Thinking about launching a token in this market?

Or granting future tokens to employees and investors?

We did some analysis on the latest tokenomics benchmarks and trends to help you plan your critical token decisions.

Or granting future tokens to employees and investors?

We did some analysis on the latest tokenomics benchmarks and trends to help you plan your critical token decisions.

1/

“Show me the incentive, and I’ll show you the outcome”

Determining who receives your tokens AND how they’re distributed impacts your token’s perception and performance.

They help determine if the core team and early backers have the right incentives in place.

“Show me the incentive, and I’ll show you the outcome”

Determining who receives your tokens AND how they’re distributed impacts your token’s perception and performance.

They help determine if the core team and early backers have the right incentives in place.

2/

Many projects have been burned in the past, with core team members and early backers “dumping on the community.”

This usually happens (a) you involve stakeholders who only want to “make a quick buck” and (b) don’t implement vesting and lockups to prevent early sell-offs.

Many projects have been burned in the past, with core team members and early backers “dumping on the community.”

This usually happens (a) you involve stakeholders who only want to “make a quick buck” and (b) don’t implement vesting and lockups to prevent early sell-offs.

3/

So how do crypto founders and operators prevent that from happening?

So how do crypto founders and operators prevent that from happening?

4/

We've put together a report on key benchmarks and insights on token vesting and token allocations.

Use this data to:

(a) plan for how big you can grow your team/investors

(b) fundraising strategy

(c) budgeting for engagement and community incentives.

We've put together a report on key benchmarks and insights on token vesting and token allocations.

Use this data to:

(a) plan for how big you can grow your team/investors

(b) fundraising strategy

(c) budgeting for engagement and community incentives.

5/

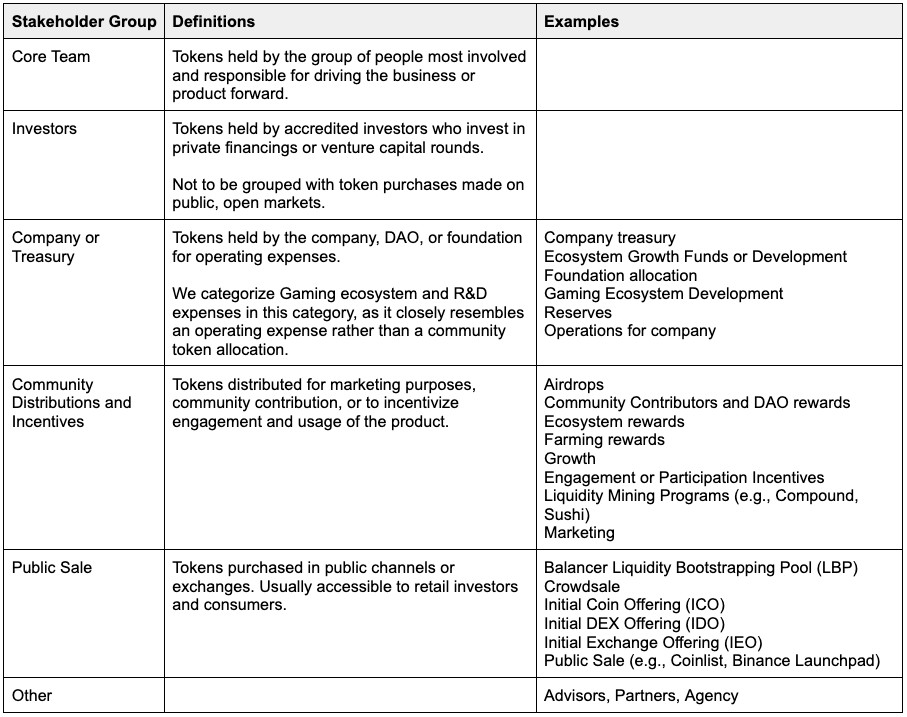

Before we start, some definitions and methodology explained.

For detailed explanations, visit the article linked at the end of this thread.

Before we start, some definitions and methodology explained.

For detailed explanations, visit the article linked at the end of this thread.

