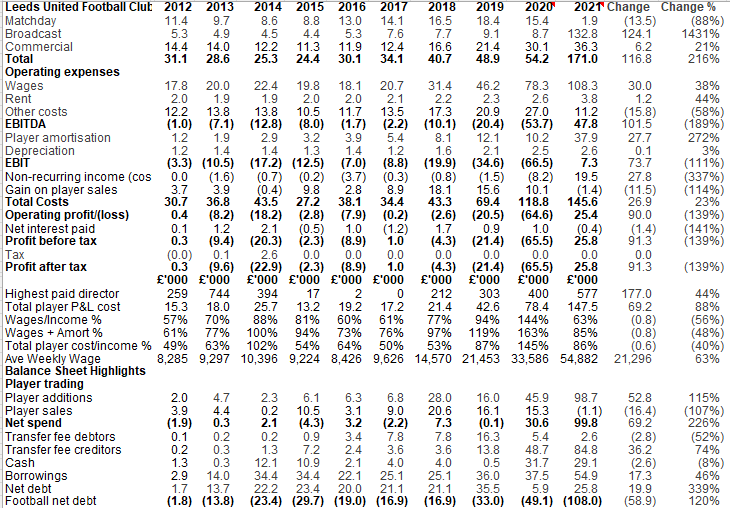

Leeds accounts for 11 months to 30 June 2021 (13 months in 2020) show an operating profit of £5m. Loan interest of £21m was waived resulting in profit before tax of £26m #LUFC

Leeds spent £63m cash on players in 2020/21. Share issue, presumably to SF49, generated £23m and club borrowed £63m and repaid £14m of loans

