Jesse Livermore is one of the first extremely successful Stock Market Speculators. Although not as well known as many others, he has been extremely influential to notable traders such as William O’Neil.

Here are 21 lessons from Livermore, a thread 🧵 👇

Here are 21 lessons from Livermore, a thread 🧵 👇

"Nothing new ever occurs in the business of speculating or investing in securities and commodities."

Human nature and psychology are the reason for this!

Human nature and psychology are the reason for this!

"Money cannot consistently be made trading every day or every week during the year."

Knowing when to press the gas and sit on your hands are two very important lessons to learn in the market.

Knowing when to press the gas and sit on your hands are two very important lessons to learn in the market.

"Don’t trust your own opinion and back your judgment until the action of the market itself confirms your opinion."

This goes hand in hand with the next quote 👇

This goes hand in hand with the next quote 👇

"The real money made in speculating has been in commitments showing in profit right from the start."

Being in the green from the get go shows you that your pivot point and timing were right.

Being in the green from the get go shows you that your pivot point and timing were right.

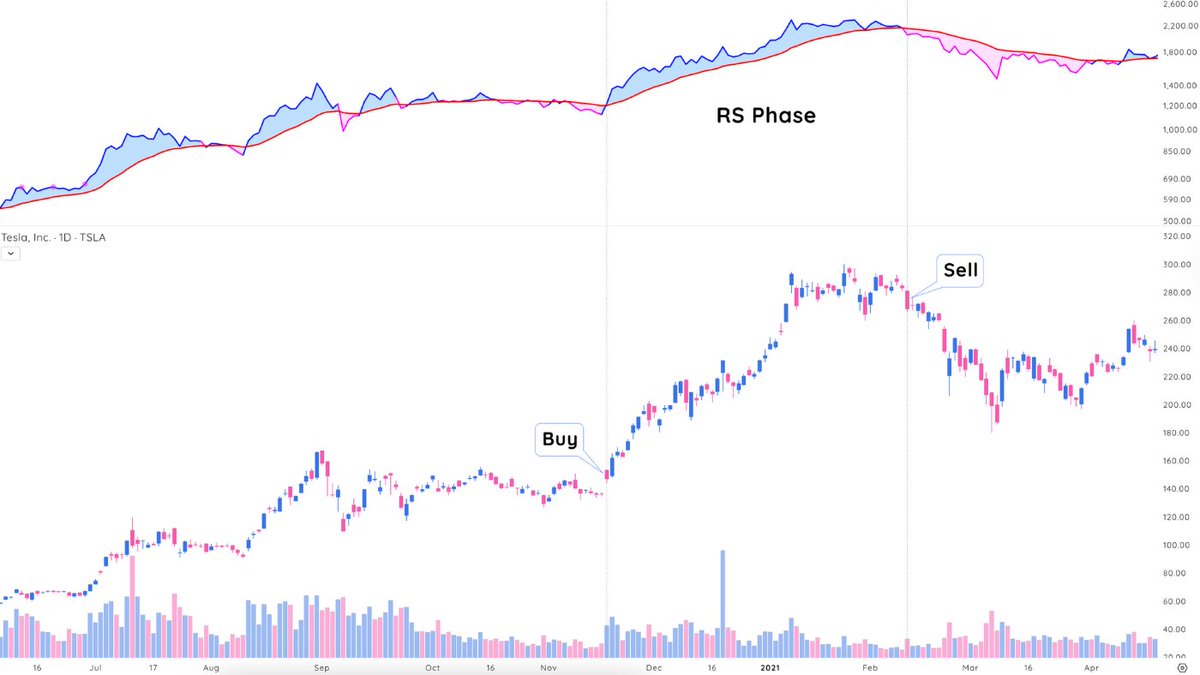

"As long as a stock is acting right, and the market is right, do not be in a hurry to take profits."

This is a great lesson and one many traders struggle with. Developing sell rules to curb your emotions is one way to achieve this!

This is a great lesson and one many traders struggle with. Developing sell rules to curb your emotions is one way to achieve this!

"The money lost by speculation alone is small compared with the gigantic sums lost by so-called investors who have let their investments ride."

Risk management is key to any successful system in the markets.

Risk management is key to any successful system in the markets.

Never buy a stock because it has had a big decline from its previous high.

Bottom fishing is never a successful strategy - no matter your timeframe.

Bottom fishing is never a successful strategy - no matter your timeframe.

"I become a buyer as soon as a stock makes a new high on its movement after having had a normal reaction."

"The human side of every person is the greatest enemy of the average investor or speculator."

Often times we let our minds get in front of what we should really be doing.

Often times we let our minds get in front of what we should really be doing.

"Big movements take time to develop."

Having the patience to allow a big move to develop is a super power.

Having the patience to allow a big move to develop is a super power.

"It is not good to be too curious about all the reasons behind price movements."

We don't need to know the why's and how's behind a price movement. We just need to know if this price movement fits within our process and system in the markets.

We don't need to know the why's and how's behind a price movement. We just need to know if this price movement fits within our process and system in the markets.

"It is much easier to watch a few than many."

Keeping track of a small amount of names in our portfolio is easier than keeping track of many.

Keeping track of a small amount of names in our portfolio is easier than keeping track of many.

"If you cannot make money out of the leading active issues, you are not going to make money out of the stock market as a whole."

We should always be most focused on the leaders no matter what.

We should always be most focused on the leaders no matter what.

"The leaders of today may not be the leaders of two years from now."

Leadership can and will change over time.

Leadership can and will change over time.

"Do not become completely bearish or bullish on the whole market because one stock in some particular group has plainly reversed its course from the general trend."

We must understand how the market is acting as a whole - not one group or stock can change the entire tide.

We must understand how the market is acting as a whole - not one group or stock can change the entire tide.

"Few people ever make money on tips. Beware of inside information. If there was easy money lying around, no one would be forcing it into your pocket."

If you found this thread to be helpful, please like & retweet the first tweet!

If you want more similar content, please follow us @TraderLion_

Let us know what your favorite quote from Jesse Livermore below 🔽

If you want more similar content, please follow us @TraderLion_

Let us know what your favorite quote from Jesse Livermore below 🔽

• • •

Missing some Tweet in this thread? You can try to

force a refresh