Should you trust international debt statistics? How big is the 'hidden debt' problem which made so many headlines lately? Has debt reporting in developing countries improved lately?

Summary thread of our blog previewing our forthcoming research w Sebastian Horn & @NickolPhilipp.

Summary thread of our blog previewing our forthcoming research w Sebastian Horn & @NickolPhilipp.

When previously undisclosed loans get reported, past debt statistics need to be revised. By tracking these revisions we are able to quantify increases in the coverage of debt statistics and analyze the timing, characteristics, and drivers of “hidden debt” revelations.

We analyze patterns in the revisions of @WorldBank International Debt Statistics (and predecessor publications) released yearly since 1979. Turns out past debt stocks are twice as likely to be revised up than revised down.

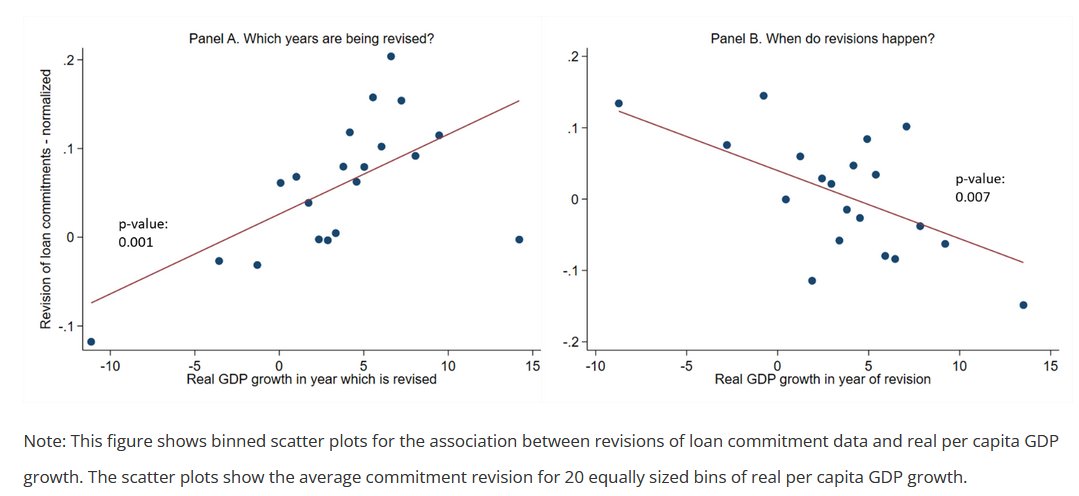

Looking at the patterns of revisions over time, we see that unreported debt builds up in times of economic boom, whereas the ex-post revisions happens during busts.

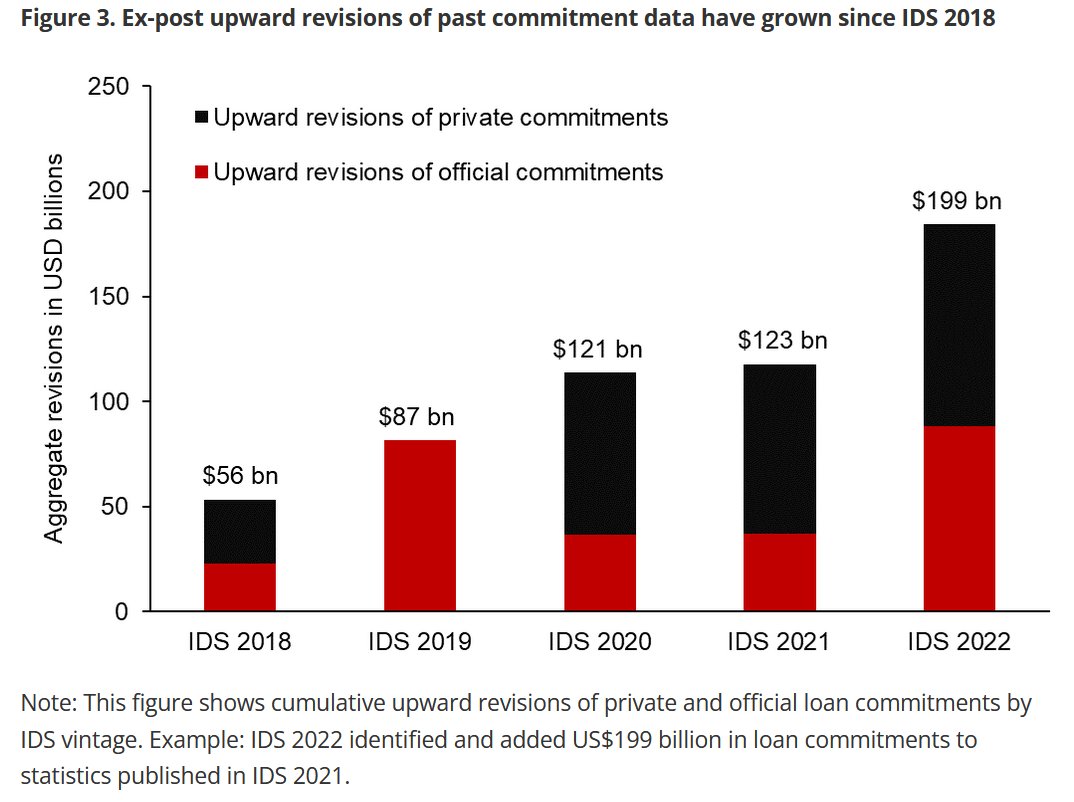

Our analysis also shows that recently published debt statistics had record levels of such upward revisions. IDS vintages released in past 5 years have identified $587 bn in previously unreported loan commitments. (15 % of relevant countries 2020 debt stocks).

We see such patterns in a range of countries. E.g. there were 20 countries who's 2016 debt stock 'grew' by more than 10% retrospectively from its originally reported value.

Our research provides some reason for optimism amidst the doom & gloom of pandemic era debt vulnerabilities. Developing countries s are coming clean on how much they have borrowed in the last boom.

Blog here and stay tuned for the paper! [END] blogs.worldbank.org/developmenttal…

Blog here and stay tuned for the paper! [END] blogs.worldbank.org/developmenttal…

• • •

Missing some Tweet in this thread? You can try to

force a refresh