$QNT bagged these 3 enormous trade and supply chain blockchain consortiums 🔄 and it was right in front of our eyes👀

✅GSBN

✅Contour

✅Tradelens

❓And more leads and insights

You don’t want to miss this one🕵️

A thread into Quants leading role in Trade Finance

👇🏻🧵

1/N

✅GSBN

✅Contour

✅Tradelens

❓And more leads and insights

You don’t want to miss this one🕵️

A thread into Quants leading role in Trade Finance

👇🏻🧵

1/N

First a short deepdive into the ecosystems (how big are they?) and than the leads to a lot of trade networks.

READ TO THE END

2/N

READ TO THE END

2/N

Network 1: GSBN

This Global Shipping Business Network (GSBN) will “handle 1 in 3 containers shipped around the world 🌎 🚢 ”- build on Hyperledger technology

- Founded by 8 global maritime cargo multinationals. Biggest is Costo from 🇨🇳, 288.000 employees✅

- 🇭🇰HK based

3/N

This Global Shipping Business Network (GSBN) will “handle 1 in 3 containers shipped around the world 🌎 🚢 ”- build on Hyperledger technology

- Founded by 8 global maritime cargo multinationals. Biggest is Costo from 🇨🇳, 288.000 employees✅

- 🇭🇰HK based

3/N

- The network aims to digitalize maritime trade using blockchain 🌊🔗

- Tech partners: Oracle, Microsoft, AntChain & Alibaba Cloud✅

4/N

- Tech partners: Oracle, Microsoft, AntChain & Alibaba Cloud✅

4/N

Network 2: Contour

The worlds biggest Trade Finance Network🌏 - build on Corda (R3) technology

- Launched Q3-2020✅

- Founded by Bangkok Bank, BNP Paribas, CTBC, Citi, ING, HSBC, SEB & Standard Chartered🏦

- Brings together >15 global trade banks

5/N

The worlds biggest Trade Finance Network🌏 - build on Corda (R3) technology

- Launched Q3-2020✅

- Founded by Bangkok Bank, BNP Paribas, CTBC, Citi, ING, HSBC, SEB & Standard Chartered🏦

- Brings together >15 global trade banks

5/N

- Just won ‘best fintech in trade’ 2022 by GTR (biggest trade finance media)

- Operating accross >50 countries🗺

Absolute beast🔥

6/N

- Operating accross >50 countries🗺

Absolute beast🔥

6/N

Network 3: Tradelens

“The TradeLens ecosystem now includes more than 300 organizations🤯” - build on Hyperledger technology

- Founded by IBM & Maersk. IBM needs no introduction. Maersk is the 2nd largest container shipping company in the world⚓️

7/N

“The TradeLens ecosystem now includes more than 300 organizations🤯” - build on Hyperledger technology

- Founded by IBM & Maersk. IBM needs no introduction. Maersk is the 2nd largest container shipping company in the world⚓️

