Thread/

Walter Schloss may be one of the most under appreciated investors of all-time.

Warren Buffett referred to him as ‘Big Walt’. They worked together under Benjamin Graham during the 1950’s.

Walter Schloss may be one of the most under appreciated investors of all-time.

Warren Buffett referred to him as ‘Big Walt’. They worked together under Benjamin Graham during the 1950’s.

1/

Walter and Warren first met at a Marshell Wells shareholder meeting. The company was trading below liquidation value which made it of interest to both of them.

Warren mentioned Walter in the ‘Superinvestors of Graham and Doddsville’ in 1984.

Walter and Warren first met at a Marshell Wells shareholder meeting. The company was trading below liquidation value which made it of interest to both of them.

Warren mentioned Walter in the ‘Superinvestors of Graham and Doddsville’ in 1984.

2/

“…He knows how to identify securities that sell at considerably less than their value to a private owner… He simply says, if a business is worth a dollar and I can buy it for 40 cents, something good may happen to me. And he does it over and over and over again….

“…He knows how to identify securities that sell at considerably less than their value to a private owner… He simply says, if a business is worth a dollar and I can buy it for 40 cents, something good may happen to me. And he does it over and over and over again….

3/

He owns many more stocks than I do – and is far less interested in the underlying nature of the business; I don't seem to have very much influence on Walter. That's one of his strengths; no one has much influence on him.” - Warren Buffett

He owns many more stocks than I do – and is far less interested in the underlying nature of the business; I don't seem to have very much influence on Walter. That's one of his strengths; no one has much influence on him.” - Warren Buffett

4/

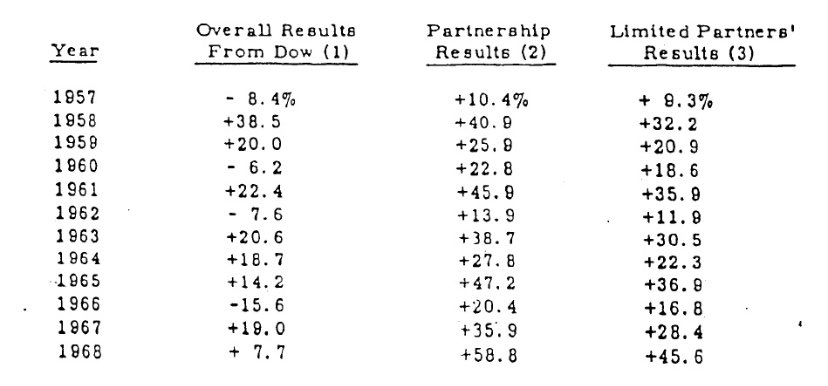

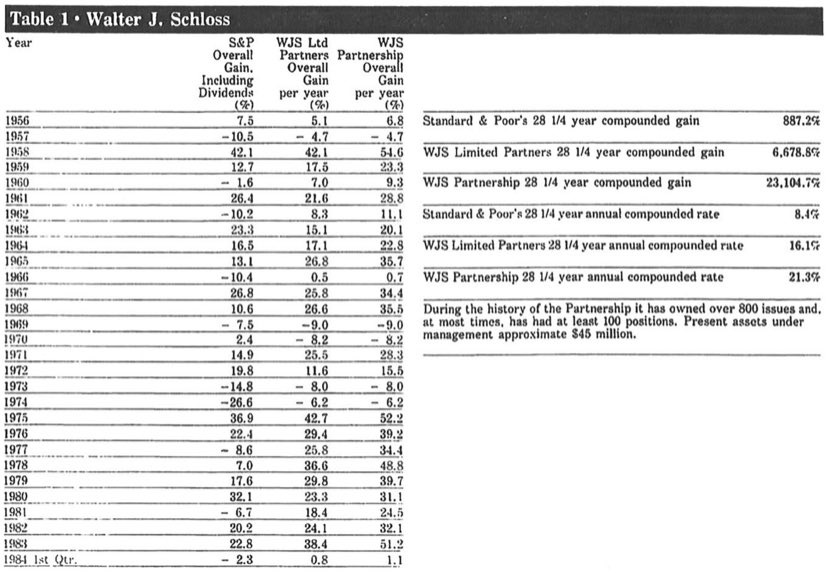

When Buffett described him as a super investor in 1984, Walter had been managing the WJS Partnership single-handedly for 28 years.

Over that 28-year period, WJS had 21.3% compounded annual return. The S&P returned just 8.4% over the same period.

When Buffett described him as a super investor in 1984, Walter had been managing the WJS Partnership single-handedly for 28 years.

Over that 28-year period, WJS had 21.3% compounded annual return. The S&P returned just 8.4% over the same period.

5/

Walter applied Benjamin Grahams net-net investing strategy.

“I used the same investment approach I used at Graham-Newman — finding net-net stocks. It was all about capital preservation because I had to serve in the best interests of my investors.” - Walter Schloss

Walter applied Benjamin Grahams net-net investing strategy.

“I used the same investment approach I used at Graham-Newman — finding net-net stocks. It was all about capital preservation because I had to serve in the best interests of my investors.” - Walter Schloss

6/

Schloss ran his one man shop out of the closet of Tweedy Browne. He intentionally wanted minimal overhead costs and didn’t want or need the resources others on Wall Street were using.

Naturally, Schloss was much more of a quantitative investor. He didn’t care for quality.

Schloss ran his one man shop out of the closet of Tweedy Browne. He intentionally wanted minimal overhead costs and didn’t want or need the resources others on Wall Street were using.

Naturally, Schloss was much more of a quantitative investor. He didn’t care for quality.

7/

“The thing about buying depressed stocks is that you really have three strings in your bow:

1) earnings will improve and the stocks will go up;

2) someone will come in and buy control of the company; or

3) the company will start buying its own stock .”

“The thing about buying depressed stocks is that you really have three strings in your bow:

1) earnings will improve and the stocks will go up;

2) someone will come in and buy control of the company; or

3) the company will start buying its own stock .”

8/

“The thing about my companies is that they are all depressed, they all have problems and there’s no guarantee that any one will be a winner. But if you buy 15 or 20 of them, they’re bound to work out well.”

“The thing about my companies is that they are all depressed, they all have problems and there’s no guarantee that any one will be a winner. But if you buy 15 or 20 of them, they’re bound to work out well.”

9/

“If you buy companies that are depressed because people don’t like them, for various reasons, and things turn a little in your favor, you get a good deal of leverage.”

- Walter Schloss

In a nutshell, he had a diversified portfolio of low quality, illiquid net-net stocks.

“If you buy companies that are depressed because people don’t like them, for various reasons, and things turn a little in your favor, you get a good deal of leverage.”

- Walter Schloss

In a nutshell, he had a diversified portfolio of low quality, illiquid net-net stocks.

10/

Walter did not work excessive hours like the rest of Wall St. He worked 9-5 and kept his entire process as simple as possible.

He did not over think anything. Walter bought a heap of incredibly cheap stocks and did not stray from his approach.

Walter did not work excessive hours like the rest of Wall St. He worked 9-5 and kept his entire process as simple as possible.

He did not over think anything. Walter bought a heap of incredibly cheap stocks and did not stray from his approach.

11/

If you want to read more about Walters approach, you can read his ‘factors needed to make money in the stock market’ one-pager below.

Walter Schloss (1916-2012).

Like, share & follow if you enjoyed.

If you want to read more about Walters approach, you can read his ‘factors needed to make money in the stock market’ one-pager below.

Walter Schloss (1916-2012).

Like, share & follow if you enjoyed.

• • •

Missing some Tweet in this thread? You can try to

force a refresh