#astrowars is here. There is a ton of content out there, but saving you time with some curated resources that are helpful and my pov on how I see it evolving

🔹 overview

🔹 framework of evaluation

🔹 phases

🔹 positioning

🧵 time, let’s go 👇

🔹 overview

🔹 framework of evaluation

🔹 phases

🔹 positioning

🧵 time, let’s go 👇

/ overview

First, from @astroport_fi itself on the why it matters, players, considerations.

How is one to decide?

First, from @astroport_fi itself on the why it matters, players, considerations.

How is one to decide?

https://twitter.com/astroport_fi/status/1519706038789980162

/ framework for evaluation

@danku_r summarizes for you some frameworks for consideration.

On point in terms of basics of how to evaluate:

🔹 how DAOs are accruing $astro

🔹 $astro derivatives peg risks

🔹 value accrual of each tkn

But what can you learn from #curvewars ?

@danku_r summarizes for you some frameworks for consideration.

On point in terms of basics of how to evaluate:

🔹 how DAOs are accruing $astro

🔹 $astro derivatives peg risks

🔹 value accrual of each tkn

But what can you learn from #curvewars ?

https://twitter.com/danku_r/status/1519761713754787840

/ phases of #astrowars

Now that you’ve had a primer, here is level 2. I’m looking at #astrowars in phases.

+ phase 1 - hype

+ phase 2 - infra

+ phase 3 - adoption

+ phase 4 - equilibrium

The key thing is to manage your expectations. Here is a product marketing phases pov

Now that you’ve had a primer, here is level 2. I’m looking at #astrowars in phases.

+ phase 1 - hype

+ phase 2 - infra

+ phase 3 - adoption

+ phase 4 - equilibrium

The key thing is to manage your expectations. Here is a product marketing phases pov

/ phase 1 - hype

DAOs are accumulating to control incentives on @terra_money ‘s top dex, similar to $CRV on $eth.

Incentives are being thrown out to accumulate your $astro

Expect hype, noise and opportunity

$CVX went from $2 to $20 at launch last May 🚀

DAOs are accumulating to control incentives on @terra_money ‘s top dex, similar to $CRV on $eth.

Incentives are being thrown out to accumulate your $astro

Expect hype, noise and opportunity

$CVX went from $2 to $20 at launch last May 🚀

/ phase 2 - infra

Hype lacks substance though. $astro needs infrastructure.

+ $vxAstro and gauge framework

+ voting mechanisms

+ marketplace for votes/bribes

+ market makers arb / keep peg

$CVX went from $20 to $2 in July, pegs for $cvxCRV off 20-30%

It’s a grind.

Hype lacks substance though. $astro needs infrastructure.

+ $vxAstro and gauge framework

+ voting mechanisms

+ marketplace for votes/bribes

+ market makers arb / keep peg

$CVX went from $20 to $2 in July, pegs for $cvxCRV off 20-30%

It’s a grind.

/ phase 3 - adoption

Now that $astro infra is in, the interesting part is the market for gov votes. Two questions, when bribe? Who bribes?

The key to adoption is evangelizing the value prop of bribing. Why, who and how bribe?

Now that $astro infra is in, the interesting part is the market for gov votes. Two questions, when bribe? Who bribes?

The key to adoption is evangelizing the value prop of bribing. Why, who and how bribe?

#curvewars started in Sept with bribe infra. $crv $cvx community put in sweat equity to educate DAOs on the value of “strategic emissions”

Instead of arbitrary time based emissions, $astro & $crv have a system that lets you adjust every 2 weeks based on needs. Here is an ELI5

Instead of arbitrary time based emissions, $astro & $crv have a system that lets you adjust every 2 weeks based on needs. Here is an ELI5

https://twitter.com/ShivanshuMadan/status/1497663781882634241

The adoption phase saw $CVX from $2 to $60 in Dec 👀

Why? $luna $frax $ldo $spell $tribe $badger bribed or stacked $CVX for their usd $eth $btc stableswap derivatives.

