Innovative Lowcap Tomb Fork on $METIS.

@repath_finance

There's a lot of building & innovation from other chains to Metis, from Yield Aggregators, #DaaS models to Solidly forks.

Let's have a look at the most promising Tomb Fork yet.

RT, and as usual, let's dive.

@repath_finance

There's a lot of building & innovation from other chains to Metis, from Yield Aggregators, #DaaS models to Solidly forks.

Let's have a look at the most promising Tomb Fork yet.

RT, and as usual, let's dive.

RePATH Finance is a first algorithmic stable coin pegged to the value of 1 $Nett token via seigniorage. Its a multi-token protocol, launched on Metis Chain that consists of the following three tokens:

- $REPT

- $RePATH

- $ReBOND

What then makes them different from others?

- $REPT

- $RePATH

- $ReBOND

What then makes them different from others?

While most Forks come with a promise of lucrative yield over long term sustainability, and fail more often than not, @repath_finance aims to build an ecosystem whilst maintaining said yield;

Cross chain integration with a different pegged token on each one.

Cross chain integration with a different pegged token on each one.

If you didn't understand what I meant, Repath is seeking to build on multiple chains; first on Metis (taking advantage of the Eco's low tx cost and scalability), and subsequently to others, this indirectly spells more adoption for the Token and a budding ecosystem.

Most Tomb Forks exist on one chain, hence don't expand & innovate w the times.

Knowledgeable Crypto investors always rotate based on Money flow at the current time. A chain can undergo downtime *cough* solana or Fud of loss of core devs *cough* Fantom, and this affects tokens

Knowledgeable Crypto investors always rotate based on Money flow at the current time. A chain can undergo downtime *cough* solana or Fud of loss of core devs *cough* Fantom, and this affects tokens

..built on that chain. With the Multi chain feature, this will be negated.

That's not all.

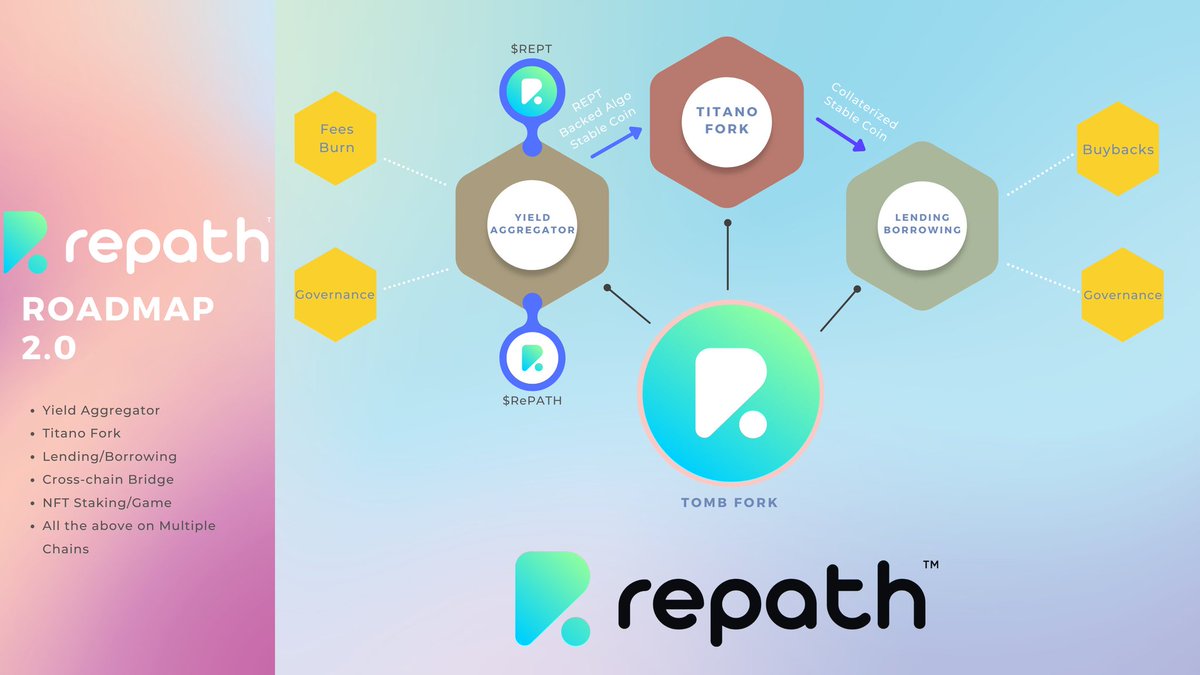

Released their roadmap and the quality of things they're bringing.

That's not all.

Released their roadmap and the quality of things they're bringing.

So it'll just be not just a Tomb Fork, but a Yield Aggregator, Lending/Borrowing Dex and so much more.

Existing on different chains.

The ultimate, Tomb Fork with added functionalities and innovation.

Existing on different chains.

The ultimate, Tomb Fork with added functionalities and innovation.

The Team is commited to making this a reality, and what from what I hear, there's HUGE announcements in view for them.

An expert thread on the technicalities and how to earn for now with the Token by @kendrickNoble7

An expert thread on the technicalities and how to earn for now with the Token by @kendrickNoble7

https://twitter.com/kendrickNoble7/status/1506181794432958465?t=YdsEbbR5t4xX2a72Bx3mQQ&s=19

I'd do mine subsequently explaining the token's functionalities, but as always, I'm positioned and if you're new on $METIS, this is very much a project to watch out for.

Currently at 9.36M Mcap.

Currently at 9.36M Mcap.

Website: repath.finance

Docs: docs.repath.finance

Twitter: @repath_finance

Telegram Announcements:

t.me/repathfinance

Discord: discord.gg/Vevv5BAy

Docs: docs.repath.finance

Twitter: @repath_finance

Telegram Announcements:

t.me/repathfinance

Discord: discord.gg/Vevv5BAy

• • •

Missing some Tweet in this thread? You can try to

force a refresh