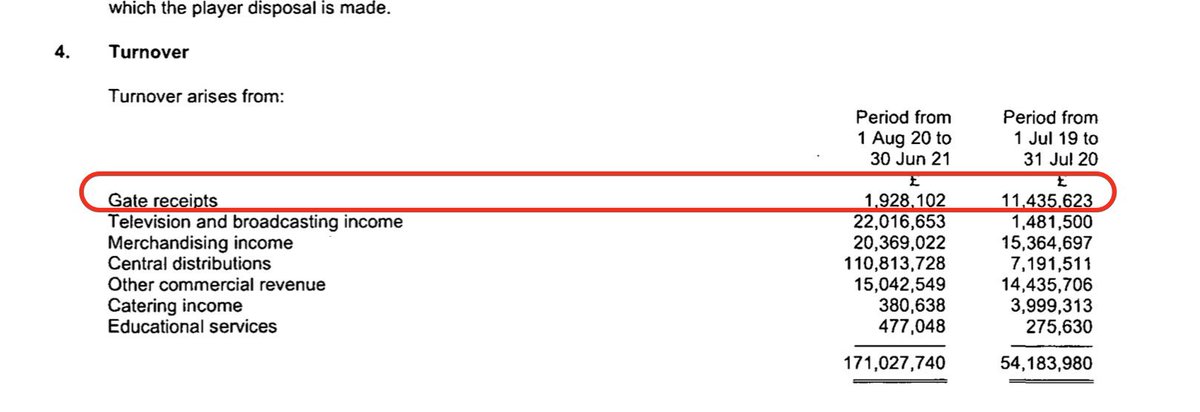

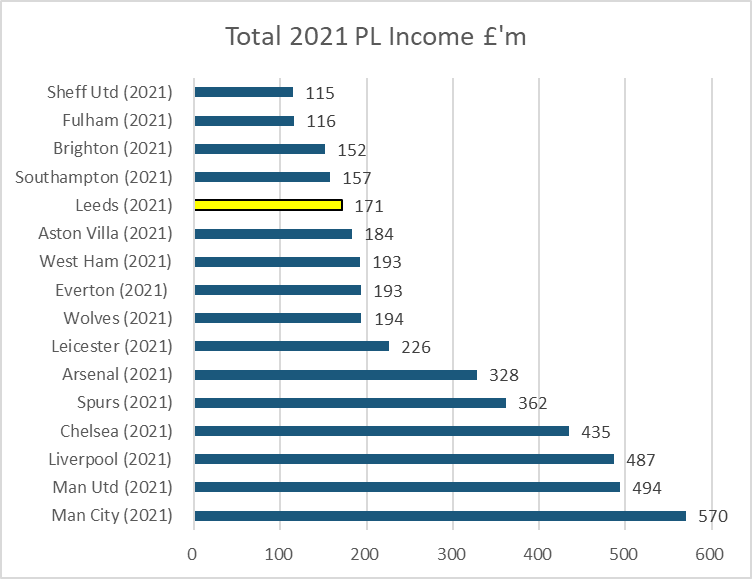

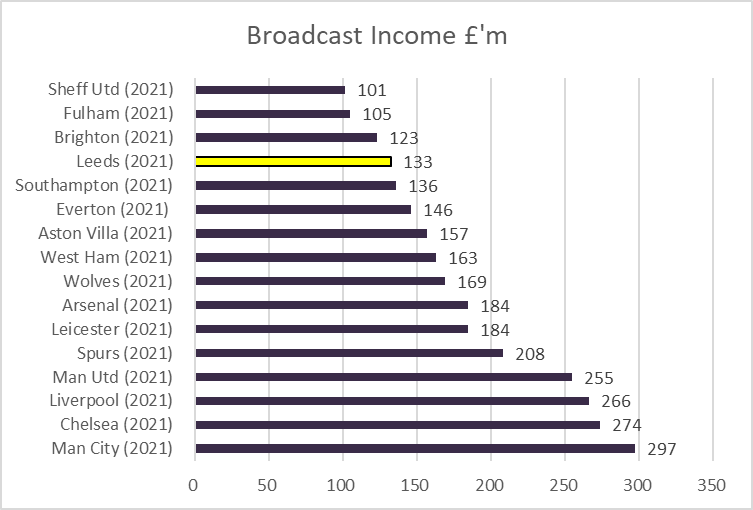

Leeds income almost tripled in 20/21 to £171m, broadcast income main driver, 77% of total. Would have been substantially higher had covid not hit Matchday income so hard

