1/19

#BNBChain Landscape

Recent concerns of the market surrounded by stablecoins, L2 wars and Terra.

However, BNB silently developed and achieved impressive statistics.

Quicktake:

• BNB Chain roadmaps 2022.

• Binance approached regulation approvals.

• Ecosystem deep dive

#BNBChain Landscape

Recent concerns of the market surrounded by stablecoins, L2 wars and Terra.

However, BNB silently developed and achieved impressive statistics.

Quicktake:

• BNB Chain roadmaps 2022.

• Binance approached regulation approvals.

• Ecosystem deep dive

2/19

Let’s dive into some highlight statistics

• TVL: Retake the 2nd rank TVL from Terra, now at $8.8B TVL

• 18.5M $BNB staked on the BNB Chain

• 3B transactions have been made on the BNB Chain, it is a remarkable point in the history of the BNB Chain as they keep #BUIDL

Let’s dive into some highlight statistics

• TVL: Retake the 2nd rank TVL from Terra, now at $8.8B TVL

• 18.5M $BNB staked on the BNB Chain

• 3B transactions have been made on the BNB Chain, it is a remarkable point in the history of the BNB Chain as they keep #BUIDL

3/19

Compare transactions on BNB Chain vs Ethereum

From May 2022 till now, BNB Chain has created a huge gap in transactions when Ethereum just recorded 1M transactions while that of BNB Chain is 4.2M

Compare transactions on BNB Chain vs Ethereum

From May 2022 till now, BNB Chain has created a huge gap in transactions when Ethereum just recorded 1M transactions while that of BNB Chain is 4.2M

4/19

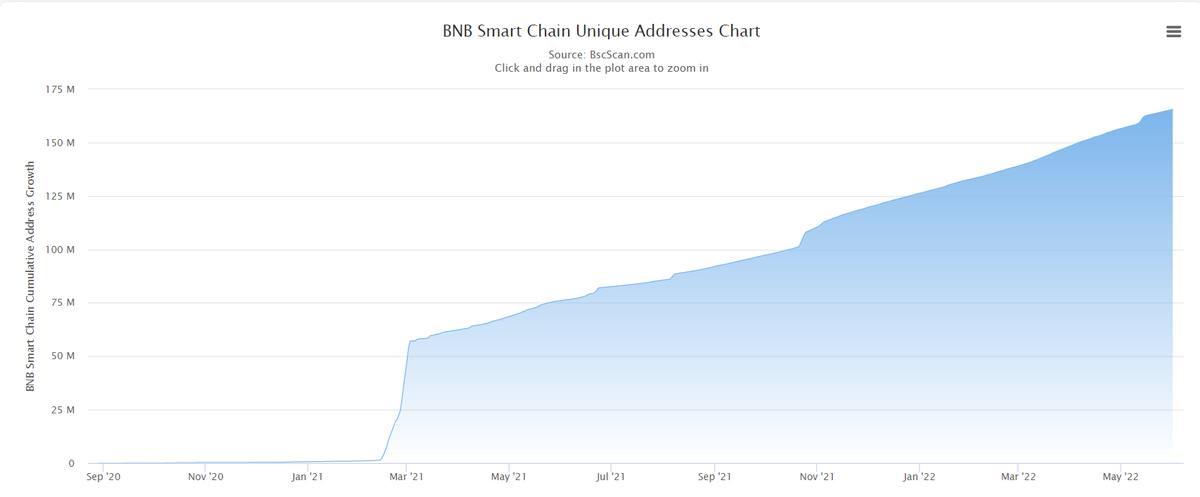

BNB Chain unique addresses skyrocketed

Recorded by @bscscan, unique addresses of BNB Chain now at 165M addresses, with an increased momentum ranging from 100k - 300k of newly created addresses daily.

• Dec 2020: 475M addresses

• June 2022: 165M addresses

Growth: 347x

BNB Chain unique addresses skyrocketed

Recorded by @bscscan, unique addresses of BNB Chain now at 165M addresses, with an increased momentum ranging from 100k - 300k of newly created addresses daily.

• Dec 2020: 475M addresses

• June 2022: 165M addresses

Growth: 347x

5/19

About the Binance CEX

• The 1st rank CEX with more than 28.6M users in 2021.

• Total annual exchange volume is $7.7T in 2021.

