1/

"𝘈 𝘛𝘰𝘵𝘢𝘭 𝘌𝘤𝘭𝘪𝘱𝘴𝘦 𝘰𝘧 𝘛𝘩𝘦 Luna" 🌖

What game was Terra trying to play?

Where did the deadly asset-liability mismatch really come from? (Hint: Not Anchor)

Was $LUNA simply destined to fail?

Mega-🧵..

"𝘈 𝘛𝘰𝘵𝘢𝘭 𝘌𝘤𝘭𝘪𝘱𝘴𝘦 𝘰𝘧 𝘛𝘩𝘦 Luna" 🌖

What game was Terra trying to play?

Where did the deadly asset-liability mismatch really come from? (Hint: Not Anchor)

Was $LUNA simply destined to fail?

Mega-🧵..

2/

Lets understand the game first.

We can approach Luna from 1st principles:

First looking at its' desired endgame, to see if it is a stable equilibrium.

Then trying to walk backwards from there to see how viable a path there is to get there.

Lets understand the game first.

We can approach Luna from 1st principles:

First looking at its' desired endgame, to see if it is a stable equilibrium.

Then trying to walk backwards from there to see how viable a path there is to get there.

3/

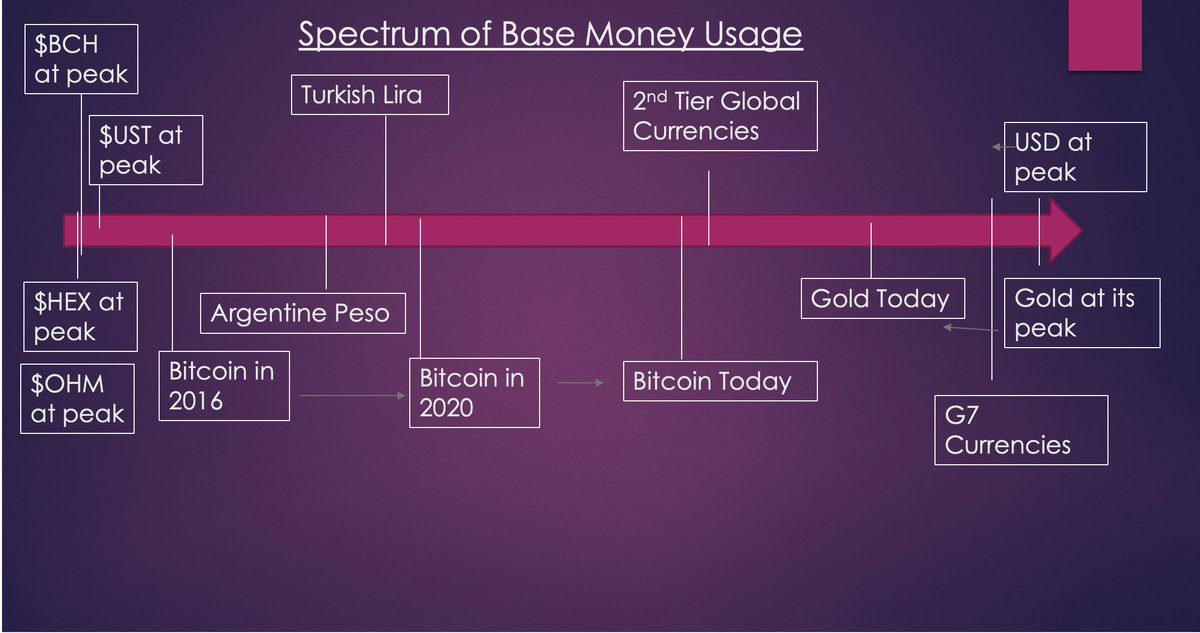

PART A: Base Money

To put it simply, Terra was trying to become digital base money.

Not just money in the 'medium of exchange' sense that the backed digital options USDC and PayPal are.

But ACTUAL base money. Terra was designed to be unbacked, aiming to be alpha-and-omega.

PART A: Base Money

To put it simply, Terra was trying to become digital base money.

