🧵

Something seriously odd is afoot in natural gas markets.

There's a BIG glut of gas in the UK.

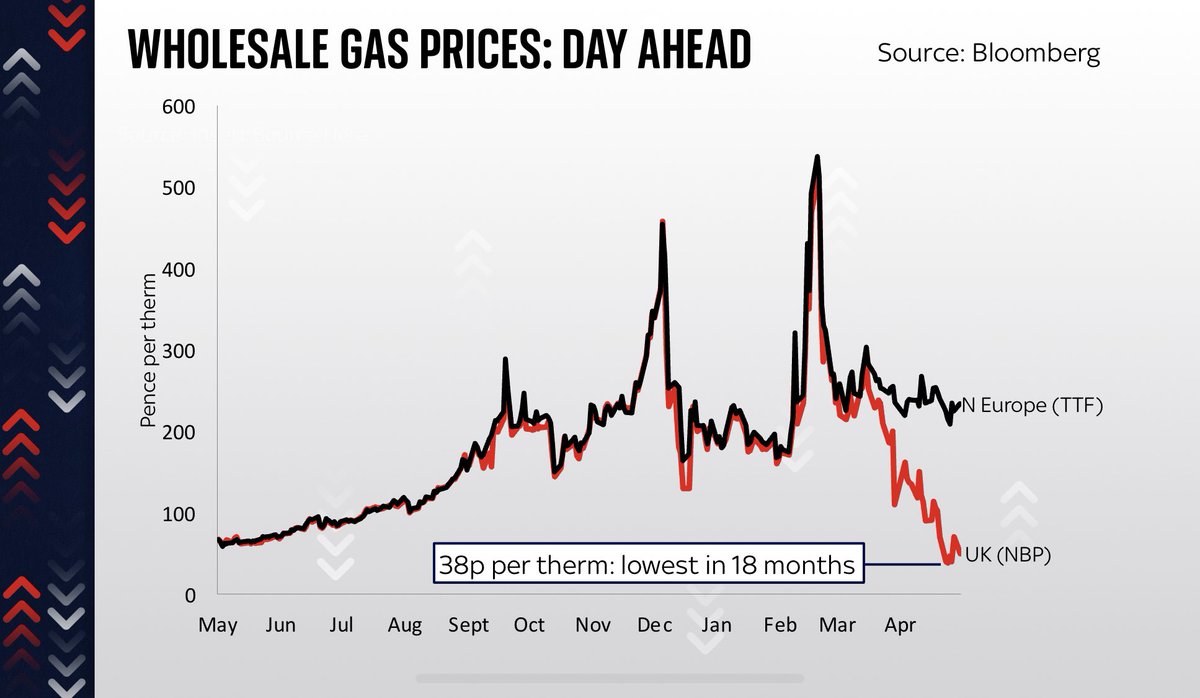

Wholesale gas prices are the lowest in 18 months.

There is so much gas no-one is quite sure what to do with it

Yet far from falling, household gas bills are heading even higher.

👇

Something seriously odd is afoot in natural gas markets.

There's a BIG glut of gas in the UK.

Wholesale gas prices are the lowest in 18 months.

There is so much gas no-one is quite sure what to do with it

Yet far from falling, household gas bills are heading even higher.

