Last week, my group closed on a 12 acre short-term rental / Airbnb property in Woodstock, NH - this deal is a culmination of 2.5 years of STR learnings.

🧵on the thesis, location, value add & guest experience plan, financing, partnership structure, & preview of what’s next.

🧵on the thesis, location, value add & guest experience plan, financing, partnership structure, & preview of what’s next.

1/ Property

-Currently 3 BD, 2.5 BA, 3100 sq ft

-Converting to 6 BD, 4.5 BA, 3700 sq ft

-12 acres, mountain views, private pond, & river frontage

-Deck, covered hot tub, and fire pit

-No zoning in Woodstock so no reg risk

zillow.com/homedetails/55…

-Currently 3 BD, 2.5 BA, 3100 sq ft

-Converting to 6 BD, 4.5 BA, 3700 sq ft

-12 acres, mountain views, private pond, & river frontage

-Deck, covered hot tub, and fire pit

-No zoning in Woodstock so no reg risk

zillow.com/homedetails/55…

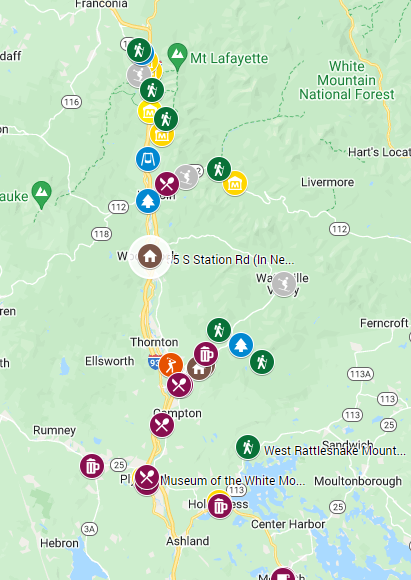

2/ Location

<2 hrs of a top 10 MSA (Boston)

<15 min to two top 5 ski resorts in NH

Direct access to snowmobile trails from the property

<10 minutes to two golf courses

10 minutes to 1000s of hiking trails in Franconia Notch State Park

<30 minutes to Mount Washington

<2 hrs of a top 10 MSA (Boston)

<15 min to two top 5 ski resorts in NH

Direct access to snowmobile trails from the property

<10 minutes to two golf courses

10 minutes to 1000s of hiking trails in Franconia Notch State Park

<30 minutes to Mount Washington

3/ Thesis

Be a top 1% STR revenue, regulatory compliant property in an already popular, all-season vacation destination.

As STR demand grows with WFH and lifestyle & travel preference changes, unique high-end Airbnbs will benefit disproportionately.

Be a top 1% STR revenue, regulatory compliant property in an already popular, all-season vacation destination.

As STR demand grows with WFH and lifestyle & travel preference changes, unique high-end Airbnbs will benefit disproportionately.

https://twitter.com/markjenney/status/1467612071088951299?s=20&t=WwKDkiCdpmWjcaBGmLWrkg

4/ Value Add

Converting garage into 2 story guest suite, turning master bedroom closets into additional bedroom.

Adding a dock on the pond. Tee box near house with a pin & putting green near pond.

Total cost: ~$100k

Final count: 6 BRs, 4.5 BAs, ~10 beds, sleeps 16+ people

Converting garage into 2 story guest suite, turning master bedroom closets into additional bedroom.

Adding a dock on the pond. Tee box near house with a pin & putting green near pond.

Total cost: ~$100k

Final count: 6 BRs, 4.5 BAs, ~10 beds, sleeps 16+ people

5/ Guest Experience

Target guests - large outdoors-loving groups including families, corporate retreats, and bachelor(ette) parties.

Outside: leaning into the pond and river. Tee box, putting green, and lots of yard games.

Inside: bar, pool / ping pong table, movie theater.

Target guests - large outdoors-loving groups including families, corporate retreats, and bachelor(ette) parties.

Outside: leaning into the pond and river. Tee box, putting green, and lots of yard games.

Inside: bar, pool / ping pong table, movie theater.

6/ Debt financing

We worked with a local bank - Bank of NH.