Binance is a great background to create opportunities for BNB Chain D-apps to approach their huge CeFi user base.

About the Binance CEX

• The 1st rank CEX with more than 28.6M users in 2021.

• Total annual exchange volume is $7.7T in 2021.

Binance is a great background to create opportunities for BNB Chain D-apps to approach their huge CeFi user base.

6/19

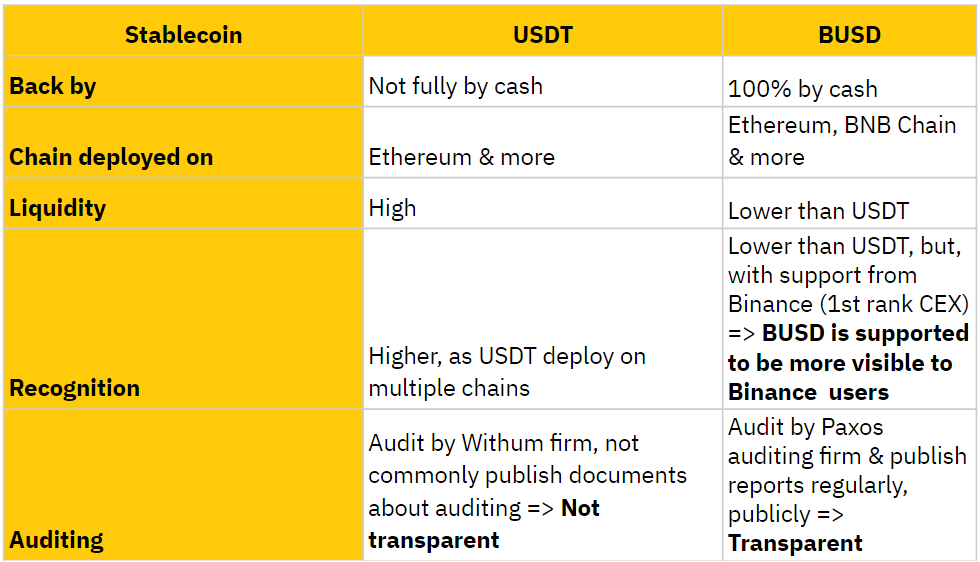

BUSD and USDT comparison

$BUSD:

• Established from Paxos & Binance.

• 100% backed by cash.

• Updated statistics to NYDFS

• Paying taxes to the US government => Protection.

USDT:

• Not actively publishing reports.

• Not fully backed by cash

• Poor user protection

BUSD and USDT comparison

$BUSD:

• Established from Paxos & Binance.

• 100% backed by cash.

• Updated statistics to NYDFS

• Paying taxes to the US government => Protection.

USDT:

• Not actively publishing reports.

