Here is our analysis of the Safaricom [@SafaricomPLC] full-year results:

#SafaricomFYResults #MwangoInsights

#SafaricomFYResults #MwangoInsights

@moneyacademyKE @coldtusker @TheAbojani @DollyOgutu @FundiMuigai @deangichukie @kenyanwalstreet @NSE_Investors @MarketMap_KE @ill_dduor 1/ Here is our analysis of the Safaricom [@SafaricomPLC] full year results with our bit of commentary.

#SafaricomFYResults #MwangoInsights

#SafaricomFYResults #MwangoInsights

2/ Here is how the share price has been the past year.

Not been a good year for it being down 11.76 for FY 2022.

#SafaricomFYResults #MwangoInsights

Not been a good year for it being down 11.76 for FY 2022.

#SafaricomFYResults #MwangoInsights

4/ M-Pesa is growing and becoming a key revenue growth driver.

It crossed the KES 100B mark this last financial year.

M-Pesa revenues were up 30.3%% YoY to KES 107.7B.

#SafaricomFYResults #MwangoInsights

It crossed the KES 100B mark this last financial year.

M-Pesa revenues were up 30.3%% YoY to KES 107.7B.

#SafaricomFYResults #MwangoInsights

5/ Here are some of the new areas that Safaricom [@SafaricomPLC] showed us for the first time:

🟢 Digifarm Revenue:+50% to 400M

🟢 IOT Revenue: +64.5% to 1.2M

🟢 Content Revenue:+100% to 500M

🟢 ICT Revenue: +29.3% to 400M

#SafaricomFYResults #MwangoInsights #BuiltForBetter

🟢 Digifarm Revenue:+50% to 400M

🟢 IOT Revenue: +64.5% to 1.2M

🟢 Content Revenue:+100% to 500M

🟢 ICT Revenue: +29.3% to 400M

#SafaricomFYResults #MwangoInsights #BuiltForBetter

8/ Dividends:

A major worry for shareholders was that dividends would be cut going into Ethiopia but seems like Safaricom has continued paying for now:

🟢Interim dividend (already paid): KES 0.64

🟢Proposed final dividend: KES 0.75

#SafaricomFYResults

A major worry for shareholders was that dividends would be cut going into Ethiopia but seems like Safaricom has continued paying for now:

🟢Interim dividend (already paid): KES 0.64

🟢Proposed final dividend: KES 0.75

#SafaricomFYResults

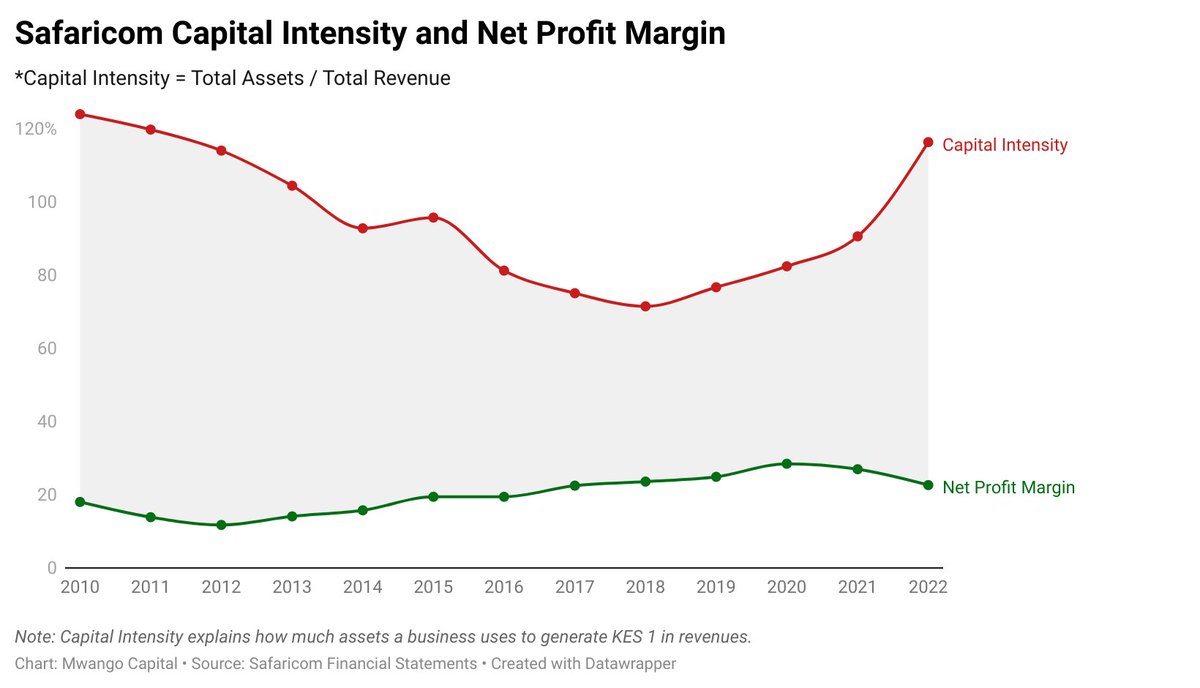

9/ The company is, unsurprisingly, increasing capital expenditure (capex) and capex intensity.

