Informative podcast about the Jones Act. Since Shawn is based in Guam, thought it would be a good opportunity to do a 🧵 about the Jones Act's impact on the island.

https://twitter.com/ShawnGumataotao/status/1528627596266569728

Guam is the only 🇺🇸 territory in the Pacific subject to the Jones Act, with American Samoa and the Confederation of the Northern Mariana Islands both exempt. Wake, Midway, and Kingman Reef are subject to the JA but aren't territories (nor, I believe, have permanent residents).

Another thing to note is that Guam—along with Wake, Midway, and Kingman Reef—is not subject to the Jones Act's requirement that vessels be domestically built. But as @GuamPort points out in this 2018 document, it's not as beneficial as you might think: drive.google.com/file/d/1shrUbR…

In 1950 the Guam Organic Act was passed making Guam an unincorporated US territory. Per that Act, a commission was established to determine which federal laws should apply to Guam. Among those it recommended excluding: coastwise laws (i.e. the JA): drive.google.com/file/d/1rqzk2v…

The act also provided for the establishment of the Guam legislature, and it wasn't long before these elected representatives started noting the contribution of high shipping rates to the island's cost of living.

In 1963 the legislature passed a resolution asking Congress to exempt it from U.S. coastwise laws, thus making it eligible for subsidized U.S. shipping engaged in foreign trade: drive.google.com/file/d/1OSR-tT…

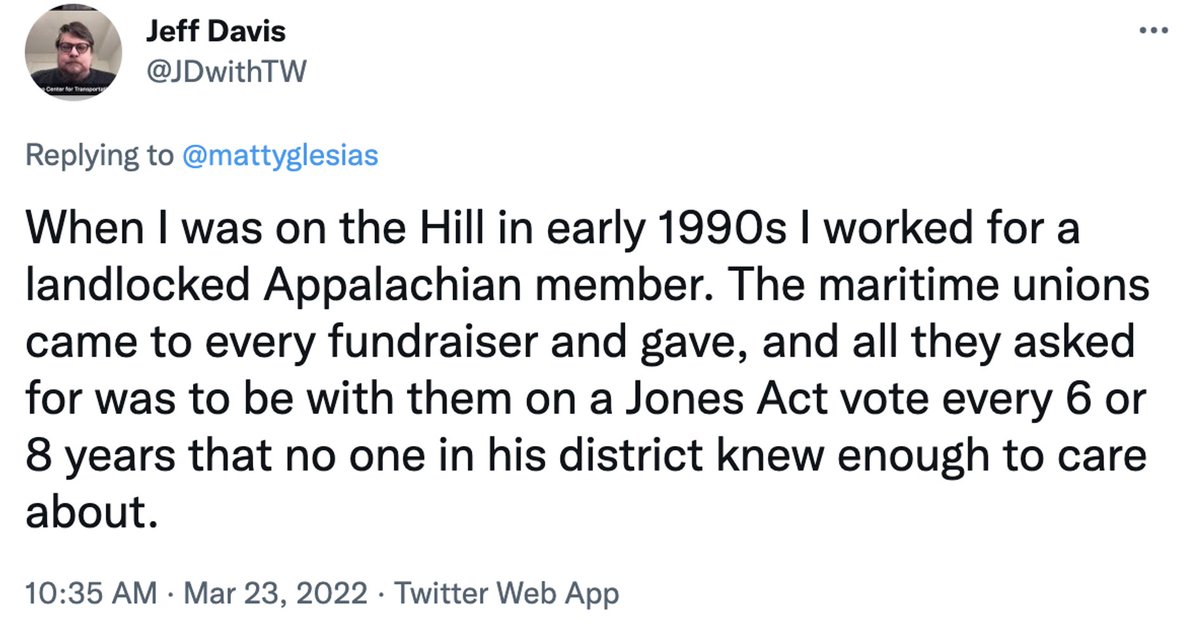

Of course, the law still persisted and in 1979 a United Nations mission to Guam released a report identifying the Jones Act as among those federal regulations that "have had a decisive impact on Guam". drive.google.com/file/d/1IRvwB0…