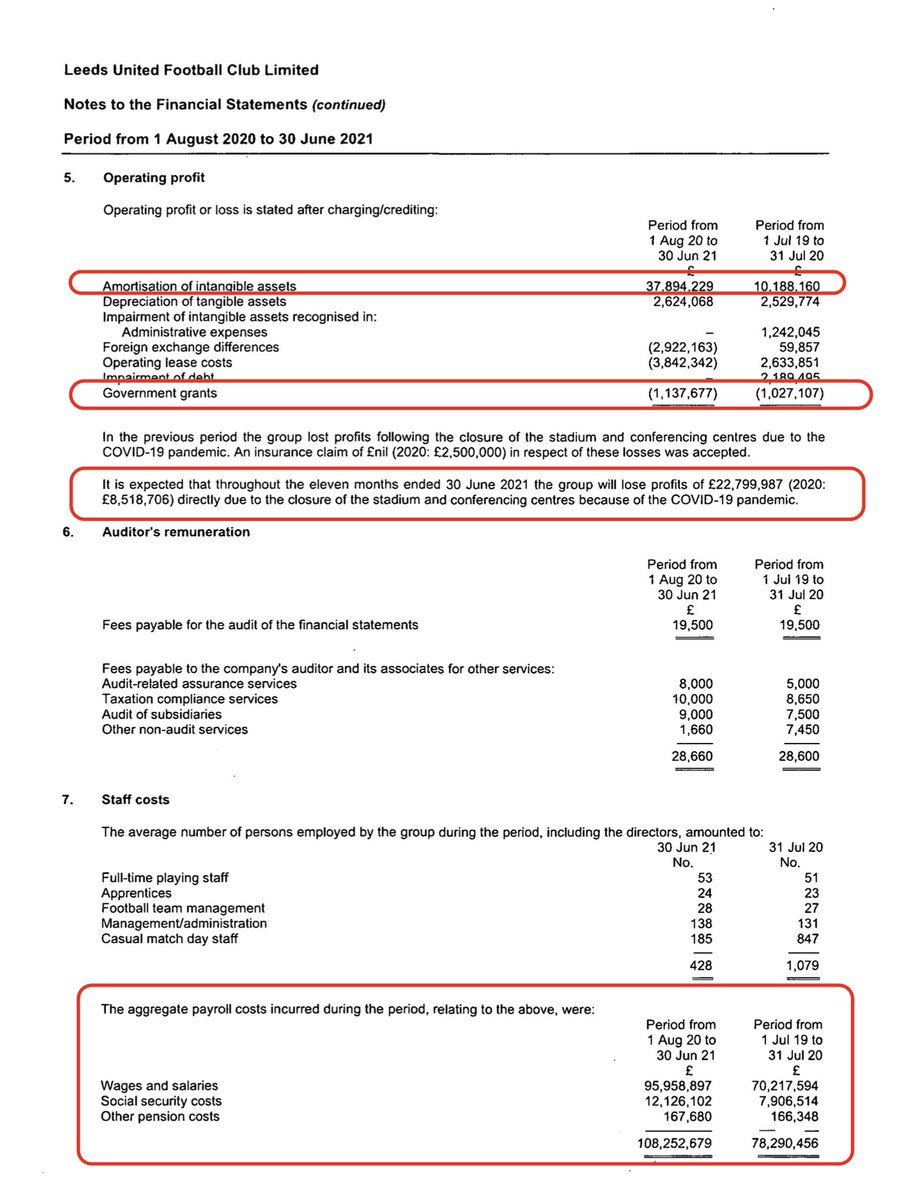

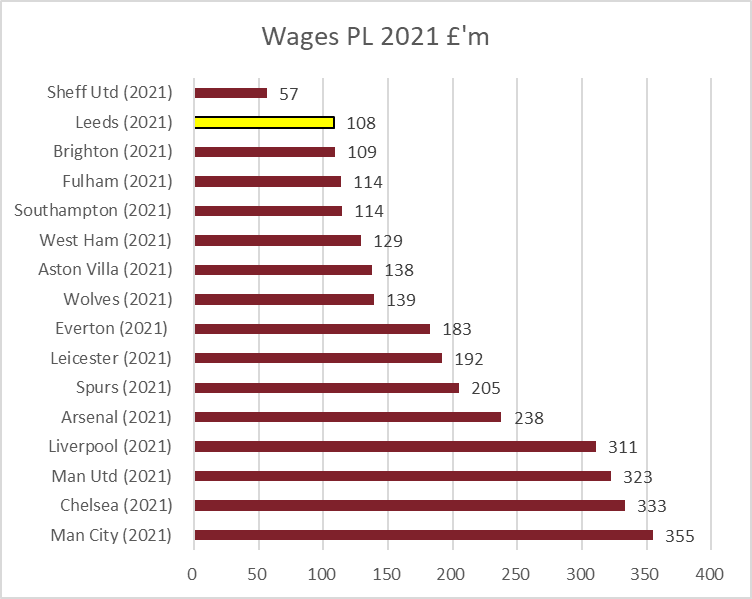

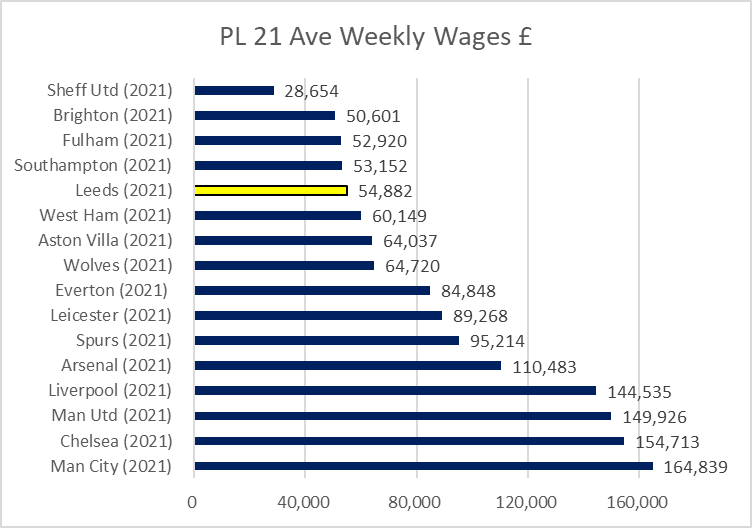

Amortisation (transfer fees over contract) up to £37m. Club had govt grants of over £1m, unclear if these are furlough monies or not. COVID costs estimated at £23m. Wages £108m for 11m compares to £78m for 13m. Ave weekly wage £55k a week

