FINAL DAY: #FTCommodities summit Day 3 has just started. Today we hear from industry leaders focusing on shipping, sustainable agriculture and ESG. There is still time to watch online live and catch up on demand: on.ft.com/2ZPm8pe

Follow this thread for today's highlights.

Follow this thread for today's highlights.

Up first @humenm talks numbers with the finance chiefs of the world’s biggest commodity traders. They reflect on the performance of their businesses and reflect on key trends facing the industry. #FTCommodities on.ft.com/2ZPm8pe

@humenm @vitolnews @Gunvor @Mercuria 'Russia represents give or take, 10% of the oil supplies of hydrogen carbon to the world. So obviously, unplugging Russia from the rest of the world will have consequences on the market.' @Trafigura's CFO Christophe Salmon at #FTCommodities. Watch: on.ft.com/2ZPm8pe

@humenm @vitolnews @Gunvor @Mercuria @Trafigura Khalid Al-Mudaifer, Vice Minister for Mining Affairs at the Ministry of Industry and Mineral Resources @mimgov joins @humenm now for our next session at #FTCommodities.

@humenm @vitolnews @Gunvor @Mercuria @Trafigura @mimgov 'There are plans in the works' for the Ministry of Industry and Mineral Resources @mimgov to invest outside of Saudi Arabia. Khalid Al-Mudaifer tells @humenm at #FTCommodities.

@humenm @vitolnews @Gunvor @Mercuria @Trafigura @mimgov 'What we need to work on in the mining sector is the perception of mining. It is needed to help with decarbonisation, people need to remember there are no minerals without mining.' #FTCommodities @mimgov

@humenm @vitolnews @Gunvor @Mercuria @Trafigura @mimgov Commodity trading - After a string of scandals, there has been a flight towards the bigger players by trade finance banks. But can small and mid-sized players, focused on more niche markets, still thrive? @humenm explores now with our next panel at #FTCommodities

@humenm @vitolnews @Gunvor @Mercuria @Trafigura @mimgov Could the gas market break? 'We are right at the extreme of how the market can function. Regulations and sanctions are the key determinant in how you manage risk.' Engelhart commodities trading partners' Huw Jenkins at #FTCommodities

@humenm @vitolnews @Gunvor @Mercuria @Trafigura @mimgov How are trade finance banks looking at the commodity trading industry against a backdrop of increasingly volatile commodity markets, the energy transition and regulators' increased focus on environmental, social and governance metrics? Our next #FTCommodities panel discuss now.

@humenm @vitolnews @Gunvor @Mercuria @Trafigura @mimgov @NatixisIM @Citi @EITIorg 'Metals are critical to the energy transition.' Mark Robinson, Executive Director of the Extractive Industries Transparency Initiative (EITI) at #FTCommodities

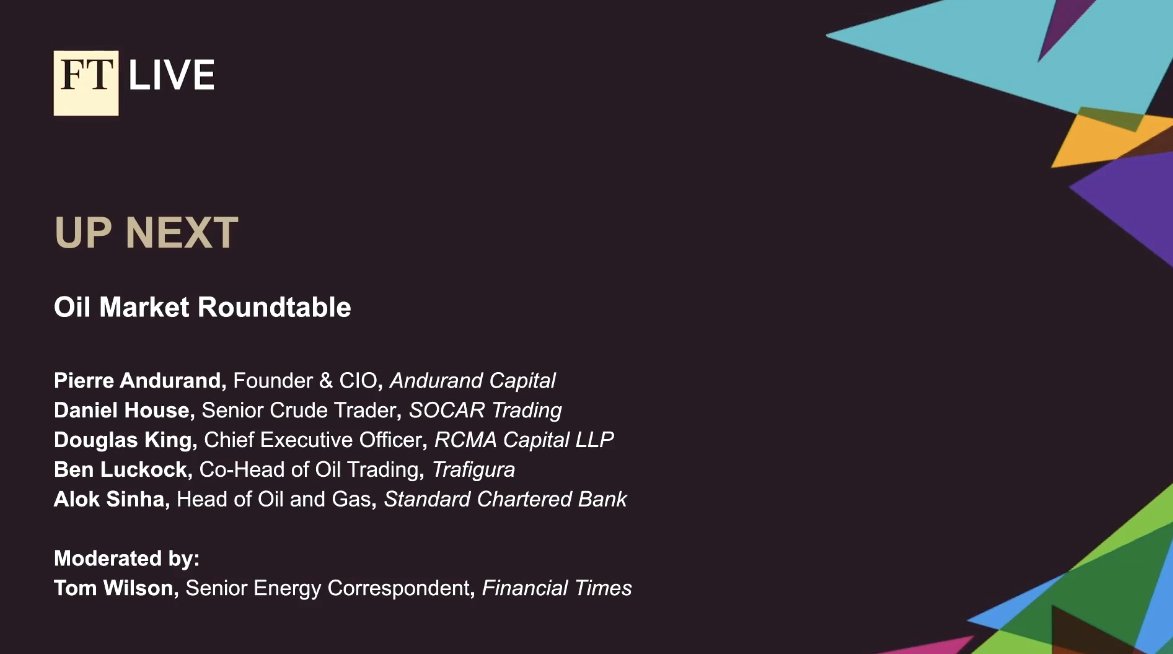

@humenm @vitolnews @Gunvor @Mercuria @Trafigura @mimgov @NatixisIM @Citi @EITIorg NOW: Crude oil has risen sharply over the past year as demand has picked up after the pandemic. But with Brent trading around $70 per barrel, what’s next for the world’s most important commodity? And is a lack of investment really responsible for the rally?

