Just 10 mins till we start our 𝐭𝐰𝐞𝐞𝐭𝐜𝐡𝐚𝐭 this afternoon.

Follow the conversation using #TrackingOurShillingKE

Follow the conversation using #TrackingOurShillingKE

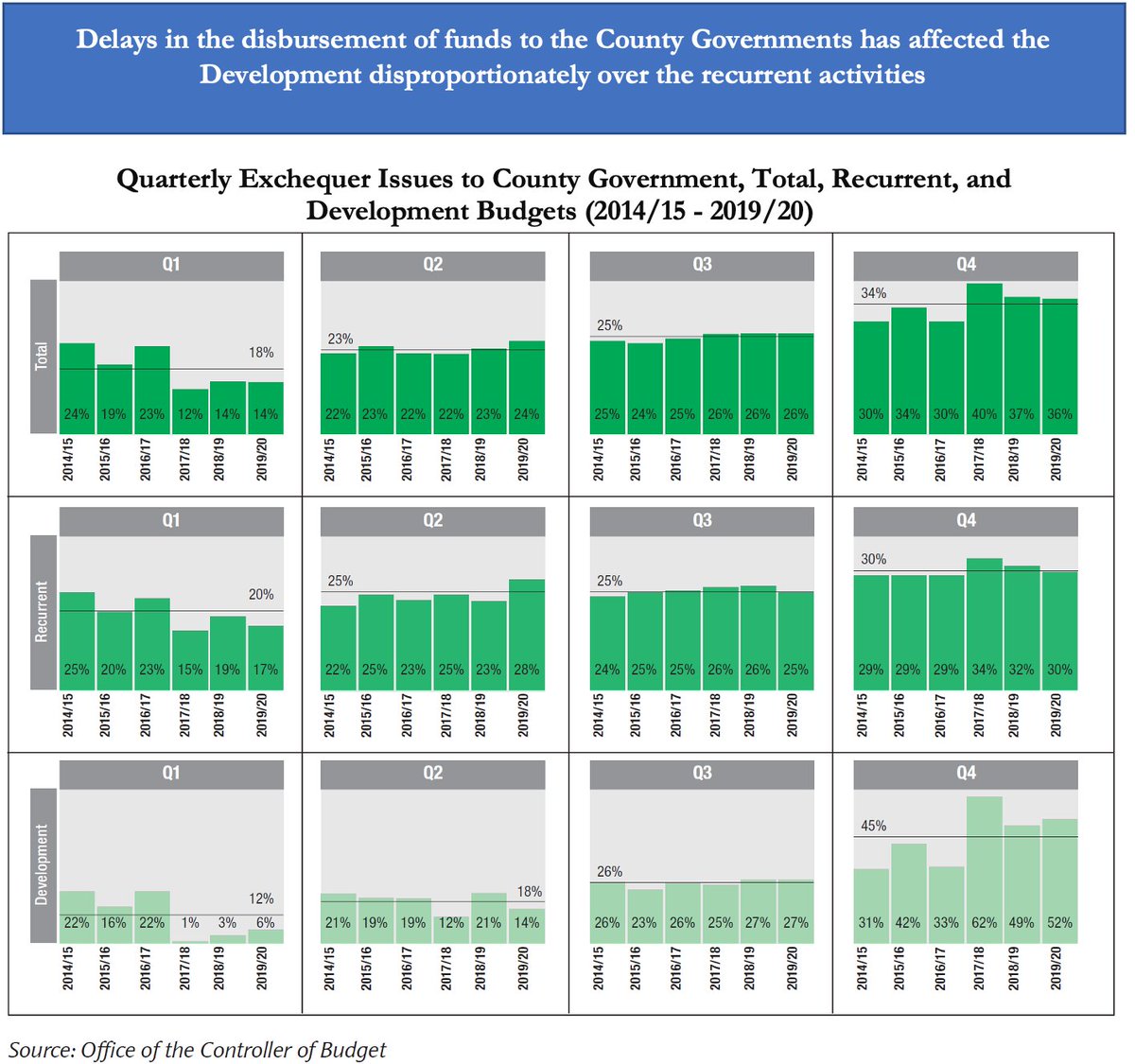

It is evident from panel (a) that at this point when counties present their budgets, they have met the fiscal rule requirement of ensuring that at least 30% is set aside for development programs and projects #TrackingOurShillingKE

The development component of the budget has however been on downward trend, from 45% in 2014/15 to 37% in 2019/20 #TrackingOurShillingKE

When compared with exchequer issues in panel (b) and with actual expenditure in panel (c) proportion of development expenditure reduces across the six financial years #TrackingOurShillingKE

This implies that while the budgets are generally planned in adherence to the PFM rules, performance deteriorates especially during implementation, first starting with the disbursement of funds and then actual spending #TrackingOurShillingKE

It is clear from this comparison that the National Government has a much more even pattern of quarterly spending for its own programs over the financial year than for spending in the form of transfers of the equitable share to counties #TrackingOurShillingKE

While both kinds of spending are delayed compared to a uniform distribution of 25 percent of the annual total in each quarter, spending on national programs is much more evenly distributed than spending on the counties in the form of the equitable share #TrackingOurShillingKE

National spending on its own programs is somewhat backloaded over the financial year with average spending in the fourth quarter of the financial year equal to 29% #TrackingOurShillingKE

However, national spending on the equitable share in the fourth quarter is, on average 37% of the total while such spending in the first quarter is 13 percent of the total for a ratio of 2.8 #TrackingOurShillingKE

County Governments are twice as backloaded as is the case for national programs. As shown above, the fourth quarter, the backloading of the equitable share is even greater than backloading of revenue collection (37 percent to 30 percent) #TrackingOurShillingKE

From this, it is evident that the National Government has prioritized its own preferred programs compared to the counties #TrackingOurShillingKE

Total disbursement of funds to Counties are mostly received late in the year - in the fourth quarter (34% of the Total) #TrackingOurShillingKE

In 2017/18 and 2019/20, 62 and 52 percent, respectively, of the funds for development budget for all counties in aggregate were received in the last quarter, indicating protracted late disbursement

ieakenya.or.ke/?wpdmdl=2595

#TrackingOurShillingKE

ieakenya.or.ke/?wpdmdl=2595

#TrackingOurShillingKE

Lateness in the disbursement of funds for development activities has a number of consequences. Construction and development projects cannot proceed effectively if activities must be slowed down in the first half of each financial year #TrackingOurShillingKE

Given that the unspent funds at the end of the year are always appropriated afresh at the beginning of the year and not specifically to development activities, this has led to a relatively lower expenditure on development over time

ieakenya.or.ke/?wpdmdl=2595

#TrackingOurShillingKE

ieakenya.or.ke/?wpdmdl=2595

#TrackingOurShillingKE

• • •

Missing some Tweet in this thread? You can try to

force a refresh