Time to go back to the incredible Allianz story that broke yesterday: how did a boring German insurer end up paying 5.8bn$ in fines & client compensation?

A thread + what I think are important lessons at the end – but before you ask, why they did it, here’s the answer.

A thread + what I think are important lessons at the end – but before you ask, why they did it, here’s the answer.

Maybe it’s time to think about insurers’ compensation too – not only bankers 😊

Our story is about 17 funds sold to institutional clients (pensions, consultants etc.) for a total of 11bn$ among 114 clients only – so yeah, average holding of 96m$.

BIG, sophisticated clients.

Our story is about 17 funds sold to institutional clients (pensions, consultants etc.) for a total of 11bn$ among 114 clients only – so yeah, average holding of 96m$.

BIG, sophisticated clients.

Before we dunk on the Allianz team, I must say I’m shocked that such clients would fall into such traps.

I mean, one fund was called Structured Alpha 1000 and was supposed to invest in 90-day T-Bills and make… 10% above money market! Seriously, how can you believe that!?

I mean, one fund was called Structured Alpha 1000 and was supposed to invest in 90-day T-Bills and make… 10% above money market! Seriously, how can you believe that!?

Back to Allianz.

How do we know exactly what happened?

Well, snitches must be snitches. There were three guys involved (as seen in the comp sheet above) & Bond-Nelson + Taylor decided to cooperate.

How do we know exactly what happened?

Well, snitches must be snitches. There were three guys involved (as seen in the comp sheet above) & Bond-Nelson + Taylor decided to cooperate.

We had some genuine Homelands scenes there: during his testimony with the SEC BN took a bathroom break…and never came back! He decided to cooperate, & Taylor did the same. He met Tournant in an empty construction site (wearing a wire?) and had the following unreal conversation

What did the trio do exactly?

I’ll try to explain it from my perspective & not follow the SEC’s “legalistic approach”.

Basically, how do you build a money machine that makes 10% with low risk? (Assuming you’re not in the Ponzi business, which is an easier biz).

I’ll try to explain it from my perspective & not follow the SEC’s “legalistic approach”.

Basically, how do you build a money machine that makes 10% with low risk? (Assuming you’re not in the Ponzi business, which is an easier biz).

You take equity risk.

But you need to hedge the fall in the market.

If you want to fully hedge, you buy at the money put options.

Put how do you pay for this?

Well, you sell call options.

Wait, is this the magic money tree?

But you need to hedge the fall in the market.

If you want to fully hedge, you buy at the money put options.

Put how do you pay for this?

Well, you sell call options.

Wait, is this the magic money tree?

Errr, no, because the most important concept in derivatives market is not the gamma squeeze or some volatility bullshit. It’s this formula.

Underlying + Put = Zero Coupon Bond + Call

So, if you do what I’ve just described, you just end up with money market return. Great 😊

Underlying + Put = Zero Coupon Bond + Call

So, if you do what I’ve just described, you just end up with money market return. Great 😊

The way to make more money, then, is (for example) to buy puts with a lower strike price, says -10%.

If the market tanks 10% you’re protected.

And you collect the price difference between your call & your put and make money regularly (esp. with short term options.)

If the market tanks 10% you’re protected.

And you collect the price difference between your call & your put and make money regularly (esp. with short term options.)

But let’s be honest you don’t make much money because -10% put are expensive.

So maybe spend less and buy- 30% downside protection?

But will investors agree? They would have more risk.

Simple solution: bullshit the marketing slides and lie about your strike prices!

So maybe spend less and buy- 30% downside protection?

But will investors agree? They would have more risk.

Simple solution: bullshit the marketing slides and lie about your strike prices!

The best was to understand how this works is this: you have a distribution of daily P&L on the stock market and your derivatives allow you to transform it into an almost constant flow of positive returns (like 10% p.a.) in exchange for a massive loss in extreme cases.

And this is more or less what happened – with fake strikes.

The red line is the strike prices in the marketing docs (10% - 25%) the other lines are the actual strike prices. Fraud #1.

The red line is the strike prices in the marketing docs (10% - 25%) the other lines are the actual strike prices. Fraud #1.

Ok, so you collect your premium, don’t spend too much on protection and make money – but it’s riskier!

Won’t investors notice the risk? Maybe, but only if they do the work themselves, not if they ask you to do it!

Won’t investors notice the risk? Maybe, but only if they do the work themselves, not if they ask you to do it!

And astoundingly, all those sophisticated investors asked the Allianz team to run the risk scenarios themselves.

Now this is where it could have been super sophisticated.

I mean, stress testing & risk calculations for derivatives are a quant’s dream. U can come up with dozens of models, from Black Scholes to heteroscedastic jump volatility diffusion with Levy processes if you fancy it.

I mean, stress testing & risk calculations for derivatives are a quant’s dream. U can come up with dozens of models, from Black Scholes to heteroscedastic jump volatility diffusion with Levy processes if you fancy it.

Easy to bullshit anyone that doesn’t understand the maths. But Tournant was a McKinsey guy, not a French quant 😊So his technique was rather simpler: he received the Excel files with the risk metrics and would just remove a number : 42.1505489755747% would become 4.1505489755747%

Keeping all the decimals made it look scientific, of course.

