1/ Gold in India

Gold is considered to be an important asset, a hedge against inflation and an immediate source of cash especially for the rural households in India. Gold is used as collateral to earn money for short term needs.

Gold is considered to be an important asset, a hedge against inflation and an immediate source of cash especially for the rural households in India. Gold is used as collateral to earn money for short term needs.

2/ Most of households do not sell gold ornaments; instead they pawn it for immediate use. In 2019 India accounted for 16% of the global gold demand. Kerala has the highest per capita consumption of gold and has the highest inflow of remittances among Indian states.

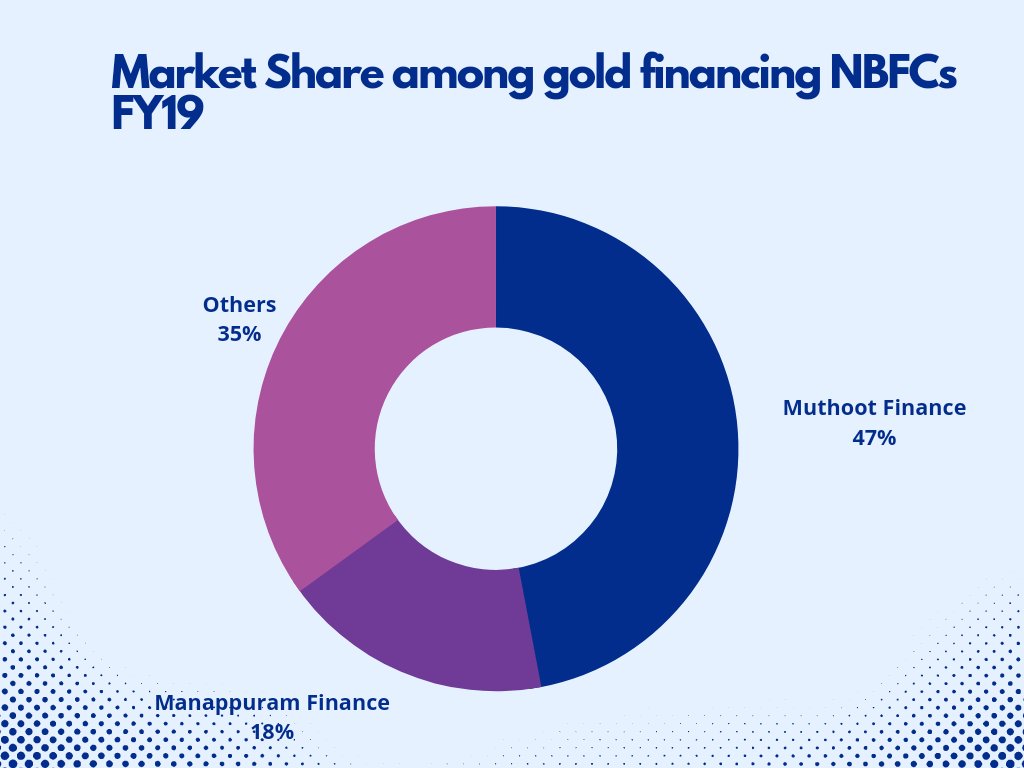

3/ Gold Loan market structure

Gold loan lenders can be classified into two:

1. Organized Sector

2. Informal or Unorganized Sector

The organized gold loan market comprises of banks, NBFC’S and Nidhi companies(35%) and unorganized sector comprises Money lenders(65%).

Gold loan lenders can be classified into two:

1. Organized Sector

2. Informal or Unorganized Sector

The organized gold loan market comprises of banks, NBFC’S and Nidhi companies(35%) and unorganized sector comprises Money lenders(65%).

4/ Rate of Gold Loans

The banks advance gold loans at a lower rate of interest than the NBFCS. Banks change an interest of 7-12% whereas the interest rates of NBFCS is in the range of 12- 22%.

Pawn Brokers and Money lender advance gold loan at an interest rate of 18-30%.

The banks advance gold loans at a lower rate of interest than the NBFCS. Banks change an interest of 7-12% whereas the interest rates of NBFCS is in the range of 12- 22%.

Pawn Brokers and Money lender advance gold loan at an interest rate of 18-30%.