We worked with a local bank - Bank of NH.

https://twitter.com/Aldigity/status/1501239923235606536?s=20&t=WwKDkiCdpmWjcaBGmLWrkg

7/ Equity financing

Structured as a JV with a large capital partner:

Upfront cash - majority coming from capital partner

Control - sponsor has day-to-day control but capital partner has oversight, can remove us for underperformance, and has final say over sale.

Structured as a JV with a large capital partner:

Upfront cash - majority coming from capital partner

Control - sponsor has day-to-day control but capital partner has oversight, can remove us for underperformance, and has final say over sale.

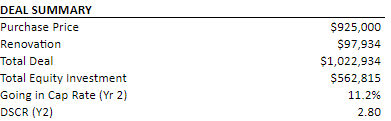

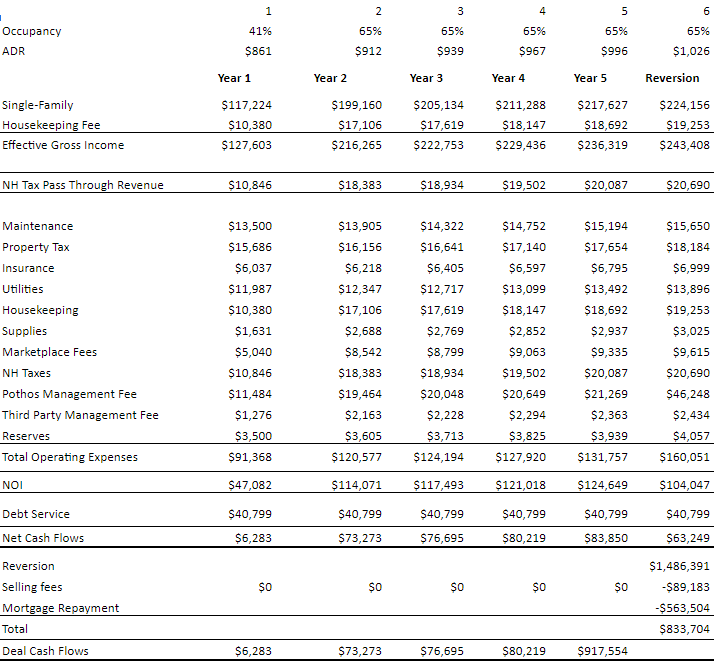

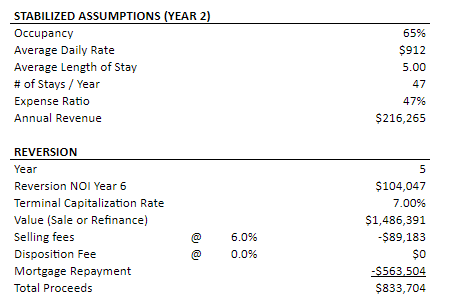

8/ Fees & Underwriting

Fees: small acquisition fee, 50-60% discount on market management fee, premium on cash flow to sponsor.

Sharing for informational purposes only***

Fees: small acquisition fee, 50-60% discount on market management fee, premium on cash flow to sponsor.