(IMPORTANT LESSON: Never trust anyone who gives you 14 decimals)

(IMPORTANT LESSON: Never trust anyone who gives you 14 decimals)

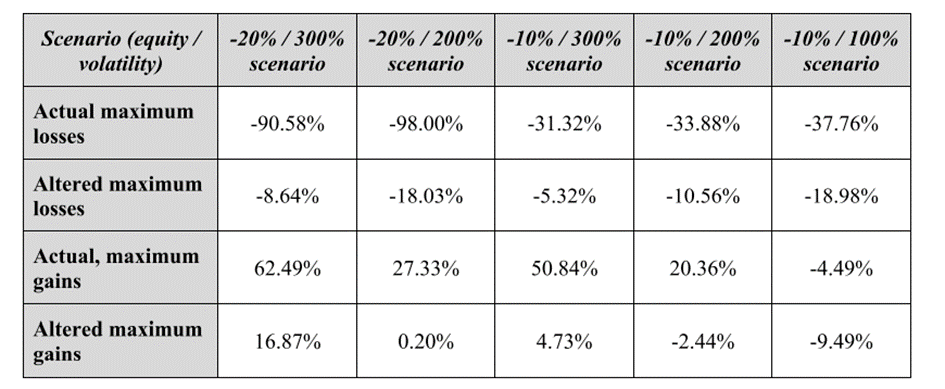

Overall, that’s what the real numbers vs. doctored numbers looked like.

You have to realize something: +200% on volatility is not that rare (I know the VIX is different but it still gives you an idea: just this year the low is 15 & the high is 36) & -20% is bad, but not imposs

You have to realize something: +200% on volatility is not that rare (I know the VIX is different but it still gives you an idea: just this year the low is 15 & the high is 36) & -20% is bad, but not imposs

In that scenario, real losses were 98% and investors were told it’s 18% ! That’s your big fat FRAUD #2

But surely, the risk and losses would materialize some day and it would show in the P&L / NAV of the funds, right?

How did they avoid this?

How did they avoid this?

Again, let’s not overthink this and make it simple: when investors asked daily returns, marketing team asked portfolio managers (HELLO? RISK DEPARTEMENT?) and they would just manually doctor the numbers. By hand. In the Excel cells & send back “Daily return: you can use this”.

Some marketing guys were not TOTALLY dumb and 1 of them emailed another 1 “We definitely sent smoothed numbers” (“smoothed” is Allianz lingo for "fake") But he didn’t freak out, just had dinner with Tournant to discuss it and, after the dinner just sent fake data to the investor

If you’re in investment manager, you know what investors always want to know is “what’s the upside”. Allocators don’t have a crystal ball, but they expect you to have one!

How do you manage those when the actual portfolio is not what you told clients?

How do you manage those when the actual portfolio is not what you told clients?

You know the drill by now.

Manually change the Excel files.

But seriously, this is tedious! So many files to doctor. So much work.

Tournant had a great team. So, one of his guys sent him a password protected Excel file with detailed instructions to alter the data!

Manually change the Excel files.

But seriously, this is tedious! So many files to doctor. So much work.

Tournant had a great team. So, one of his guys sent him a password protected Excel file with detailed instructions to alter the data!

So nice of this guy to explain his boss how to commit fraud.

But also, you don’t want to be detected, right? So, the nice guy also provided instructions for this - and honestly this is hilarious.

But also, you don’t want to be detected, right? So, the nice guy also provided instructions for this - and honestly this is hilarious.

Imagine being caught because your client sees your Excel formula saying

=if(Risk>5%, Risk =3.0314%, Risk = 2.1235%)

=if(Risk>5%, Risk =3.0314%, Risk = 2.1235%)

Obviously, all this was done for money: somehow, they had a compensation formula based not only on P&L but also on the “risk” their clients were taking. This was not only about convincing clients but also directly linked to their bonus. Tournant put it nicely in an email:

“This recalculation is worth about 900K to our Comp pool”.

Recalculation

Recalculation

Raising money was also important. And they used good old Madoff tactics there.

1) Tease your client

2) Explain the fund is private and accepts no new money 3) Tell your client you’ll accept his money but only as a favor.

This bullshit will always work, I guess.

1) Tease your client

2) Explain the fund is private and accepts no new money 3) Tell your client you’ll accept his money but only as a favor.

This bullshit will always work, I guess.

And as you probably have already guessed, all this collapsed with the Covid crash, when the stress scenario materialized, and investors realized the losses were on exactly the advertised losses!

Allianz lost much more than the 6bn$ in this debacle: because the SEC banned AllianzGI from doing more business, Allianz transferred 120bn$ of AUM to Voya.

They contributed 32% of assets (theirs being more profitable) against a 24% stake – clearly a loss of value.

They contributed 32% of assets (theirs being more profitable) against a 24% stake – clearly a loss of value.

What lessons can we draw from this?

1) It’s not only bankers who do horrible shit!

2) How can Allianz (and maybe other firms) let that kind of business operate with exactly 0 risk controls?

3) Why are such compensations so drastically limited in a bank and not an insurer?

1) It’s not only bankers who do horrible shit!

2) How can Allianz (and maybe other firms) let that kind of business operate with exactly 0 risk controls?

3) Why are such compensations so drastically limited in a bank and not an insurer?

Last point which I think is crucial. Compensation rules have targeted risk takers. I think this is mistake. Sure, the “trader’s call” is a nice theoretical thing in an academic paper but it’s extremely rare. Traders hate 0 bonus much more than you think.

I’m not even sure I ever saw one case where the “trader’s call” was a reason for a massive problem.

The key problem is the risk SELLER. The guy who understands the risks much better, sells crap, takes no risk and makes money. This is the blind spot in comp rules!

The key problem is the risk SELLER. The guy who understands the risks much better, sells crap, takes no risk and makes money. This is the blind spot in comp rules!

• • •

Missing some Tweet in this thread? You can try to

force a refresh