Success in a Crashing Market (aka asymmetric ideas to gain from the mess) a 🧵: this week sucked for traders. Convictions made and not made were tested. I’ve been confident in a flush for the last two months (even posting about it), but didn’t trust myself to size correctly. 1/

https://twitter.com/Jarsci/status/1511385773211279364

Being right with wrong size is the same as being wrong. No one has to make the same mistake twice.A friend once said “the trader you were yesterday isn’t the same trader you are today”🧘♂️. Consider reading @jackschwager’s Market Wizards or @hkuppy for positioning advice 2/

There’s a good chance SPY hits 3300 - 3500 🪦 and inflation continues 💸. Here are a few asymmetric ideas to gain from the mess. 3/

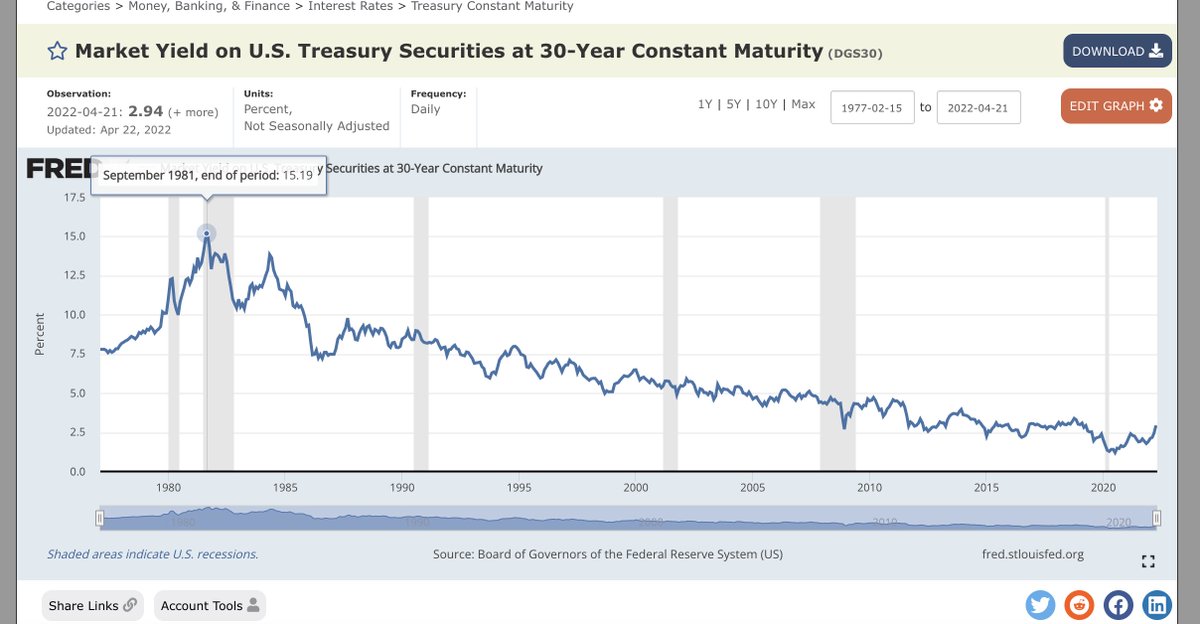

*Buy 30 Year Treasuries* Be patient. In September 1981, yields hit 15.1%. The average compound annual return of the SPY for the next 30 year period was 10.45%. Beat the market with a “Risk free” instrument. No brainer. 4/

This trade was the basis for the #FIRE movement in the 1980s and today’s low rate regime left current acolytes in a tough spot. 30Y is at 2.94%. Is it possible it could hit 9% when inflation is nearing 15%? Sure. Interested in fire, look at @mrmoneymustache or @vicki_robin 5/

In the same vein, consider purchasing the maximum annual amount of Ibonds in May. $10K limit (per year per SSN) bond that must be purchased directly from the treasury that yields 7%+ (new rate published in may) 6/

treasurydirect.gov/indiv/research…

treasurydirect.gov/indiv/research…

*Buy OTM LEAP options or sell Puts* on any asset class you think will recover at the bottom. It took the SPY 1Y6M, 3Y2M, 1Y1M, 2M to recover at least 50% from the bottom in 1987, 2000, 2008, 2020. 7/

When markets crash, call options prices decline and put writing becomes much more profitable due to vol. If you place your call strike 25 - 30% above current prices for 2 years out (reverse for puts), you have a very decent chance of making a legendary profit… 8/

Take a look at $BRKB (a company with +$140B of cash + free cash flow, etc). These opportunities will present again. 9/

How to know when the bottom is in? Look for a day with massive margin calls, air gaps in spread, and high single digit losses + a dovish statement from the fed announcing the end of QT or the start of a new QE cycle. March 20’ had -9 & -12% days 10/

cnbc.com/2020/03/22/bre…

cnbc.com/2020/03/22/bre…

*Short the SPY/QQQ/DOW and purchase offsetting call options*. The weekly index charts look bad. We’ll likely retest March 14th lows. If those don’t hold, we’re likely going to fall towards the 200 week moving average. Fed risk and bad technicals make this trade easier. 11/

^^^ seems like obvious advice. Why call it out? People have a bias against hitting the sell button. Like most things, I did too until I tried it. Super easy, not scary. 12/

*Throw your winners out with the bath water*. Depending on your level of confidence on an upcoming crash/downturn (and your views on future tax brackets), use this opportunity to rebase your non-dividend paying profitable equities. 13/

Take the cash now so you can put it to work later. Great companies like $BRKB and commodities could see a drop (just like they did in the previous downturns) and you could always buy them back (just like they will be doing). 14/END

• • •

Missing some Tweet in this thread? You can try to

force a refresh