The narrative sounds simple: sanctions will crash the Ruble, isolate Russian economy, create massive inflation and hopefully Russia will cave.

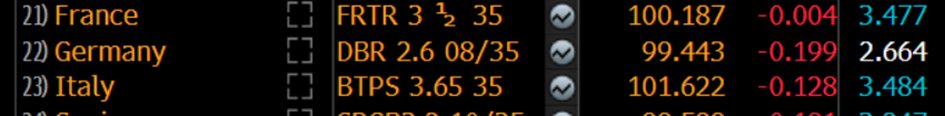

But the chart for EUR vs RUB stubbornly disagrees… What’s happening here? Are sanctions not working? Why?

Important thread (I think)

But the chart for EUR vs RUB stubbornly disagrees… What’s happening here? Are sanctions not working? Why?

Important thread (I think)

But first, I wanted to check if screen prices are genuine – so I called a dealer and tried to sell a bit of RUB. At first, it felt like I was trying to sell him child porn! But eventually, after a bit of a weird convo, they were ready to trade, not too far from the screen price.

So, it does look like RUB recovered a big chunk of the drop. How is it possible if all of Russia’s FX reserves are frozen? Let’s dig.

True, not all reserves are frozen, but it does not seem like Russia is selling its gold and almost all transactions (including FX) with the Central Bank of Russia (CBR) have been prohibited.

So, again, why isn’t the RUB crashing?

So, again, why isn’t the RUB crashing?

Two things worth pointing out:

1. Sorry for the oversimplification, but you care about FX only because of international trade. If we discovered the people on Mars have a currency, I don’t think we’d care about the parity with the USD, with all that trade going on with them.

1. Sorry for the oversimplification, but you care about FX only because of international trade. If we discovered the people on Mars have a currency, I don’t think we’d care about the parity with the USD, with all that trade going on with them.

And of course,

2. Trade hasn’t really stopped with Russia. We still sell them stuff (or China does) and they still sell us commodities and energy.

We’ve embargoed Vuitton handbags and other stuff, but I’m not sure it’s really meaningful.

2. Trade hasn’t really stopped with Russia. We still sell them stuff (or China does) and they still sell us commodities and energy.

We’ve embargoed Vuitton handbags and other stuff, but I’m not sure it’s really meaningful.

If you look at the currency balance of Russia, the picture is pretty clear: even if the stock is frozen, the flow is still pretty much positive for Russia, so they still have all the hard currency they need to buy stuff they want

But the story doesn’t stop here, far from it.

Because, as @PaulJDavies pointed out this weekend, a mystery remains: haven’t we blocked Russia’s FX USD reserves precisely so that they can’t continue to use them.

Well, this is where it gets very tricky and interesting.

Because, as @PaulJDavies pointed out this weekend, a mystery remains: haven’t we blocked Russia’s FX USD reserves precisely so that they can’t continue to use them.

Well, this is where it gets very tricky and interesting.

To manage the FX crisis, Poutine passed a rather smart decree saying that all exporters in Russia have to sell withing three days their hard FX in exchange for Rubles:

sanctionsnews.bakermckenzie.com/urgent-measure…

sanctionsnews.bakermckenzie.com/urgent-measure…

In theory this would support the RUB and allow the importers to buy FX at a reasonable with their RUB.

Initially, I thought this was happening in the market, but this doesn’t work because the volumes are too big.

So, who are the exporters selling their FX to?

Initially, I thought this was happening in the market, but this doesn’t work because the volumes are too big.

So, who are the exporters selling their FX to?

My 2nd guess was a non-sanctioned bank (e.g. Gazprombank) which would then sell it to an importer. But this is tricky because the importer and the exporter will not use same amounts at same time (the decree only leaves 3 days to sell)

No way a bank can take that massive FX risk.

No way a bank can take that massive FX risk.

So it leaves us with only 1 option (which btw is the logical one): the exporters sell to the CBR and the CBR injects it in the system – via a non-sanctioned bank – when required by an importer. This way there is no selling pressure on the RUB - no need for the frozen stock.

But wait: does this mean that the CBR is still playing with USDs? Isn’t it supposed to be sanctioned? Sure, it's weird to imagine that the US can sanction anyone in the world just because they are handling USD, but one should remember that it is precisely what the US love doing!

I mean, BNP, a French bank, paid a 9bn$ fine precisely because of this!