• Not fully backed by cash

• Poor user protection

7/19

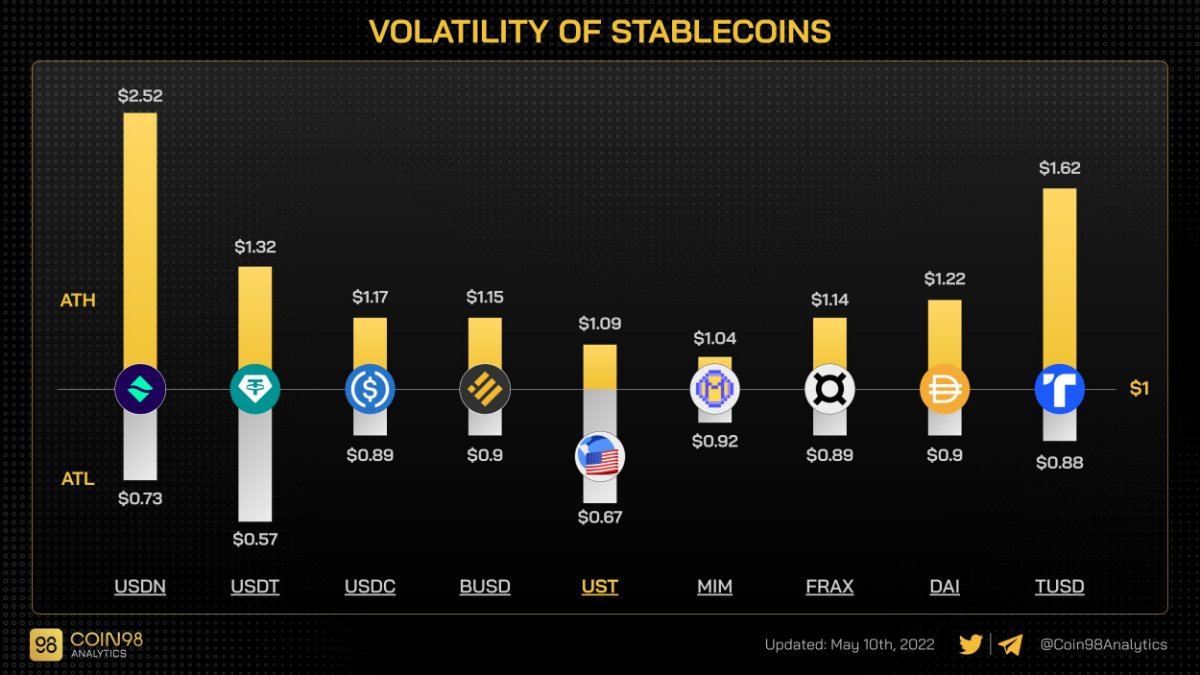

The stability of $BUSD

When collecting ATH, ATL of those popular stablecoins on the market, it is obvious to tell that BUSD is sharing top 2 of the “most stable” stablecoins with DAI, when it depegged downwards to just $0.9 and bounced back.

The stability of $BUSD

When collecting ATH, ATL of those popular stablecoins on the market, it is obvious to tell that BUSD is sharing top 2 of the “most stable” stablecoins with DAI, when it depegged downwards to just $0.9 and bounced back.

8/19

@BinanceLabs formed a $500m fund with support from leading global institutional investors.

This fund focused on projects related to expanding cryptocurrency use cases and increasing adoption of Web 3.

Let’s have a look at Binance Labs recent investments.

@BinanceLabs formed a $500m fund with support from leading global institutional investors.

This fund focused on projects related to expanding cryptocurrency use cases and increasing adoption of Web 3.

Let’s have a look at Binance Labs recent investments.

9/19

The 5th season of #MVB is live.

This seasonal program has positively influenced the change of BNB Chain from just 200 - 1,370 projects today, within more than a year => Fastest growing ecosystem.

The 5th season started => repeat the positive loop.

The 5th season of #MVB is live.

This seasonal program has positively influenced the change of BNB Chain from just 200 - 1,370 projects today, within more than a year => Fastest growing ecosystem.

The 5th season started => repeat the positive loop.

https://twitter.com/bnbchain/status/1531746338655948801?s=21&t=iyT-XNP88ssgMrfyMr8dsQ

10/19

@ape_swap has formed partnerships with Torus Wallet.

Users can simply use ApeSwap services using social media accounts like Facebook, Google, Reddit, …etc. => Give users the convenience to access ApeSwap.

@ape_swap has formed partnerships with Torus Wallet.

Users can simply use ApeSwap services using social media accounts like Facebook, Google, Reddit, …etc. => Give users the convenience to access ApeSwap.

https://twitter.com/ape_swap/status/1528187707226304512

11/19

Binance obtains regulatory approval in Italy.

This means Binance has the right to provide crypto services to Italian & the citizen using Binance will be protected.

Binance obtains regulatory approval in Italy.

This means Binance has the right to provide crypto services to Italian & the citizen using Binance will be protected.

12/19

Binance signed a MoU with The Ministry of Digital Development of the Republic of Kazakhstan.

Crypto adoption “in your area” 💰💰

Not only Kazakhstan but also Africa is previously engaged to crypto by Binance efforts.

binance.com/en/blog/ecosys…

Binance signed a MoU with The Ministry of Digital Development of the Republic of Kazakhstan.

Crypto adoption “in your area” 💰💰

Not only Kazakhstan but also Africa is previously engaged to crypto by Binance efforts.

binance.com/en/blog/ecosys…

13/19

@binance is one of the fastest CEX to support Terra 2.0, among other CEXs.

They even support the airdrop events of Terra 2.0 to those who suffered from the loss relating to LUNA & UST.

@binance is one of the fastest CEX to support Terra 2.0, among other CEXs.