7/N

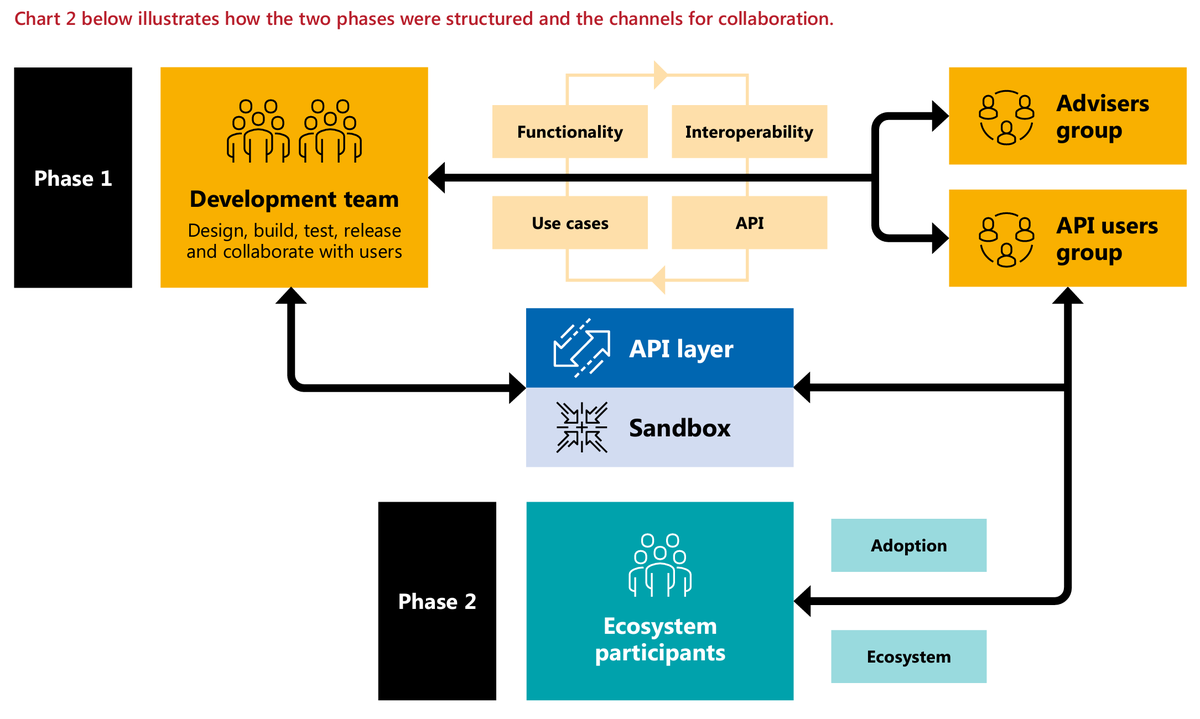

Now the leads, storywise from my POV📖

Before we start some key 🔑 info here is needed to see the whole picture:

$QNT = integrated and the default interoperability solution of Oracle Blockchain Platform (OBP), after Microsoft the biggest software provider in the🌎🔥

8/N

Before we start some key 🔑 info here is needed to see the whole picture:

$QNT = integrated and the default interoperability solution of Oracle Blockchain Platform (OBP), after Microsoft the biggest software provider in the🌎🔥

8/N

https://twitter.com/sannl11/status/1454434376259981314

According to the Oracles Blockchain Chief $QNT Overledger is used with many clients. Besides KPMG (big😉) we don’t get a lot of info (nature of enterprise).

Gilbert (CEO) confirmed that since the Oracle Certification they been busy keeping up with demand📈

NOW WE START

9/N

Gilbert (CEO) confirmed that since the Oracle Certification they been busy keeping up with demand📈

NOW WE START

9/N

https://twitter.com/SanNL11/status/1512513410591866886

Lets begin with #GSBN.

- GSBN announced going live with Oracle, but the LedgerInsights article was vague about Oracle role exactly (cloud hosting or blockchain?)

Decided it could be nothing so moved on (📸2).

10/N

- GSBN announced going live with Oracle, but the LedgerInsights article was vague about Oracle role exactly (cloud hosting or blockchain?)

Decided it could be nothing so moved on (📸2).

10/N

Totally forgot about GSBN but after reading about GSBN 6 months later I checked their website.

Turn out I (we) were wrong.

GSBN is indeed build on Oracle Blockchain Platform✅

11/N

Turn out I (we) were wrong.

GSBN is indeed build on Oracle Blockchain Platform✅

11/N

Not just that, GSBN is explicity named as an example in the blog written by Oracle about $QNT and interoperability😏

Oracle gave us a huge nugget about interop between trade networks GSBN (Oracle based) & #Contour (Corda based)👀

Blog (must read📚):tinyurl.com/yckmyswh

12/N

Oracle gave us a huge nugget about interop between trade networks GSBN (Oracle based) & #Contour (Corda based)👀

Blog (must read📚):tinyurl.com/yckmyswh

12/N

So we have:

- $QNT as Oracle default interop solution

- Oracle blog about $QNT naming GSBN (client) & Contour

- Team swamped with Oracle client demand after certification

But to be 100% sure we need one more thing. A link between $QNT and Contour

And bamm, there it was🔥

13/N

- $QNT as Oracle default interop solution

- Oracle blog about $QNT naming GSBN (client) & Contour

- Team swamped with Oracle client demand after certification

But to be 100% sure we need one more thing. A link between $QNT and Contour

And bamm, there it was🔥

13/N

It all made sense when seeing this last missing link. I have zero doubt, both GSBN and Contour are part of OVN, the network of networks💪🏻

Extremely bullish and huge entities that 99% of crypto can’t even dream of…💭

LETS CONTINUE

14/N

Extremely bullish and huge entities that 99% of crypto can’t even dream of…💭

LETS CONTINUE

14/N

Network #3: Tradelens.

This week new info came to light after a new #ODAP draft with MIT.

They literally named Tradelens when routing data accross DLTs and ecosystems✅

Add in an old team slide from 2020 and safe to say Tradelens =part of OVN🙌🏼

3,1 billion events🤯(📸4)

15/N

This week new info came to light after a new #ODAP draft with MIT.