👇

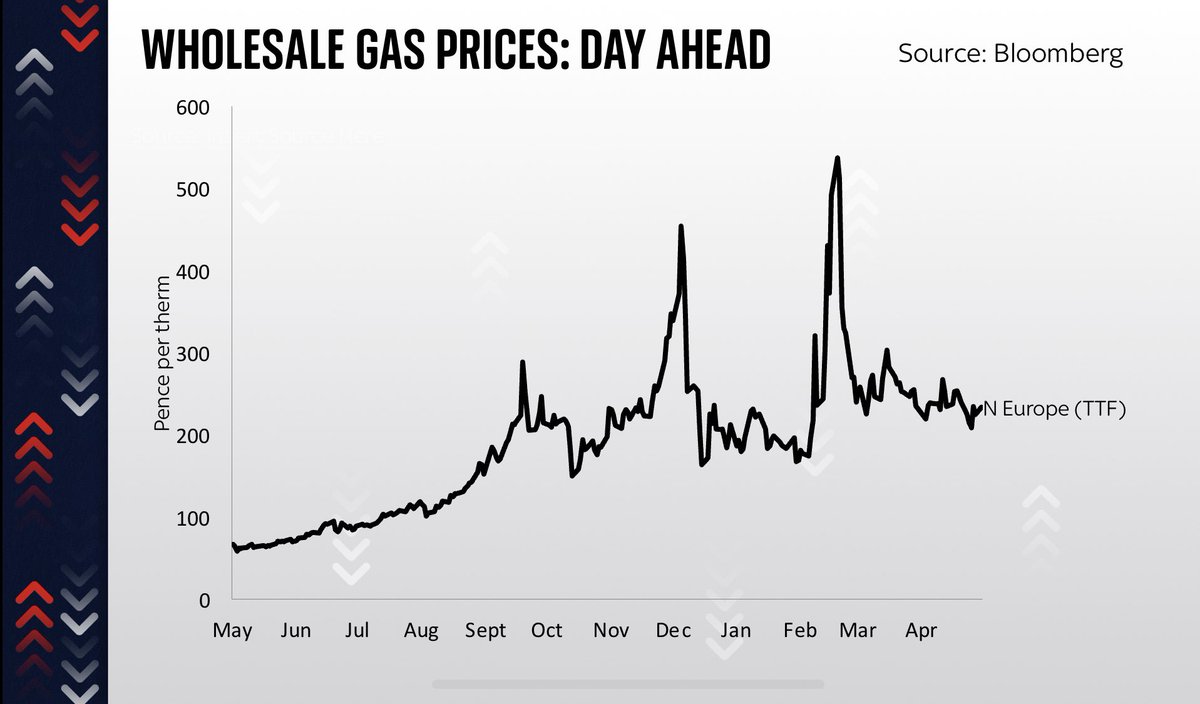

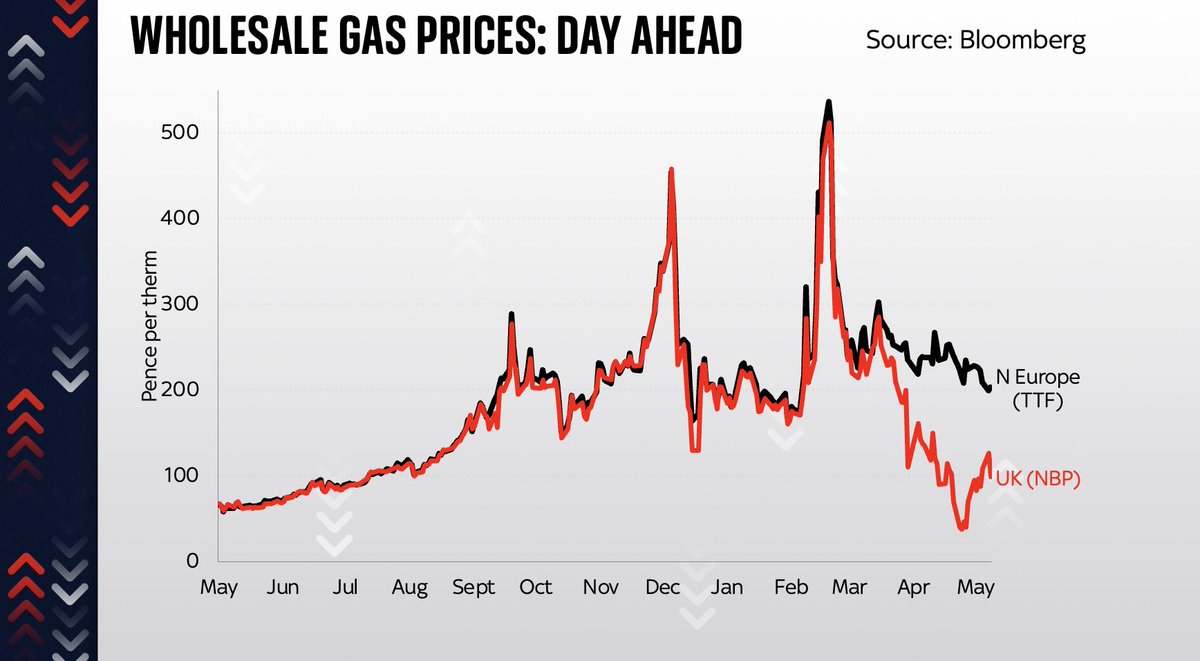

Let's start with a chart of EU natural gas prices on the wholesale markets.

