The best traders take advantage of alternate entries to build positions before a stock becomes obvious to the crowd.

Here are 7 lesser known Chart Patterns that are a MUST in any trader's tool box 🧵👇

Here are 7 lesser known Chart Patterns that are a MUST in any trader's tool box 🧵👇

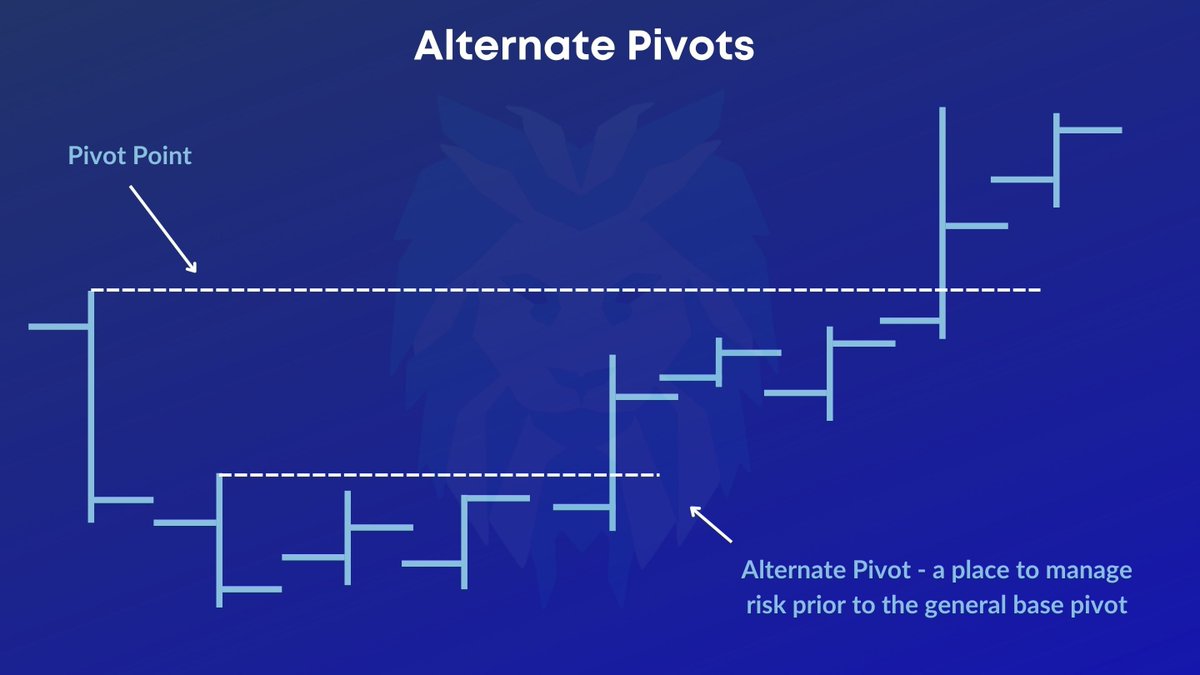

#1: Alternate Pivots

Alternate pivots offer earlier entries when compared to regular pivots.

These pivots are important because:

▪️ They offer the same if not better R/R then regular pivots

▪️ Less volatility around these areas

▪️ Allow you to start positions EARLIER

Alternate pivots offer earlier entries when compared to regular pivots.

These pivots are important because:

▪️ They offer the same if not better R/R then regular pivots

▪️ Less volatility around these areas

▪️ Allow you to start positions EARLIER

#2: High Volume Close (HVC)

The HVC is created from a big volume gap up.

The close of this day is an important point for institutions to support.

If institutions are in supporting this point, price should be very responsive - making it a great, lower risk entry.

The HVC is created from a big volume gap up.

The close of this day is an important point for institutions to support.

If institutions are in supporting this point, price should be very responsive - making it a great, lower risk entry.