They literally named Tradelens when routing data accross DLTs and ecosystems✅

Add in an old team slide from 2020 and safe to say Tradelens =part of OVN🙌🏼

3,1 billion events🤯(📸4)

15/N

Oh and Tradelens partnered with Contour this week✅

Don’t wanna jump to conclusions on this partnership but wouldn’t suprise me if $QNT is involved💁♂️

ALMOST THERE… some final tweets regarding Quant Network and Trade Finance🧵

16/N

Don’t wanna jump to conclusions on this partnership but wouldn’t suprise me if $QNT is involved💁♂️

ALMOST THERE… some final tweets regarding Quant Network and Trade Finance🧵

16/N

https://twitter.com/tradefinglobal/status/1524006765800869892

Quants big involvement in Trade Finance and Supply Chain is no suprise for long term $QNT holders🏦

The CEO advices‼️the International Chamber of Commerce (ICC) on DLT, the largest business organization in the world🌍(represents 45million companies)

17/N

The CEO advices‼️the International Chamber of Commerce (ICC) on DLT, the largest business organization in the world🌍(represents 45million companies)

17/N

ICC recently released a report with McKinsey on the global future trade finance system📖

The interoperability layer (DLT API Gateways) is essential to connect all these networks. Gilbert got a Linkedin tag✅

18/N

The interoperability layer (DLT API Gateways) is essential to connect all these networks. Gilbert got a Linkedin tag✅

18/N

Hyperledger is involved in many of these Trade Finance and Supply chain initiatives. They know!😏

19/N

19/N

Bonus: Marco Polo (another Trade Finance beast🔥) also part of OVN?

Older lead, not as clear as the others but also very possible. But judge yourself 👇🏻📸

20/N

Older lead, not as clear as the others but also very possible. But judge yourself 👇🏻📸

20/N

And don’t forget ICICI, INDIAs 🇮🇳 largest private bank (100k employees🧑🏽💻)

ICICI is talking about $QNT, the Network of Networks regarding Trade Finance🎥.

Listen to the whole 55sec video (worth it), ICICI onboarded 500+ clients on their Trade Finance platform!!🔥

21/N

ICICI is talking about $QNT, the Network of Networks regarding Trade Finance🎥.

Listen to the whole 55sec video (worth it), ICICI onboarded 500+ clients on their Trade Finance platform!!🔥

21/N

ICICI is also working with 14 other banks and started a new consortium for Trade Finance on blockchain in India.🤝

14 more 🇮🇳banks connected to the OVN?😏

22/N

14 more 🇮🇳banks connected to the OVN?😏

22/N

Trade Finance is a multi trillion dollar market💰

But what so absurd is about the scale of Overledger Network🌎is that these networks will be AVERAGE ecosystems in the world of $QNT…

23/N

But what so absurd is about the scale of Overledger Network🌎is that these networks will be AVERAGE ecosystems in the world of $QNT…

23/N

Every sector will produce 10s or 100s of networks like this and $QNT is succesfully on its way to connect the biggest ones.

From finance (payments like CBDCs & RTGS), health, pharma, identity and energy to governments (continents), IoT and even Automobile👇🏻🚗

UNCAPPED🔥

24/N

From finance (payments like CBDCs & RTGS), health, pharma, identity and energy to governments (continents), IoT and even Automobile👇🏻🚗

UNCAPPED🔥

24/N

https://twitter.com/sannl11/status/1483532973626609665

Don’t miss this opportunity of a lifetime (not even top 70)✅

25/25

#tradefinance #Interoperability #networkofnetworks

$BTC $XRP $DOT $WTK $LUNA $XLM, $XDC, $QNT, $ALGO, $HBAR, $GALA, $AVAX, $SOL, $ATOM, $MATIC, $LINK, $CELO, $DAG $STG $FWT $APE $BNB $ADA $NEAR $LTC $BCH $ROSE

25/25

#tradefinance #Interoperability #networkofnetworks

$BTC $XRP $DOT $WTK $LUNA $XLM, $XDC, $QNT, $ALGO, $HBAR, $GALA, $AVAX, $SOL, $ATOM, $MATIC, $LINK, $CELO, $DAG $STG $FWT $APE $BNB $ADA $NEAR $LTC $BCH $ROSE

If you enjoyed this 🧵, don’t forget to follow me for more insights on Quant @SanNL11 (there is just so much)

You can also like and retweet this thread for awereness, much appreciated💪🏻↓↓

You can also like and retweet this thread for awereness, much appreciated💪🏻↓↓

https://twitter.com/SanNL11/status/1525113799296032773

• • •

Missing some Tweet in this thread? You can try to

force a refresh