Not just money in the 'medium of exchange' sense that the backed digital options USDC and PayPal are.

But ACTUAL base money. Terra was designed to be unbacked, aiming to be alpha-and-omega.

4/

Base money basically means that people are comfortable to exchange their labour for payment, and then stay in that asset.

While I have sympathy for the goal of a stable counterpart to Bitcoin, the path to get there is so hard it makes Odysseus journey look like a gentle sail.

Base money basically means that people are comfortable to exchange their labour for payment, and then stay in that asset.

While I have sympathy for the goal of a stable counterpart to Bitcoin, the path to get there is so hard it makes Odysseus journey look like a gentle sail.

5/

If so hard to achieve, why do projects and investors keep putting resources into such a goal?

Because the upside is huge-

If you actually achieve it and people don't sell out of your 'money', you get access to the printer and profit from the so-called 'seigniorage'.

If so hard to achieve, why do projects and investors keep putting resources into such a goal?

Because the upside is huge-

If you actually achieve it and people don't sell out of your 'money', you get access to the printer and profit from the so-called 'seigniorage'.

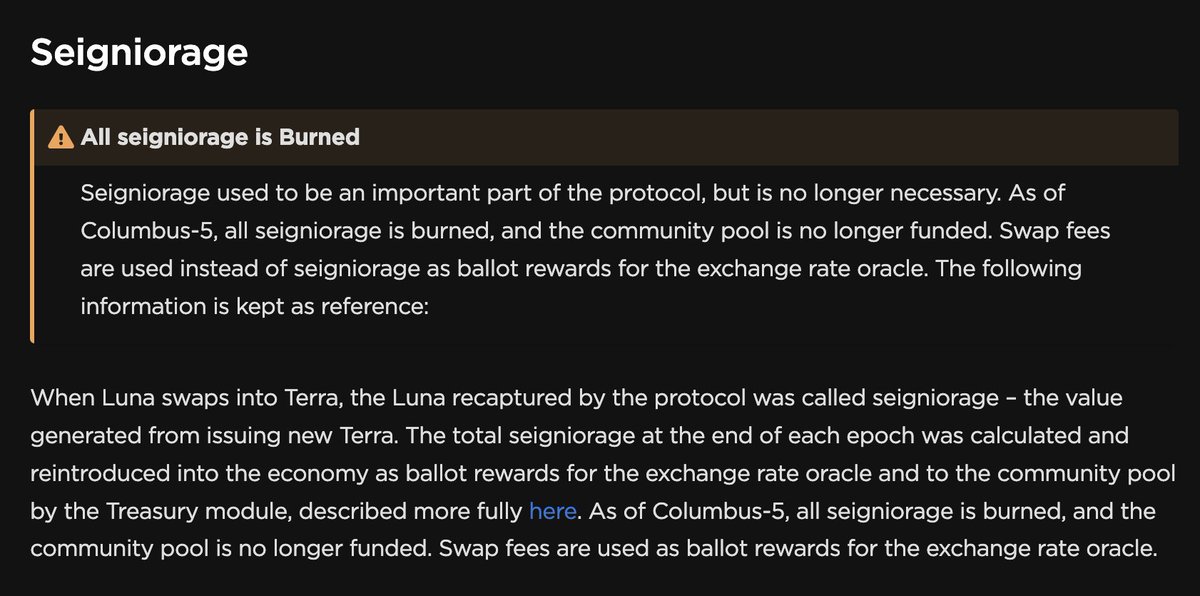

6/

Seigniorage is the difference between how much it costs you to make the money, and how many much the money is worth.

To keep your seigniorage, people must not want to (or be able to) leave the ecosystem. Terra's plan was to become a core component of the Digital Asset space.

Seigniorage is the difference between how much it costs you to make the money, and how many much the money is worth.

To keep your seigniorage, people must not want to (or be able to) leave the ecosystem. Terra's plan was to become a core component of the Digital Asset space.

