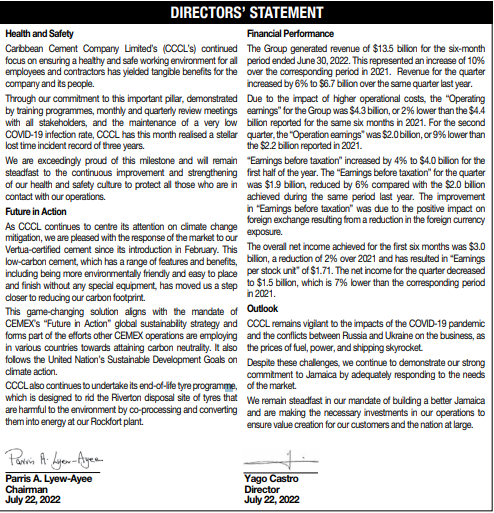

This performance seems to have been largely driven by lower finance expenses and lower losses on foreign exchange.

- Sales ⬆️ 18%

-Net Income ⬆️ 34%

This performance seems to have been largely driven by lower finance expenses and lower losses on foreign exchange.

Of note, the company's leverage position has materially improved. Financial obligations in general have fallen since 2020, positioning the balance sheet well for future growth.

Operating cashflows were robust. It was used to buy more fixed assets and to pay various forms of debt

Operating cashflows were robust. It was used to buy more fixed assets and to pay various forms of debt

At a price of 75.86, CCC is currently trading at 14.9 times earnings.

The stock took a dive late last year when investors caught wind of a pending decision for $CCC.ja to pay a fee not exceeding 4% of Net Sales to it's ultimate parent.

The stock took a dive late last year when investors caught wind of a pending decision for $CCC.ja to pay a fee not exceeding 4% of Net Sales to it's ultimate parent.

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh