(1/7) 🪄 Why should you care about Olympus Pro? ➡️ In this thread we will do a deep-dive into how protocols and DAOs can use our bonding strategies to create more resilient treasuries and stronger liquidity.

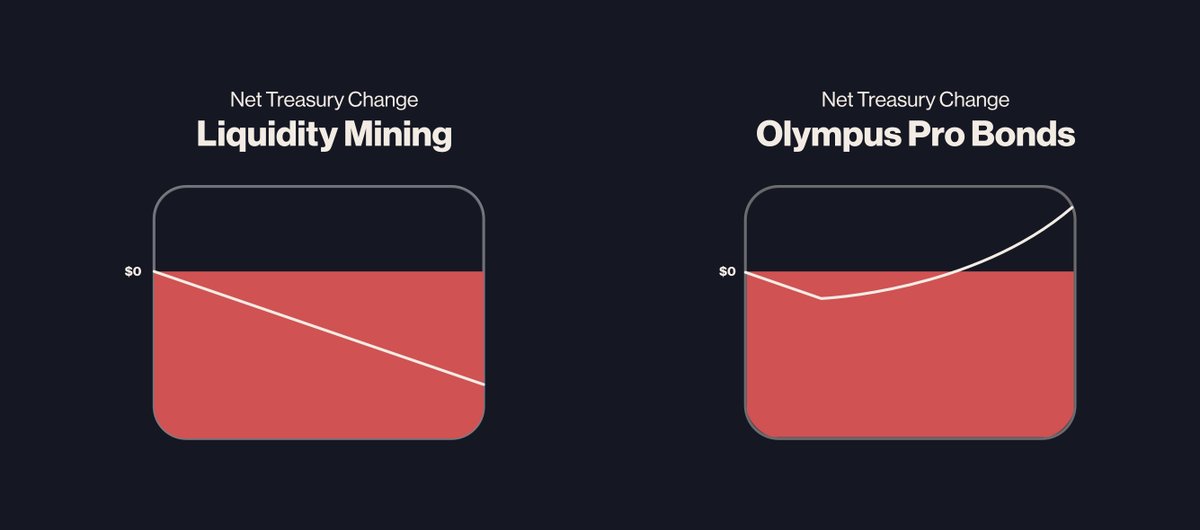

(2/7) PoL enables protocols to stop relying on unsustainable liquidity mining incentives and reduce dependence on third-party LPs. Olympus Pro makes this process easier and more capital efficient by reducing acquisition costs and keeping a net-positive treasury balance.

(3/7) Moving on to the second benefit of using Olympus Pro. Treasury Diversification. DAOs are overexposed to their own native token. This can result in high token volatility and difficulty raising capital in bear markets.

(4/7) Treasury diversification opens up a lot of possibilities. For example, you could acquire bribing assets and engage in protocols like @ConvexFinance @TokenReactor or @balancer. But, how can a DAO or Protocol acquire these assets without heavily affecting the token price?

(5/7) The answer is Long-Dated Bonds. Olympus Pro allows you to delay token dilution over a set period of time. Longer vesting terms enable you to raise capital and delay potential price impact.

(6/7) Did we spark your curiosity?

Get in touch with Olympus Pro: ohm.fyi/sog

Start Bonding: ohm.fyi/pro-twt

Dive Deeper: ohm.fyi/11u

Or, come and visit us in the OlympusDAO discord under #olympus-pro

Get in touch with Olympus Pro: ohm.fyi/sog

Start Bonding: ohm.fyi/pro-twt

Dive Deeper: ohm.fyi/11u

Or, come and visit us in the OlympusDAO discord under #olympus-pro

(7/7) Oh, and btw:

Involved in a crypto project & believe they could use our bonds? If a project fills in your Discord handle on the form and starts our program, we will give you 10% of our fees for the first month.

➡️ ohm.fyi/sog

Involved in a crypto project & believe they could use our bonds? If a project fills in your Discord handle on the form and starts our program, we will give you 10% of our fees for the first month.

➡️ ohm.fyi/sog

• • •

Missing some Tweet in this thread? You can try to

force a refresh