7/

They were making some progress:

-Major centralized exchange listings

-Cross-chain defi protocol integrations

-Even winning "Curve Wars" liquidity battles

But though they achieved more than other comparable attempts, it was still very early going in the money grand scheme:

They were making some progress:

-Major centralized exchange listings

-Cross-chain defi protocol integrations

-Even winning "Curve Wars" liquidity battles

But though they achieved more than other comparable attempts, it was still very early going in the money grand scheme:

8/

Key Q to ask: If X became base money, who would profit from all the seignorage? Most non-government answers aren't convincing outcomes.

While UST had been through a few battles like May 2021, holders at any moment might want to redeem their 'unbacked' dollars for real ones.

Key Q to ask: If X became base money, who would profit from all the seignorage? Most non-government answers aren't convincing outcomes.

While UST had been through a few battles like May 2021, holders at any moment might want to redeem their 'unbacked' dollars for real ones.

9/

UST holders staying in = keep seignorage

UST holders withdrawing = liability

This is where the reserves came in. They used some of the seignorage they earned selling their LUNA to buy backed stables USDC/USDT (and later BTC/AVAX) in order to be able to absorb $UST sells.

UST holders staying in = keep seignorage

UST holders withdrawing = liability

This is where the reserves came in. They used some of the seignorage they earned selling their LUNA to buy backed stables USDC/USDT (and later BTC/AVAX) in order to be able to absorb $UST sells.

10/

PART B: The Fatal Flaw

While the system looked robust from the outside, there was a Death Star 'thermal exhaust port' weakness-

But instead of releasing heat out of Terra, it was releasing assets. And the more assets got out, the more the asset-liability mismatch grew.

PART B: The Fatal Flaw

While the system looked robust from the outside, there was a Death Star 'thermal exhaust port' weakness-

But instead of releasing heat out of Terra, it was releasing assets. And the more assets got out, the more the asset-liability mismatch grew.

11/

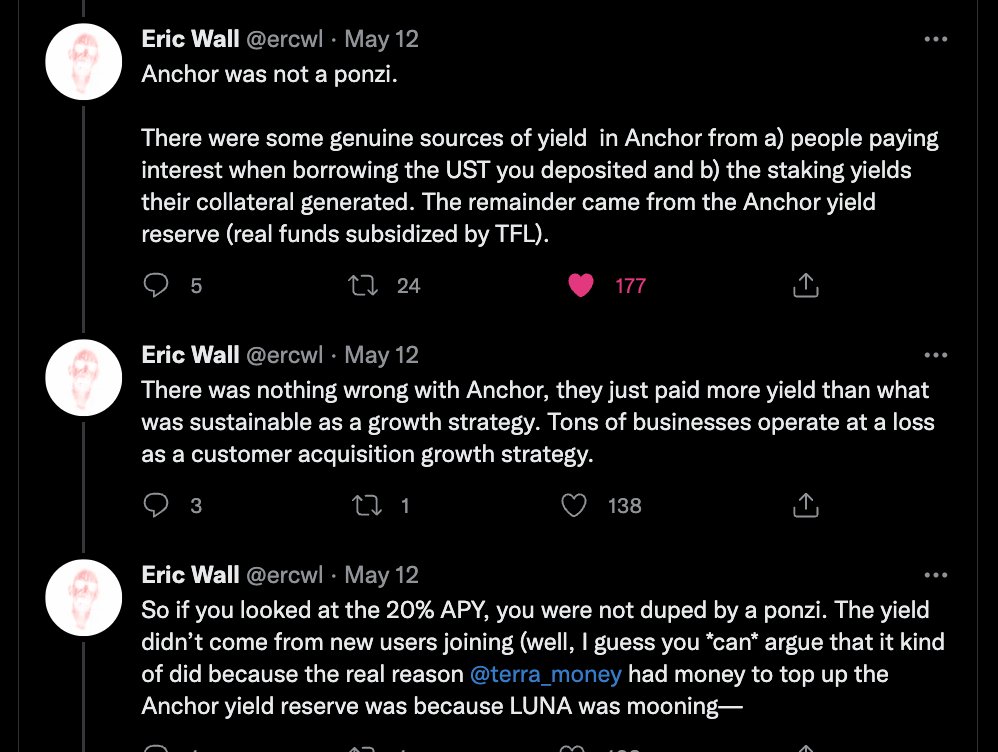

No, the story is NOT that 20% Anchor yield was a ponzi.

UST growth due to Anchor exacerbated the underlying issue, but to understand what really happened, lets consider what I like to call "a magic box".

People put in $18bn of 'assets' in a magic box order to mint 18bn UST.

No, the story is NOT that 20% Anchor yield was a ponzi.

UST growth due to Anchor exacerbated the underlying issue, but to understand what really happened, lets consider what I like to call "a magic box".

People put in $18bn of 'assets' in a magic box order to mint 18bn UST.

12/

So people put the money in the UST-Box, and take out UST tokens- which are kind of like IOUs they could later be exchanged back for dollars.

People took those IOUs and put them in other attractive looking boxes like the Anchor-Box or StablecoinLP-Box in order to earn yield..

So people put the money in the UST-Box, and take out UST tokens- which are kind of like IOUs they could later be exchanged back for dollars.

People took those IOUs and put them in other attractive looking boxes like the Anchor-Box or StablecoinLP-Box in order to earn yield..

13/

But when people panicked and yanked their IOUs back to return them to the UST-BOX, they found out that there wasn't $18bn in it anymore.. not even half of that.

Lets pinpoint where that money went. What was really hiding inside the UST-Box?

But when people panicked and yanked their IOUs back to return them to the UST-BOX, they found out that there wasn't $18bn in it anymore.. not even half of that.

Lets pinpoint where that money went. What was really hiding inside the UST-Box?

14/

When a UST buyer put $ in the box, there was a contraption inside that flipped that $ for shares of LUNA.

We'll get into the price used for that share conversion, but the KEY question is:

Where does the $ go? Does it escape the box entirely?

When a UST buyer put $ in the box, there was a contraption inside that flipped that $ for shares of LUNA.

We'll get into the price used for that share conversion, but the KEY question is:

Where does the $ go? Does it escape the box entirely?

15/

And here we get to the crux of it all- there's two categories of LUNA sellers:

1) The Project- broadly Terraform Labs, LFG, Stability Pool, etc

2) Investors who bought LUNA

If The Project exchanges the LUNA for the $, conversion price is irrelevant- $ stays in the box.

And here we get to the crux of it all- there's two categories of LUNA sellers:

1) The Project- broadly Terraform Labs, LFG, Stability Pool, etc

2) Investors who bought LUNA

If The Project exchanges the LUNA for the $, conversion price is irrelevant- $ stays in the box.

16/

However if it is an independent LUNA investor who does the share conversion.. well if he pockets the $ he gets, the asset-liability mismatch in the box starts to increase!

And the higher the mktCap of LUNA the conversion happened at, the more the mismatch grew every time.

However if it is an independent LUNA investor who does the share conversion.. well if he pockets the $ he gets, the asset-liability mismatch in the box starts to increase!

And the higher the mktCap of LUNA the conversion happened at, the more the mismatch grew every time.

