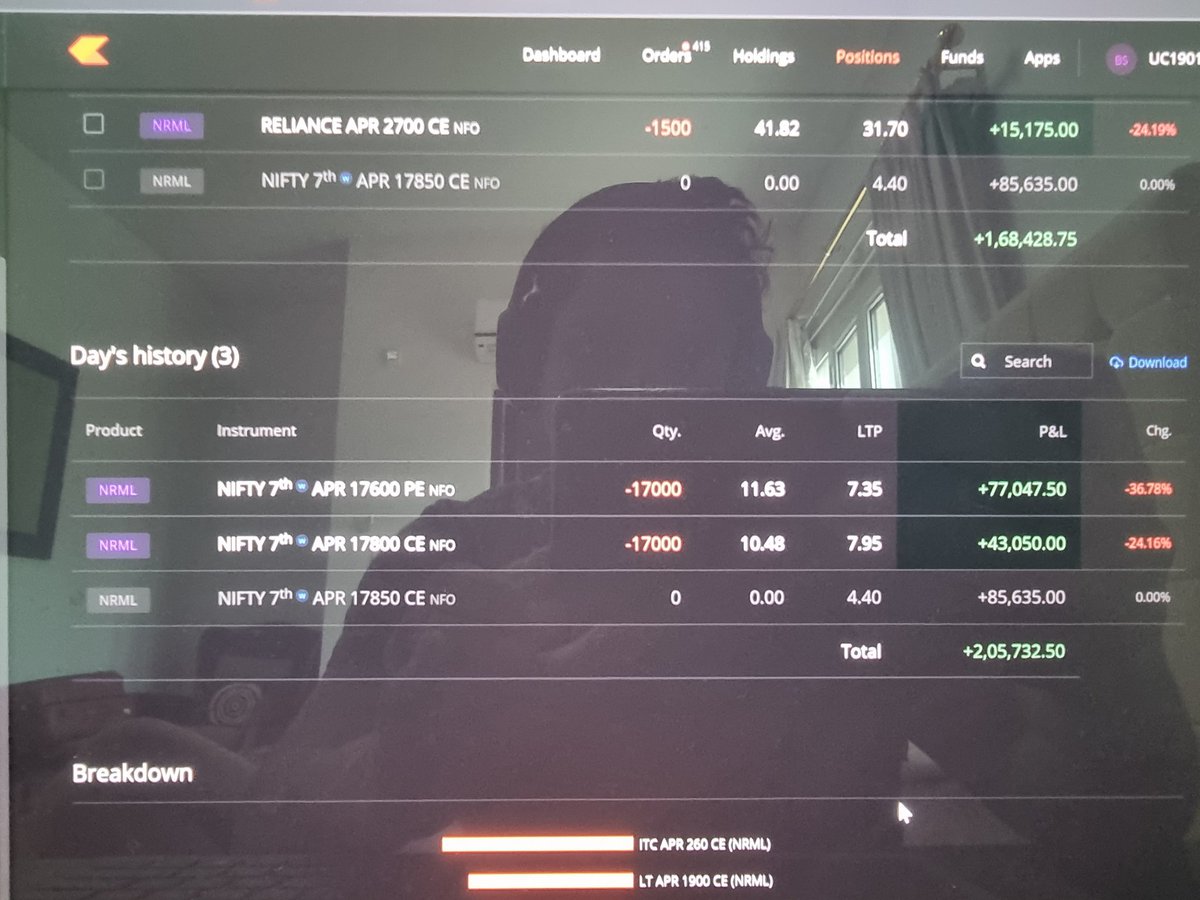

No more adjustments, not comfortable with moving closer or further from here, so 3PT Mtm SL. If it hits will sell 17850 and 17600 for whatever price ans have 2pt tsl on that

