Ed Seykota turned $5k to $15M in just 12 years.

Here are 20 of Ed's key quotes & takeaways to maximize your trading returns 👇🧵

Here are 20 of Ed's key quotes & takeaways to maximize your trading returns 👇🧵

"Systems don’t need to be changed. The trick is for a trader to develop a system with which he is compatible."

"Having a quote machine is like having a slot machine at your desk – you end up feeding it all day long. I get my price data after the close each day."

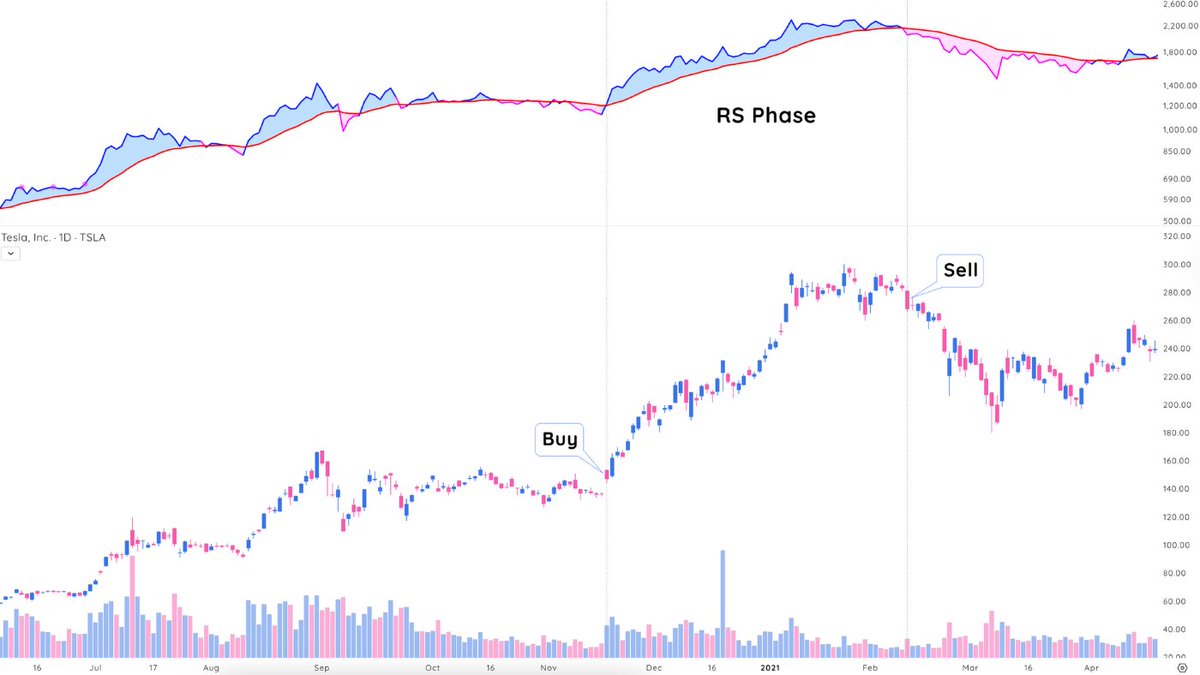

"In order of importance to me are:

1) The long term trend

2) The current chart pattern

3) Picking a good spot to buy or sell"

1) The long term trend

2) The current chart pattern

3) Picking a good spot to buy or sell"

"Markets are fundamentally volatile. No way around it. Your problem is not in the math. There is no math to get you out of having to experience uncertainty."

"Dramatic and emotional trading experiences tend to be negative. Pride is a great banana peel, as are hope, fear, and greed. My biggest slip-ups occurred shortly after I got emotionally involved with positions."

"If you want to know everything about the market, go to the beach. Push and pull your hands with the waves. Some are bigger waves, some are smaller. But if you try to push the wave out when it’s coming in, it’ll never happen. The market is always right."

"The key to long-term survival and prosperity has a lot to do with the money management techniques incorporated into the technical system."

"I usually ignore advice from other traders, especially the ones who believe they are on to a “sure thing”. The old timers, who talk about “maybe there is a chance of so and so,” are often right and early."

"Trying to trade during a losing streak is emotionally devastating. Trying to play “catch up” is lethal."

"The elements of good trading are

(1) Cutting losses

(2) Cutting losses

(3) Cutting losses

If you can follow these three rules, you may have a chance."

(1) Cutting losses

(2) Cutting losses

(3) Cutting losses

If you can follow these three rules, you may have a chance."

"In your recipe for success, don’t forget commitment – and a deep belief in the inevitability of your success."

Ed Seykota has been one of the most successful market participants ever, turning 5k into 15M in 12 years.

Here are some pillars to his success:

✅ Risk Management

✅ Emotional Control

✅ Execution of a System

✅ Belief in Oneself

Master these.

Here are some pillars to his success:

✅ Risk Management

✅ Emotional Control

✅ Execution of a System

✅ Belief in Oneself

Master these.

That's a wrap!

If you enjoyed this thread:

1. Follow @TraderLion_ for more threads like this!

2. RT the tweet below to share with your audience 👍

If you enjoyed this thread:

1. Follow @TraderLion_ for more threads like this!

2. RT the tweet below to share with your audience 👍

https://twitter.com/1485052376/status/1514269186075340800

• • •

Missing some Tweet in this thread? You can try to

force a refresh