0/16 ‘Governance’ is a major means of creating intrinsic value by the community in chains and derivative services that apply PoS. Following the industry awakening #junoprop16, I'd like to share my views on recent Stargaze proposal #23.

1/16 Stargaze (hereafter $STARS) is the first NFT marketplace within the $ATOM ecosystem with a vision to create a community-led marketplace.

2/16 In addition to the ongoing utility of Launchpad and Protocol Governance, $STARS plans to expand its utility for investors and creators in the future including social token issuance, NFT DeFi, and so on.

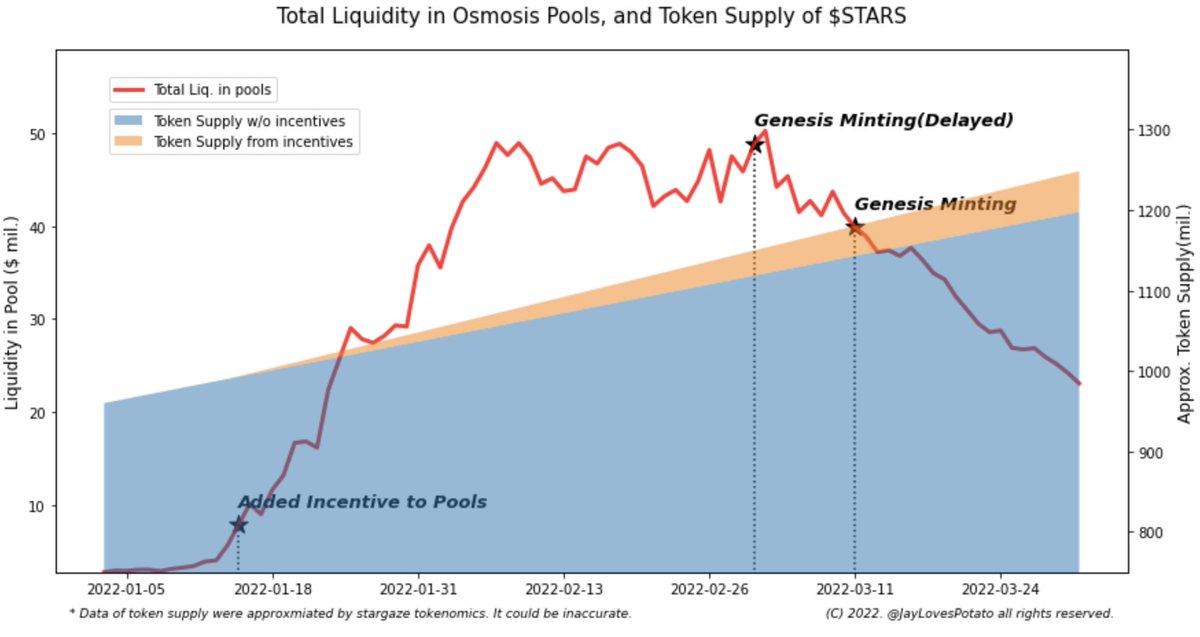

3/16 Starting from January 14, 2022, Osmosis has provided liquidity to $STARS through two pools($ATOM/$STARS and $OSMO/$STARS) by adding 30 million $STARS as incentives.

4/16 We could witness much price hype and liquidity provision as soon as the incentivized pool kicked in; yet, $STARS is facing much downward pressure for it could not provide much utility after the Genesis Mint.

(As of 3/31, $STARS Only)

OSMO/STARS : $16m

STARS/ATOM : $7m

(As of 3/31, $STARS Only)

OSMO/STARS : $16m

STARS/ATOM : $7m

5/16 In response, the Stargaze core team proposed the prop#23 to add additional 30m and 20m Stargaze incentives to the STARS/OSMO and ATOM/STARS pools respectively. I assume this proposal came in light of preventing downward pressure and liquidity drain.

: wallet.keplr.app/#/stargaze/gov…

: wallet.keplr.app/#/stargaze/gov…

6/16 I think this proposal could backfire and leave the impact that the core team did not intend. The proposal may lead to an unhealthy outcome for the $STARS ecosystem. Here’s why:

7/16 [Utility]: $STARS has not yet procured enough utility as planned on the project roadmap. Although many NFT projects are onboarding on $STARS, it's hard to imagine further functional or economic incentives for token holders at the moment. We need more than gov. and launchpad.

8/16 Without the marketplace launch in coming days or weeks, $STARS provided through incentive pools will not likely lead to a new influx of $STARS holders but will lead to higher sell pressure coming from incumbent LP holders.

9/16 [Tokenomics]: Inflation and incentive pools are providing enough supply yet you can see that total liquidity in Osmosis Pools is declining. I think this could be interpreted as excessive token supply.

(*Total supply is an approximation based on $STARS tokenomics and current block height. It could be inaccurate.)

$STARS tokenomics could be found here: mirror.xyz/stargazezone.e…)

$STARS tokenomics could be found here: mirror.xyz/stargazezone.e…)

10/16 What if the liquidity equivalent to 0.27mil of tokens per day is added to the ecosystem as proposed without a clear timeline for further addition of token utility?

11/16 As witnessed from the aforementioned graphic data, I suspect the proposed incentive won’t lead to much positive outcome. Indeed, compared to the current token supply, the incentive addition is pretty insignificant.

12/16 Price and liquidity are very important factors for crypto service operation. However, the very first thing to take into account is how to increase token value by securing token utility. And, I believe the ecosystem governance should be prioritized toward utility increase.

13/16 Incentive programs and the introduction of Superfluid staking, both financial instruments, are just a means to an end to boost the adoption and intrinsic value of the network.

14/16 We believe that proposals that include partnerships with projects with utility that would ultimately bring the stakers tangible benefits, will be better off for the long term.

15/16 We are rooting for the Stargaze team which has delivered their promises along with clear communication with the community.

16/16 However, we believe that a proposal that focuses on increasing the utility of the tokens will then increase the intrinsic value of the network is required at this point of time.

• • •

Missing some Tweet in this thread? You can try to

force a refresh