Sharing for informational purposes only***

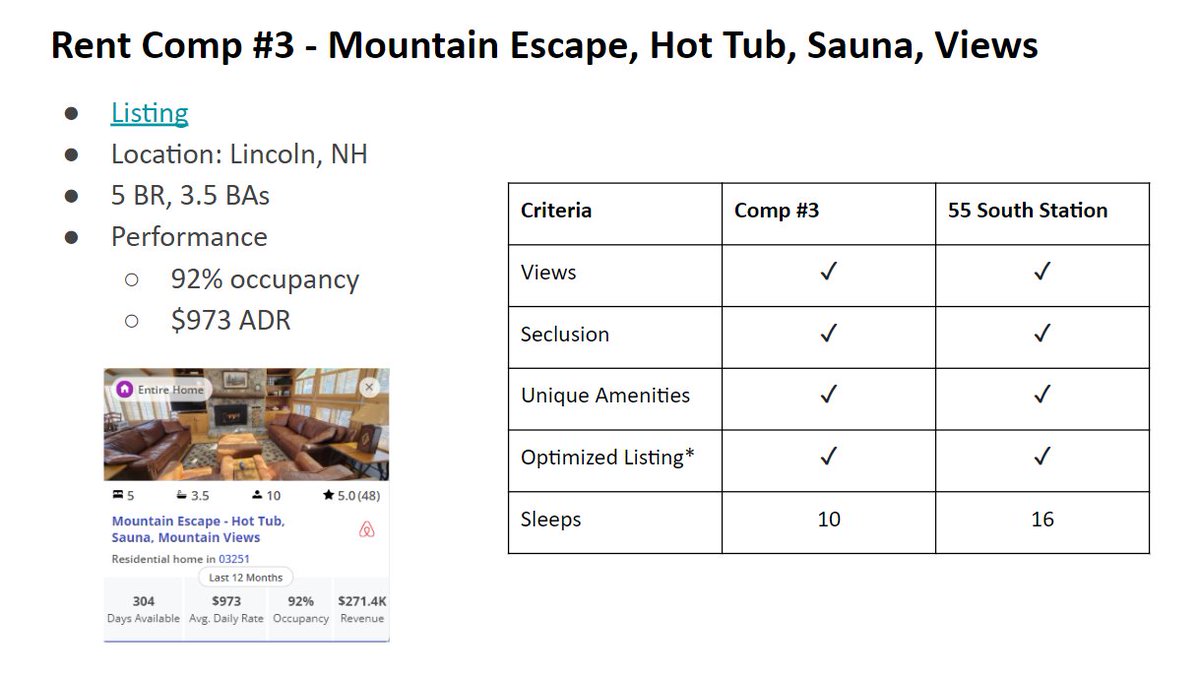

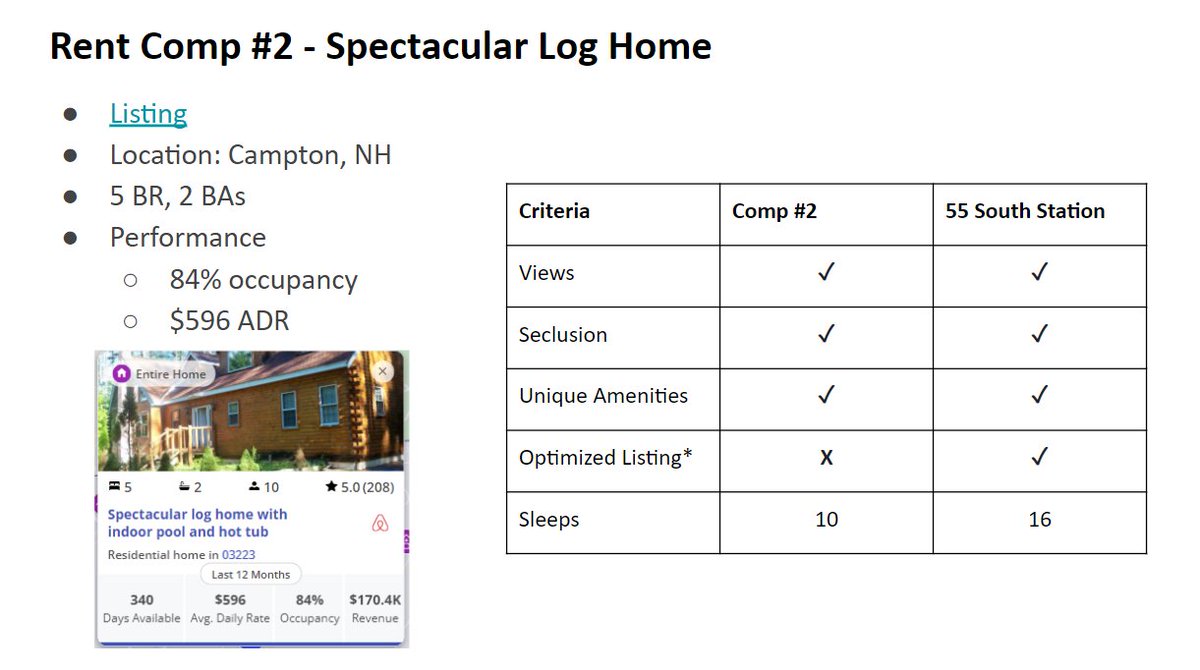

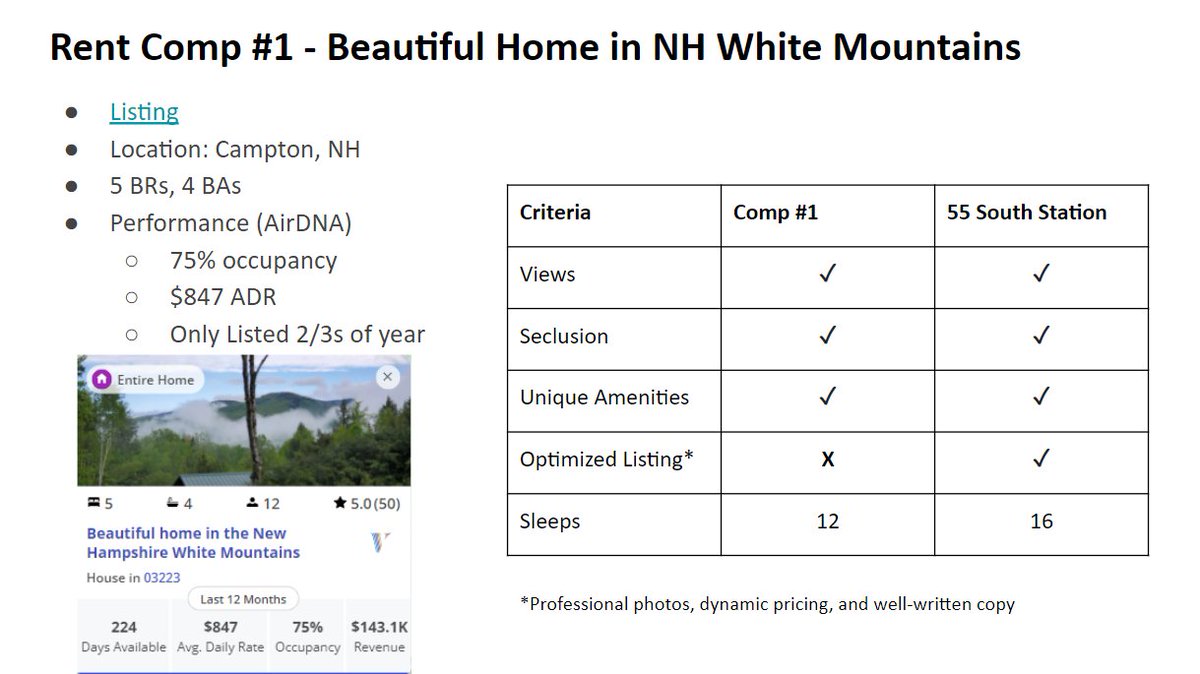

9/ Comps

Once renovations are complete, this property will be superior to all of the best performing comparable properties in the market .

Once renovations are complete, this property will be superior to all of the best performing comparable properties in the market .

10/ Risks

-Operations: this is essentially a boutique resort - massive learning curve

-Revenue: the comps are there but still feels bold to put yourself in top 1%

