I get like 5-10 DMs a day asking about how to get better at solidity (some even ask if Im taking interns lol).

While this may be rudimentary and somewhat "obvious" knowledge, I'll try to explain the concept that really helped me "get it" when I first started learning.

While this may be rudimentary and somewhat "obvious" knowledge, I'll try to explain the concept that really helped me "get it" when I first started learning.

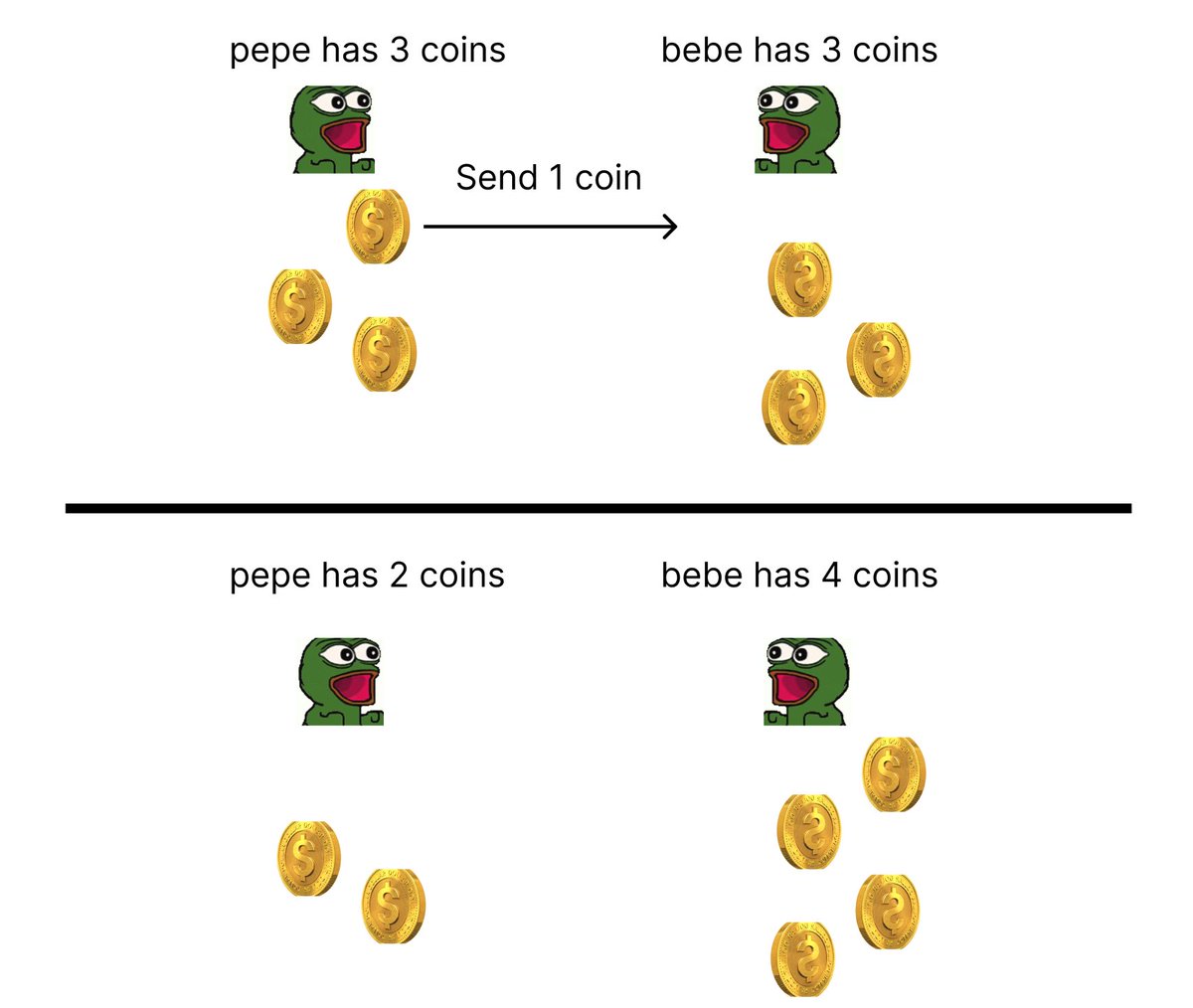

When you interact with Ethereum, a majority of the time you're transferring some sort of token from your own wallet to another.

It's common to think "transferring a token" is an actual action of sending something to someone. ie the token is actually getting "sent".

It's common to think "transferring a token" is an actual action of sending something to someone. ie the token is actually getting "sent".

However, it's much more simple than that.

There isn't actually "3 tokens" in your wallet, it's just a number (your balance) that represent how many tokens you should have.

So when you're 'sending' a token, it's just a simple increment/decrement of the 2 wallet balances.

There isn't actually "3 tokens" in your wallet, it's just a number (your balance) that represent how many tokens you should have.

So when you're 'sending' a token, it's just a simple increment/decrement of the 2 wallet balances.

I know this is simple, but personally, once I REALLY understood that everything is just a number in a ledger that gets updated (that wallets and contracts can look up), I started to be able to better conceptualize how to create contracts / modify existing ERC standards.

For example, these are the 'rules' for most tokens in your wallet.

Rules:

1. Your balance starts at 0 -> my_balance = 0

2. When you receive tokens, increase your balance

3. When you send tokens, decrease your balance

4. When someone requests your balance, return my_balance

Rules:

1. Your balance starts at 0 -> my_balance = 0

2. When you receive tokens, increase your balance

3. When you send tokens, decrease your balance

4. When someone requests your balance, return my_balance

So understanding that the amount of tokens you 'own' is a simple variable that returns a number based on certain rules (ie increments/decrements every time you send receive), we can do some cool things.

We can modify the rules for a token such that every time someone receives a token, we multiply their balance by 2. Or maybe take 10% of the received tokens and donate it to a DAO.

We can literally do anything since balances are just numbers calculated by arbitrary rules we set

We can literally do anything since balances are just numbers calculated by arbitrary rules we set

So for my implementation of token dripping, I changed how my_balance is calculated.

Rather than my returning the actual number of my_balance when someone requests how many tokens I own, I returned my_balance + (emissionRate * length of time I started dripping).

Rather than my returning the actual number of my_balance when someone requests how many tokens I own, I returned my_balance + (emissionRate * length of time I started dripping).

Not sure if this is super helpful and I know it's 'common' knowledge and 'no shit the blockchain is just a ledger', but really grasping this concept helped me a ton - like it was an awakening experience for me lmao.

Maybe just me tho xD

Maybe just me tho xD

• • •

Missing some Tweet in this thread? You can try to

force a refresh