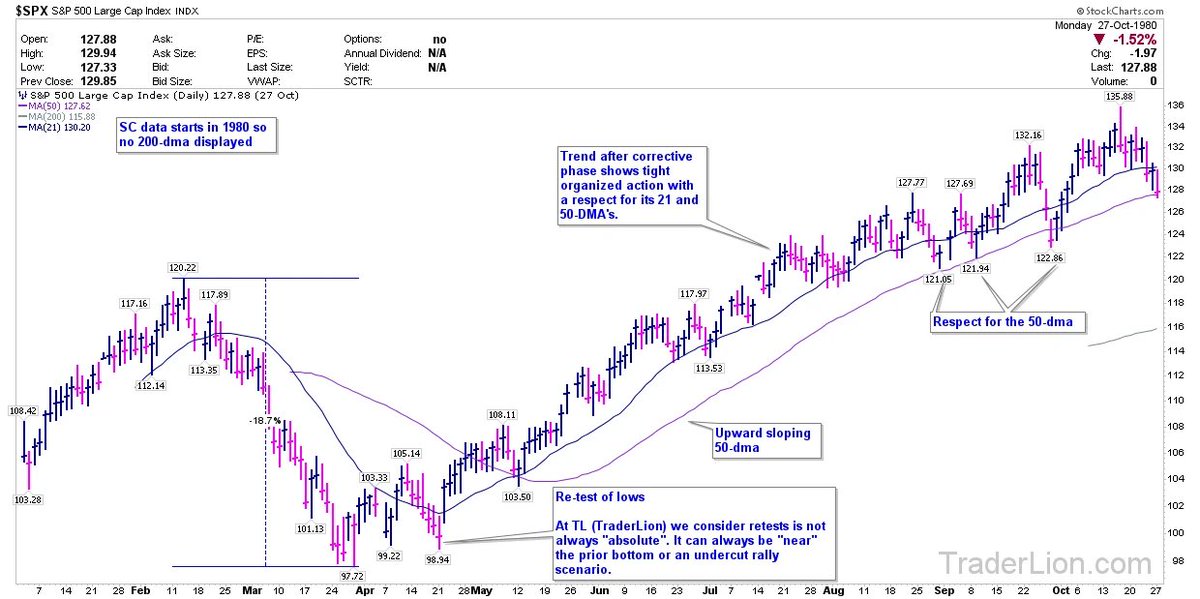

#3: Pivot Retest

The pivot retest setup happens when price retests the prior support/resistance point & then rallies back through.

This can be a powerful setup as it acts as a 'shakeout' and reverses higher with stronger hands holding the name.

The pivot retest setup happens when price retests the prior support/resistance point & then rallies back through.

This can be a powerful setup as it acts as a 'shakeout' and reverses higher with stronger hands holding the name.

#4: In The Wick Setup

We are looking for stocks that open in the wick of the prior session's bar.

The buy trigger is when price moves through the prior day's high.

The stop loss should be the low of the current day.

We are looking for stocks that open in the wick of the prior session's bar.

The buy trigger is when price moves through the prior day's high.

The stop loss should be the low of the current day.

#5: Oops Up Reversal

The Oops Up Reversal setup is best implemented on a gap down (usually created from a poor close the prior session) that finds demand quickly.

The buy trigger is when price moves through the prior day's low.

The stop loss should be LOD or a defined %.

The Oops Up Reversal setup is best implemented on a gap down (usually created from a poor close the prior session) that finds demand quickly.

The buy trigger is when price moves through the prior day's low.

The stop loss should be LOD or a defined %.

This setup was created by legendary trader Larry Williams.

Hear more on his his trading journey in our interview with him for the TraderLion Podcast 👇

Hear more on his his trading journey in our interview with him for the TraderLion Podcast 👇