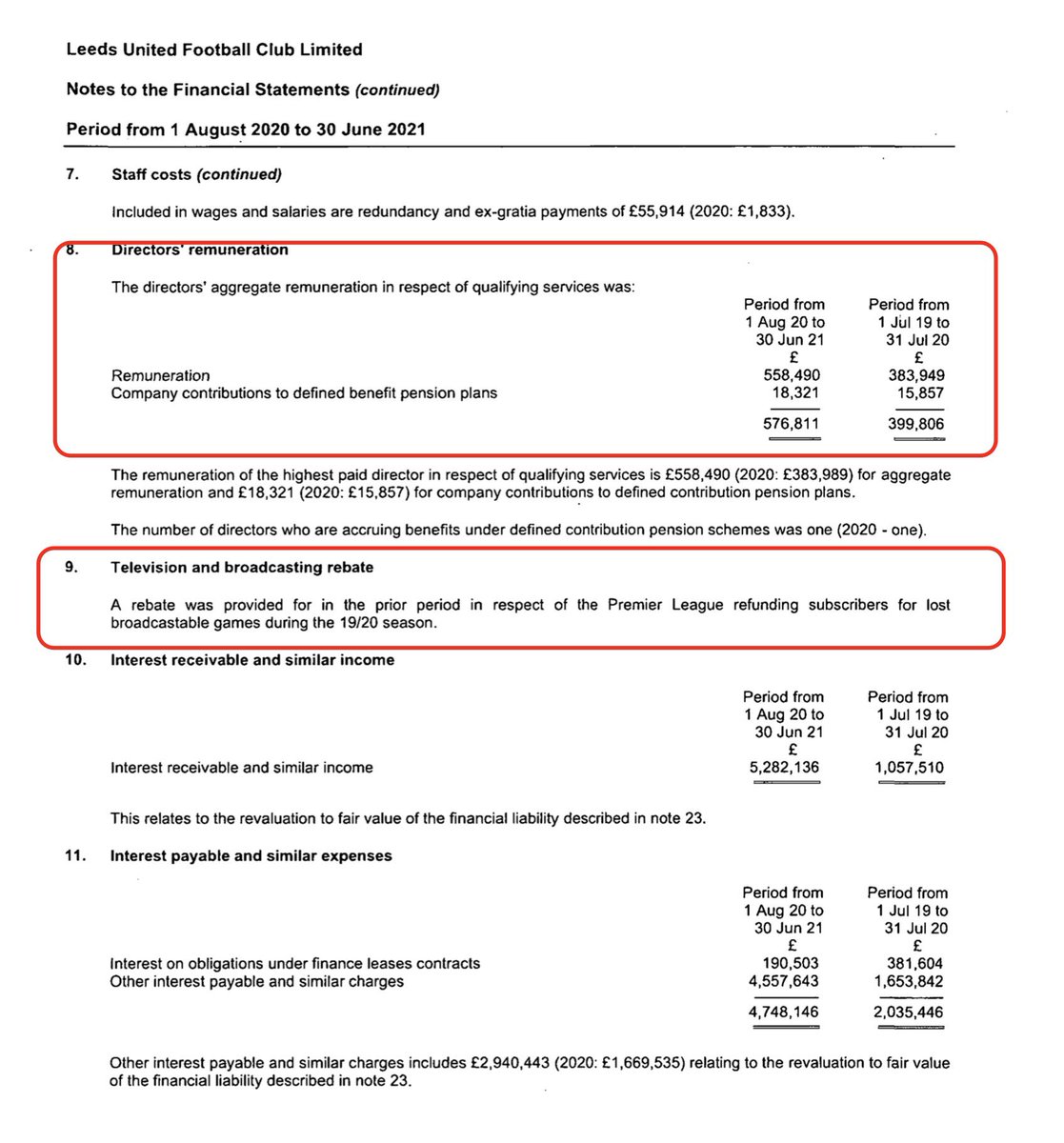

Leeds highest paid director earnings ⬆️ £170k to £577k. Premier League broadcast rebate of £7m was somewhat confusingly charged to the previous season in the Championship

