This is Alex Rozek.

He runs Boston Omaha $BOC, almost like a tiny version of Berkshire.

He’s the grandson of Warren Buffett’s late sister Doris.

In 2015, he started publishing his shareholder letters.

Here are snippets that stood out to me:

📷 credit = WSJ

He runs Boston Omaha $BOC, almost like a tiny version of Berkshire.

He’s the grandson of Warren Buffett’s late sister Doris.

In 2015, he started publishing his shareholder letters.

Here are snippets that stood out to me:

📷 credit = WSJ

First, an introduction of Omaha Boston’s businesses

Controlled

1. Link Media Outdoor - billboard operations

2. General Indemnity Group - surety insurance

3. Airebeam - wireless broadband provider

Minority stakes

👉 Logic Real Estate

👉 Dream Finders Homes

👉 Crescent Bank

Controlled

1. Link Media Outdoor - billboard operations

2. General Indemnity Group - surety insurance

3. Airebeam - wireless broadband provider

Minority stakes

👉 Logic Real Estate

👉 Dream Finders Homes

👉 Crescent Bank

1/ Decision-making Framework

Alex Rozek lays out his framework clearly how he intends to run the company.

This allows him to attract the right kind of investors.

1. Incentives

2. Decentralization

3. Long-term thinking

4. Focus on cash

5. Partnership

Alex Rozek lays out his framework clearly how he intends to run the company.

This allows him to attract the right kind of investors.

1. Incentives

2. Decentralization

3. Long-term thinking

4. Focus on cash

5. Partnership

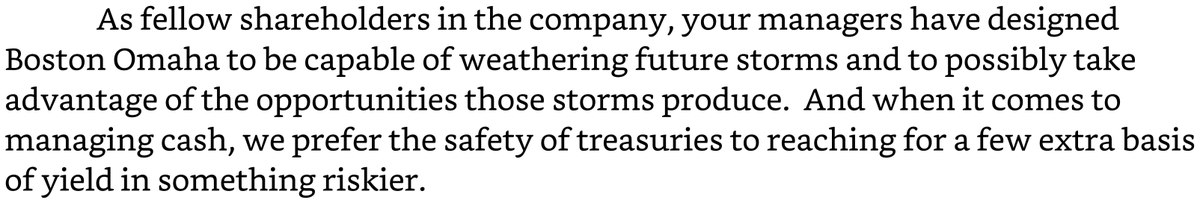

2/ Longevity First, Returns Second

Most investors think of returns and not risks.

Alex thinks of making good returns safely and it's never about putting the company in a tight spot.

He's playing the long game.

Most investors think of returns and not risks.

Alex thinks of making good returns safely and it's never about putting the company in a tight spot.

He's playing the long game.