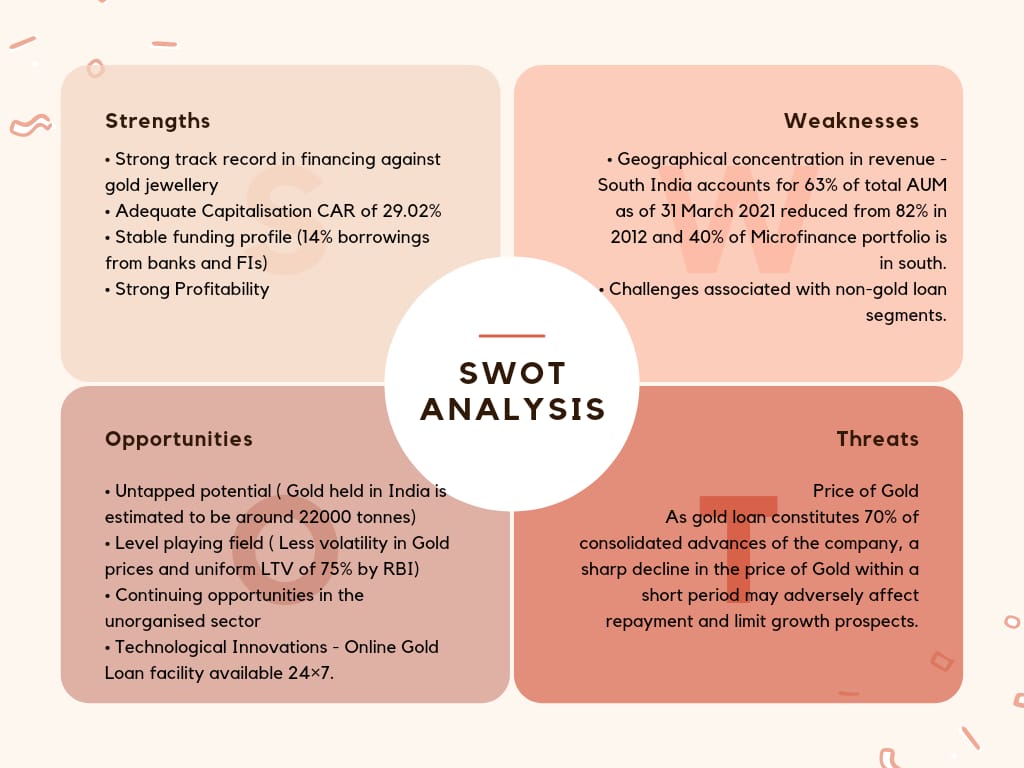

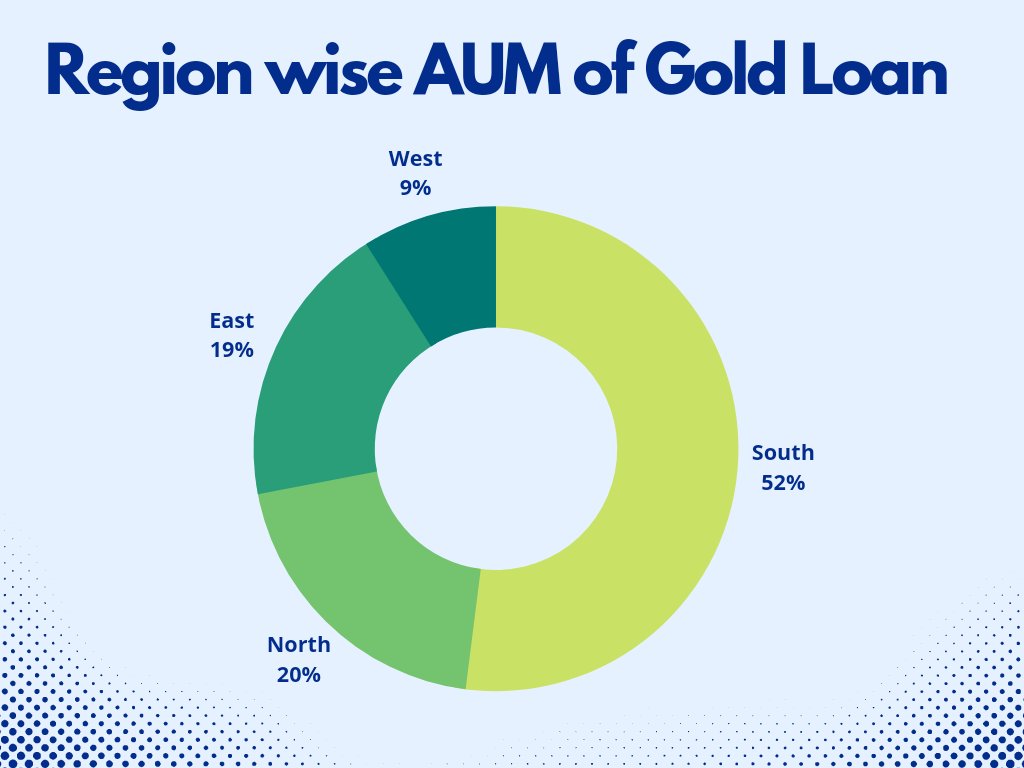

5/ About Manappuram Finance

Manappuram Finance Ltd has its base in Kerala. It is the second-largest gold finance NBFC in India. The Company provides loans against the pledge of used household gold jewellery and extends short-term gold loan.