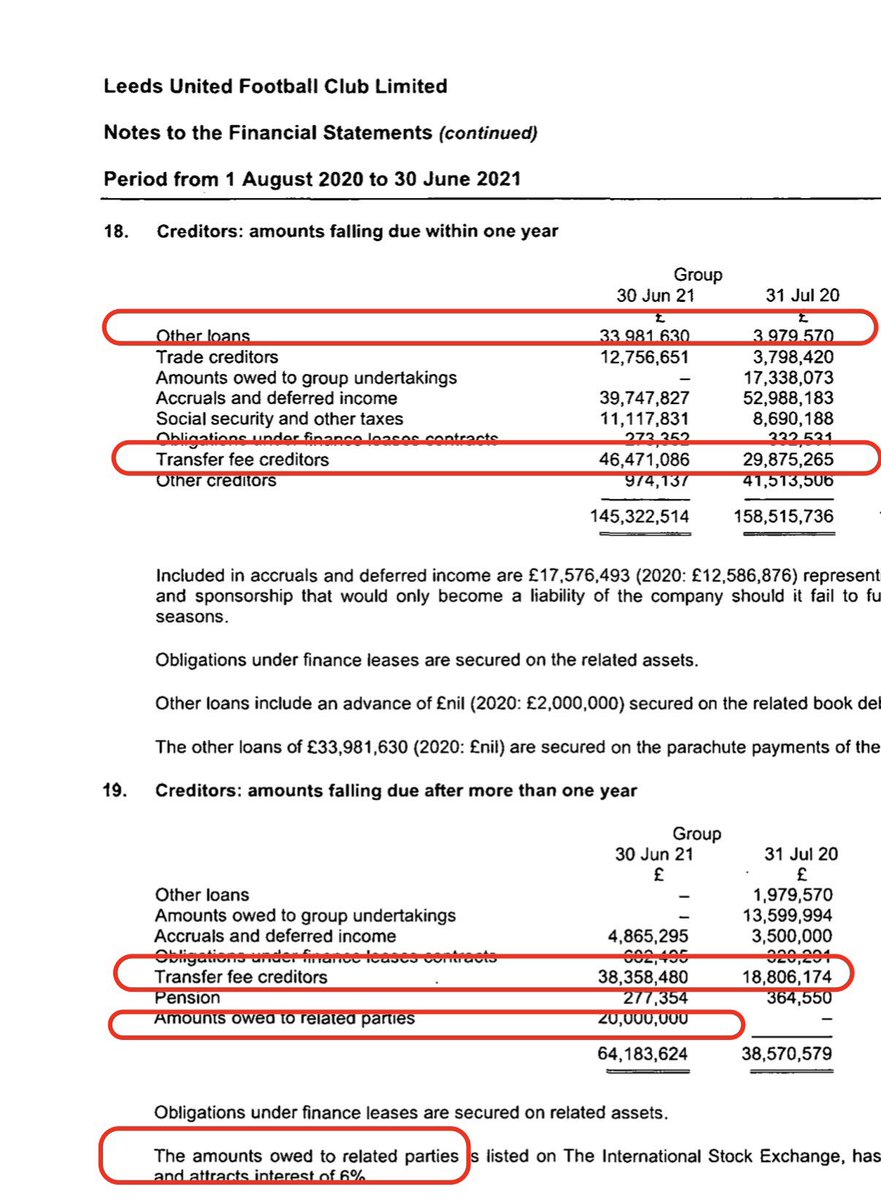

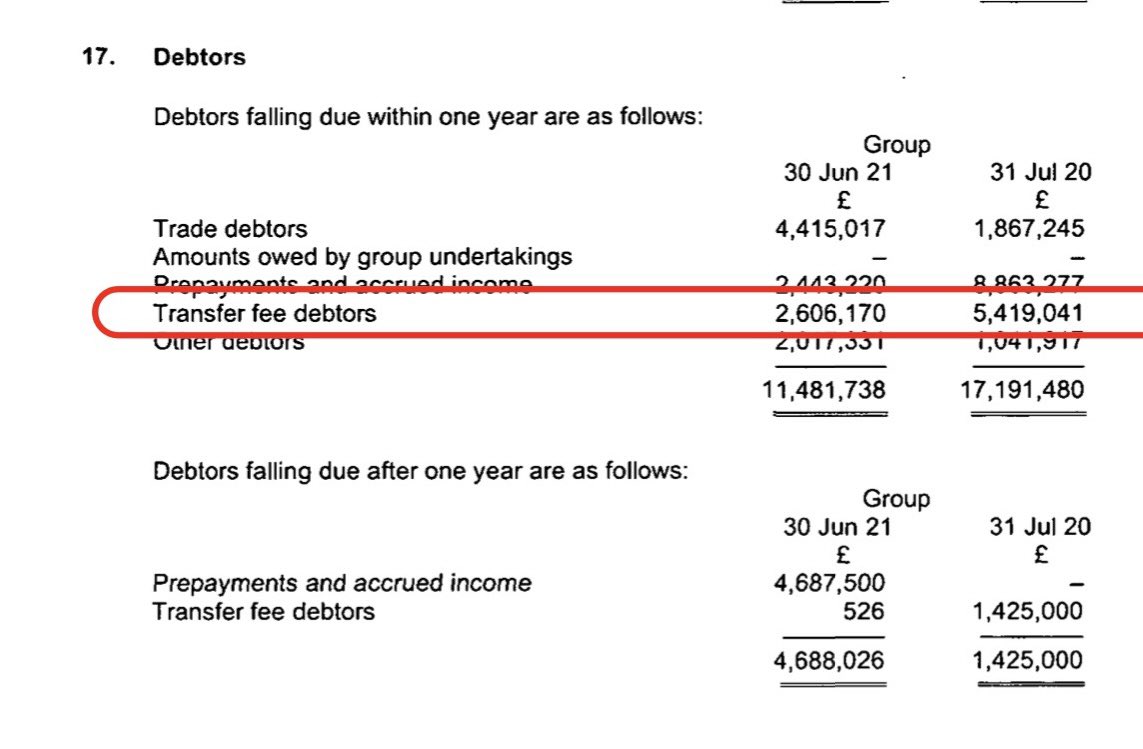

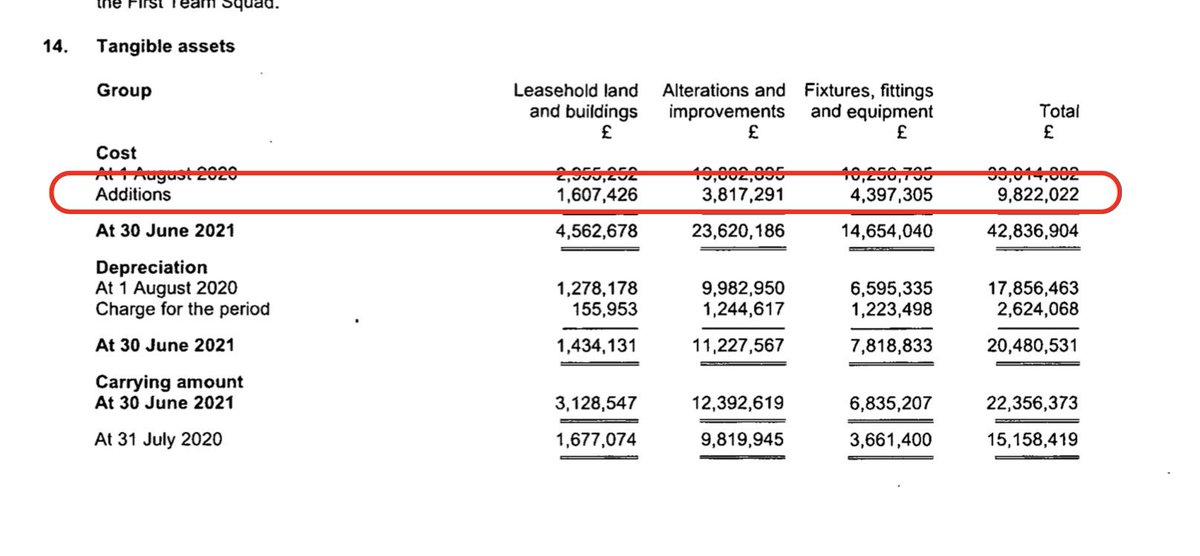

Leeds spent £5m on ground/property improvements in 2020/21. Club was owed £2.6m on instalments on player sales & owed other clubs £85m for players bought. Loans were £54m, including £20m due to related party, not sure if AR of 49’ers.