#FTCommodities

#FTCommodities

@humenm @vitolnews @Gunvor @Mercuria @Trafigura @mimgov @NatixisIM @Citi @EITIorg @SOCARofficial @StanChart @thomas_m_wilson 'Going to see $150 oil highs this summer.' @Trafigura Co-Head of Oil Trading Ben Luckock

'We will get an oil shock in 2022, I can easily see $225-50 peak prices.' Douglas King, Chief Executive Officer at RCMA Capital LLP

#FTCommodities

'We will get an oil shock in 2022, I can easily see $225-50 peak prices.' Douglas King, Chief Executive Officer at RCMA Capital LLP

#FTCommodities

@humenm @vitolnews @Gunvor @Mercuria @Trafigura @mimgov @NatixisIM @Citi @EITIorg @SOCARofficial @StanChart @thomas_m_wilson Secondary sanctions on buying Russian crude oil? Dependant on 'two factors - How the war progresses as everything is on the table and who is doing what, such as China buying up Russian oil at discounted rates that knock the West.' @Trafigura's Ben Luckock at #FTCommodities

@humenm @vitolnews @Gunvor @Mercuria @Trafigura @mimgov @NatixisIM @Citi @EITIorg @SOCARofficial @StanChart @thomas_m_wilson Feeding a growing global population while reducing an environmental footprint is the biggest challenge facing agriculture and one that cannot be ignored. But how should the industry respond and what part can consumers play in creating a more sustainable future? #FTCommodities

@humenm @vitolnews @Gunvor @Mercuria @Trafigura @mimgov @NatixisIM @Citi @EITIorg @SOCARofficial @StanChart @thomas_m_wilson @EmikoTerazono @DaphneHameetem1 @StandMighty @glennhurowitz Blockchain & Sustainability: 'I think it could be an effective and helpful tool to help utilise sustainable actions.' Wei Peng, LDC Global Head of Sustainability for Grains & Oilseeds at #FTCommodities

@humenm @vitolnews @Gunvor @Mercuria @Trafigura @mimgov @NatixisIM @Citi @EITIorg @SOCARofficial @StanChart @thomas_m_wilson @EmikoTerazono @DaphneHameetem1 @StandMighty @glennhurowitz We return after our #FTCommodities summit lunch to hear Angelicoussis Group Chief Executive Officer Maria Angelicoussis in conversation with @tradewindsnews Editor-in-chief Julian Bray for a CEO spotlight. Watch: on.ft.com/2ZPm8pe

@humenm @vitolnews @Gunvor @Mercuria @Trafigura @mimgov @NatixisIM @Citi @EITIorg @SOCARofficial @StanChart @thomas_m_wilson @EmikoTerazono @DaphneHameetem1 @StandMighty @glennhurowitz @tradewindsnews 'We won't be lifting Russian cargo, it is an ethical component' alongside following sanctions. #FTCommodities Angelicoussis Group Chief Executive Officer Maria Angelicoussis.

@humenm @vitolnews @Gunvor @Mercuria @Trafigura @mimgov @NatixisIM @Citi @EITIorg @SOCARofficial @StanChart @thomas_m_wilson @EmikoTerazono @DaphneHameetem1 @StandMighty @glennhurowitz @tradewindsnews 'We believe in LNG in the short, mid and long term. We think it is a core component to the Energy Transition.' Angelicoussis Group Chief Executive Officer Maria Angelicoussis at #FTCommodities. Watch: on.ft.com/2ZPm8pe

@humenm @vitolnews @Gunvor @Mercuria @Trafigura @mimgov @NatixisIM @Citi @EITIorg @SOCARofficial @StanChart @thomas_m_wilson @EmikoTerazono @DaphneHameetem1 @StandMighty @glennhurowitz @tradewindsnews The last two years have seen a rollercoaster in dry, wet and gas shipping markets. What are the lessons from the last two years, and how will freight markets play out in 2022 and beyond? We discuss managing freight volatility now with our next panel at #FTCommodities

@humenm @vitolnews @Gunvor @Mercuria @Trafigura @mimgov @NatixisIM @Citi @EITIorg @SOCARofficial @StanChart @thomas_m_wilson @EmikoTerazono @DaphneHameetem1 @StandMighty @glennhurowitz @tradewindsnews Demands to cut carbon emissions are reshaping relationships between charterers, shipowners, and investors. How are markets evolving as decarbonisation accelerates, how deep will these changes reach, and what are the implications? Our final #FTCommodities summit panel explore now.

@humenm @vitolnews @Gunvor @Mercuria @Trafigura @mimgov @NatixisIM @Citi @EITIorg @SOCARofficial @StanChart @thomas_m_wilson @EmikoTerazono @DaphneHameetem1 @StandMighty @glennhurowitz @tradewindsnews @Cargill @BalticExchange @HELMEPA 'Hydrogen and carbon value chains are the future. Carbon capture will be important to get there.' @ABSeagle's Chairman, President & CEO Christopher J. Wiernicki on cutting carbon emissions in shipping at #FTCommodities summit.

@humenm @vitolnews @Gunvor @Mercuria @Trafigura @mimgov @NatixisIM @Citi @EITIorg @SOCARofficial @StanChart @thomas_m_wilson @EmikoTerazono @DaphneHameetem1 @StandMighty @glennhurowitz @tradewindsnews @Cargill @BalticExchange @HELMEPA @ABSeagle We have come to the end of our 2022 #FTCommodities global summit in Lausanne, Switzerland. Thank you to all of our sponsors and partners. Watch on demand here: on.ft.com/2ZPm8pe

• • •

Missing some Tweet in this thread? You can try to

force a refresh