$CRV is the largest liquidity center $20b TVL on the largest chain $eth. Tokenomics is just part of equation

Why? $luna $frax $ldo $spell $tribe $badger bribed or stacked $CVX for their usd $eth $btc stableswap derivatives.

$CRV is the largest liquidity center $20b TVL on the largest chain $eth. Tokenomics is just part of equation

/ phase 4 - equilibrium

This phase is important, mostly because at this stage the market matures.

+ marketplace KPIs clear

+ benchmarks established

+ DAOs have best practices based on existing game theory

+ new DAOs have a playbook

$CVX has stabilized between $25-35 last 3 mo.

This phase is important, mostly because at this stage the market matures.

+ marketplace KPIs clear

+ benchmarks established

+ DAOs have best practices based on existing game theory

+ new DAOs have a playbook

$CVX has stabilized between $25-35 last 3 mo.

History will rhyme, you can expect similar phases. It’s not a negative, it just takes time to build infra by great builders

+ Astroport - @Delphi_Digital

+ Bribe Mkt - @redactedcartel

+ Gov - @retrogrademoney @reactor_money @ApolloDAO @SpecProtocol @orion_money

+ bribe - ?

+ Astroport - @Delphi_Digital

+ Bribe Mkt - @redactedcartel

+ Gov - @retrogrademoney @reactor_money @ApolloDAO @SpecProtocol @orion_money

+ bribe - ?

/ positioning

I’m learning with you. The wars will be different, but $astro value prop is clear.

The top dex on what will be the top 2 chain next to $ETH will attract outsized liquidity. $2b $astro vs $20b $crv. Top 2 in volume so I can afford to wait for it to mature.

I’m learning with you. The wars will be different, but $astro value prop is clear.

The top dex on what will be the top 2 chain next to $ETH will attract outsized liquidity. $2b $astro vs $20b $crv. Top 2 in volume so I can afford to wait for it to mature.

I’m assessing a number of things. I will focus my points more on my considerations and not my final decision

+ team + gtm strategy

+ bd capabilities

+ tokenomics

+ KPI framework

+ team + gtm strategy

+ bd capabilities

+ tokenomics

+ KPI framework

/ team + gtm strategy

Pay attention to the team’s approach.

+ How are they building buzz?

+ How did they approach lock drop?

+ Are they aware of phases and how did they mitigate risks?

+ How are they resourced?

+ Is security of your funds prioritized?

Pay attention to the team’s approach.

+ How are they building buzz?

+ How did they approach lock drop?

+ Are they aware of phases and how did they mitigate risks?

+ How are they resourced?

+ Is security of your funds prioritized?

/ bd capabilities

Partnerships are 🔑. Pay attention to which team:

+ gathers key partners, investors

+ aligns help with each phase - launch, infra, adoption, equilibrium

There are teams that lead and create the market, and those who ride along.

Partnerships are 🔑. Pay attention to which team:

+ gathers key partners, investors

+ aligns help with each phase - launch, infra, adoption, equilibrium

There are teams that lead and create the market, and those who ride along.

/ tokenomics

Each protocol actually offers great value. I focused on a few simple questions.

+ value accrual model

+ do I want a protocol with partial or 100% of tokenomics focused on building a moat?

Incentives drive everything.

Each protocol actually offers great value. I focused on a few simple questions.

+ value accrual model

+ do I want a protocol with partial or 100% of tokenomics focused on building a moat?

Incentives drive everything.