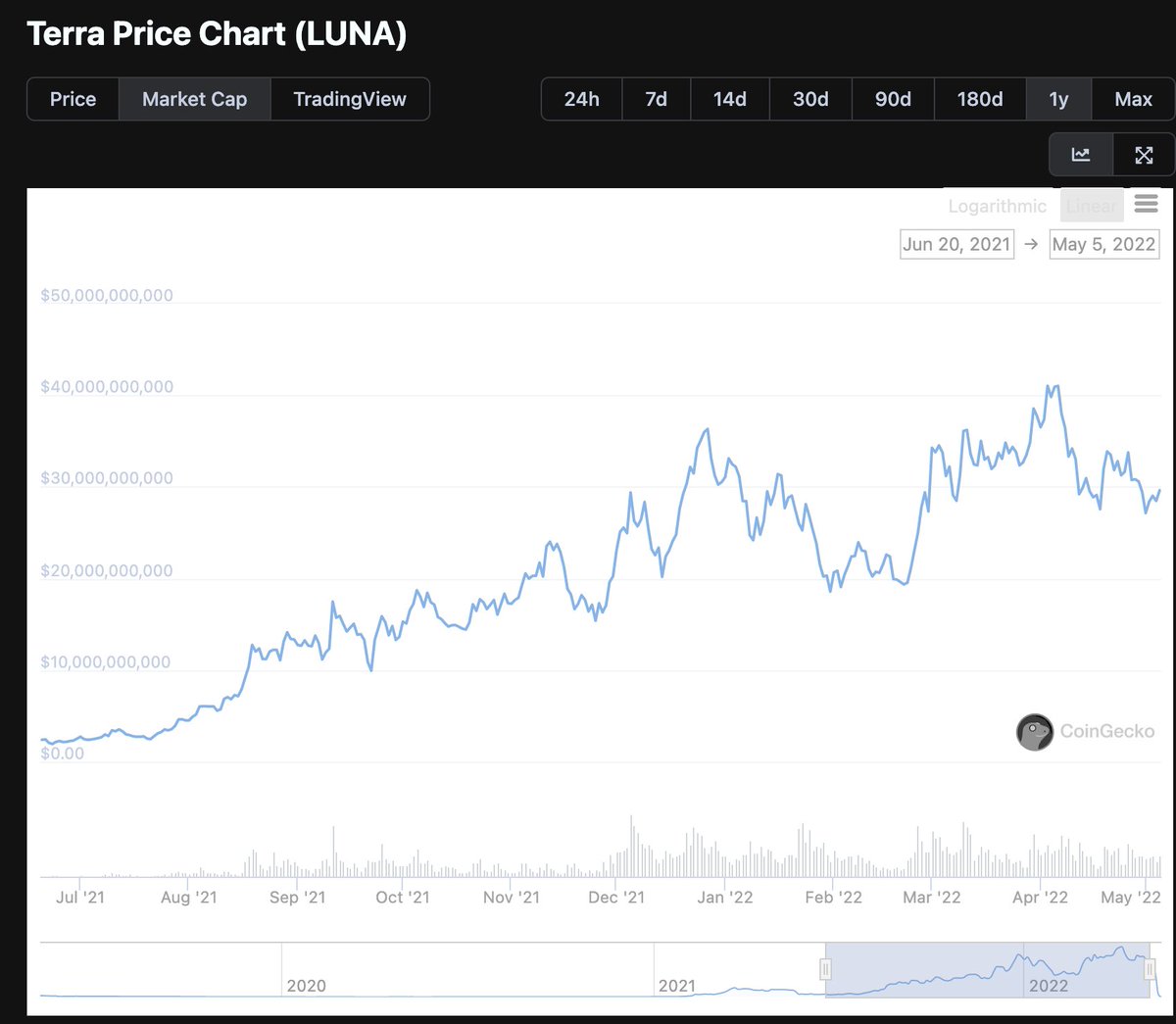

17/

While Terra thought with their Columbus-5 upgrade that "All seigniorage was being burned", they were fatally mistaken-

UST Face Value: $1

UST Creation Cost: fraction of LUNA (1/current price)

200M seed tokens cost~20c, converted at average price of $50 = ~$10bn budget hole!

While Terra thought with their Columbus-5 upgrade that "All seigniorage was being burned", they were fatally mistaken-

UST Face Value: $1

UST Creation Cost: fraction of LUNA (1/current price)

200M seed tokens cost~20c, converted at average price of $50 = ~$10bn budget hole!

18/

This was the *real* source of the fatal flaw that led to the asset-liability mismatch.

Anchor's infamous 20% yield, while being indirectly responsible as it encouraged more UST minting, ultimately only cost $1-2bn which likely was made up by the increasing attention value.

This was the *real* source of the fatal flaw that led to the asset-liability mismatch.

Anchor's infamous 20% yield, while being indirectly responsible as it encouraged more UST minting, ultimately only cost $1-2bn which likely was made up by the increasing attention value.