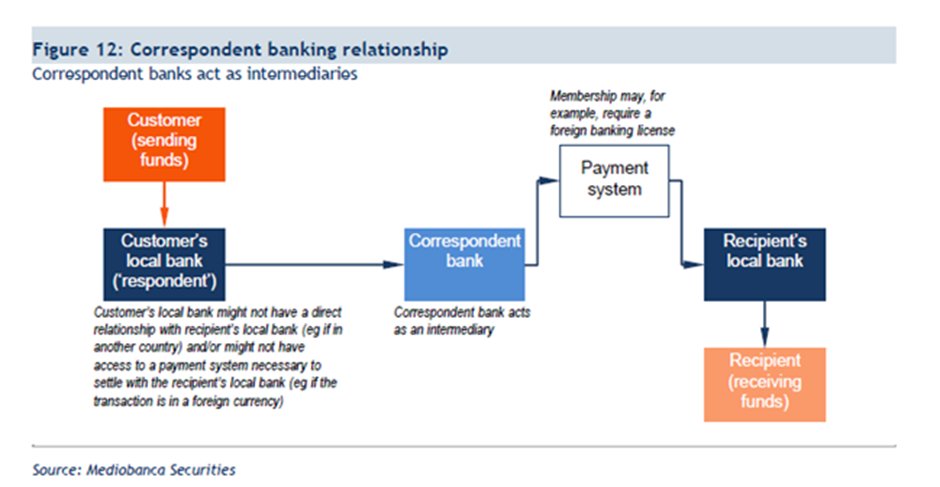

The reason is that every single USD out there is ultimately settled in the US (at the NY Fed iirc) by American institutions which are the direct counterparties of the Fed payment system.

The reason is that every single USD out there is ultimately settled in the US (at the NY Fed iirc) by American institutions which are the direct counterparties of the Fed payment system.

So even the USD held by the CBR is ultimately somehow a claim on the Fed – with many intermediaries. And this is where is the loophole that allows the CBR to continue the USD. As @Alea_ pointed out, OFAC sanctions only prohibit *transactions* with the CBR (not freeze)

@Alea_ This means that CBR USD accounts that are not at a US entity are not explicitly prohibited by OFAC restrictions. Imagine the following: CBR has a USD acct at Gazprombank, Gazprombank has a USD acct at a Chinese bank and Chinese bank has a USD acct at a US depositary institution.

@Alea_ Sure, Gazprombk is aware that it has USD from CBR. But Chin bank only knows about the net value of Gazprombk USD – could be plenty of non-sanctioned entities. Worse, US depositary bank – correspondent bank for Chinese bank - would only have net value of all USD of Chinese bank

This network is hiding the CBR transactions. It doesn’t mean that they’re totally legal and that there is no risk. US sanctions for correspondent banks are a very tricky topic. See there

https://twitter.com/jeuasommenulle/status/1227982367664504833?s=20&t=C_VxlEwyqSx-Ok6OfofO1g

Being a correspondent means that you only transfer money from one bank to another, you don't really know who the ultimate clients are As nicely summarised in this chart by Mediobanca

But this doesn't mean that a correspondent bank has no liability. In the US, in particular, the Bank secrecy act says that they must have "appropriate, specific, and, where necessary, enhanced, due diligence policies, procedures, and controls -

that are reasonably designed to detect and report instances of money laundering through those accounts.” and OCC has issued rather strict guidelines on this. Basically if the whole thing was suspicious and you pretend you didn't notice, you're in trouble.

So my final take is the following: the way the sanctions system is designed, the CBR can pretty much “outsource” its FX management to private sector entities.

And there are, ultimately, US banks involved. The risk that this could backfire in the future is definitely non zero.

And there are, ultimately, US banks involved. The risk that this could backfire in the future is definitely non zero.

But more importantly, finding a way to close this loophole would be a massive blow to Russia’s economy – because so far, sanctions are only partially working.

tagging the persons involved in the discussion this weekend and who greatly help me understand

@dsquareddigest @Alea_ @PaulJDavies @RobinBrooksIIF

@dsquareddigest @Alea_ @PaulJDavies @RobinBrooksIIF

@dsquareddigest @Alea_ @PaulJDavies @RobinBrooksIIF And the one person who could actually do something about it : @Brad_Setser

(SORRY of course it's a USD vs RUB chart, not sure how that got mixed up - not that it changes anything fundamentally)

• • •

Missing some Tweet in this thread? You can try to

force a refresh