Why inflation will drop MARKEDLY in to 2023 😱

A thread..

(If you want to keep betting on higher inflation, then look away now..)

A thread..

(If you want to keep betting on higher inflation, then look away now..)

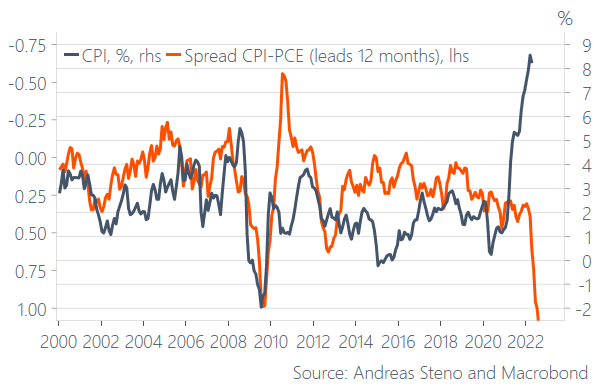

The spread between trimmed CPI and trimmed PCE measures has turned all-time-wide, which is usually something we see 1-2 quarters ahead of the actual peak in inflation...

Why is that?

Why is that?

CPI-weights are updated substantially less frequently than PCE-weights, why the CPI may underestimate the behavioural effects from rising prices currently.

Will consumers substitute goods in the basket after a rapid price increase or maybe just outright decrease spending?

Will consumers substitute goods in the basket after a rapid price increase or maybe just outright decrease spending?

If we allow the spread between trimmed CPI and PCE prices to lead the ACTUAL CPI development by 12 months, we get a very strong leading indicator that points clearly to the downside for H2-2022 and in to 2023.

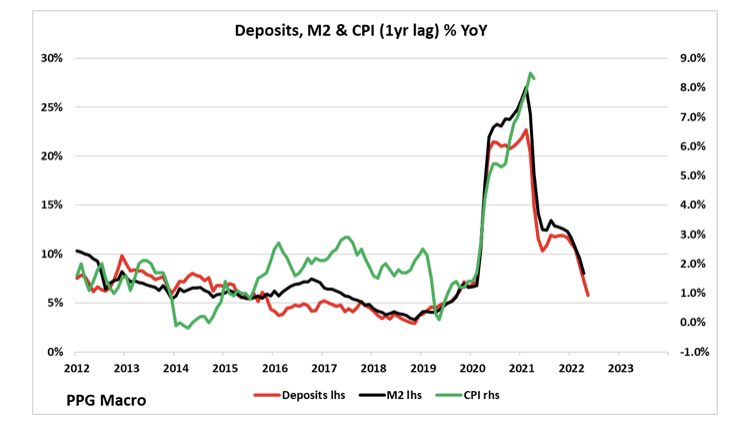

This rhymes perfectly with the waning effects from the "money printing" of 2020/2021, which point in the same direction for inflation over the coming 12 months

H/T @PPGMacro

H/T @PPGMacro

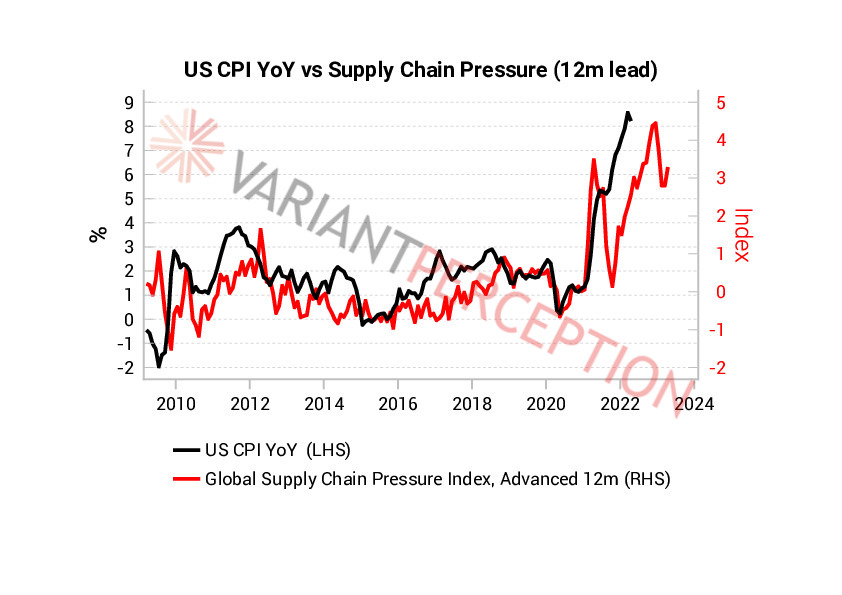

Even the supply chain shows signs of easing, which is also a comforting factor for the inflation outlook

H/T @VrntPerception

H/T @VrntPerception

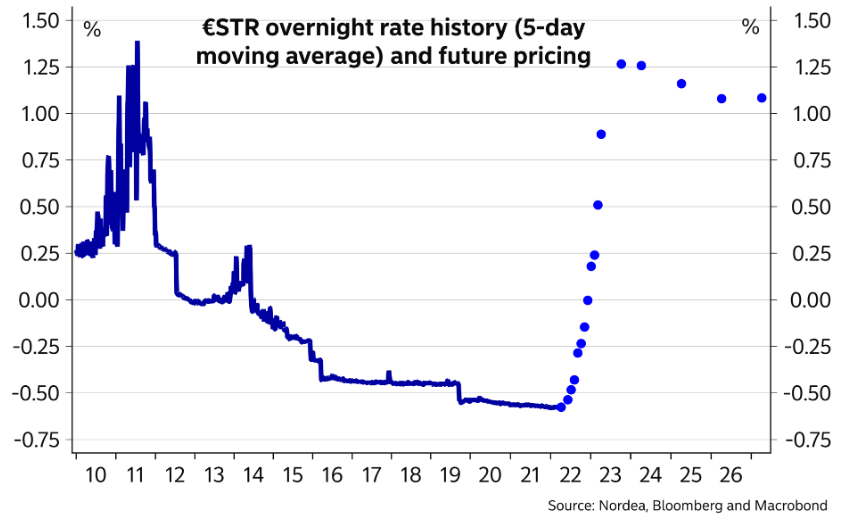

Bottom-line: Yes, inflation is at horrible levels and central banks will act (also the ECB), BUT it is an extremely high conviction call of mine that inflation will slow VERY fast in to 2023.

And please throw garbage at me, if I am wrong about that in 6-12 months from now

And please throw garbage at me, if I am wrong about that in 6-12 months from now

• • •

Missing some Tweet in this thread? You can try to

force a refresh