ATTN ALL FOUNDERS

Please read this important PSA.

How to protect your company from hostile takeover ↓↓

Please read this important PSA.

How to protect your company from hostile takeover ↓↓

So,

Founder-Led companies are the ONLY companies I invest in.

Why? They r the best investments.

I put my money where my mouth is and want every startup I back to be governed as Founder-Led.

Founder-Led companies are the ONLY companies I invest in.

Why? They r the best investments.

I put my money where my mouth is and want every startup I back to be governed as Founder-Led.

The irony…

It’s IN investor best interest for a company to be Founder-Led.

That’s what the best VCs have realized.

Find a great business and a great founder,

support them relentlessly.

It’s IN investor best interest for a company to be Founder-Led.

That’s what the best VCs have realized.

Find a great business and a great founder,

support them relentlessly.

Some examples?

Founders Fund, A16Z, DST, Tiger, Untitled, Tribe, Hedosophia, SOMA, Human Capital, Westcap, General Atlantic, BlackRock.

Ironically, most of the hedge fund & crossover investors too.

I’m sure I missed some...

Founders Fund, A16Z, DST, Tiger, Untitled, Tribe, Hedosophia, SOMA, Human Capital, Westcap, General Atlantic, BlackRock.

Ironically, most of the hedge fund & crossover investors too.

I’m sure I missed some...

The Mob VCs are notably different than pro-founder VCs.

Sequoia, Benchmark, etc.

They have the OPPOSITE mentality.

Milk the founder for growth, kill the founder, dump the stock.

Sequoia, Benchmark, etc.

They have the OPPOSITE mentality.

Milk the founder for growth, kill the founder, dump the stock.

It’s RIDICULOUS that old-school investors still try for control.

By doing so they create hostile situations,

Make it miserable to build with them,

And then completely f*cking the company and the team.

By doing so they create hostile situations,

Make it miserable to build with them,

And then completely f*cking the company and the team.

Of course, founders aren’t perfect.

But, how about giving some advice from a place of love?

That works for me 98% of the time.

This has never crossed the minds of a Mob investor; they only know power.

But, how about giving some advice from a place of love?

That works for me 98% of the time.

This has never crossed the minds of a Mob investor; they only know power.

Ok, ugh sorry for all that!

onto the tactics...

onto the tactics...

~~ Make sure quorum requires you present ~~

What is “Board quorum”?

It’s the threshold by which an official Board Meeting can be called.

Make sure a meeting CANNOT be called without you.

This prevents the classic “went to Hawaii came back and was fired!” situation.

What is “Board quorum”?

It’s the threshold by which an official Board Meeting can be called.

Make sure a meeting CANNOT be called without you.

This prevents the classic “went to Hawaii came back and was fired!” situation.

~~ Never issue a permanent Board seat ~~

Somehow, investors have convinced founders that Preferred Seats should last forever (until IPO).

NO WAY.

No accountability whatsoever.

No seat anywhere, in any system, should be lifelong!

Somehow, investors have convinced founders that Preferred Seats should last forever (until IPO).

NO WAY.

No accountability whatsoever.

No seat anywhere, in any system, should be lifelong!

~~ Use only Common Seats ~~

Bring investors into COMMON Seats.

These are voted on by the common vote in which founders have large control.

This is becoming FAR more common.

Every great founder in my network is getting this.

Bring investors into COMMON Seats.

These are voted on by the common vote in which founders have large control.

This is becoming FAR more common.

Every great founder in my network is getting this.

We did this at Bolt.

And here’s something crazy: we’ve NEVER fired a board member.

Shocking? ... Not quite.

Everyone is accountable and we work together.

In public companies, Preferred Seats do not exist, and for good reason.

And here’s something crazy: we’ve NEVER fired a board member.

Shocking? ... Not quite.

Everyone is accountable and we work together.

In public companies, Preferred Seats do not exist, and for good reason.

If a VC plays hardball here, it’s a red flag 🚩

But if you really need a middle ground:

1/ Say the seat be removed by Majority of Common Vote + one other Preferred Director Vote

2/ Say the seat may be removed by Majority of Common Vote + a Majority Board Vote

But if you really need a middle ground:

1/ Say the seat be removed by Majority of Common Vote + one other Preferred Director Vote

2/ Say the seat may be removed by Majority of Common Vote + a Majority Board Vote

3/ Put a tail on their seat (ie 12 months) after which it converts to a Common Seat

Note: Board Observers should always be able to be terminated by Common Vote, those should never be permanent either.

Note: Board Observers should always be able to be terminated by Common Vote, those should never be permanent either.