#manappuram

Manappuram Finance Ltd has its base in Kerala. It is the second-largest gold finance NBFC in India. The Company provides loans against the pledge of used household gold jewellery and extends short-term gold loan.

#manappuram

6/ It named as the largest wealth creator for the year 2019 in the list of ET500 companies with market capitalization of over 50 billion. It was the first company to start online gold lending in 2015, online gold loans account for 59% of overall gold loans as of Q3FY21.

#finance

#finance

7/ Other Loan Segments

It has diversified its product streams from a pure gold lending company to a diversified financial company. Their current product segments include gold loan, microfinance, home loan and CV finance, with gold loan accounting for 73% of AUM in Q3FY21.

It has diversified its product streams from a pure gold lending company to a diversified financial company. Their current product segments include gold loan, microfinance, home loan and CV finance, with gold loan accounting for 73% of AUM in Q3FY21.

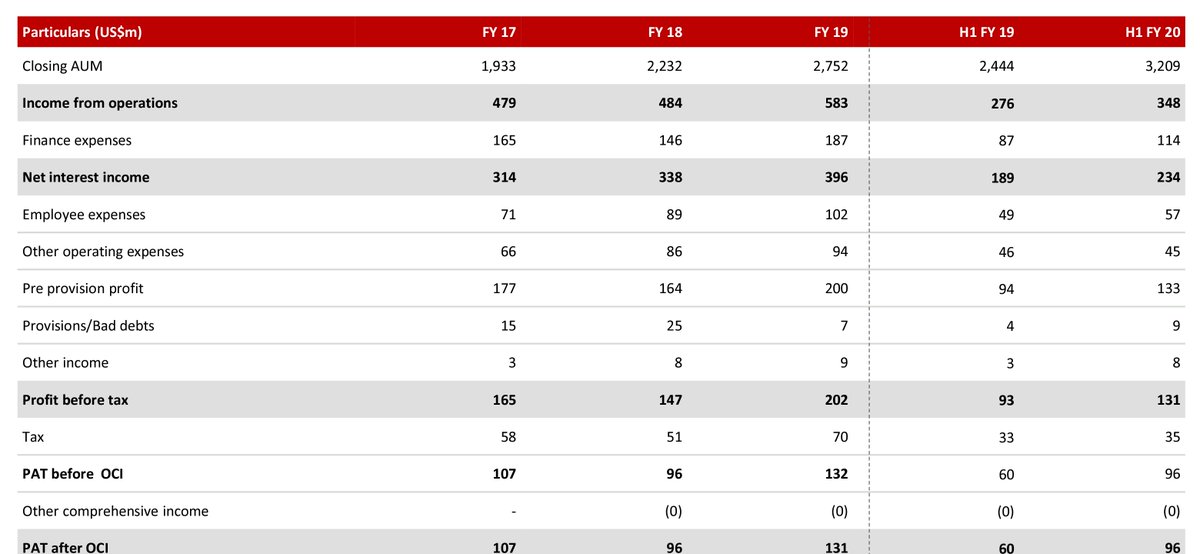

8/ Financials

During the FY 2020-21, the Company’s consolidated revenue from operations grew by 1.1 % and the Profit after Tax increased by 17.6 % to ₹4683 Million . The Company’s consolidated AUM grew by 7.9% to

₹2,72,242 million during the year.

During the FY 2020-21, the Company’s consolidated revenue from operations grew by 1.1 % and the Profit after Tax increased by 17.6 % to ₹4683 Million . The Company’s consolidated AUM grew by 7.9% to

₹2,72,242 million during the year.

9/ Acquisitions and Subsidiaries

Manappuram acquired Asirvad in 2015 to venture into microfinance at a cost of 110 cr. Ashirvad's current AUM stands at 7002 Cr. as of Q4FY22. This business reported a profit of Rs.13 crore for FY22.

Manappuram acquired Asirvad in 2015 to venture into microfinance at a cost of 110 cr. Ashirvad's current AUM stands at 7002 Cr. as of Q4FY22. This business reported a profit of Rs.13 crore for FY22.

10/ Vehicle Finance business have reported an AUM of Rs. 1,643 crore, which is up by 8.8% QOQ and by 56.1% YOY. (As of Q4FY22)

Home loan business, total book of Rs. 845 crore, which is up by 3.5% QOQ and up by 26.9% YOY. It operates from 73 branches and reported a profit of 7 Cr.

Home loan business, total book of Rs. 845 crore, which is up by 3.5% QOQ and up by 26.9% YOY. It operates from 73 branches and reported a profit of 7 Cr.