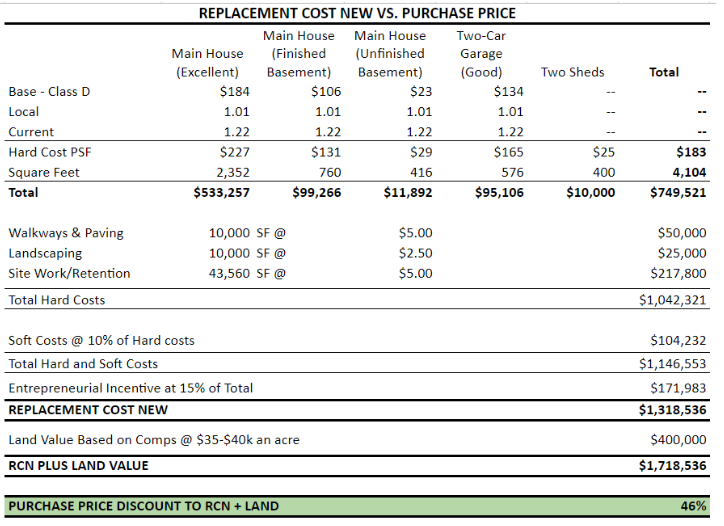

-Overpaying: we bought at least 46% discount to replacement cost but recent appreciation feels top of market-ish

-Operations: this is essentially a boutique resort - massive learning curve

-Revenue: the comps are there but still feels bold to put yourself in top 1%

-Overpaying: we bought at least 46% discount to replacement cost but recent appreciation feels top of market-ish

11/ Exit strategy

We put this deal together for the possibility of an exit to institutional capital in mind.