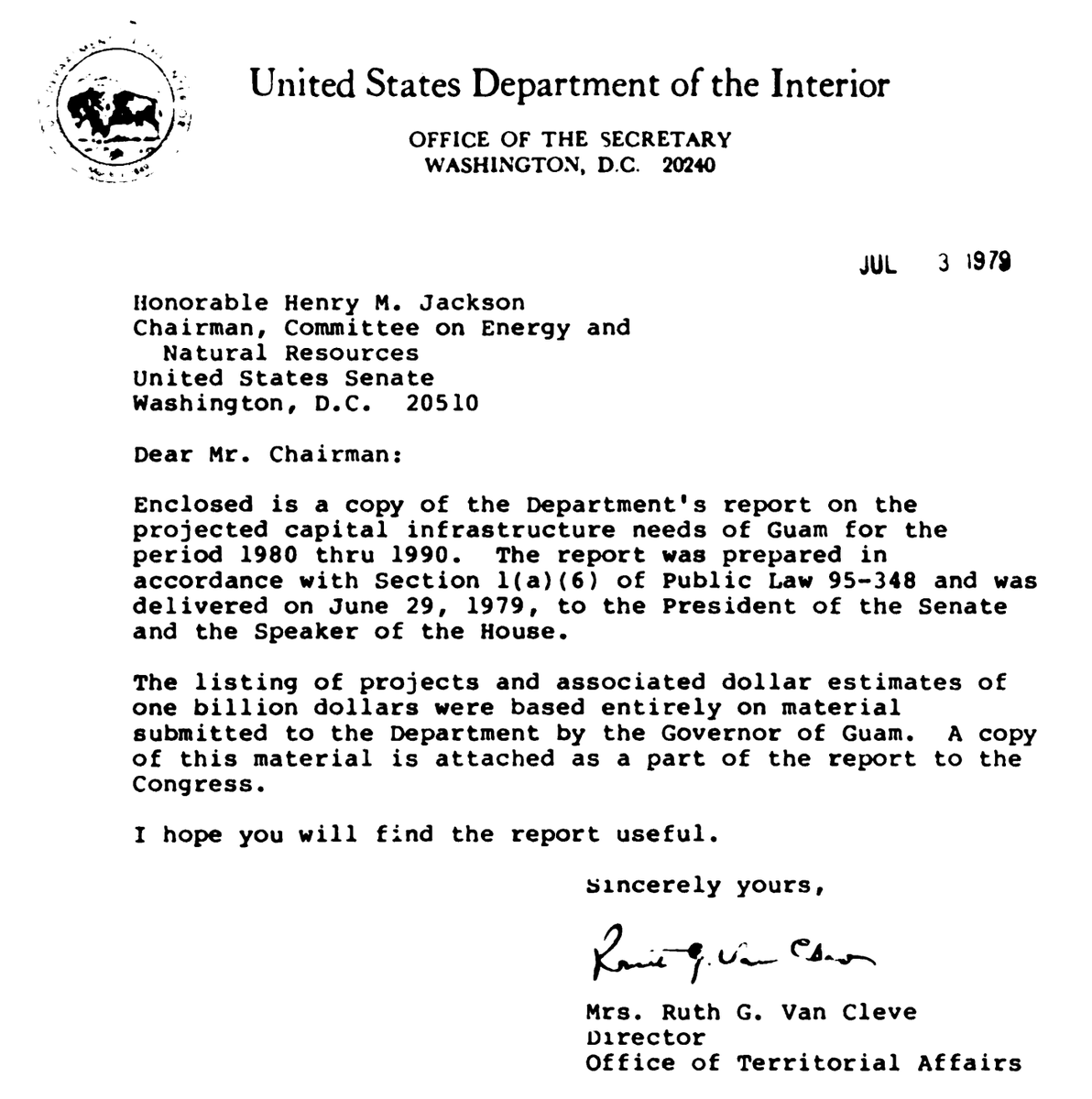

Also in 1979 @Interior's Director of the Office of Territorial Affairs sent a letter labeling the JA an economic hindrance to Guam and noting that, due to the law, "the transportation costs for US products are generally higher than the transportation costs for foreign products."

Two years later a report from Arthur Laffer (👀) entitled "Government Policies and Economic Growth in Guam" highlighted the Jones Act: drive.google.com/file/d/1leEmVb…

In 1995, the US Navy noted that the Hawaii and Guam trades were characterized by little competition and high freight rates. So high, in fact, that "Because of the high cost of transportation to Guam the Navy is considering shifting many personnel and operations to Japan."

A year later, the government of Guam noted a report finding that "average rates in the Guam trade are about $1,300-$1,500 per [forty foot container] higher than a reasonable cost standard would provide." Total estimated cost to the Guam economy was pegged at $40-$50 million/year.

The report added that this amount was "estimated to cost each family on Guam at least $1,139 a year."

Adjusted for inflation that's about $2,100 today.

A copy of the report can be found here: drive.google.com/file/d/1nP_c1e…

Adjusted for inflation that's about $2,100 today.

A copy of the report can be found here: drive.google.com/file/d/1nP_c1e…

The report also pointed out that "The Guam Trade is completely dominated by a duopoly" comprising Matson and Horizon Lines. In 2011 Horizon—under severe legal and financial duress—exited the trade, and it went from a duopoly to a monopoly.

It is amidst this background the Guam governor's Council of Economic Advisors announced a 2012 agenda that prominently featured seeking a Jones Act exemption: web.archive.org/web/2013101211…

Suffice to say, the exemption didn't happen. Fortunately, the monopoly didn't last as APL entered the trade using foreign-built ships. Matson has responded with legal action against APL: freightwaves.com/news/matson-to…

Notably, @maziehirono and @brianschatz have lent their support to Honolulu-based Matson in its effort: drive.google.com/file/d/1maMVvM…

This more or less brings us to the current day. Of note, unlike other non-contiguous states and territories (@RepEdCase excepted) political leaders in Guam regularly criticize the JA. This, for example, is from @GuamCongressman last July:

https://twitter.com/cpgrabow/status/1419992111760478231

Rep. San Nicolas also said this in 2018: postguam.com/michael-san-ni…

Gov. @louleonguerrero, meanwhile, criticized the Jones Act earlier this year:

https://twitter.com/cpgrabow/status/1488524225166118924

So that's more or less an overview of Guam's history with the JA. For more info, here are some links worth checking out:

* 2014 Guam legislature report on a resolution calling for JA reform: guamlegislature.com/Committee_Repo…

* 1979 report on the JA and Guam: drive.google.com/file/d/11hkDXU…

* 2014 Guam legislature report on a resolution calling for JA reform: guamlegislature.com/Committee_Repo…

* 1979 report on the JA and Guam: drive.google.com/file/d/11hkDXU…

please unroll @threadreaderapp

• • •

Missing some Tweet in this thread? You can try to

force a refresh