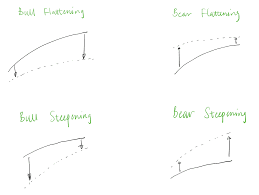

The term 'bear flattening' is likely to be the floating narrative now! What does it mean and how does it impact investors?

Bear flattener refers to the convergence of interest rates along the yield curve as short term rates rise faster than long term rates and is seen as a harbinger of an economic contraction.

So the term premium falls because the short term rates rise while long term stagnate

So the term premium falls because the short term rates rise while long term stagnate

Why bear? Because rise in long term rates are considered as a signal of higher growth(&inflation) expectations, rise in short term rates purely reflect Central Bank's actions which emerge from tightening

This is how bear flattening looks like. Both rates rise but short term rates rise more

Source: Google images

Source: Google images

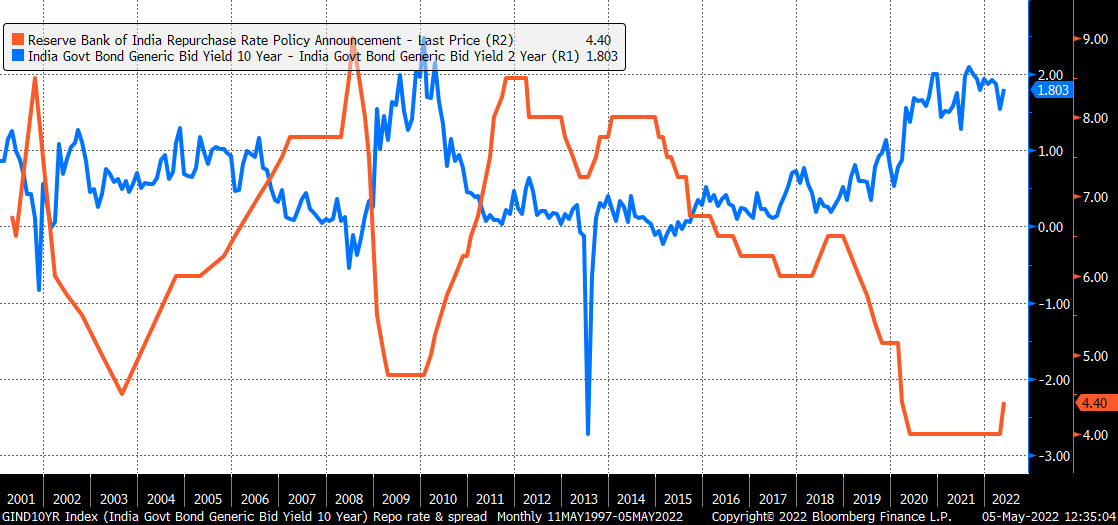

Have we seen something similar in India? Yes, and they have resulted in valuation de rating

A period of rising repo and falling spread are instances of bear flattening

A period of rising repo and falling spread are instances of bear flattening

Going forward, long term yields are likely to peak and short term yields will rise given the Central bank's actions. Most loans will get repriced and this will find a reflection in equity vals getting derated. This indeed, will be the global narrative now

• • •

Missing some Tweet in this thread? You can try to

force a refresh