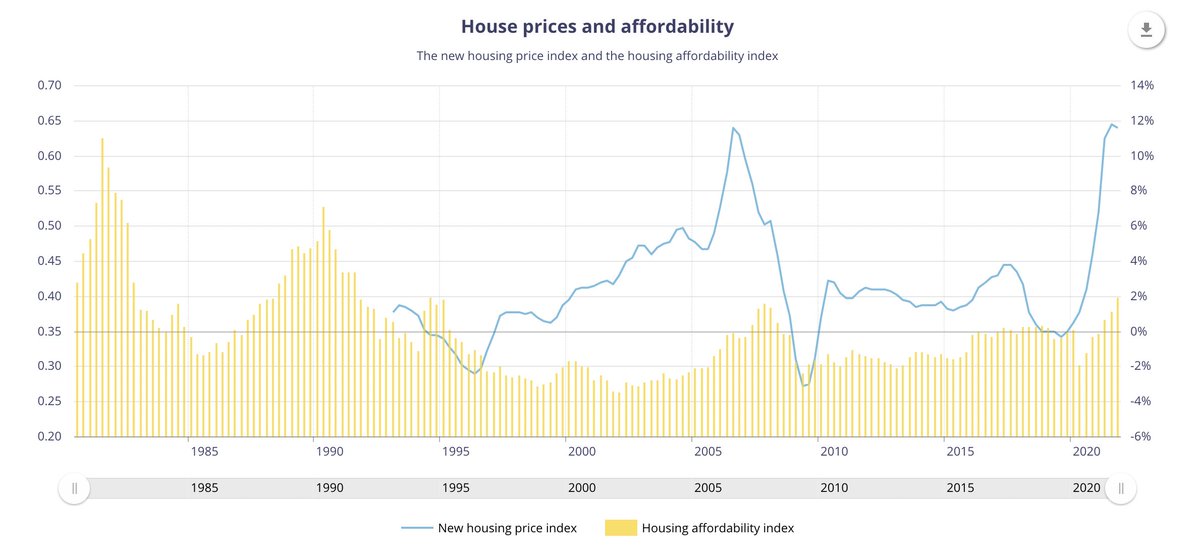

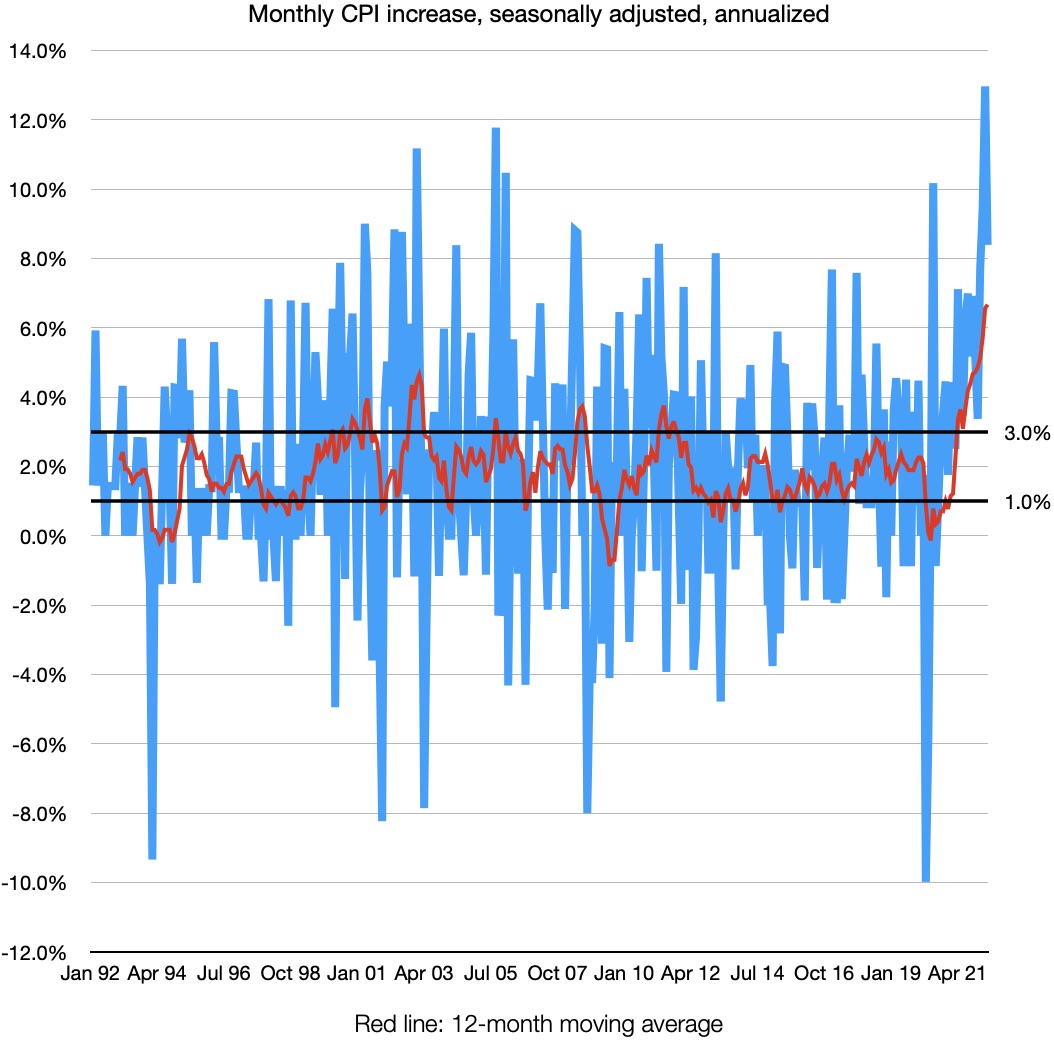

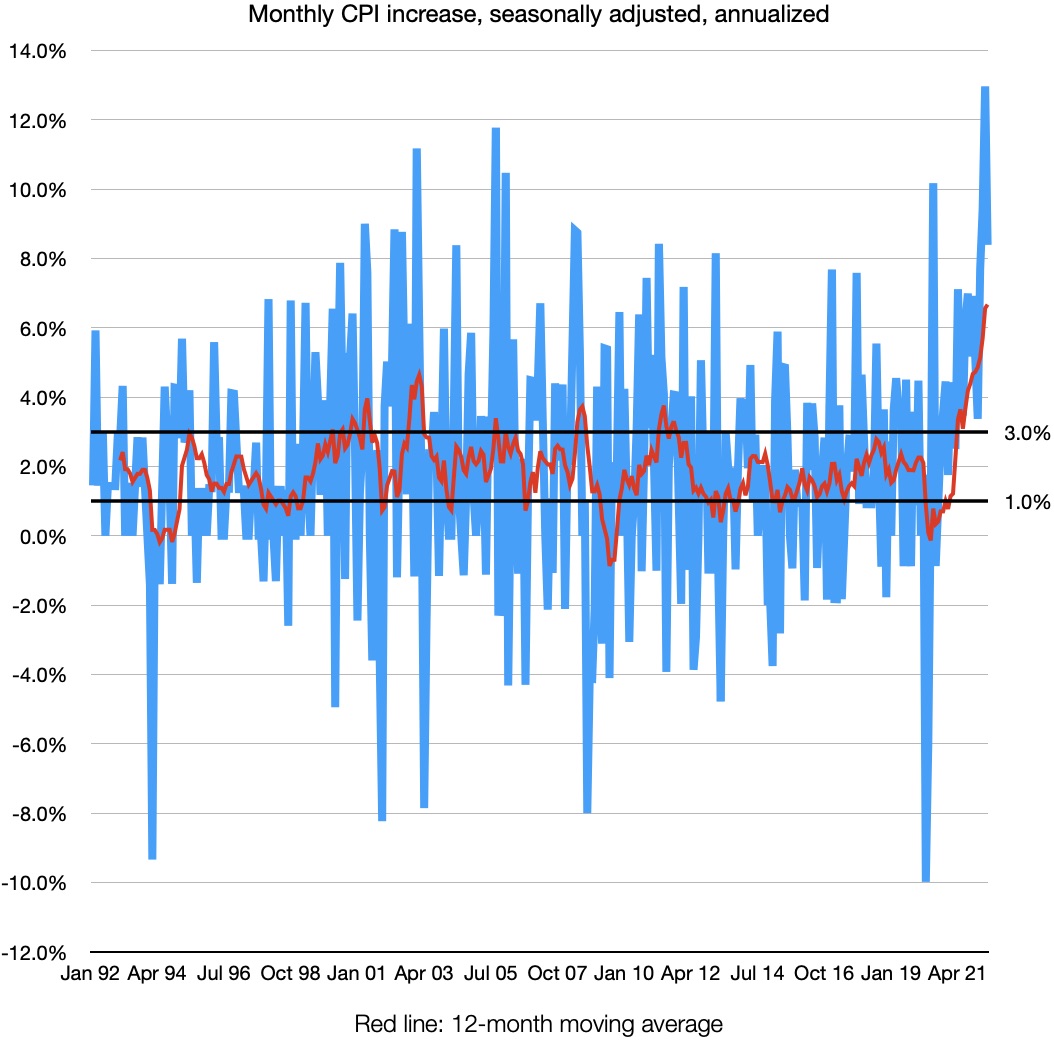

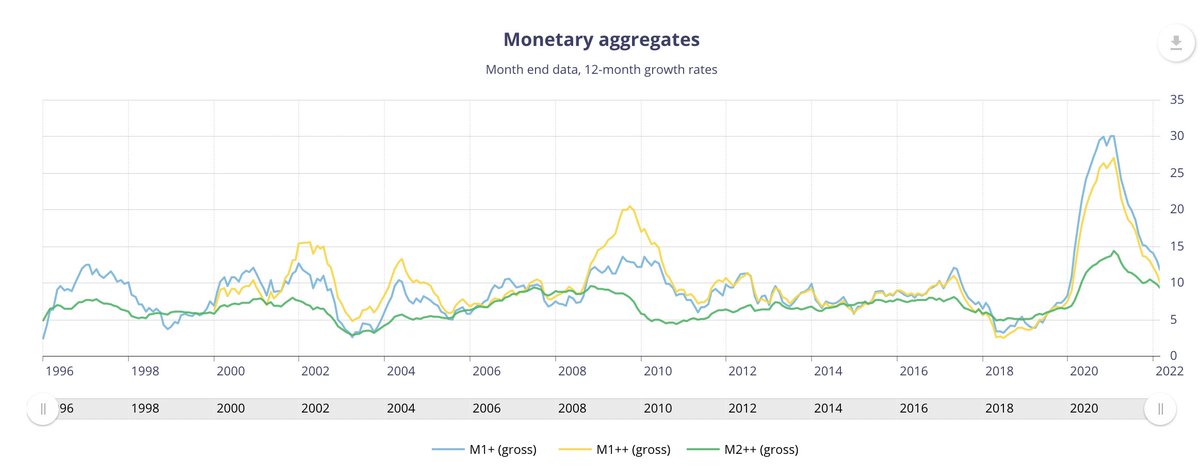

No one disputes inflation is currently too high. There’s a debate about how much of that is the Bank of Canada’s doing. But how well has the Bank done at controlling inflation generally? A couple of charts follow… 1/n

The blue line shows monthly annualized inflation (CPI-based) over the last 30 yrs. It bounces up & down quite a bit, as you might imagine: month to month, all kinds of movements in individual prices can push the CPI up or down, for reasons unrelated with monetary policy. 2/n

The red line is the twelve-month moving average of these. It’s much more stable, rarely straying beyond the Bank’s 1 to 3 per cent target range. In fact, from 1992 to Feb 2020, the bank kept annual inflation within that range 82 per cent of the time. 3/n

Since that time, inflation has been much less stable. No kidding: governments first locked down the entire economy, then unlocked it. The initial impact of the lockdown was sharply deflationary: from Feb-April 2020, prices fell at an 8% annualized rate. 4/n

Through most of 2020, inflation remained below the Bank’s target rate. Eventually, however, unlocked activity, government support and accommodating monetary policy brought inflation back into the target range. Supply chain disruptions and the war in Ukraine did the rest. 5/n

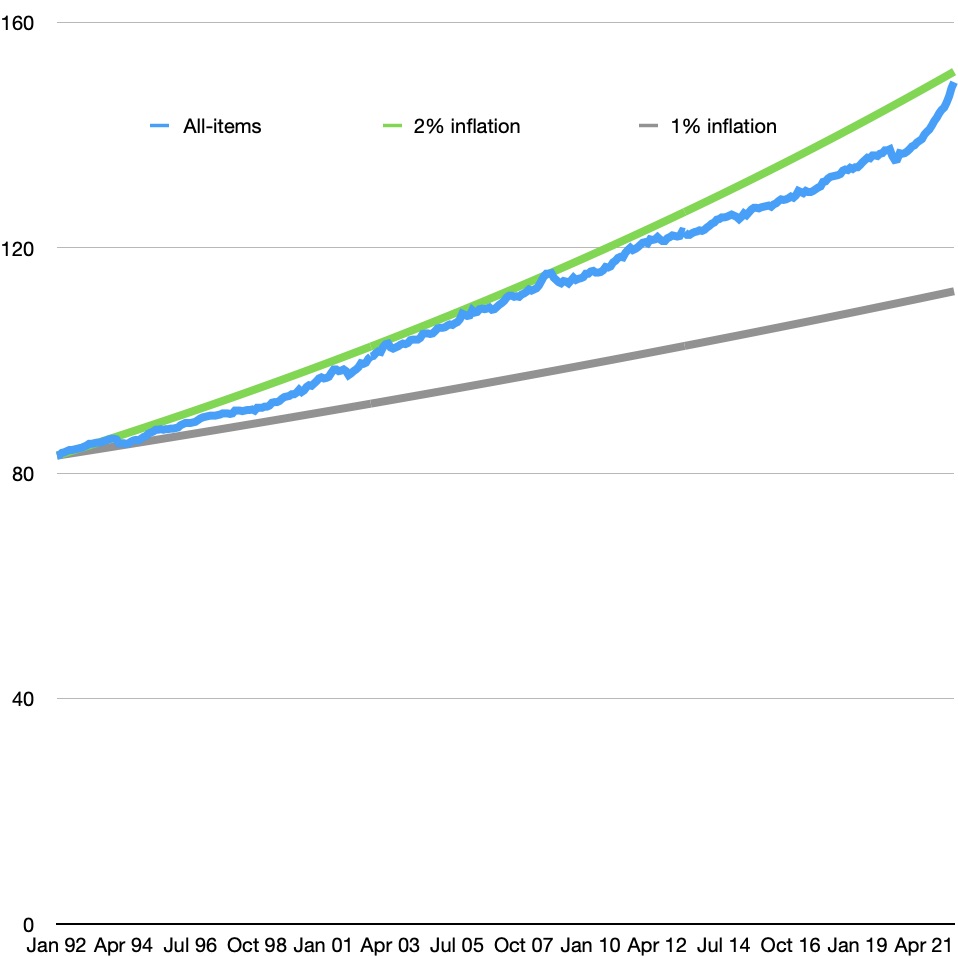

But while inflation is currently running well above target, the cumulative rise in prices, taking into account previous periods of below target inflation is much more muted. One way of seeing this can be found on this chart…(@stephenfgordon posted something similar earlier)

Even with the recent runup in prices, inflation is still slightly below where it would have been had priced kept increasing steadily at 2% per annum. But it’s not *much* below. From Jan ’92 to April ’22, inflation averaged 1.96% annually. From Jan ’92 to Feb ’20, 1.81%. 7/n