This is what you'd pay for gas delivered tomorrow.

The line here shows the main N European gas price, TTF in Netherlands.

It looks much as you'd expect. Down a bit from the invasion but still V HIGH

This is what you'd pay for gas delivered tomorrow.

The line here shows the main N European gas price, TTF in Netherlands.

It looks much as you'd expect. Down a bit from the invasion but still V HIGH

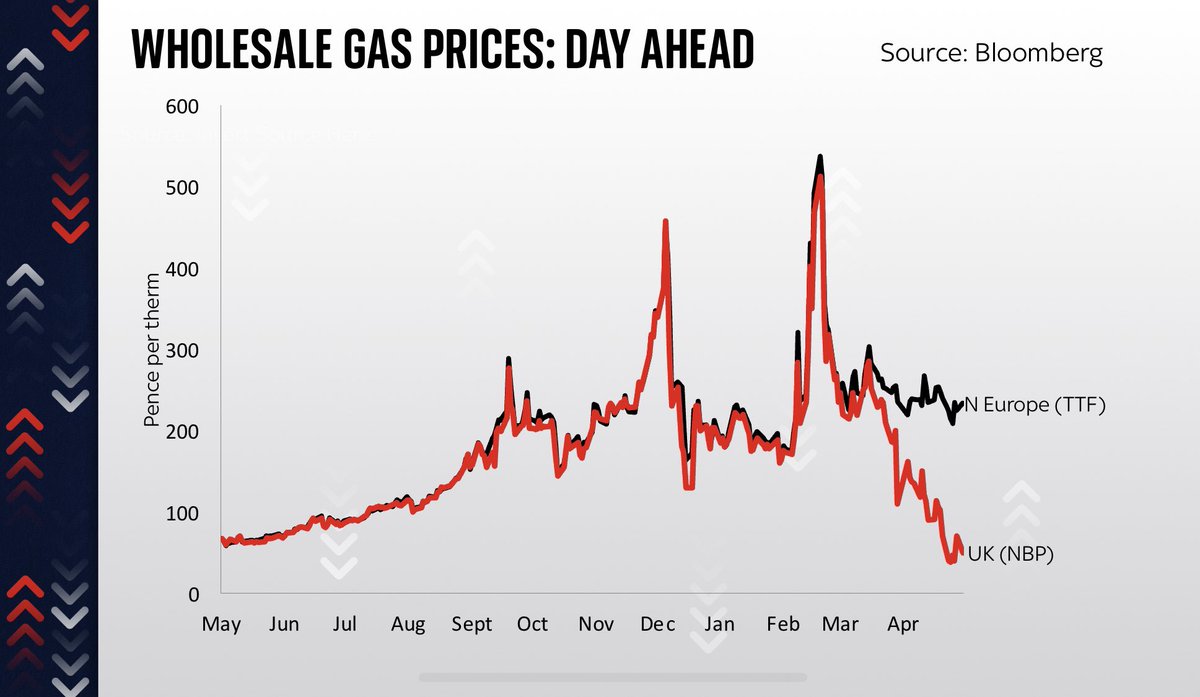

Now let's add the equivalent UK line. Note I've converted both to the same pricing convention. And note how aligned they are right up until March, when the UK line drops precipitously.

It's VERY low! Lower than pre-invasion. Actually the lowest in 18 months.

For real.

It's VERY low! Lower than pre-invasion. Actually the lowest in 18 months.

For real.

The notion that even as Britons face the biggest cost of living crunch in generations, caused in large part by crazily high natural gas prices, natural gas prices themselves are now down close to what might be considered "normal" levels is somewhat mind-blowing, right?