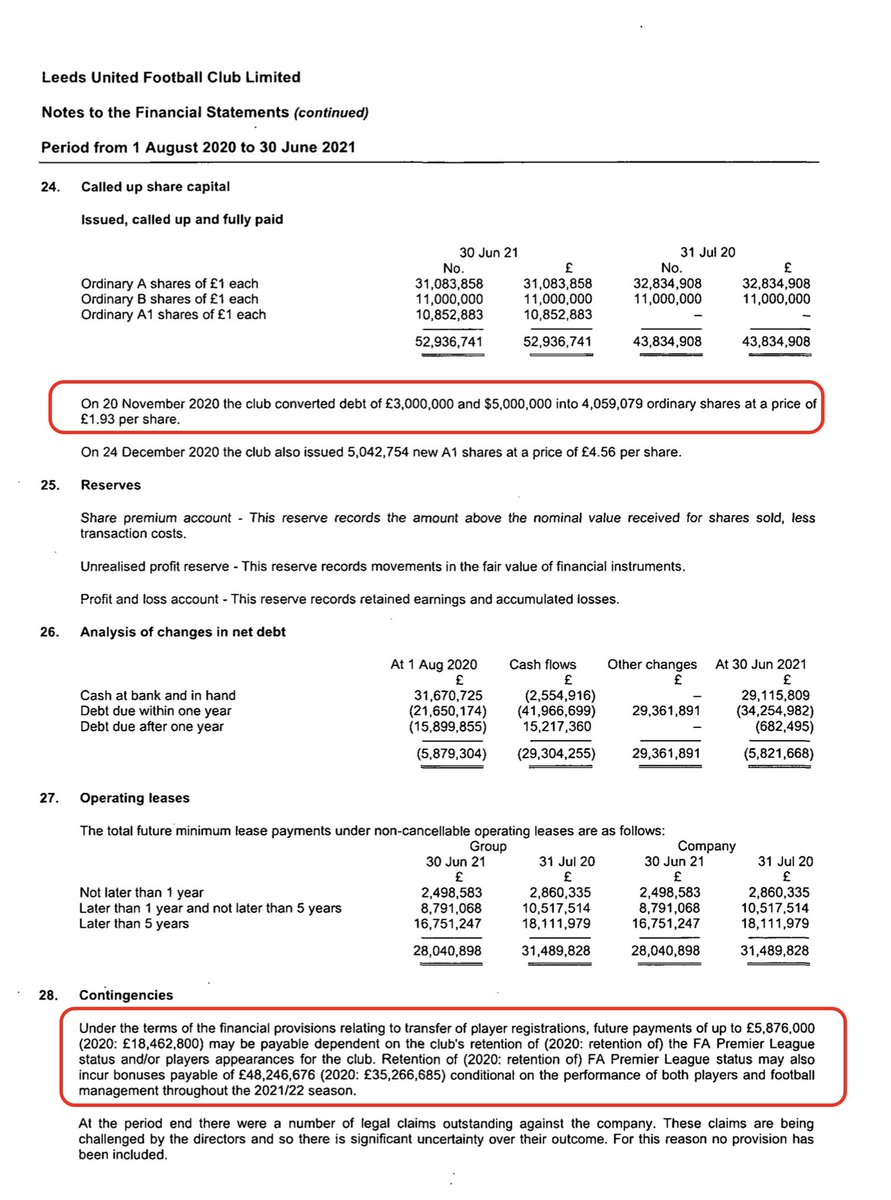

Leeds converted loans into shares during 2020/21. Bonuses of £35m payable when avoided relegation in that season and will be £48m if avoid relegation this season

Lender (AR?) waived loans of £21m in the year and £8m of loans converted into shares. No rent physically paid on Elland Road for first 33 months of the lease. Majority ownership of Leeds still with AR company in Singapore.

Leeds income in 1st season back in PL puts it between Villa and Southampton, although remember Leeds accounts only cover 11 months.

Broadcast income lower than would expect for a club finishing 9th but many other clubs have 44 PL matches included in their figures in the period 1 July 2020 to 30 June 2021 due to covid lockdown.

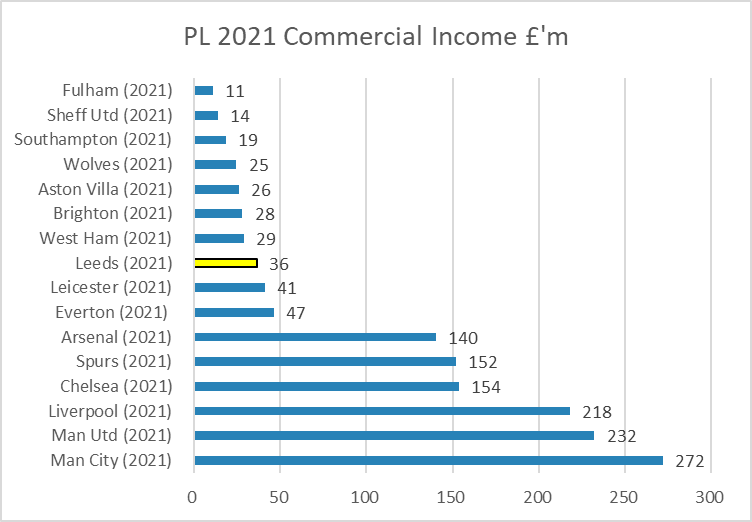

Leeds commercial income for 11 months already puts it half way up Premier League totals despite only one Covid impacted season in the division.

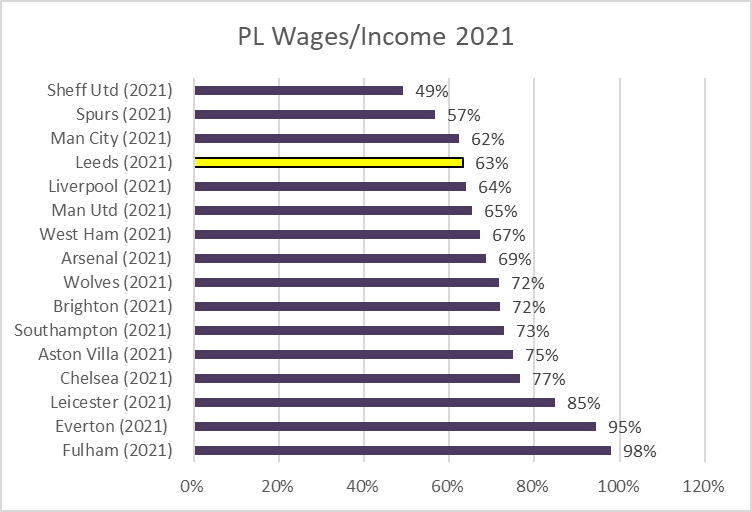

Leeds wage bill second lowest in PL but only covers 11 months, would have been £118m on annualised basis. Expect to rise again if avoid relegation due to new signings and contracts. Wages 63% of income well within UEFA guidelines.

