Ethereum staking is getting financialized before our eyes.

While staking directly yields ~5%, you can more than double this without adding much risk.

It requires understanding staking pools and the related financial derivatives 🧵

While staking directly yields ~5%, you can more than double this without adding much risk.

It requires understanding staking pools and the related financial derivatives 🧵

We're all pretty familiar with Ethereum staking.

For Ethereum to switch to its Proof of Stake (PoS) consensus mechanism, it requires stakers to deposit ETH in order to participate in the consensus voting.

In return, new ETH is issued to stakers instead of miners.

For Ethereum to switch to its Proof of Stake (PoS) consensus mechanism, it requires stakers to deposit ETH in order to participate in the consensus voting.

In return, new ETH is issued to stakers instead of miners.

However, direct staking comes with several drawbacks:

• It requires technical know-how to set up and operate

• Min deposit of 32 ETH, which not everyone has

• Staked ETH is locked up until after the PoS merge

To resolve these issues, enter Staking Pools

• It requires technical know-how to set up and operate

• Min deposit of 32 ETH, which not everyone has

• Staked ETH is locked up until after the PoS merge

To resolve these issues, enter Staking Pools

Staking Pools are services which abstract the depositing of ETH from running a validator node.

People with ETH can deposit it into a staking pool, and a different group of people can operate the validator nodes do the actual staking.

People with ETH can deposit it into a staking pool, and a different group of people can operate the validator nodes do the actual staking.

In exchange for ETH, depositors receive a representative token from the Staking Pool which is a claim on that ETH.

After the merge, this token is redeemable for ETH.

Since it is backed by the promise of future ETH, the token assumes the ETH-equivalent value even today.

After the merge, this token is redeemable for ETH.

Since it is backed by the promise of future ETH, the token assumes the ETH-equivalent value even today.

The staking rewards are distributed as follows:

• % goes to validator node operators as a fee

• % goes to the DAO Treasury of the Staking Pool, usually controlled by a governance token

• Remainder (majority) accrues value to the representative token

• % goes to validator node operators as a fee

• % goes to the DAO Treasury of the Staking Pool, usually controlled by a governance token

• Remainder (majority) accrues value to the representative token

By far the biggest Staking Pool today is @LidoFinance with 86% market share.

With Lido, anyone can deposit any amount of Ethereum and receive the representative token, stETH in return. No need to run a node.

stETH trades at 1 ETH and is supported by a peg mechanism.

With Lido, anyone can deposit any amount of Ethereum and receive the representative token, stETH in return. No need to run a node.

stETH trades at 1 ETH and is supported by a peg mechanism.

ETH holders can stake via Lido without any minimum deposit.

The stETH they receive back is immediately liquid, which they can spend or lend out.

stETH itself is also rebased on a daily basis, so the yield earned also becomes available to the depositors immediately.

The stETH they receive back is immediately liquid, which they can spend or lend out.

stETH itself is also rebased on a daily basis, so the yield earned also becomes available to the depositors immediately.

In exchange for access and convenience, Lido depositors forego 10% of their staking rewards, which are instead split between operators and the DAO treasury.

A partner network of institutions serve as operators.

The DAO treasury is controlled by the governance token LDO.

A partner network of institutions serve as operators.

The DAO treasury is controlled by the governance token LDO.

The second-largest Staking Pool is @Rocket_Pool with 4.5% market share.

RocketPool launched a lot later than Lido (Nov of last year), but has been growing in market share since.

It boasts a fully decentralized network of node operators - anyone can become an operator.

RocketPool launched a lot later than Lido (Nov of last year), but has been growing in market share since.

It boasts a fully decentralized network of node operators - anyone can become an operator.

RocketPool's representative token is rETH (analogous to stETH for Lido).

RP's governance token is RPL, although it functions a bit differently (serves as insurance collateral) than LDO does for Lido.

Below is a side-by-side comparison of Lido and RocketPool

RP's governance token is RPL, although it functions a bit differently (serves as insurance collateral) than LDO does for Lido.

Below is a side-by-side comparison of Lido and RocketPool

While Staking Pool depositors give up a % their staking rewards, they can turn around and lend out the entire balance of their tokens (stETH, rEth, etc).

This allows them to earn a greater total yield than if they had staked their ETH directly.

This allows them to earn a greater total yield than if they had staked their ETH directly.

But is there a way to increase the yield even more?

What if we were to use the stETH as collateral to borrow more ETH against it, and then take that ETH and deposit it back in the staking pool to get back more stETH plus staking yield?

This is what icETH does for you.

