Since everyone seems to want to write profiles on Javi Olivan (Facebook's new COO), a nudge there's a lot of material in their lawsuits as he's long played a key role without public attention. He features widely in the 000s of leaked pages in six4three case (see NBC News). /1

He was a key lieutenant in decision to weaponize enforcement of FB's APIs/data reciprocity growth hacking plus acquiring Onavo to spy on users to identify competitive threats. In a hint to Onavo real purpose, it reported into his part of the org. see FTC and private suits. /2

The surveillance of the market using Onavo is how Facebook also identified WhatsApp's rocket growth to the point of paying ~$19B for a company with barely any revenue because, IIRC from the docs, Olivan had waved red flag of risk if Google acquired it. See antitrust suits. /3

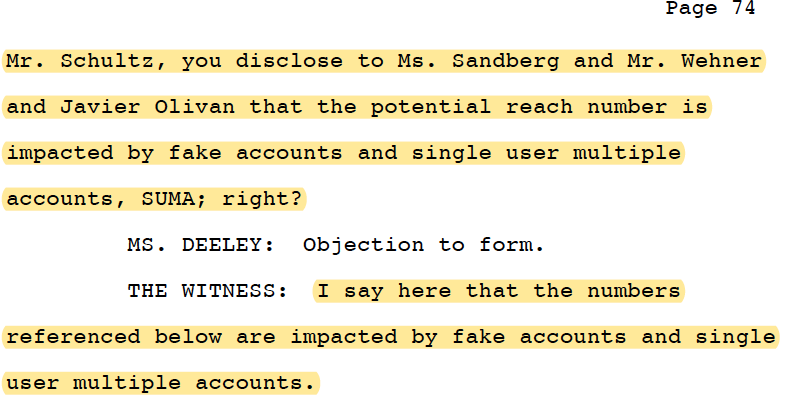

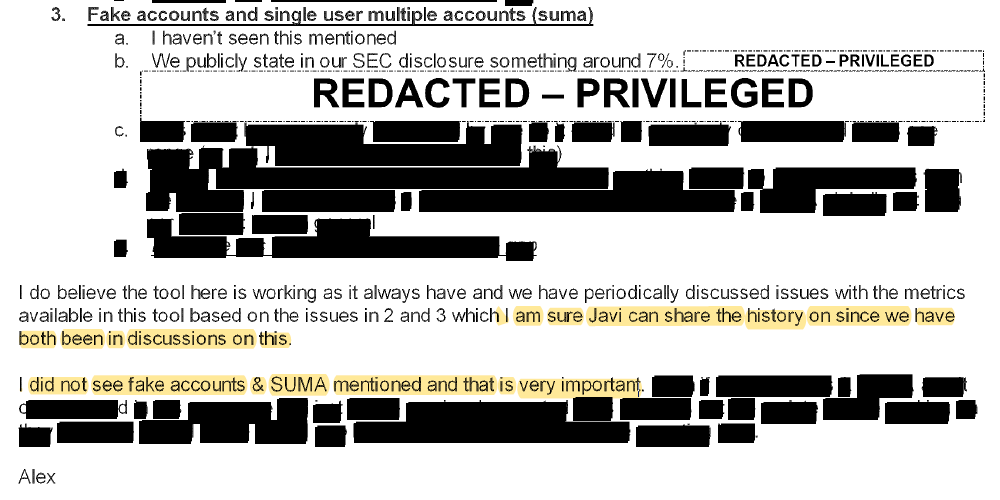

Olivan also was very much in the loop on the inflated potential reach metrics that were shown to most advertisers. Now part of Facebook whistleblower complaint to SEC and a fraud claim from a now certified class action lawsuit in NdCal. /4

I believe Olivan has been deposed several times, something Sandberg avoided, so it will be interesting if this further exposes FB. His "Growth Team" included Alex Schultz, who always seemed to be a major risk area for FB, including on the SUMA and fake accounts management. /5

and will end with a link to thread on why this all matters...

https://twitter.com/jason_kint/status/1532097106617442304?s=20&t=80y_4geTPbXpx6bAjONzFA

• • •

Missing some Tweet in this thread? You can try to

force a refresh