Will it be possible and how exactly will it work (ie what will the exit cap rate be)? Not sure - time will tell.

We put this deal together for the possibility of an exit to institutional capital in mind.

Will it be possible and how exactly will it work (ie what will the exit cap rate be)? Not sure - time will tell.

https://twitter.com/Aldigity/status/1470170705958510592?s=20&t=WwKDkiCdpmWjcaBGmLWrkg

12/ Scalable strategy - deal template:

-Market: median STR revenue ~$40-60k, occupancy >65%, <3 hours of major MSA, <30 minutes of major attractions

-Property: >2 acres, 3 BR, 2 BA, 1500 sq ft with ability to expand, views, water access, some unique factor

-Regulatory compliance

-Market: median STR revenue ~$40-60k, occupancy >65%, <3 hours of major MSA, <30 minutes of major attractions

-Property: >2 acres, 3 BR, 2 BA, 1500 sq ft with ability to expand, views, water access, some unique factor

-Regulatory compliance

13/ Scalable strategy - numbers

-Purchase price: $600k-$1mm

-Cosmetic updates + increasing capacity: $50-125k

-Amenities & furniture: $65k-$180k

Total basis: $700k-$1.3mm

Revenue: $140k-$250k

Stabilized NOI (~55% opex): $65k-$115k NOI

Value at 7% cap rate: $930k-$1.6mm

-Purchase price: $600k-$1mm

-Cosmetic updates + increasing capacity: $50-125k

-Amenities & furniture: $65k-$180k

Total basis: $700k-$1.3mm

Revenue: $140k-$250k

Stabilized NOI (~55% opex): $65k-$115k NOI

Value at 7% cap rate: $930k-$1.6mm

14/ Thank yous

@HaydenLaverty, @RyanDanz, & @robesposito for input on fee / deal structure.

@NoahBudet for insurance - 10/10 would recommend to other STR folks.

@markjenney & @imrichardfertig for inspiration.

@MrJonesSTRs for being a day-to-day sounding board.

@HaydenLaverty, @RyanDanz, & @robesposito for input on fee / deal structure.

@NoahBudet for insurance - 10/10 would recommend to other STR folks.

@markjenney & @imrichardfertig for inspiration.

@MrJonesSTRs for being a day-to-day sounding board.

15/ Thank yous

The fingerprints of #Retwit are all over this deal - everything from @StudentRentPro musings on debt financing to @moseskagan & @joepohlen advice on an LLC naming.

Oh, and our capital partner came via #retwit. Wild stuff.

The fingerprints of #Retwit are all over this deal - everything from @StudentRentPro musings on debt financing to @moseskagan & @joepohlen advice on an LLC naming.

Oh, and our capital partner came via #retwit. Wild stuff.

https://twitter.com/joepohlen/status/1471619372271783940?s=20&t=WwKDkiCdpmWjcaBGmLWrkg

16/ Thank yous

Most importantly, my Pothos Capital partners - Ali Kothari (back-office), Jesse Prato (acquisitions), Johnny Fayad (guest experience) - who make this thing go (I just tweet)

@JessePrato @JohnnyFayad

Couldn’t ask for a better, more fun group.

Most importantly, my Pothos Capital partners - Ali Kothari (back-office), Jesse Prato (acquisitions), Johnny Fayad (guest experience) - who make this thing go (I just tweet)

@JessePrato @JohnnyFayad

Couldn’t ask for a better, more fun group.

Fin/ If you found this thread and deal overview interesting, feel free to give me a follow and the initial tweet a retweet.

Hopefully there will be more deal breakdowns like this to come in the near future!

Oh and here is the Pothos team.

Hopefully there will be more deal breakdowns like this to come in the near future!

Oh and here is the Pothos team.

https://twitter.com/Aldigity/status/1514036827359002625?s=20&t=uL0CyYBSUvLP1duXpOHgbA

• • •

Missing some Tweet in this thread? You can try to

force a refresh