What if we were to use the stETH as collateral to borrow more ETH against it, and then take that ETH and deposit it back in the staking pool to get back more stETH plus staking yield?

This is what icETH does for you.

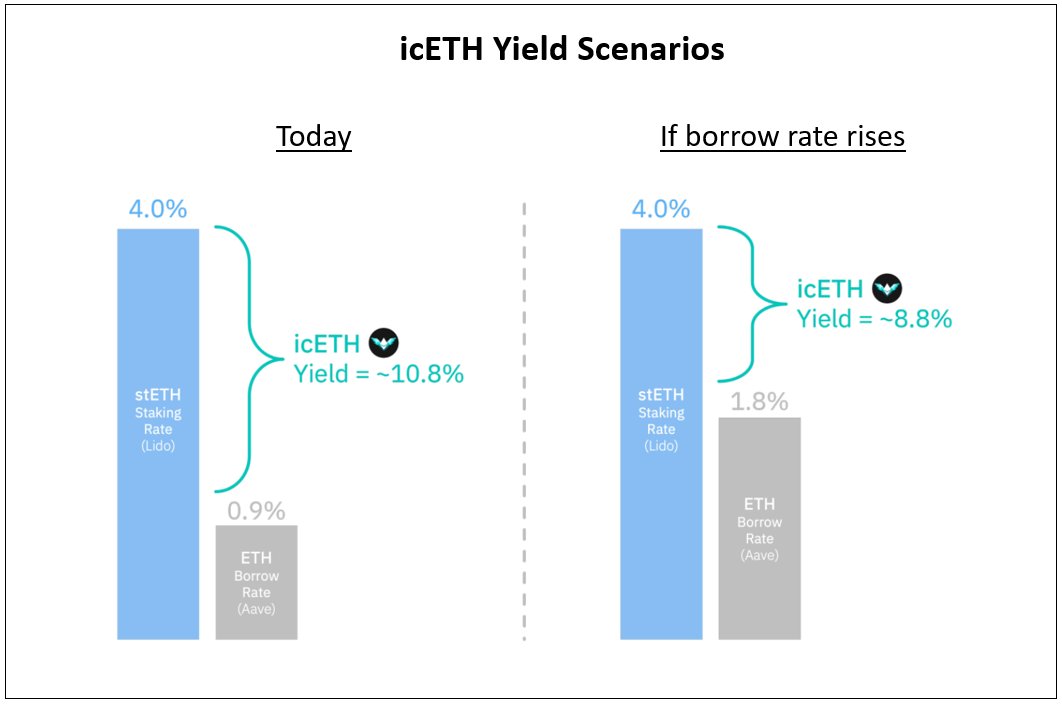

The Interest Compounding ETH Index (icETH) by @indexcoop employs a recursive strategy of borrowing, swapping, and redepositing to attain a leverage ratio of ~3x

icETH capitalizes on the difference between ETH borrow rates and ETH staking yields. The bigger the delta, the higher the yield.

This gap may eventually be arbitraged away, but for now it allows icETH to attain a 2.65x multiplier on the yield of stETH to achieve 10.8%.

This gap may eventually be arbitraged away, but for now it allows icETH to attain a 2.65x multiplier on the yield of stETH to achieve 10.8%.

When you deposit ETH into an icETH smart contract, you receive icETH in return and everything else is handled for you.

And yes, you can now find ways to generate yield on the icETH tokens!

For example, you can provide liquidity to the icETH-ETH pair on @Uniswap for +4%.

And yes, you can now find ways to generate yield on the icETH tokens!

For example, you can provide liquidity to the icETH-ETH pair on @Uniswap for +4%.

To summarize:

1) You can stake directly, but you can also us a a staking pool to get back liquid tokens

2) These tokens can then be leveraged to borrow more ETH to amplify the yield. That's how icETH works

3) icETH tokens can then even be used to earn add'l yield

1) You can stake directly, but you can also us a a staking pool to get back liquid tokens

2) These tokens can then be leveraged to borrow more ETH to amplify the yield. That's how icETH works

3) icETH tokens can then even be used to earn add'l yield

You made it all the way through!

Now get to maxing out that staking yield.

And don’t forget to follow me for more crypto deep-dives.

End 🧵

Now get to maxing out that staking yield.

And don’t forget to follow me for more crypto deep-dives.

End 🧵

Quick update on Lido: they just (3 hours after this thread) published their roadmap to decentralize their operator node network

https://twitter.com/LidoFinance/status/1514673952378998790

• • •

Missing some Tweet in this thread? You can try to

force a refresh