This amazing @aarthiswami piece digs deep into a predatory lending scheme run by @LifeAtPurdue & some mysterious bankers. 👇

It's been a big few days of back-to-back scandals in the #studentloan market, but this one deserves special attention.

Here's why.

🧵

It's been a big few days of back-to-back scandals in the #studentloan market, but this one deserves special attention.

Here's why.

🧵

https://twitter.com/YahooFinance/status/1510283062881525772

Mounting evidence shows that Purdue's attention-loving president @purduemitch- former Republican governor & party hack- sold out students to pursue a right-wing fever dream.

Unfortunately for Mitch, @LifeAtPurdue broke a bunch of laws on the way. Now the walls are closing in.

Unfortunately for Mitch, @LifeAtPurdue broke a bunch of laws on the way. Now the walls are closing in.

The family @aarthiswami profiles has a shocking story:

“Feldman's son took out a $10,373 [income-share agreement] for the 2018-19...year, and a $29,491 ISA for the 2019-2020 year...That $39,864 loan ballooned to $99,660.50 as of January 2022.”

Why would *anyone* take this deal?

“Feldman's son took out a $10,373 [income-share agreement] for the 2018-19...year, and a $29,491 ISA for the 2019-2020 year...That $39,864 loan ballooned to $99,660.50 as of January 2022.”

Why would *anyone* take this deal?

As is *always* the case when colleges and Wall Street cut deals to exploit students, @LifeAtPurdue's scheme is built on lies.

In 2020, @theSBPC @NCLC4consumers called on @FTC to investigate deceptive marketing by @VemoEd, the firm in bed w @purduemitch.

In 2020, @theSBPC @NCLC4consumers called on @FTC to investigate deceptive marketing by @VemoEd, the firm in bed w @purduemitch.

https://twitter.com/theSBPC/status/1267450990564978689

But this is just part of the story.

At every step, @VemoEd @LifeAtPurdue told families, including the Feldmans, that the contract they signed was "not a loan" at all- the same lie that landed @BetterFutureFwd @Meratas in regulators' crosshairs last year.

purdue.edu/backaboiler/di…

At every step, @VemoEd @LifeAtPurdue told families, including the Feldmans, that the contract they signed was "not a loan" at all- the same lie that landed @BetterFutureFwd @Meratas in regulators' crosshairs last year.

purdue.edu/backaboiler/di…

Why tell @LifeAtPurdue families that these high-cost loans are something else?

B/c if an ISA is "credit" or "a loan," then when a school pushes it on students, it is also a "private education loan" under the Truth in Lending Act.

That gives students' clear, enforceable rights.

B/c if an ISA is "credit" or "a loan," then when a school pushes it on students, it is also a "private education loan" under the Truth in Lending Act.

That gives students' clear, enforceable rights.

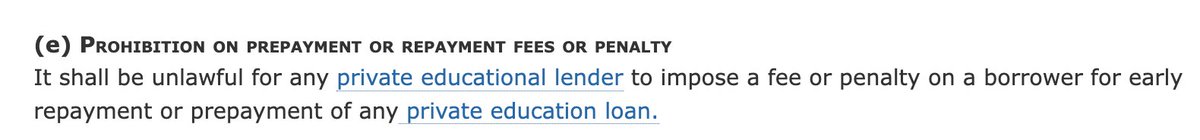

For families who took on a @LifeAtPurdue ISA and had second thoughts, federal law prohibits so-called "prepayment penalties."

That means no one should ever face extra charges for paying off an ISA early.

Yet @LifeAtPurdue demanded twice what the Feldmans' borrowed ~3 years ago.

That means no one should ever face extra charges for paying off an ISA early.

Yet @LifeAtPurdue demanded twice what the Feldmans' borrowed ~3 years ago.

The contract the Feldmans' signed even states outright that these charges are "not an interest rate or annual percentage rate."

That means that this is just an illegal, unenforceable prepayment penalty.

purdue.edu/backaboiler/di…

That means that this is just an illegal, unenforceable prepayment penalty.

purdue.edu/backaboiler/di…

Worse, the whole deal is an illegal "preferred lender arrangement" banned by the Higher Education Act of 1965.

You see, schools have a rancid record of taking cash from lenders and sticking students with high-cost loans.

This is history repeating.

nytimes.com/2007/04/01/opi…

You see, schools have a rancid record of taking cash from lenders and sticking students with high-cost loans.

This is history repeating.

nytimes.com/2007/04/01/opi…

In 2008, Congress banned exactly the sort of back-room deals @purduemitch cut with his Wall Street buddies.

Private lenders can *never* market loans using schools' name, logo or mascot. If they do, schools may forfeit future students' access to Pell Grants & federal loans.

Yet:

Private lenders can *never* market loans using schools' name, logo or mascot. If they do, schools may forfeit future students' access to Pell Grants & federal loans.

Yet:

So why did @LifeAtPurdue shake down the Feldmans on behalf of whoever owns "Back a Boiler Fund LLC"?

Why does @LifeAtPurdue keep breaking the law?

What stake does @purduemitch have in the scheme?

Something stinks. @SecCardona @usedgov must step in now.

protectborrowers.org/purdue-must-st…

Why does @LifeAtPurdue keep breaking the law?

What stake does @purduemitch have in the scheme?

Something stinks. @SecCardona @usedgov must step in now.

protectborrowers.org/purdue-must-st…

• • •

Missing some Tweet in this thread? You can try to

force a refresh