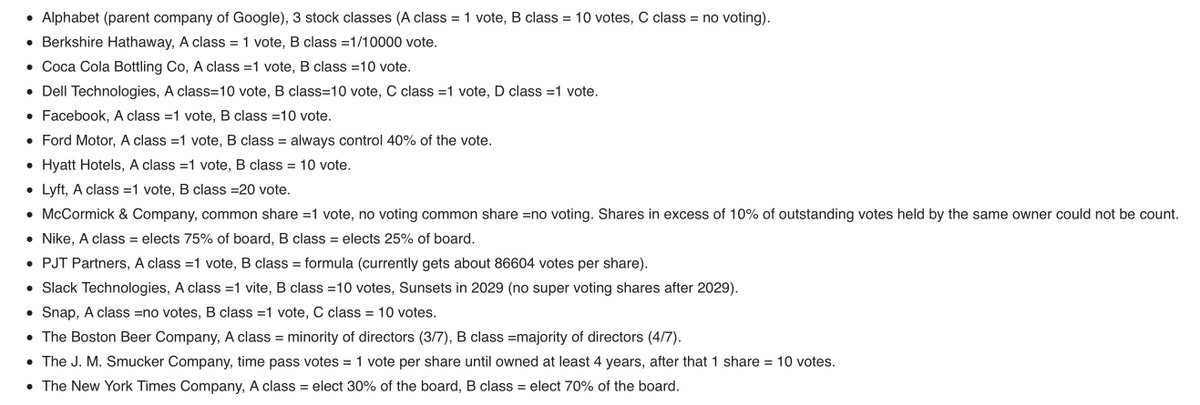

~~ Add 10X-30X Founder Class Shares ~~

This is critical to be able to influence the common vote as you get increasingly diluted.

Most of the great companies do it for good reason.

Src: my-financial-wealth.com/2020/01/30/sup…

This is critical to be able to influence the common vote as you get increasingly diluted.

Most of the great companies do it for good reason.

Src: my-financial-wealth.com/2020/01/30/sup…

~~ Add multiple votes to your Board Seat ~~

The Founder Board Seat should have several votes.

Most top founders I know do this.

Some even have rights that as the Board expands so does their vote.

The Founder Board Seat should have several votes.

Most top founders I know do this.

Some even have rights that as the Board expands so does their vote.

~~ Define a high standard for founder/CEO termination ~~

CEO termination must be “For Cause” in the ByLaws.

It's easy to overlook this critical definition.

Work with your attorneys on a For Cause definition that protects you.

CEO termination must be “For Cause” in the ByLaws.

It's easy to overlook this critical definition.

Work with your attorneys on a For Cause definition that protects you.

~~ Have pro-founder pro-company counsel ~~

Attorneys have major influence on a company.

And many make far more money from the VCs. #FollowTheMoney

There are exceptions; some attorneys have built reputations by working with the best founders.

Find them.

Attorneys have major influence on a company.

And many make far more money from the VCs. #FollowTheMoney

There are exceptions; some attorneys have built reputations by working with the best founders.

Find them.

~~ CEO compensation vote ~~

CEO comp is one of the few issues that you’ll be at odds with Board Members over.

Even though it shouldn’t.

I’ve never had an issue w/ my investments.

We sit down, talk about what’s fair, and make it happen.

But make sure you know the mechanics.

CEO comp is one of the few issues that you’ll be at odds with Board Members over.

Even though it shouldn’t.

I’ve never had an issue w/ my investments.

We sit down, talk about what’s fair, and make it happen.

But make sure you know the mechanics.

~~ Permit Founder transfers ~~

Make sure in your bylaws that Founder Transfers are allowed.

You want to be able to transfer shares to a trust for family planning easily.

Or to a vehicle by which you can collateralize for financing options.

Make sure in your bylaws that Founder Transfers are allowed.

You want to be able to transfer shares to a trust for family planning easily.

Or to a vehicle by which you can collateralize for financing options.

Alright so I think that's it for the tactics!

IMO this should not be a Founders vs Investors, Us vs Them debate.

If you want to make money, invest in founder-led organizations.

Doing the above is literally in everyone’s best interest.

IMO this should not be a Founders vs Investors, Us vs Them debate.

If you want to make money, invest in founder-led organizations.

Doing the above is literally in everyone’s best interest.

Still,

Founders YOU HAVE TO STAND YOUR GROUND.

Investors can only gain control if you let them.

EVERY time I’ve coached a founder who decided to “trust” their investors,

and conceded on these points,

it's’s backfired… without fail.

Founders YOU HAVE TO STAND YOUR GROUND.

Investors can only gain control if you let them.

EVERY time I’ve coached a founder who decided to “trust” their investors,

and conceded on these points,

it's’s backfired… without fail.

You have to make governance a priority.

ALWAYS sacrifice valuation in exchange for governance.

I’ll take lower valuation for more control any day of the week.

The best investors will want you to have control.

ALWAYS sacrifice valuation in exchange for governance.

I’ll take lower valuation for more control any day of the week.

The best investors will want you to have control.

Alright Kings and Queens.

Go forth and save this g-d forsaken planet!

Let there be light!

Long live the king!

Go forth and save this g-d forsaken planet!

Let there be light!

Long live the king!

Don't you forget to RT! RT! RT!

Oh yeah and I almost forgot 🤦♂️

Sign this pledge with every investor coming onboard to make sure you're values aligned.

Modify it as you see fit: ryantakesoff.com/partnering-ple…

Sign this pledge with every investor coming onboard to make sure you're values aligned.

Modify it as you see fit: ryantakesoff.com/partnering-ple…

ICYMI, these are the situations you’re trying to avoid

https://twitter.com/theryanking/status/1512946585554112514

• • •

Missing some Tweet in this thread? You can try to

force a refresh