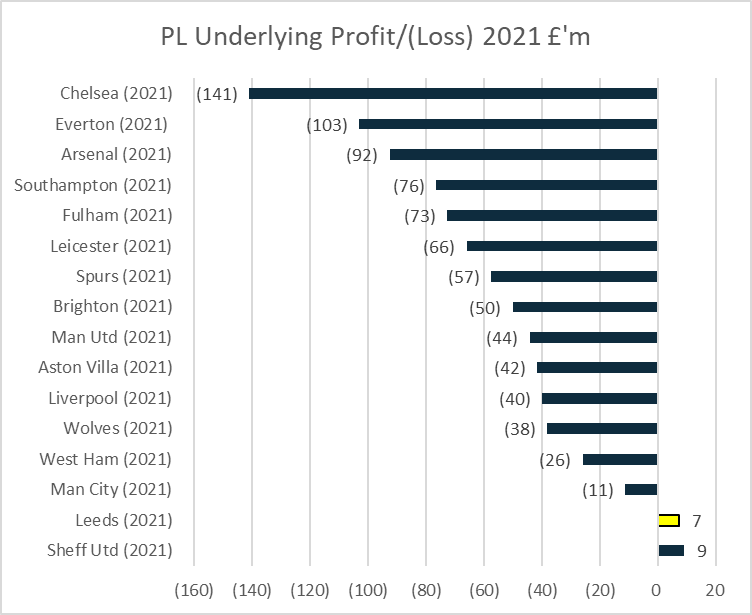

Leeds underlying profits (adjusting for one off non-recurring items) of £7m mean it was only one of two clubs to make a profit in 2020/21...both from Yorkshire

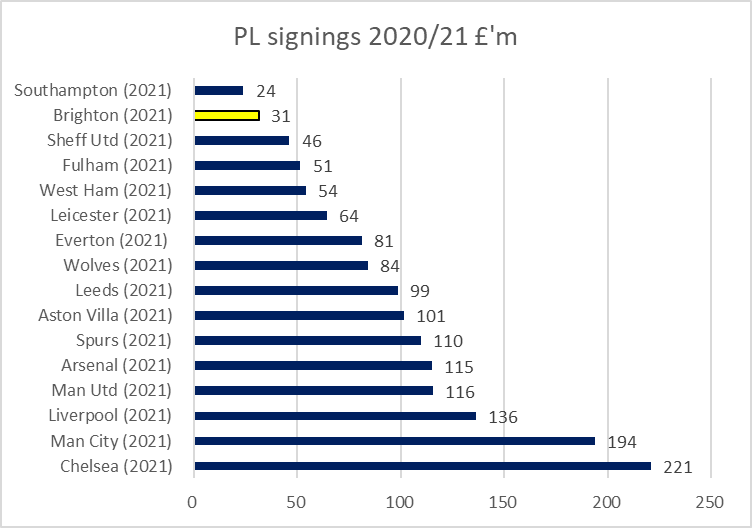

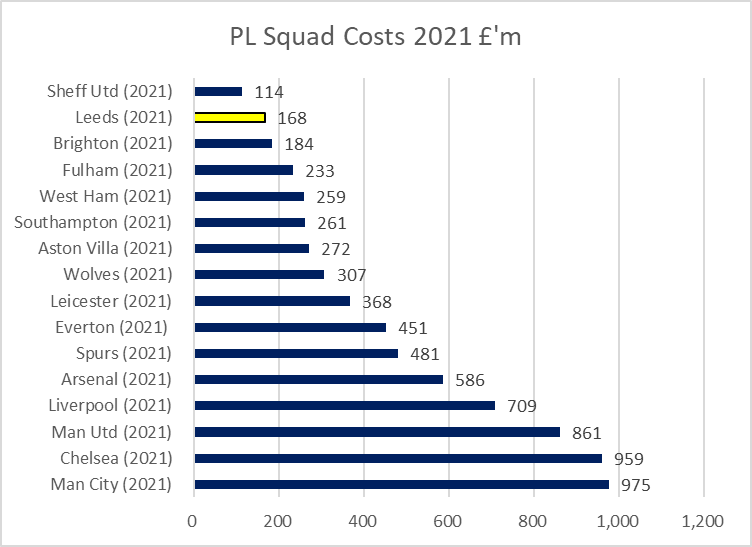

Leeds player signings significantly higher than most clubs historically in first season in PL. Squad cost was 2nd lowest in PL at end of season.

• • •

Missing some Tweet in this thread? You can try to

force a refresh