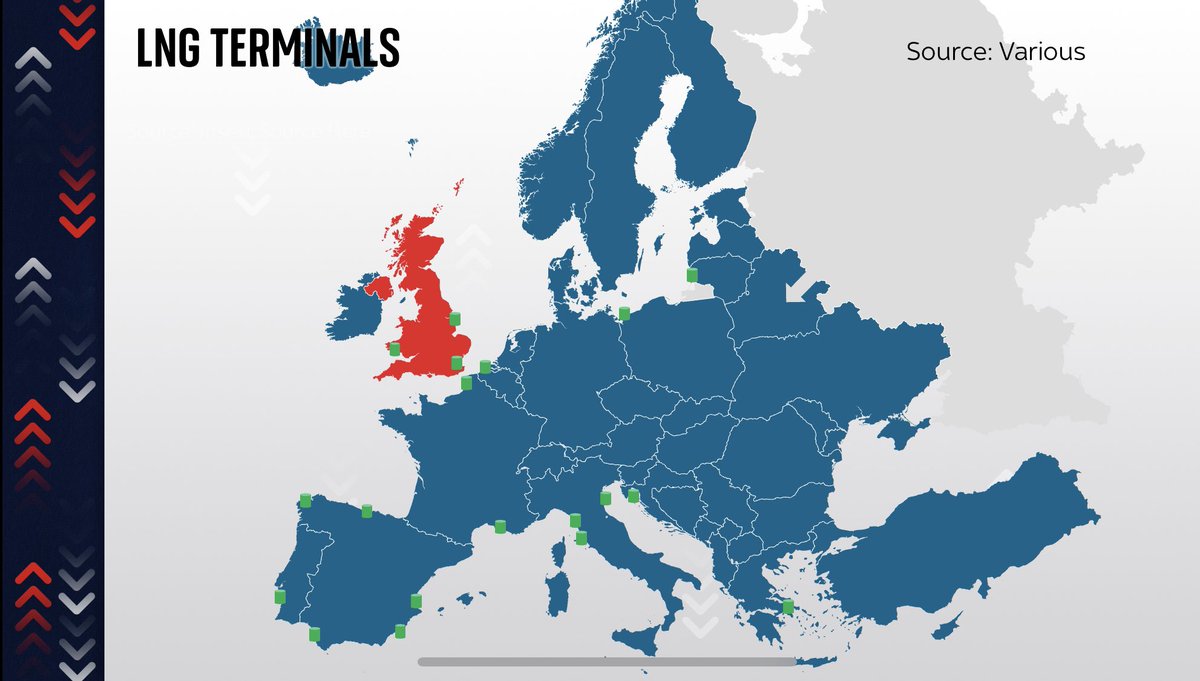

What's behind this? To answer that we need to ponder not a chart but a map. Because what matters above all in natural gas markets is not price but geography, or more specifically where the gas pipelines and facilities are...

