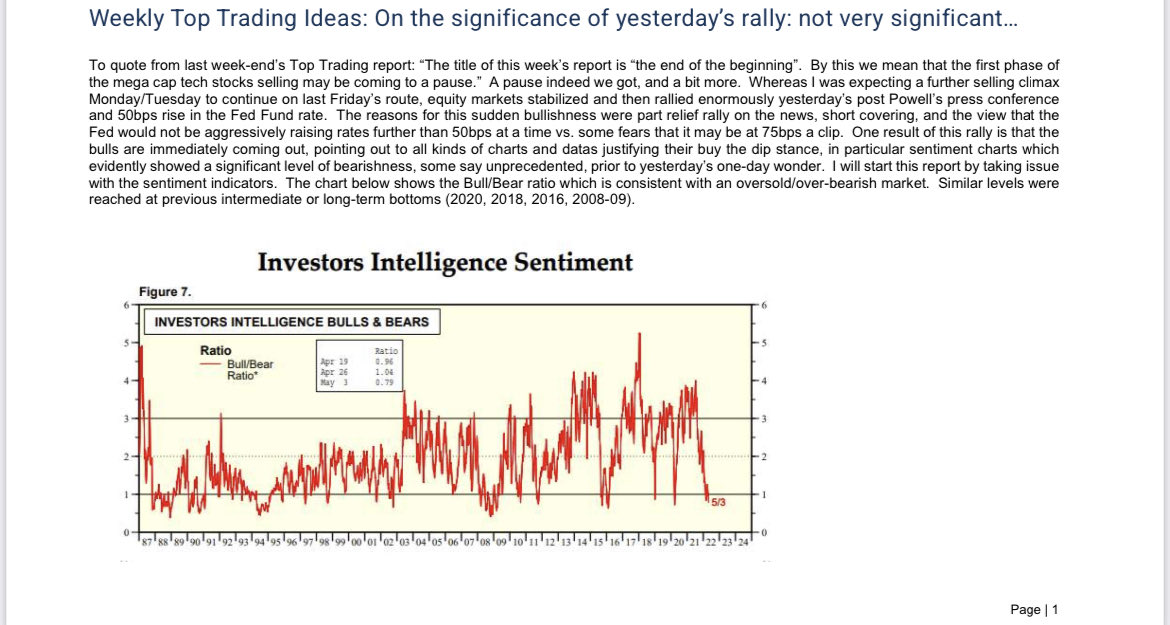

I have been the most vocal $ARKK bear on twitter since $130 last summer. In recent months I have described the broader market as offering return free risk. I have refrained from predicting a crash - until yesterday in my twitter space. Markets only really crash from