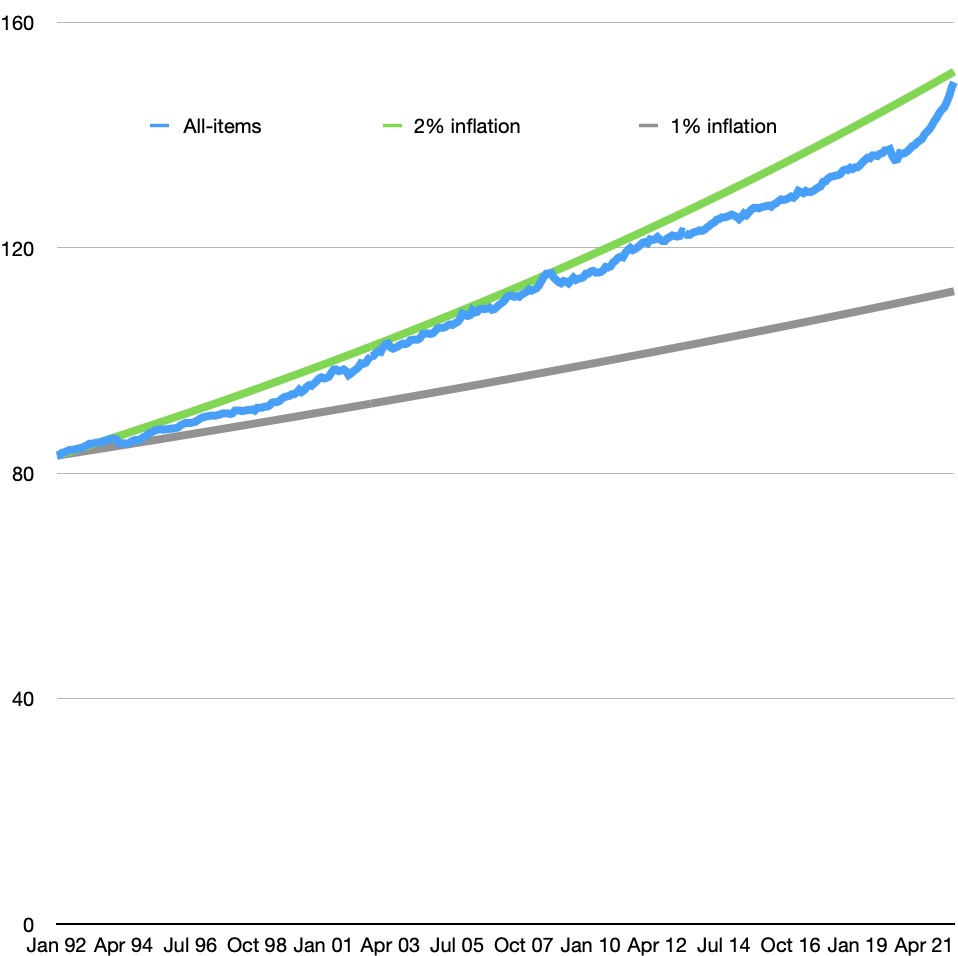

Addendum: How much has recent inflation affected expectations of future inflation? Not much. Chart shows the spread between conventional bonds & real return (ie inflation-adjusted) bonds, reflecting market expectations of inflation. It’s now at 1.88%.

bankofcanada.ca/rates/indicato…

bankofcanada.ca/rates/indicato…

Apparently market participants are confident in the Bank’s willingness and ability to get inflation back down to target.