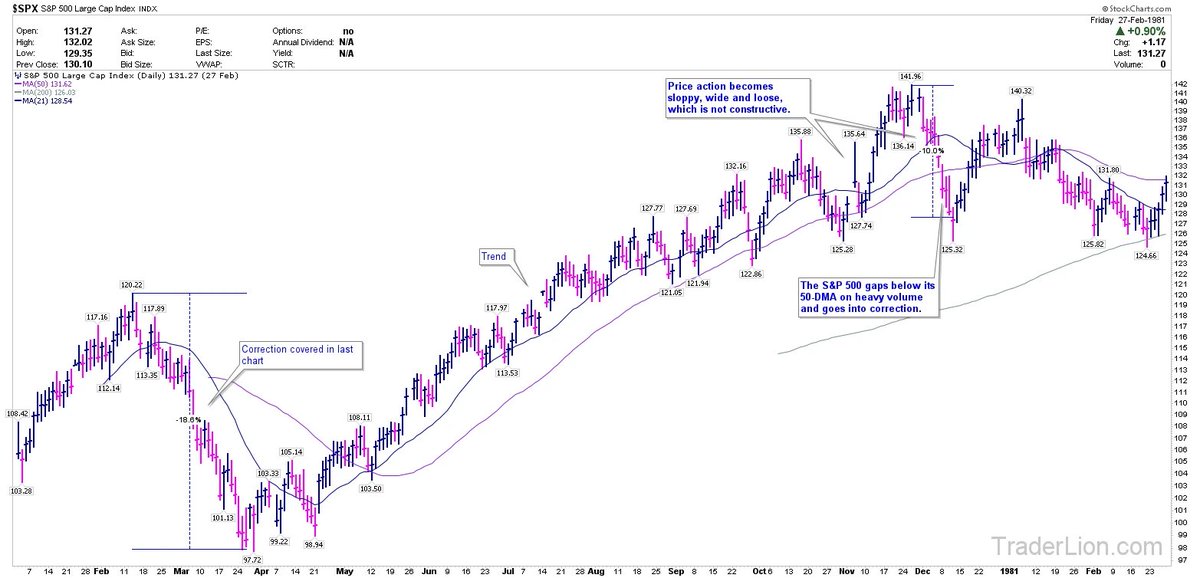

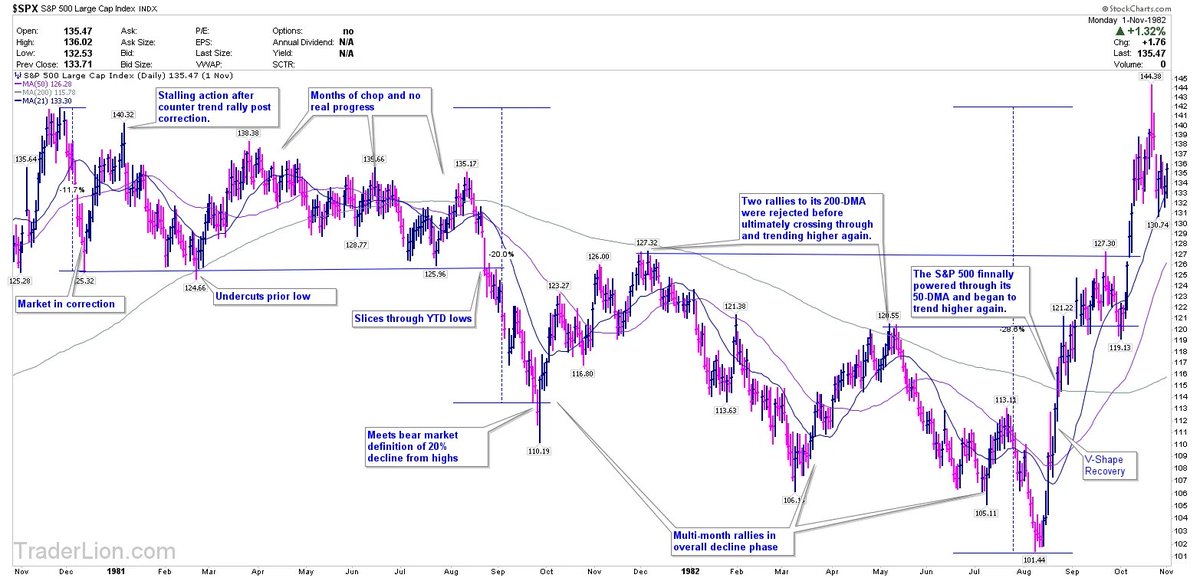

#6: Undercut & Rally Setup

The U&R setup usually occurs at the low or bottom of a base or structure.

This is often what we see in William O'Neil's 'Double Bottom' base structure.

Buy Point: Up Through Prior Swing Low

Stop Loss: Low of U&R Day

The U&R setup usually occurs at the low or bottom of a base or structure.

This is often what we see in William O'Neil's 'Double Bottom' base structure.

Buy Point: Up Through Prior Swing Low

Stop Loss: Low of U&R Day

If you are interested in learning more about well known basing patterns, here's a thread we posted earlier this year 👇

https://twitter.com/TraderLion_/status/1498771599763423238?s=20&t=MCaFLL-wI4VMBTGmJ8-MSg

#7: Power of 3 Setup

The Power of 3 pattern is when the 10SMA, 20SMA, & 50SMA are all within 1.5% of each other & price overtakes all three to the upside in one bar.

The Launchpad usually follows this pattern, where the moving averages form a 'launchpad' underneath price.

The Power of 3 pattern is when the 10SMA, 20SMA, & 50SMA are all within 1.5% of each other & price overtakes all three to the upside in one bar.

The Launchpad usually follows this pattern, where the moving averages form a 'launchpad' underneath price.

Learning the following 6 patterns will allow you to become a much more versatile trader 💪

✅ High Volume Close (HVC)

✅ Alternate Pivots

✅ Pivot Retests

✅ In The Wick

✅ Oops Up Reversal

✅ Undercut & Rally

✅ Power of 3

✅ High Volume Close (HVC)

✅ Alternate Pivots

✅ Pivot Retests

✅ In The Wick

✅ Oops Up Reversal

✅ Undercut & Rally

✅ Power of 3

As always, the overall context of each chart should be taken into consideration when making buy and sell decisions.

These patterns work best to the long side when the stock and general markets are uptrending. 📈

These patterns work best to the long side when the stock and general markets are uptrending. 📈

What other patterns do you use? Let us know below! 👇

That's a wrap!

If you enjoyed this thread:

1. Follow @TraderLion_ for more content on trading & the stock market.

2. RT the tweet below to share this thread with your audience 👍

If you enjoyed this thread:

1. Follow @TraderLion_ for more content on trading & the stock market.

2. RT the tweet below to share this thread with your audience 👍

https://twitter.com/1485052376/status/1519769452140711936

• • •

Missing some Tweet in this thread? You can try to

force a refresh