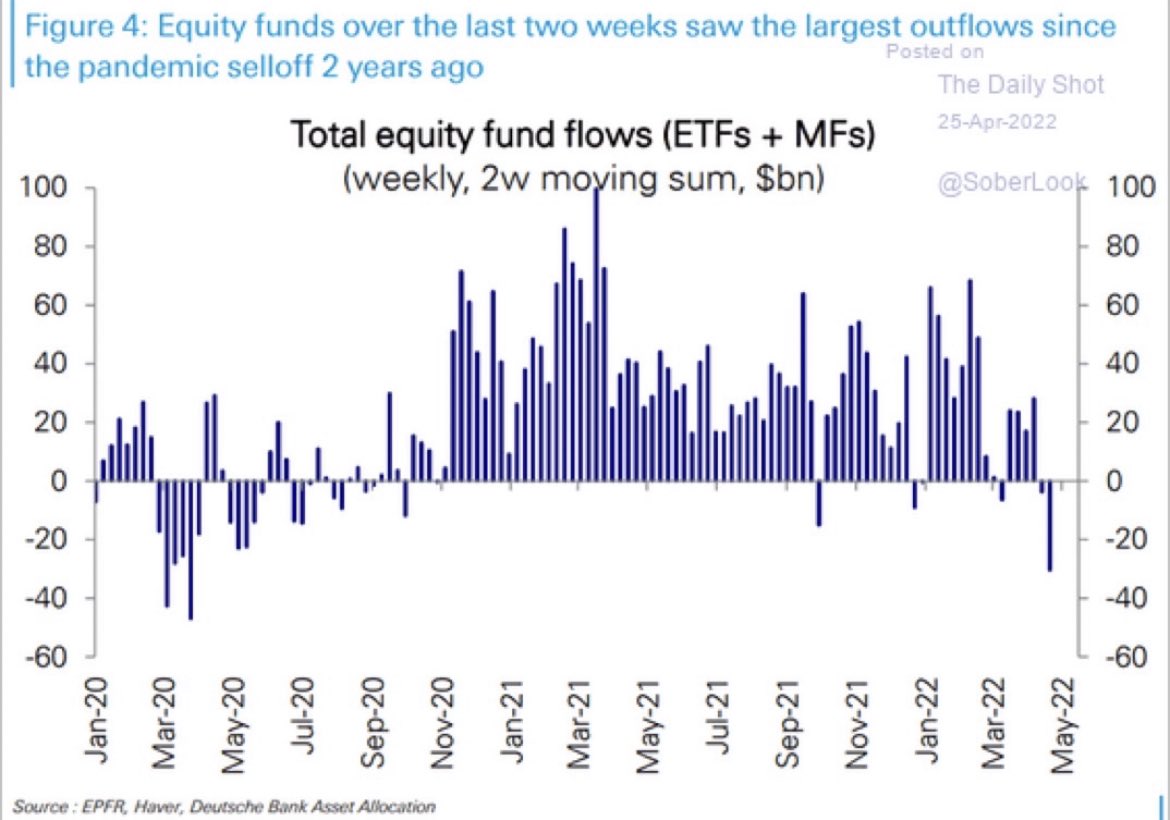

oversold conditions. Equity markets are confronted with the unholy trinity of rising interest rates, a rising oil price and a rising dollar. Selling by retail has been minimal. Last Thursday saw record one day inflows. $ARKK has seen inflows in 10 of the last 13 weeks despite

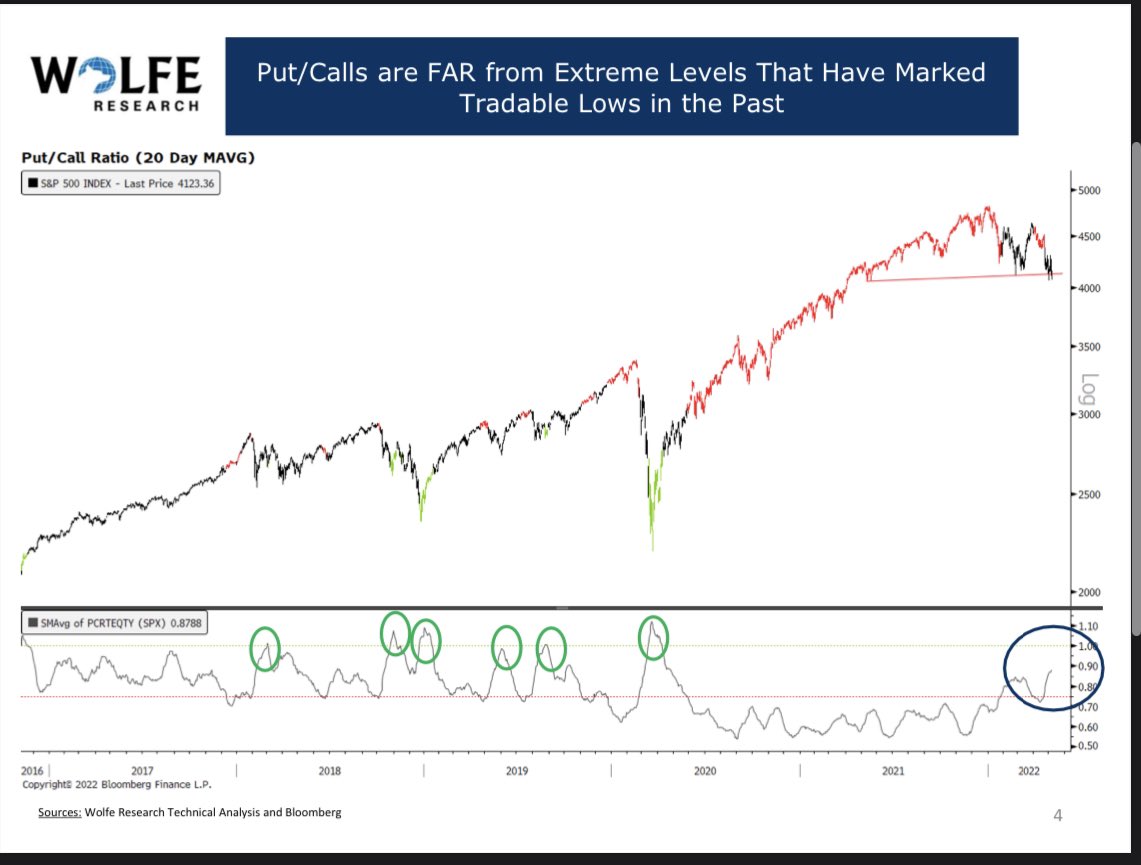

a 50% YTD decline in share price (h/t @daChartLife ). These are things one does not see at a bottom. The complacency is staggering. Denial is not the name of a river in Egypt. The charts here from the prescient Rob Ginsberg are rather foreboding

I fear that the investing public will soon get the memo and that there will be a rush for the exits. The Fed safety net has Ben removed. In fact, the Fed put has been replaced by a Fed call. Whatever happened to don’t fight the Fed?

The equity market offers zero upside and massive downside IMHO. Investors have been made complacent by years of reckless monetary policy from central banks around the world. Inflation has put an end to the liquidity game. #TINA IS DEAD. #GOLDILOCKS IS DEAD. #FOMO IS DEAD.

I suspect rates and spreads are going considerably higher; equities will implode. New investors who entered the market in recent years and believe this fugazi of a market is both normal and sustainable are about to get a very expensive education. The rational bubble is giving

• • •

Missing some Tweet in this thread? You can try to

force a refresh