▪️Capex was up jumped 42.4% to KES 49.8B for FY 2022.

▪️Group capex projected to be KES 100-108B in FY23 (Kenya only: KES 40-43B).

#SafaricomFYResults

▪️Capex was up jumped 42.4% to KES 49.8B for FY 2022.

▪️Group capex projected to be KES 100-108B in FY23 (Kenya only: KES 40-43B).

#SafaricomFYResults

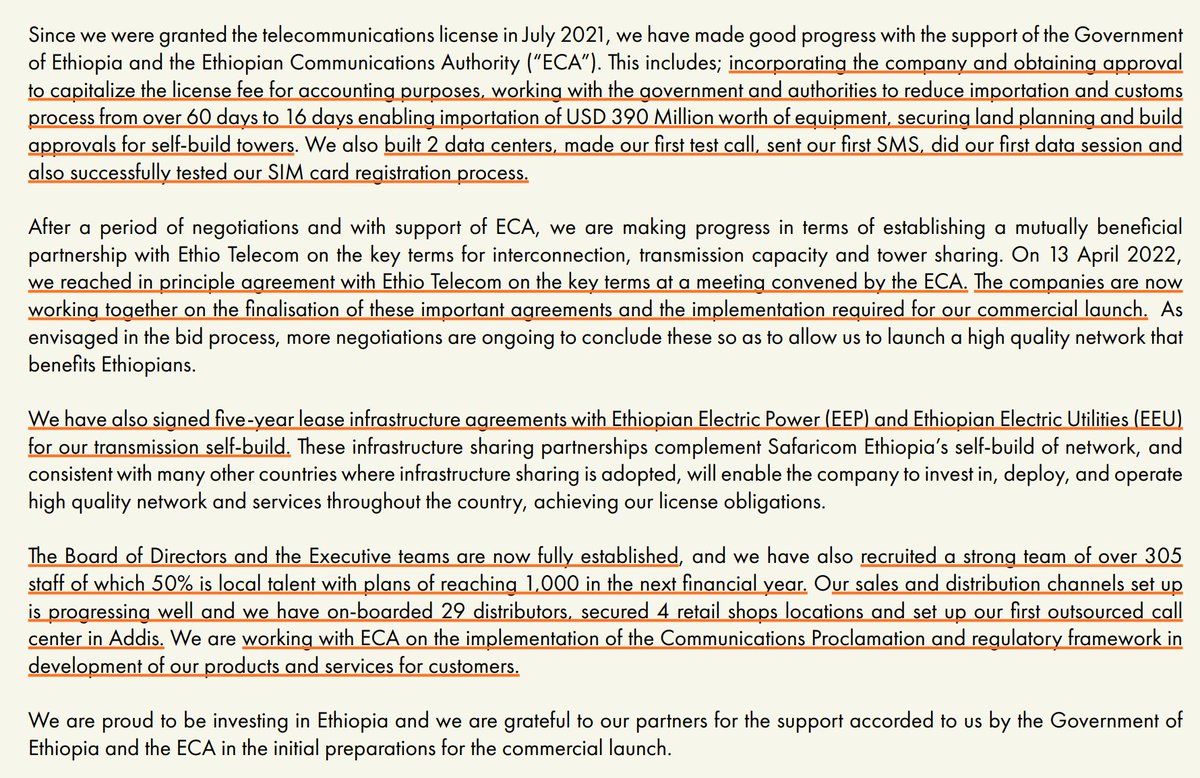

10/ Updates on Ethiopia:

▪️Commercial launch this year.

▪️Recruited over 305 staff; plans on reaching 1,000 in FY23.

▪️Board of Directors and Executive teams fully established.

And more:

▪️Commercial launch this year.

▪️Recruited over 305 staff; plans on reaching 1,000 in FY23.

▪️Board of Directors and Executive teams fully established.

