About -

KPIT is a leading independent software development & integration partner helping mobility leapfrog towards a clean, smart & safe future. It accelerates clients implementation of next gen mobility technologies.

KPIT is a leading independent software development & integration partner helping mobility leapfrog towards a clean, smart & safe future. It accelerates clients implementation of next gen mobility technologies.

Global Presence -

KPIT has been earning 42% from USA, 41% from Europe and 17% from Rest of the world.

Aggressively localising it's workforce in USA & Europe in order to clinch large deals in engineering service space.

KPIT has been earning 42% from USA, 41% from Europe and 17% from Rest of the world.

Aggressively localising it's workforce in USA & Europe in order to clinch large deals in engineering service space.

Financial Summary -

Q3 FY22 (YoY)

Revenue were at Rs.622 Cr.⬆️20%

PAT at Rs.70 Cr.⬆️68%

EBITDA at Rs.115 Cr.⬆️41%

EPS at Rs. 2.56 ⬆️66%

Q3 FY22 (YoY)

Revenue were at Rs.622 Cr.⬆️20%

PAT at Rs.70 Cr.⬆️68%

EBITDA at Rs.115 Cr.⬆️41%

EPS at Rs. 2.56 ⬆️66%

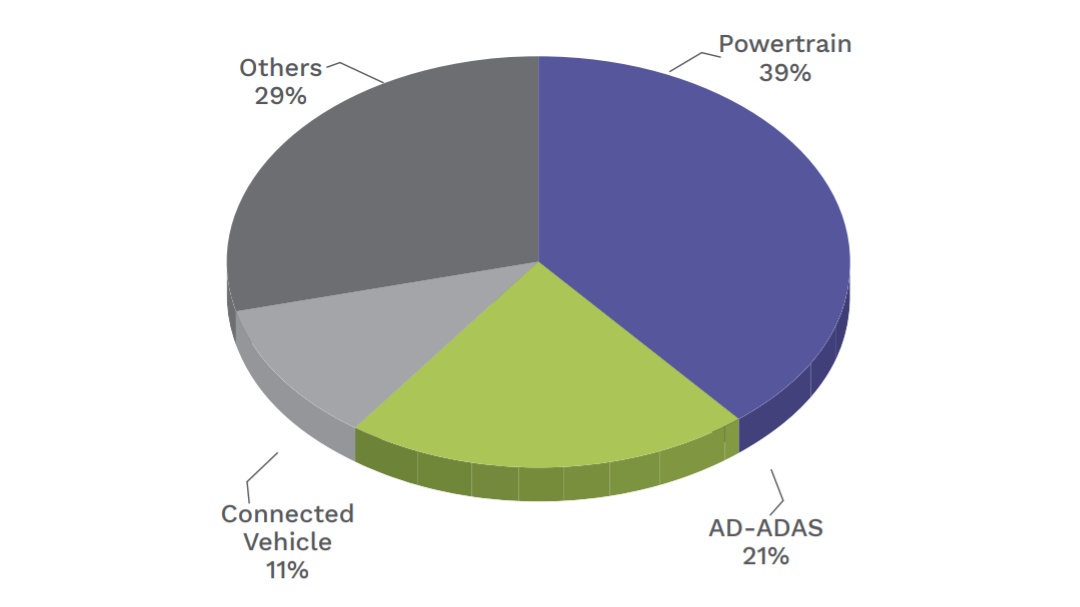

Revenue Breakup -

KPIT earns 39% of it's revenue form Powertrain, 21% from AD-ADAS ( Autonomous Driving- Autonomous Driver Assistance System), 11% from Connected Vehicle & 29% others.

KPIT earns 39% of it's revenue form Powertrain, 21% from AD-ADAS ( Autonomous Driving- Autonomous Driver Assistance System), 11% from Connected Vehicle & 29% others.

▪️Electric & Conventional Powertrain :

KPIT provides a complete suite of engineering services in the electrification space such as Battery Management System, Vehicle to Grid stack, Inverter platform, which can be used by OEMs to reduce the overall development time & cost.

KPIT provides a complete suite of engineering services in the electrification space such as Battery Management System, Vehicle to Grid stack, Inverter platform, which can be used by OEMs to reduce the overall development time & cost.

▪️AD-ADAS :

It could emerge as catalyst for KPIT

.

ADAS is a part of a big concept of autonomous driving (AD) & it is the most important technology for self-driving cars. It constantly keeps an eye on the road and alerts the driver in real-time of any impending danger.

It could emerge as catalyst for KPIT

.

ADAS is a part of a big concept of autonomous driving (AD) & it is the most important technology for self-driving cars. It constantly keeps an eye on the road and alerts the driver in real-time of any impending danger.

Further,

ADAS is a mix of 12 technologies that primarily work with the help of 3types of sensors i.e. RADAR, LiDAR & CAMERA. These

technologies can be divided into 3 main groups based on their functionalities i.e. Sensing & Analyzing, Deciding, and Controlling.

ADAS is a mix of 12 technologies that primarily work with the help of 3types of sensors i.e. RADAR, LiDAR & CAMERA. These

technologies can be divided into 3 main groups based on their functionalities i.e. Sensing & Analyzing, Deciding, and Controlling.

▪️Connected Vehicle :

India is carrying out extensive work in the areas of electric and hybrid cars, hydrogen fuel cells, multiple battery technologies. This provides opportunities for engineering solutions in the field of alternate powertrains.

India is carrying out extensive work in the areas of electric and hybrid cars, hydrogen fuel cells, multiple battery technologies. This provides opportunities for engineering solutions in the field of alternate powertrains.

As more automobiles connect, software competency will provide an edge & open further opportunities for the service providers.

Long Term Triggers -

• Global automotive industry is getting disturbed from automation & electrification led by new age automotive players.

• Niche offering, strong relationship with global automotive OEMs & established suppliers.

• Global automotive industry is getting disturbed from automation & electrification led by new age automotive players.

• Niche offering, strong relationship with global automotive OEMs & established suppliers.

• KPIT enjoys an established client base to whom it offers multiple

services. The company helps customers go

from design to production.

services. The company helps customers go

from design to production.

Acquisition -

KPIT acquired controlling stake in #PathPartner.

PathPartner is a specialist design service and solution provider of operating system software and low-level software for Automotive, Camera, Radar and Multimedia devices.

KPIT acquired controlling stake in #PathPartner.

PathPartner is a specialist design service and solution provider of operating system software and low-level software for Automotive, Camera, Radar and Multimedia devices.

Risks -

• Macro environment uncertainty in Europe & US.

• Stress in automotive sector.

• Rupee's appreciation against key customer currency

• Macro environment uncertainty in Europe & US.

• Stress in automotive sector.

• Rupee's appreciation against key customer currency

Conclusion -

Long term growth prospects seems positive of KPIT Technologies driven by new growth opportunities getting created for the automotive industry as a whole.

Long term growth prospects seems positive of KPIT Technologies driven by new growth opportunities getting created for the automotive industry as a whole.

🙏 Please like 👍, comment & retweet ♻️ if you find this useful.

• • •

Missing some Tweet in this thread? You can try to

force a refresh