They even support the airdrop events of Terra 2.0 to those who suffered from the loss relating to LUNA & UST.

https://twitter.com/Terrians_/status/1530036050826911744

14/19

BNB Chain offers Terra developers to join BNB Chain.

The benefits for Terra devs:

• Finance-The $1B BNB Chain Fund shares a part for Terra devs.

• Support from 1,370 projects on BNB Chain ecosystems.

• Partnership w top tier projects like Coinmarketcap, Trust Wallet.

BNB Chain offers Terra developers to join BNB Chain.

The benefits for Terra devs:

• Finance-The $1B BNB Chain Fund shares a part for Terra devs.

• Support from 1,370 projects on BNB Chain ecosystems.

• Partnership w top tier projects like Coinmarketcap, Trust Wallet.

15/19

Ce-DeFi: @VenusProtocol Mini Program will be integrated into Binance mobile app.

Venus is currently the biggest lending on BNB Chain, with $800M TVL.

Venus was given a chance to provide its best services to newly CeFi users while also drawing attention of Binance users

Ce-DeFi: @VenusProtocol Mini Program will be integrated into Binance mobile app.

Venus is currently the biggest lending on BNB Chain, with $800M TVL.

Venus was given a chance to provide its best services to newly CeFi users while also drawing attention of Binance users

16/19

Binance Labs invested $6 million into Zecrey.

Zecrey provide a simple and private way to use efficient cross-chain protocols based on Zk Roll-Ups technology => managing & aggregating assets easily multi-chain.

binance.com/en/blog/ecosys…

Binance Labs invested $6 million into Zecrey.

Zecrey provide a simple and private way to use efficient cross-chain protocols based on Zk Roll-Ups technology => managing & aggregating assets easily multi-chain.

binance.com/en/blog/ecosys…

17/19

BNB Chain roadmap 2022😎 #BNB

🔸Faster and cheaper transactions

🔸More decentralization

🔸BAS and zkBAS chains, sidechains with upgrades?

🔸More validators, from 21 to 42?

BNB Chain roadmap 2022😎 #BNB

🔸Faster and cheaper transactions

🔸More decentralization

🔸BAS and zkBAS chains, sidechains with upgrades?

🔸More validators, from 21 to 42?

https://twitter.com/BNBCHAIN/status/1531703808471932929

18/19

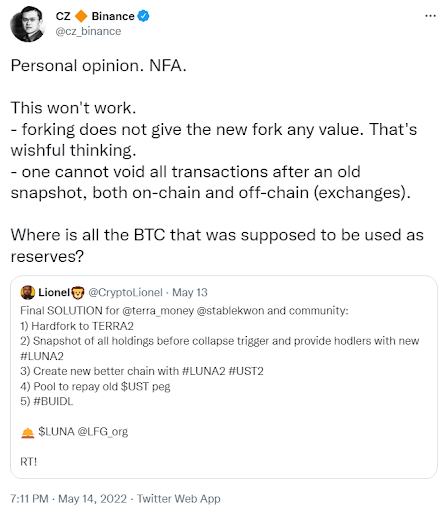

CZ commented about Terra 2.0

It is meaningless, instead Do Kwon should burn the LUNA & refund to affected users, investors.

Lesson: Users 1st & build products people use => create value => what made Binance so successful

Like the name of BNB Chain (Build and build)

CZ commented about Terra 2.0

It is meaningless, instead Do Kwon should burn the LUNA & refund to affected users, investors.

Lesson: Users 1st & build products people use => create value => what made Binance so successful

Like the name of BNB Chain (Build and build)

19/19

Crypto adoption mission given to Binance

29 shopping malls, 13 hotels & 4 mixed-use communities currently accepted cryptos though #binance Pay

Mass adoption incoming with #BNB

Crypto adoption mission given to Binance

29 shopping malls, 13 hotels & 4 mixed-use communities currently accepted cryptos though #binance Pay

Mass adoption incoming with #BNB

https://twitter.com/cz_binance/status/1531582484554600450?s=21&t=vUFwbvUIa1H5hR-3VEO57w

We had a small typo in this tweet. The numbers should be:

• Dec 2020: 475K addresses

• June 2022: 165M addresses

• Dec 2020: 475K addresses

• June 2022: 165M addresses

• • •

Missing some Tweet in this thread? You can try to

force a refresh