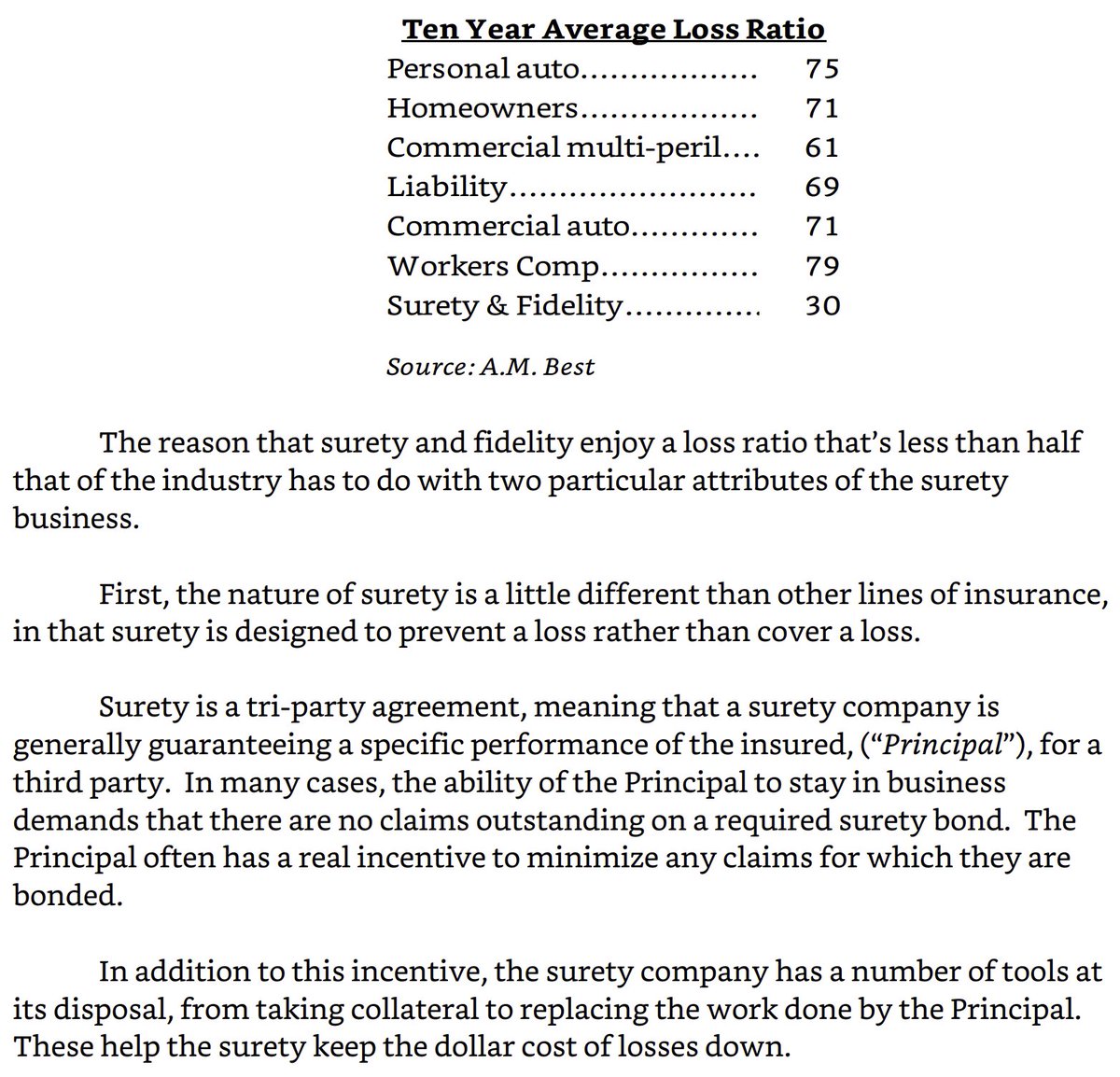

3/ Why He's In Surety Insurance

1. High frequency of policies

2. low loss limits

3. short duration

It’s also where competition is minimum, creating healthy margins.

1. High frequency of policies

2. low loss limits

3. short duration

It’s also where competition is minimum, creating healthy margins.

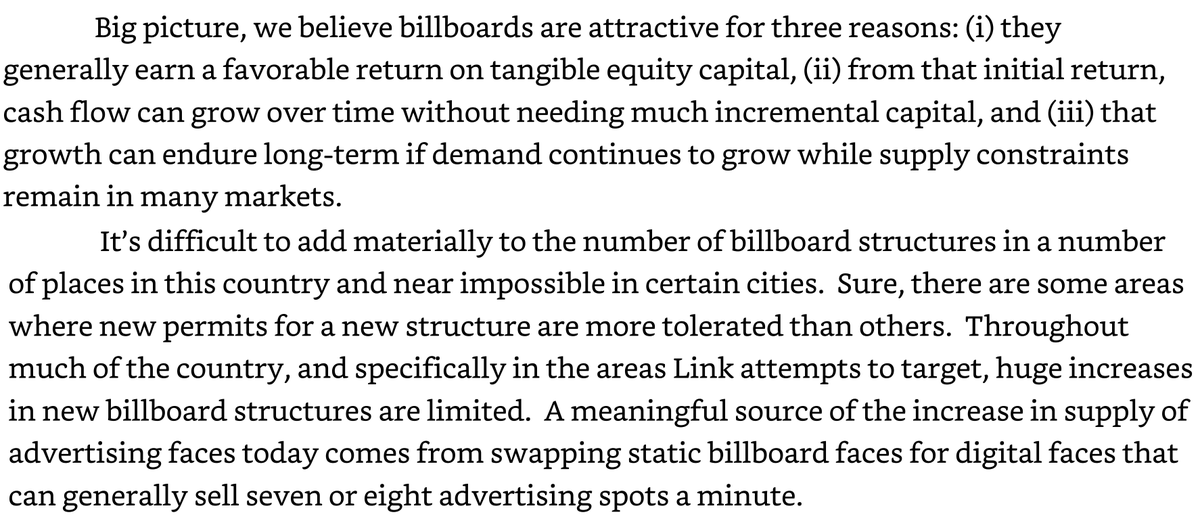

3/ Why Billboards?

Lesser supply in the industry -> Lesser competition

Demand grows -> higher prices -> favourable return on tangible equity capital

He also goes on to talk about the differences between static and digital billboards

Lesser supply in the industry -> Lesser competition

Demand grows -> higher prices -> favourable return on tangible equity capital

He also goes on to talk about the differences between static and digital billboards

4/ Why Fiber Internet Services?

In 2020, Boston Omaha bought AireBeam.

Airebeam is a disciplined operator, finding markets where they can be the first truly high-speed network in town.

+ Stable revenue

+ Growth in the industry

+ Low maintenance capex

= Good returns

In 2020, Boston Omaha bought AireBeam.

Airebeam is a disciplined operator, finding markets where they can be the first truly high-speed network in town.

+ Stable revenue

+ Growth in the industry

+ Low maintenance capex

= Good returns

5/ Summary

Traits he wants in businesses:

1. Low level of competition

2. Low risks

3. Good returns on tangible assets

4. Fair price

How he does his investments:

1. Never take unnecessary risks to squeeze returns

2. Only do business with people he trusts

Traits he wants in businesses:

1. Low level of competition

2. Low risks

3. Good returns on tangible assets

4. Fair price

How he does his investments:

1. Never take unnecessary risks to squeeze returns

2. Only do business with people he trusts

That's a wrap!

If you enjoyed this thread:

1. Follow me @SlingshotCap for more of these

2. Download Boston Omaha's letters here: drive.google.com/drive/folders/…

3. Share this thread with more people by retweeting it!

If you enjoyed this thread:

1. Follow me @SlingshotCap for more of these

2. Download Boston Omaha's letters here: drive.google.com/drive/folders/…

3. Share this thread with more people by retweeting it!

https://twitter.com/SlingshotCap/status/1508428980629745665

• • •

Missing some Tweet in this thread? You can try to

force a refresh