11/ Rate of Borrowings

Commercial Papers ₹1142 Cr @ 3.45% to 9.00% pa

US Dollar Bonds ₹2204 Cr @ 5.90% pa

Non-convertible Debentures ₹6590 Cr @ 7.35% to 13.25% pa

Term Loans (Indian) ₹2672 Cr @ 7.75% to 10.25% pa

Term Loans (Foreign) ₹102 Cr @ 3 month LIBOR plus 280bps

Commercial Papers ₹1142 Cr @ 3.45% to 9.00% pa

US Dollar Bonds ₹2204 Cr @ 5.90% pa

Non-convertible Debentures ₹6590 Cr @ 7.35% to 13.25% pa

Term Loans (Indian) ₹2672 Cr @ 7.75% to 10.25% pa

Term Loans (Foreign) ₹102 Cr @ 3 month LIBOR plus 280bps

12/ The average cost of borrowing is 10.3% and average lending rate was 20.35%. Under the new regulations the idea is to charge 24% considering this increased credit cost scenario. (Concall May'22)

13/ Non-performing Assets

GNPA brought down to 5.9% from 12.3% during quarter(Q4FY22),company is compliant with the

new RBI IRAC norms. Loan to NBFCs stood at Rs. 31 crore and loan to the MSME and others at Rs.

920 crore.

GNPA brought down to 5.9% from 12.3% during quarter(Q4FY22),company is compliant with the

new RBI IRAC norms. Loan to NBFCs stood at Rs. 31 crore and loan to the MSME and others at Rs.

920 crore.

14/ Provisions and write-offs during the quarter Rs.24 crore compared to Rs. 17 crore in

Q3. The Board declared an interim dividend of Rs. 0.75 during the quarter. Company is well

capitalized with a capital adequacy ratio of 31%. Consolidated net worth stands at Rs. 8,368

crore.

Q3. The Board declared an interim dividend of Rs. 0.75 during the quarter. Company is well

capitalized with a capital adequacy ratio of 31%. Consolidated net worth stands at Rs. 8,368

crore.

16/ Current Situation

Manappuram Finance reported weak quarter, with net profit declining by 42.4% YoY on account of subdued growth in gold loan AUM and 19.6% YoY decline in NII.

In FY22, the company adopted a pricing strategy, which entailed reducing gold loan rates by ~200bps

Manappuram Finance reported weak quarter, with net profit declining by 42.4% YoY on account of subdued growth in gold loan AUM and 19.6% YoY decline in NII.

In FY22, the company adopted a pricing strategy, which entailed reducing gold loan rates by ~200bps

17/ The management cited continued high competition and low demand as key reasons for this weak growth. However, with demand starting to pick up in 1QFY23, along with a gradual reduction in systemic liquidity, the management holds a positive outlook on gold loan growth.

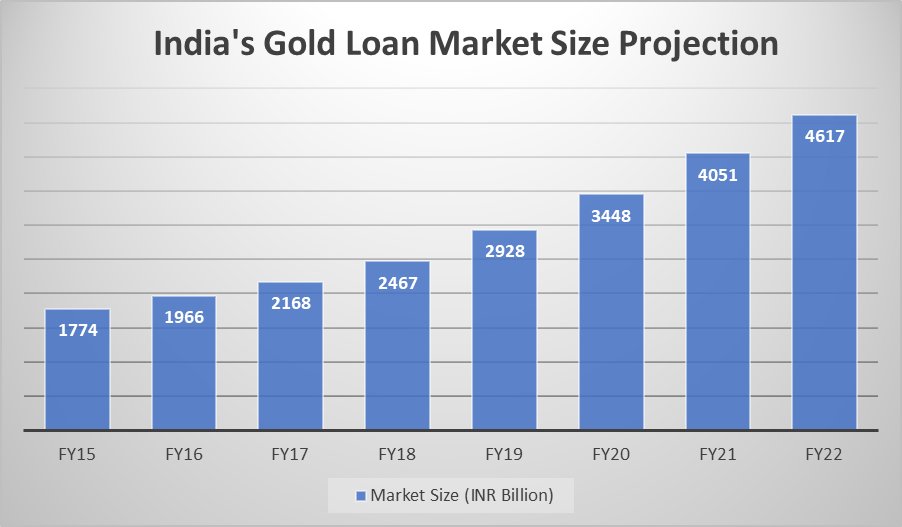

17/ Conclusion

The gold loan market has much growth potential- with increasing return migrants, starting of small businesses and also with an emerging and robust online market. Over long term, Manappuram wants to grow their loan AUM 15-20% with ROEs of >20%.

The gold loan market has much growth potential- with increasing return migrants, starting of small businesses and also with an emerging and robust online market. Over long term, Manappuram wants to grow their loan AUM 15-20% with ROEs of >20%.

• • •

Missing some Tweet in this thread? You can try to

force a refresh