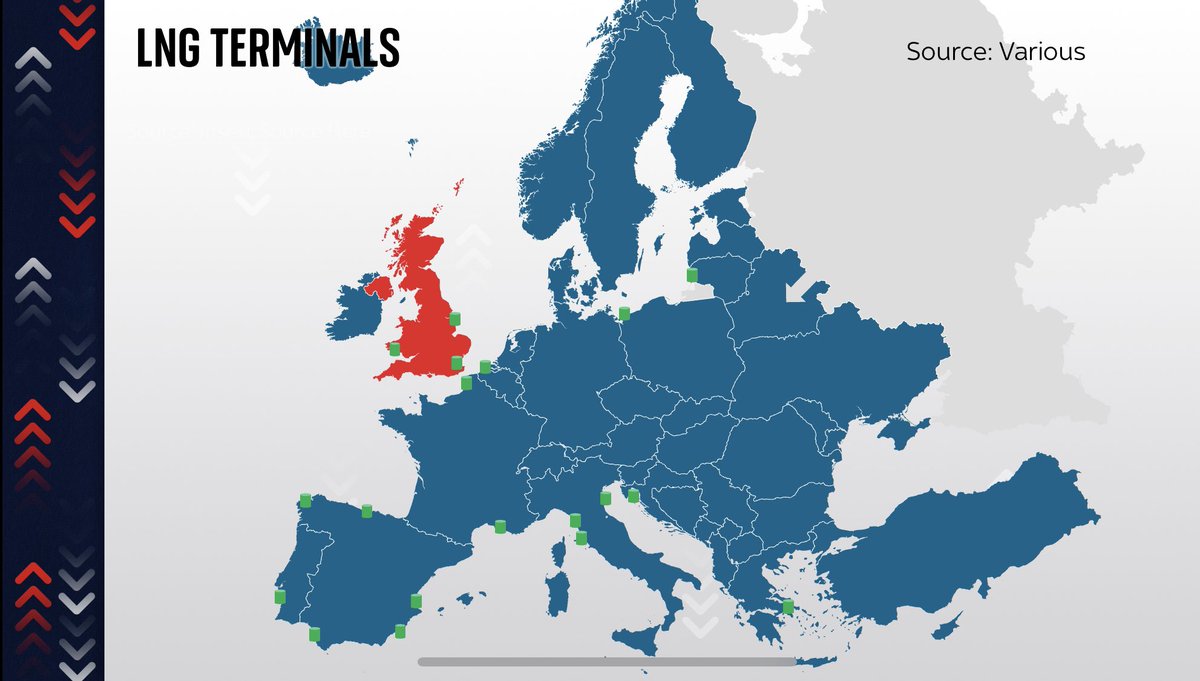

Everyone knows we need to reduce the amount of gas from Russia to continental Europe (esp Germany). Some of that can be replaced with gas via pipelines from N Africa and Azerbaijan, but not enough. We'll need a lot more Liquefied Natural Gas, the stuff that arrives in containers

But here's the thing. While Europe has a fair few LNG terminals (green on this map) they aren't really in the right places. Lots in the Iberian peninsula but there isn't enough pipeline capacity to get much of that gas up to Germany. In N Europe there are scant terminals.

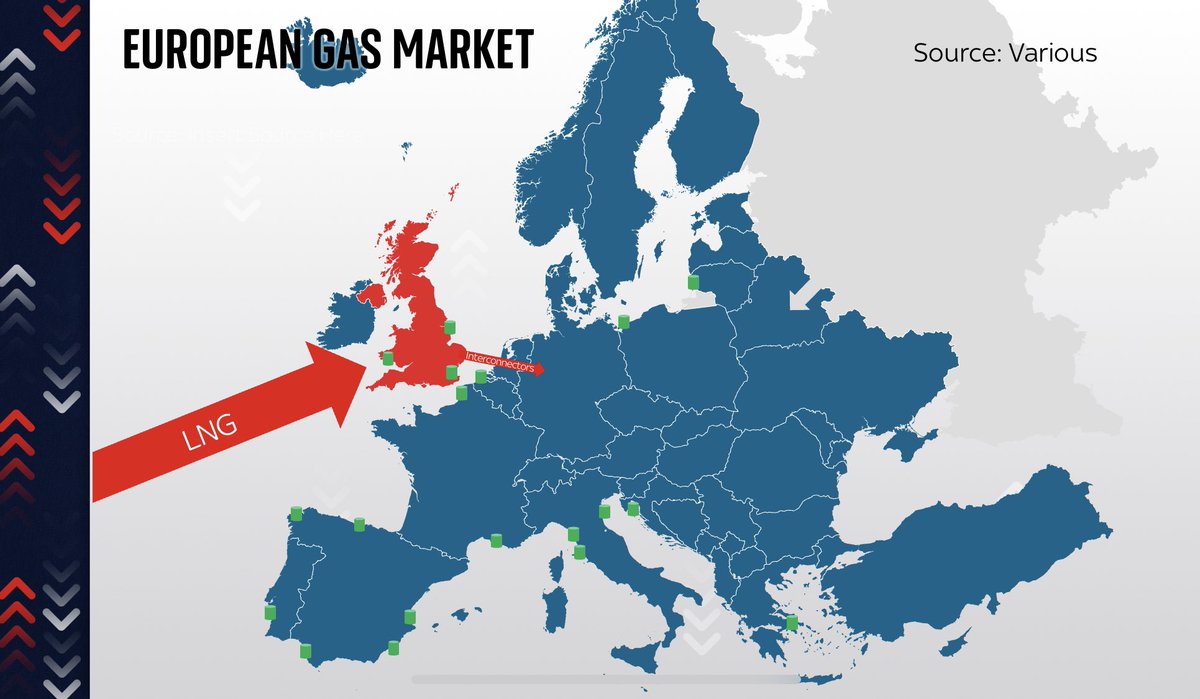

That brings us to the UK with its three terminals and decent spare capacity (up until recently). As I wrote shortly before the invasion, it was plausible UK could end up playing a role as a kind of land-bridge, taking LNG off ships and transiting it to the continent