19/

What's more, we can now solve another question-

"What was the fair value market cap of $LUNA at any point in time?"-

+ Value of Terra blockchain at that moment (comparables: Fantom ~$1bn up to Avax ~$10bn)

- Asset/Liability mismatch at that moment.

= Net Enterprise Val

What's more, we can now solve another question-

"What was the fair value market cap of $LUNA at any point in time?"-

+ Value of Terra blockchain at that moment (comparables: Fantom ~$1bn up to Avax ~$10bn)

- Asset/Liability mismatch at that moment.

= Net Enterprise Val

20/

With a ~$5bn blockchain value and an A/L mismatch that was only increasing from the underlying minting mechanism, it is clear that the fair value could get buried => 0 under the pressure of the senior UST debt.

Unless UST became base money, it was IOU debt- not gold coins.

With a ~$5bn blockchain value and an A/L mismatch that was only increasing from the underlying minting mechanism, it is clear that the fair value could get buried => 0 under the pressure of the senior UST debt.

Unless UST became base money, it was IOU debt- not gold coins.

21/

PART C: Doomed to Fail?

Once everything fell apart, explainooors were quick to tell us that it was all predictable, and could have only ended this way

bc- UST was unbacked

bc- variable price treasury assets

bc- Anchor reducing yield would cause mass exit

Well. Kind of.

PART C: Doomed to Fail?

Once everything fell apart, explainooors were quick to tell us that it was all predictable, and could have only ended this way

bc- UST was unbacked

bc- variable price treasury assets

bc- Anchor reducing yield would cause mass exit

Well. Kind of.

22/

Despite the design flaw, the A/L mismatch was moving in both directions- it was sometimes contracting too as we will see below.

Also, even after Anchor yields starting coming down to self-sustaining levels, there was no immediate exodus.

Despite the design flaw, the A/L mismatch was moving in both directions- it was sometimes contracting too as we will see below.

Also, even after Anchor yields starting coming down to self-sustaining levels, there was no immediate exodus.

23/

When Terra raised VC rounds, it was reducing the A/L mismatch.

E.g. a recent round raised $1bn at ~$20bn valuation,

By selling 4-yr locked LUNA which would only be valuable if Terra kept making strides on becoming base money-

This effectively reduced the A/L by $1bn.

When Terra raised VC rounds, it was reducing the A/L mismatch.

E.g. a recent round raised $1bn at ~$20bn valuation,

By selling 4-yr locked LUNA which would only be valuable if Terra kept making strides on becoming base money-

This effectively reduced the A/L by $1bn.

24/

Another variable arose when LFG bought $3bn of $BTC for their reserve.

This was like going 3x-leverage long BTC:

Can be great PNL in a bull market, but have to avoid liquidation in the meantime.

Risk assets crashing ended up reducing, instead of extending, their runway.

Another variable arose when LFG bought $3bn of $BTC for their reserve.

This was like going 3x-leverage long BTC:

Can be great PNL in a bull market, but have to avoid liquidation in the meantime.

Risk assets crashing ended up reducing, instead of extending, their runway.

25/

Ultimately: Achieving a base-money outcome is 10/10 difficulty stuff.

Timing, execution, design- Everything must be perfect.

And most importantly of all, understanding the game being played:

The improper assessment of Terra's asset leak brought on its' final eclipse.

Ultimately: Achieving a base-money outcome is 10/10 difficulty stuff.

Timing, execution, design- Everything must be perfect.

And most importantly of all, understanding the game being played:

The improper assessment of Terra's asset leak brought on its' final eclipse.

In a later post we will discuss-

-Could LFG have avoided the death spiral after the depeg?

-Where does Luna go from here?

In the meantime feel free to RT this thread, only collective lessons learnt will allow us to move the space forward.

-Could LFG have avoided the death spiral after the depeg?

-Where does Luna go from here?

In the meantime feel free to RT this thread, only collective lessons learnt will allow us to move the space forward.

https://twitter.com/gametheorizing/status/1526373843908153345?s=20&t=QzBwVpYRbUFq9yiIvVQ8HA

• • •

Missing some Tweet in this thread? You can try to

force a refresh