And more:

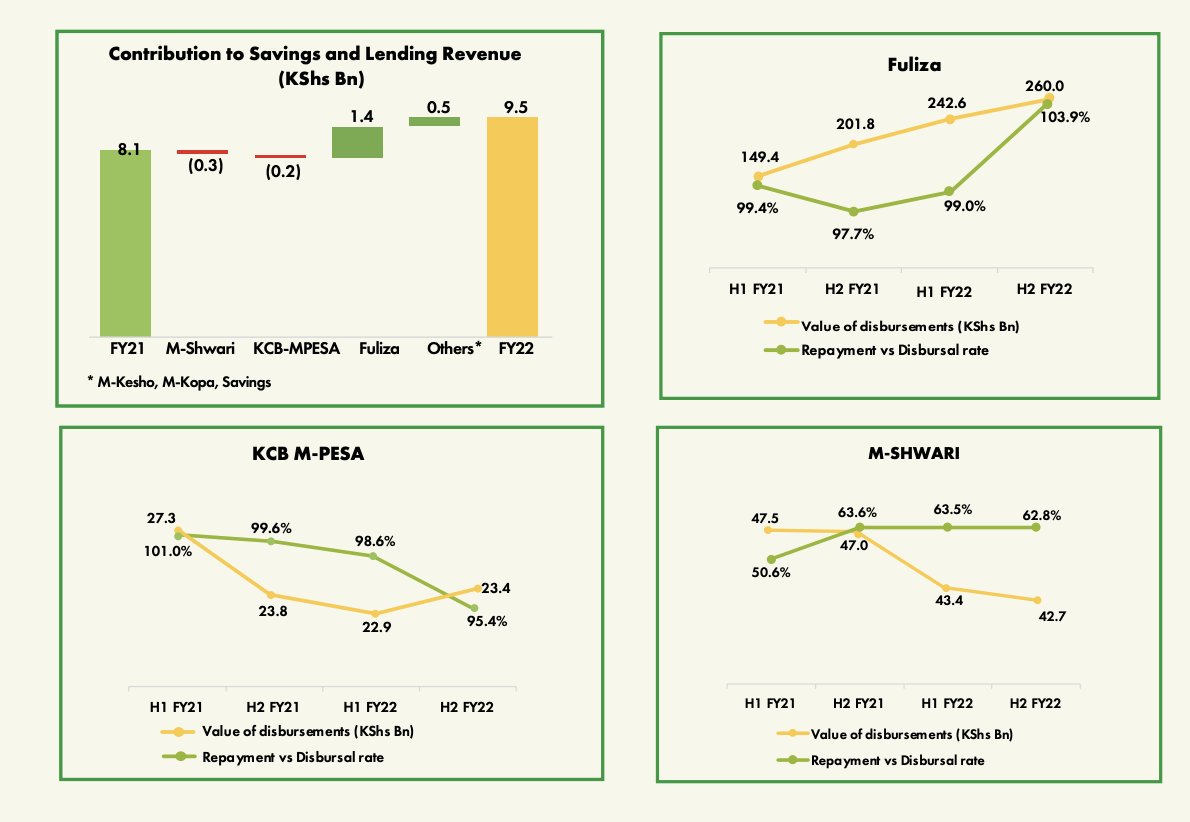

11/ Fuliza, KCB and M-Pesa YoY Growth (KES):

Disbursements

🟢Fuliza: +43.1% to 502.6B (1.37B per day)

🔴KCB-Mpesa: -9.4% to 46.3B

🔴M-Shwari: -8.9% to 6.1B

Revenues:

🟢Fuliza: +31% to 5.94B

🔴KCB-Mpesa: -18.7% to 0.7B

🔴M-Shwari: -13.4% to 1.9B

#SafaricomFYResults

Disbursements

🟢Fuliza: +43.1% to 502.6B (1.37B per day)

🔴KCB-Mpesa: -9.4% to 46.3B

🔴M-Shwari: -8.9% to 6.1B

Revenues:

🟢Fuliza: +31% to 5.94B

🔴KCB-Mpesa: -18.7% to 0.7B

🔴M-Shwari: -13.4% to 1.9B

#SafaricomFYResults

13/ The Safaricom [@SafaricomPLC ] results tool kit:

Presentation:

mwangocapital.files.wordpress.com/2022/05/fy22_i…

Press Release:

mwangocapital.files.wordpress.com/2022/05/fy22_p…

Results Booklet:

mwangocapital.files.wordpress.com/2022/05/fy22_r…

Enjoy!

#SafaricomFYResults

Presentation:

mwangocapital.files.wordpress.com/2022/05/fy22_i…

Press Release:

mwangocapital.files.wordpress.com/2022/05/fy22_p…

Results Booklet:

mwangocapital.files.wordpress.com/2022/05/fy22_r…

Enjoy!

#SafaricomFYResults

• • •

Missing some Tweet in this thread? You can try to

force a refresh