https://twitter.com/EdConwaySky/status/1493949024638021633

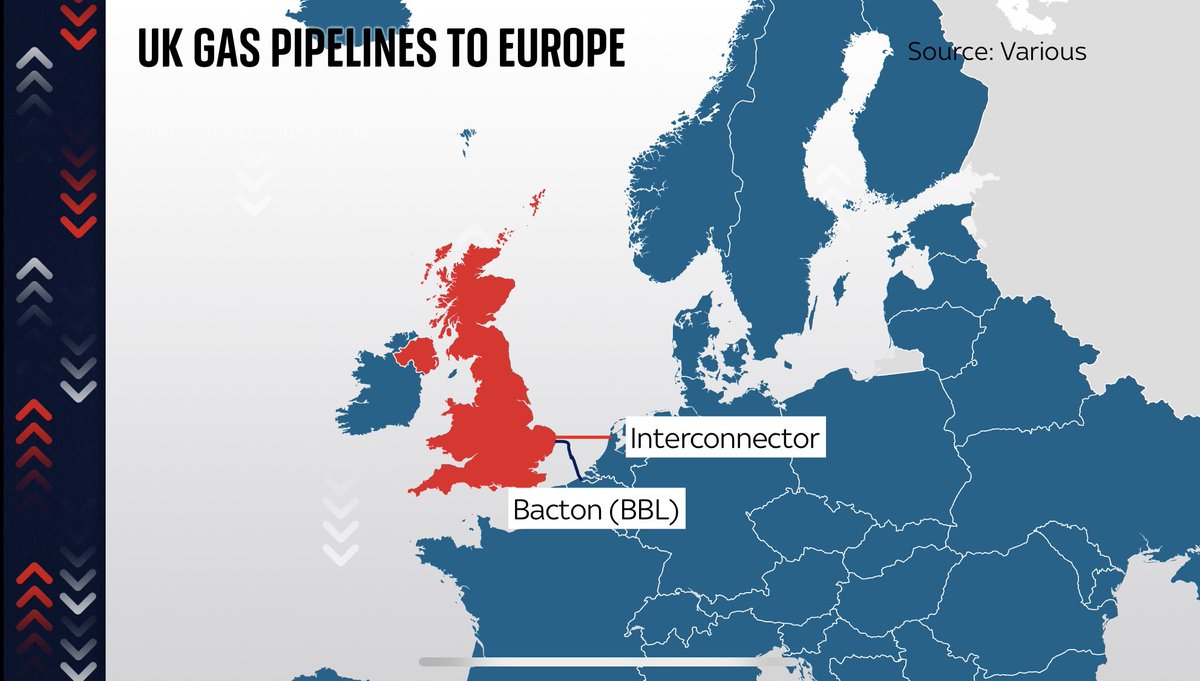

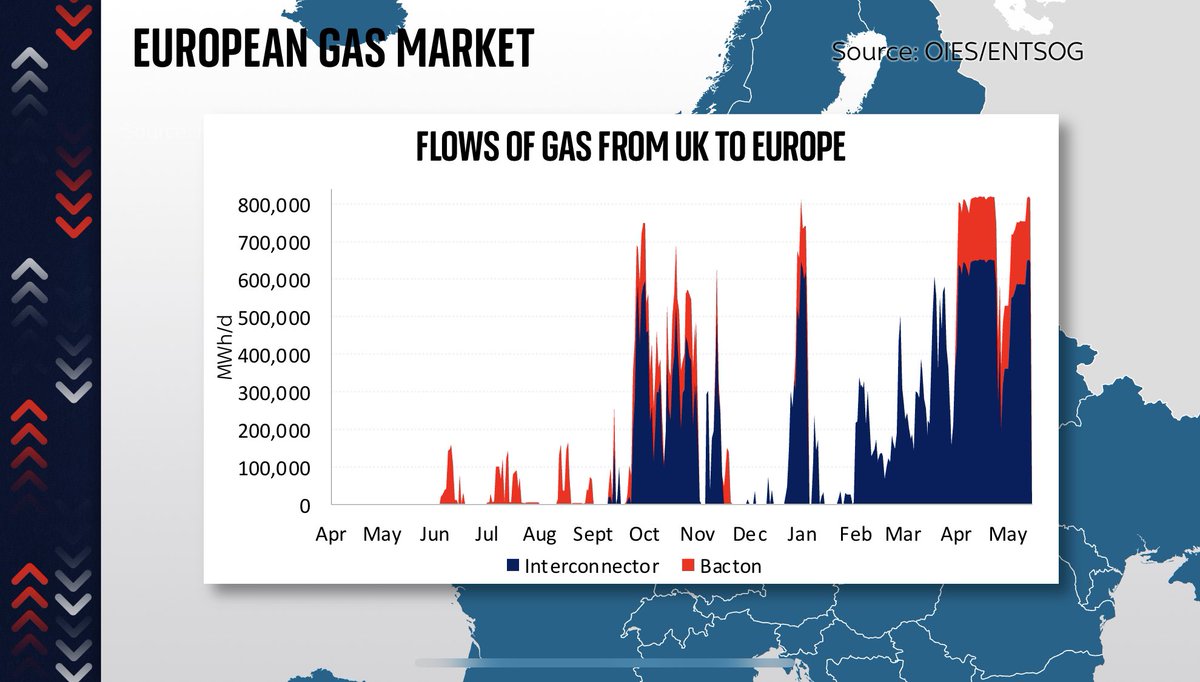

The gas could pass via the two gas pipelines which run from East Anglia to Belgium & Netherlands and onwards into N Europe, filling the void. And that's pretty much what's happened in recent months...

In fact, these two pipes, BBL and interconnector, have been flowing at full capacity towards Europe for weeks now. They are maxed out. And this is something of an issue. Because there's still a lot of LNG coming into the UK, unable to get across the Channel...

Lots of gas coming in.

Not enough capacity for it to leave.

And since no one is turning on their radiators this time of year (esp with domestic prices so high) there's not enormous demand for that gas. So all sorts of weird stuff is happening

Not enough capacity for it to leave.

And since no one is turning on their radiators this time of year (esp with domestic prices so high) there's not enormous demand for that gas. So all sorts of weird stuff is happening

One of them is that UK power stations are burning far more gas than usual, turning that into electricity which they then export to the continent. Suddenly the UK, which has mostly been a big importer of electricity, has become a big exporter, sending record amounts to Europe(!)

The perversity of all this is that if the UK had more gas storage this would be an ideal time to replenish it, locking away the gas ahead of a grim winter. Instead, we retired our biggest storage reservoir a few years ago and have next to no space to put all this cheap gas

Then again there's an argument that if we had lots of storage then prices prob wouldn't be quite so low since there would be more demand for the gas.

So I suppose you could argue that these low prices are in part thanks to this much derided decision. But that raises another key q

So I suppose you could argue that these low prices are in part thanks to this much derided decision. But that raises another key q

We've established that overnight wholesale gas prices are at the lowest level in 18 months. Electricity prices are also, btw, unusually low. So when will we see this reflected in our bills?? Is the cost of living crisis over?!

Sorry you're not going to like the next bit...

Sorry you're not going to like the next bit...