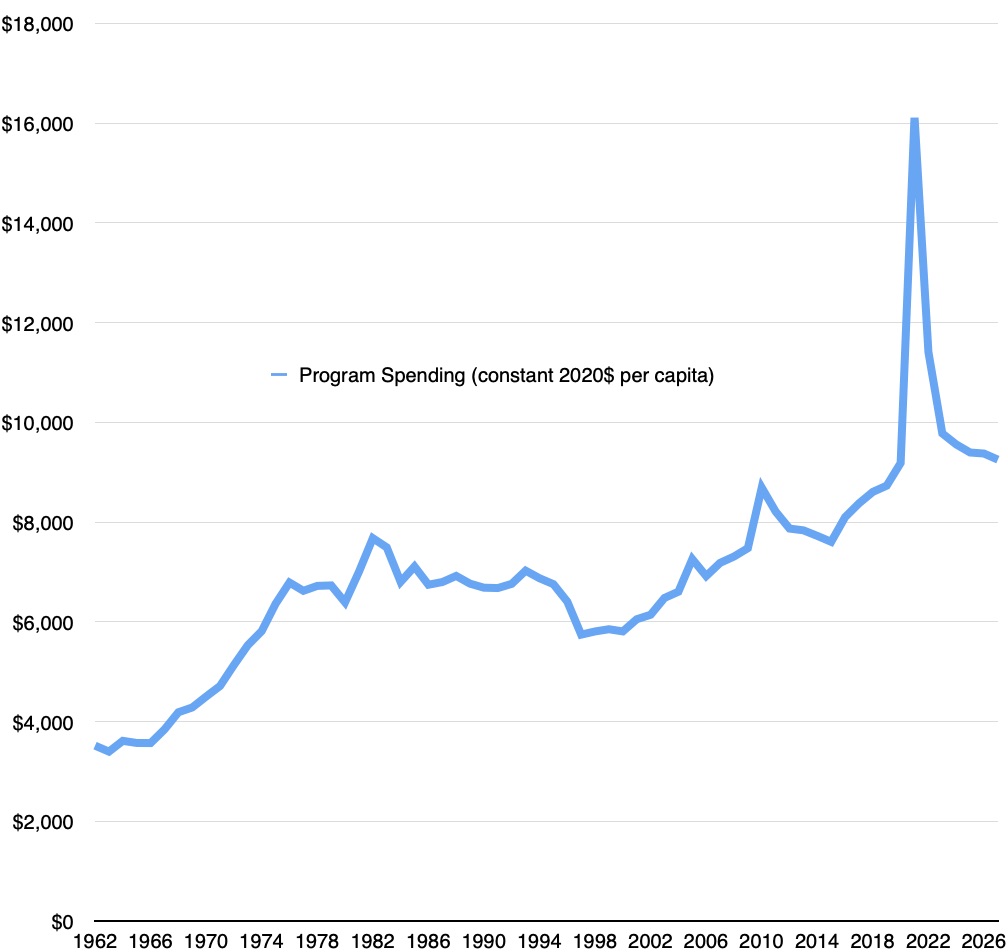

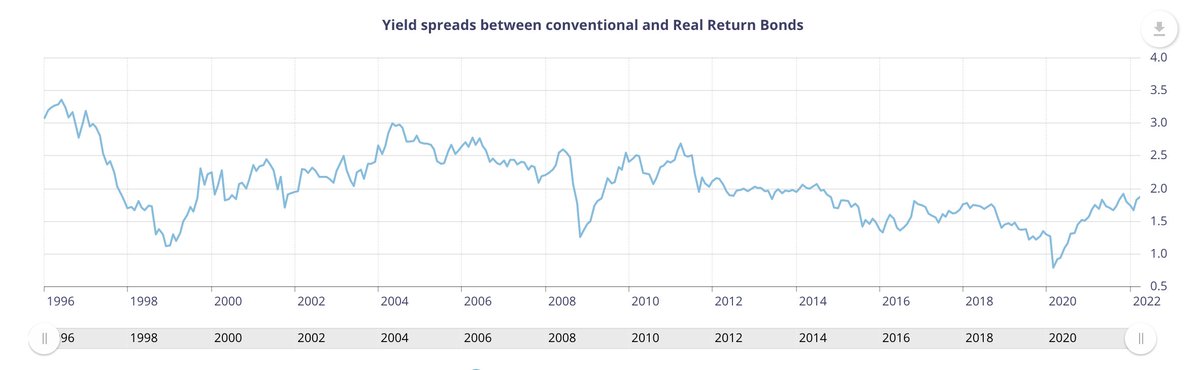

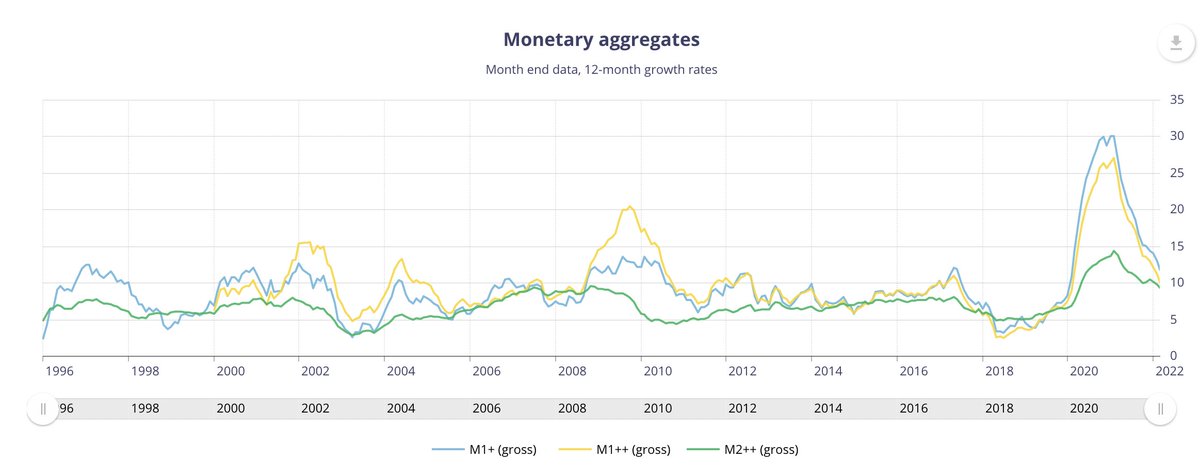

This may explain why. Lots of people v. excited about growth in the Bank’s balance sheet, but what matters for inflation is how that feeds into growth in money & credit: the monetary aggregates. (Even these don’t always explain a lot in the short term. But in long run they do.)

Money supply grew strongly in early 2020, perhaps affecting inflation rate in late 2021. But by any measure it is now back close to rates of growth observed in Great Moderation of previous 30 years.

• • •

Missing some Tweet in this thread? You can try to

force a refresh