/ KPI framework

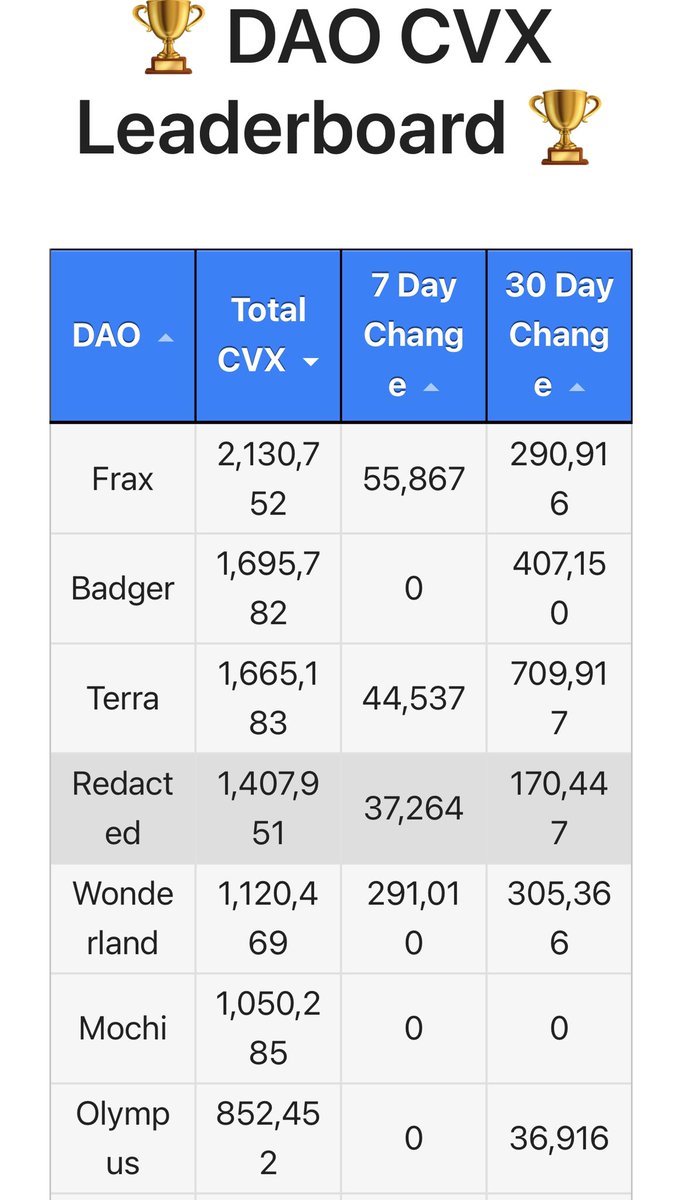

All the above is great, but what about KPIs. I’m already convinced $astro will monopolize terra volume. But the #astrowars tkn?

+ $astro accrual - DAO total & accrual velocity

+ control - $astro per tkn

+ % $astro locked of daily emissions

+ $ bribe / tkn

All the above is great, but what about KPIs. I’m already convinced $astro will monopolize terra volume. But the #astrowars tkn?

+ $astro accrual - DAO total & accrual velocity

+ control - $astro per tkn

+ % $astro locked of daily emissions

+ $ bribe / tkn

/ bribe market thoughts

@astroport_fi decision to keep competition open will mean an added layer of innovation and partnerships that is hard to predict.

@terra_money also has $UST already natively.

@astroport_fi decision to keep competition open will mean an added layer of innovation and partnerships that is hard to predict.

@terra_money also has $UST already natively.

But the model is clear. Any $astro LP whether stableswap derivative or volatile tkn w/ a liquidity mining budget is a potential customer and can use @astroport_fi more efficiently for liquidity incentives.

If you’re bullish $luna, hard to not be bullish long term on $astro

If you’re bullish $luna, hard to not be bullish long term on $astro

/ last thoughts

If you’ve gone through this and still unsure of which protocol, the no rekt suggestion is to support via farming (not buying) and monitor same set of KPIs for each.

If anyone can mirror the $cvx dune dashboard for terra. Let me know.

dune.com/Marcov/Convex-…

If you’ve gone through this and still unsure of which protocol, the no rekt suggestion is to support via farming (not buying) and monitor same set of KPIs for each.

If anyone can mirror the $cvx dune dashboard for terra. Let me know.

dune.com/Marcov/Convex-…

/ sharing means caring

If helpful, or you know someone who can get value out of this thread, share the original post below.

If helpful, or you know someone who can get value out of this thread, share the original post below.

https://twitter.com/0xcha0s/status/1519871334020489216

• • •

Missing some Tweet in this thread? You can try to

force a refresh