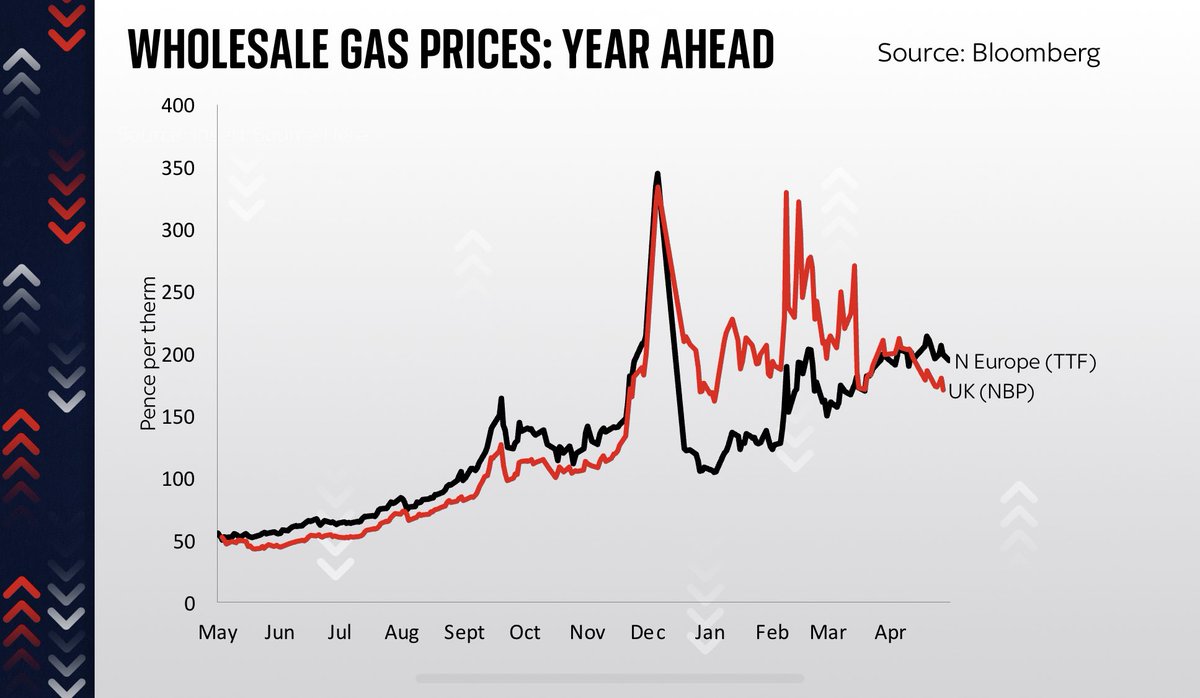

The short answer is that energy companies say they set their prices based NOT on the day ahead prices but on prices months or years ahead. And guess what...

Those prices are still eye-wateringly high, similar to those in mainland Europe. Look:

Those prices are still eye-wateringly high, similar to those in mainland Europe. Look:

In fact it's more perverse still.

In recent weeks, even as the day-ahead price dropped, the FUTURES curve actually rose slightly so the running tally for where the price cap is likely to end up in Oct actually went UP even as day-ahead prices collapsed.

You couldn't make it up.

In recent weeks, even as the day-ahead price dropped, the FUTURES curve actually rose slightly so the running tally for where the price cap is likely to end up in Oct actually went UP even as day-ahead prices collapsed.

You couldn't make it up.

This anomaly may not last long. That's what investors are betting. Prices v volatile; day ahead gas jumped from 40p to 100p a therm in only a few days.

Even so.

Incredibly surreal that even as everyone talks abt gas shortages we are in the midst of the biggest glut in a long time

Even so.

Incredibly surreal that even as everyone talks abt gas shortages we are in the midst of the biggest glut in a long time

The UK is drowning in gas - but consumers will get little or no relief from these very low prices.

My full analysis on @SkyNews here: news.sky.com/story/the-surr…

My full analysis on @SkyNews here: news.sky.com/story/the-surr…

For those of you who prefer to consume your news/analysis in video form, here's something I did for @SkyNews about this. The anomaly may prove short-lived, but it's yet another sign of the craziness of energy markets right now

👀UPDATE👀

Even as @ofgem says domestic gas bills are heading for £2.8k, UK wholesale day-ahead gas prices are STILL far lower than rest of Europe.

We still have a GLUT of gas in the UK.

But because household bills are based on futures markets, consumers don't benefit (see 👆)

Even as @ofgem says domestic gas bills are heading for £2.8k, UK wholesale day-ahead gas prices are STILL far lower than rest of Europe.

We still have a GLUT of gas in the UK.

But because household bills are based on futures markets, consumers don't benefit (see 👆)

• • •

Missing some Tweet in this thread? You can try to

force a refresh