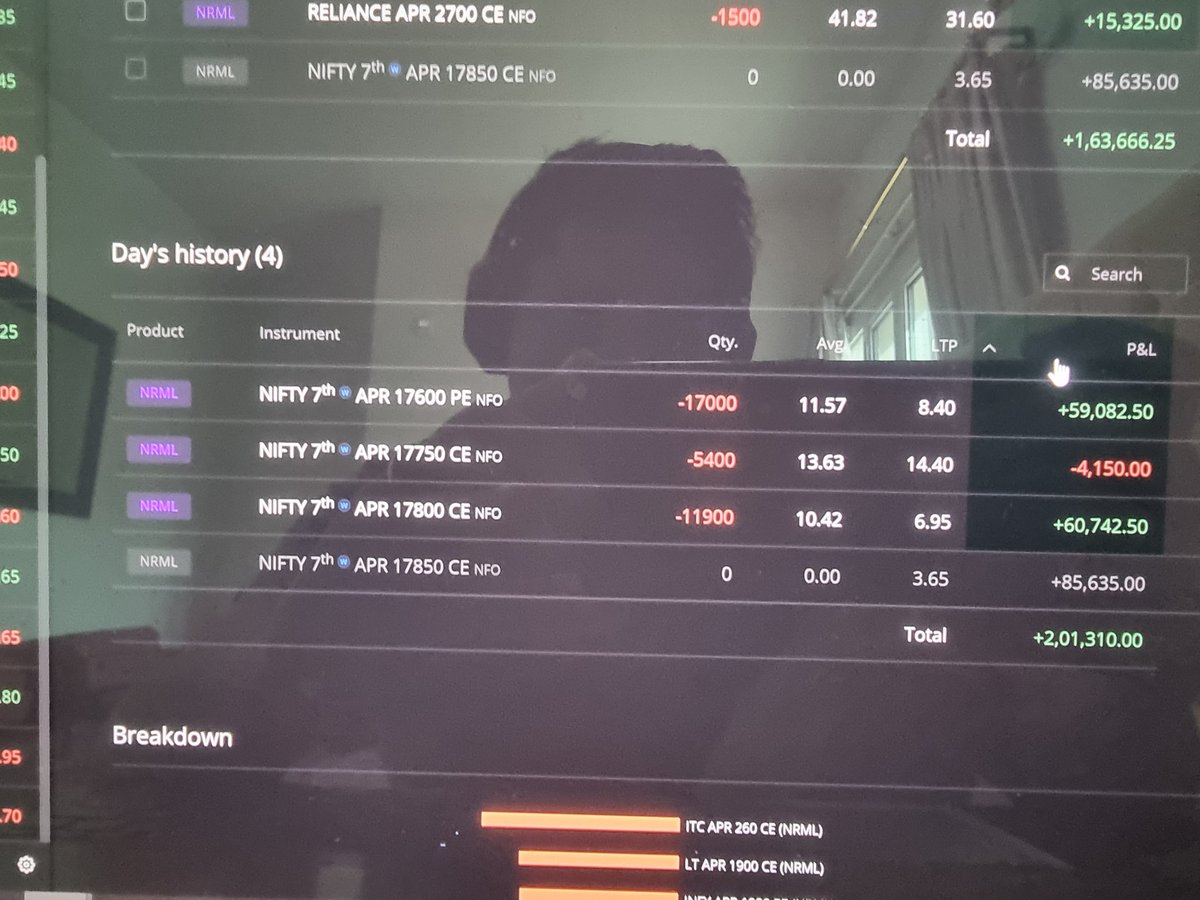

Got sniped on CE SL perfectly at 19 and then on PE SL at 10, now trade is basically dead , can gain 7pt from this so mtm SL of 2pt

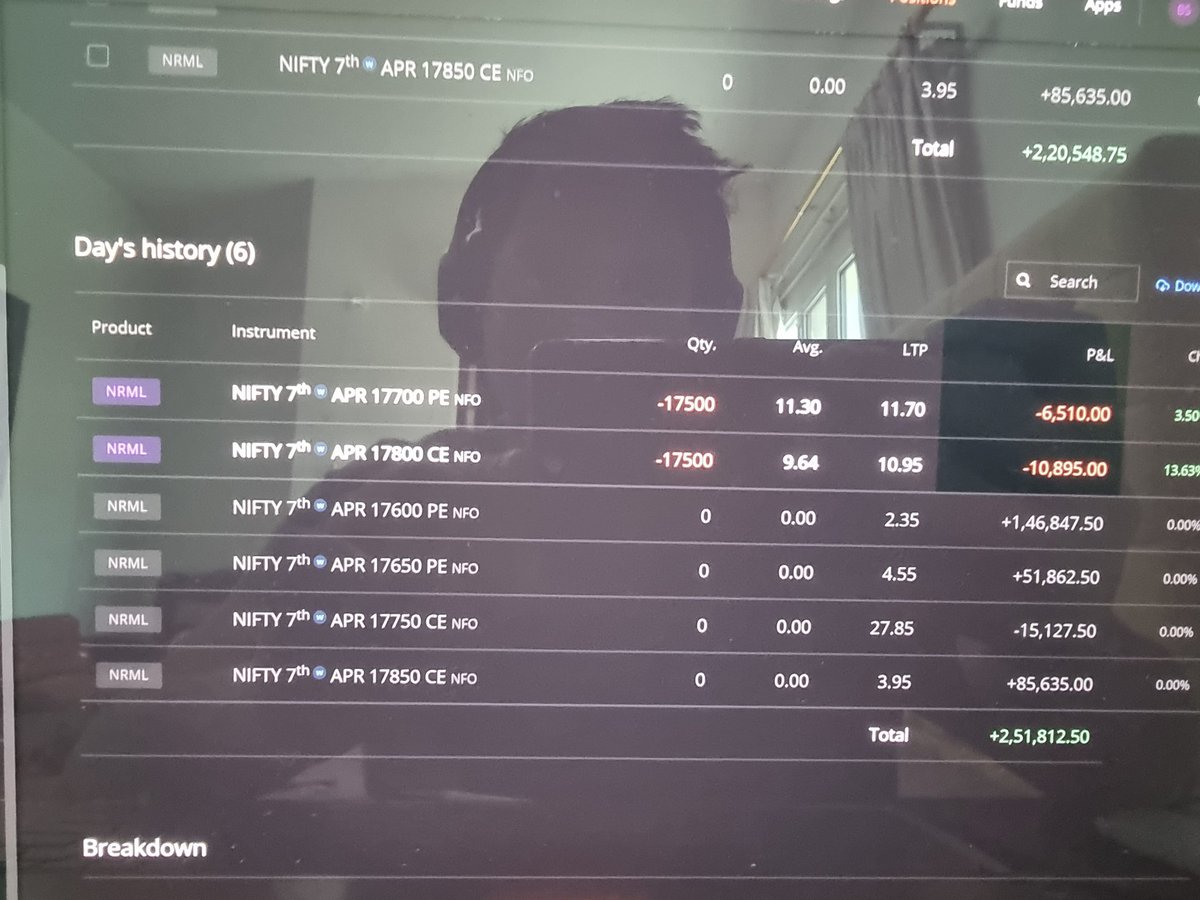

Plan is to take home 5 points today regardless of what happens, got blasted by the Gama expansion on Pe

• • •

Missing some Tweet in this thread? You can try to

force a refresh