6/

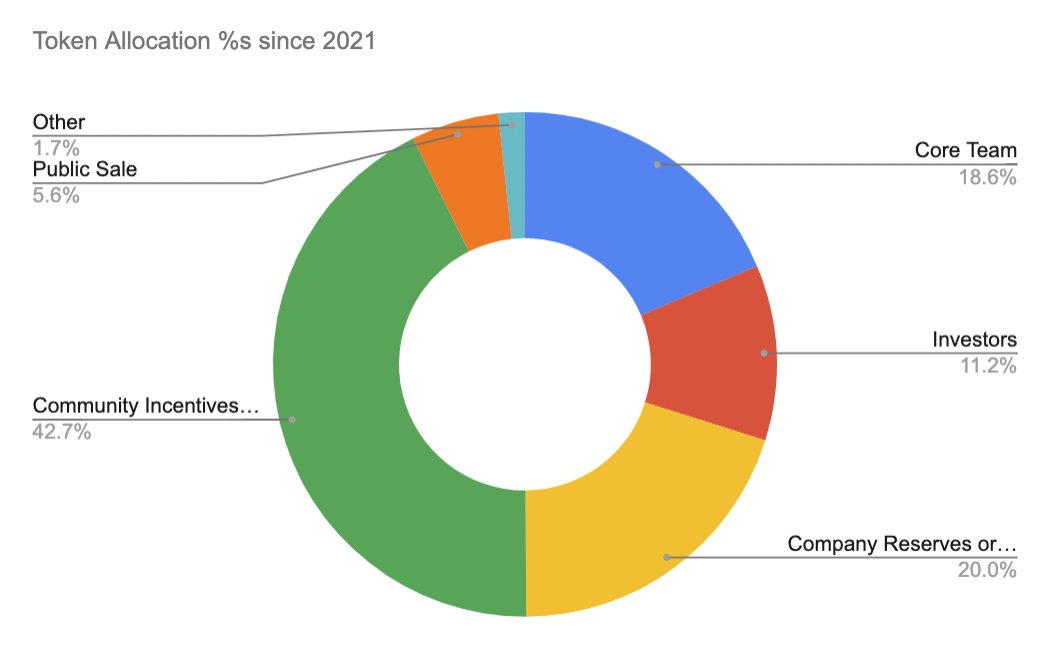

[Insight 1 of 6] Token allocation benchmarks for planning your future distributions

Overall token allocations since 2021.

Use this as a starting point.

[Insight 1 of 6] Token allocation benchmarks for planning your future distributions

Overall token allocations since 2021.

Use this as a starting point.

7/

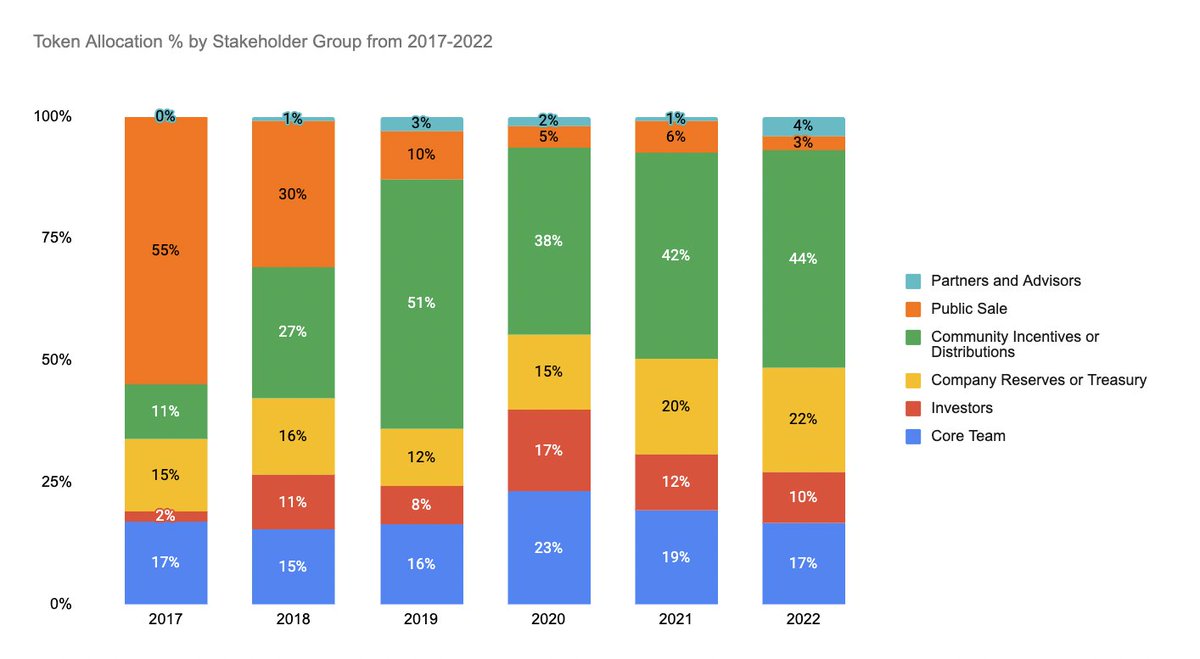

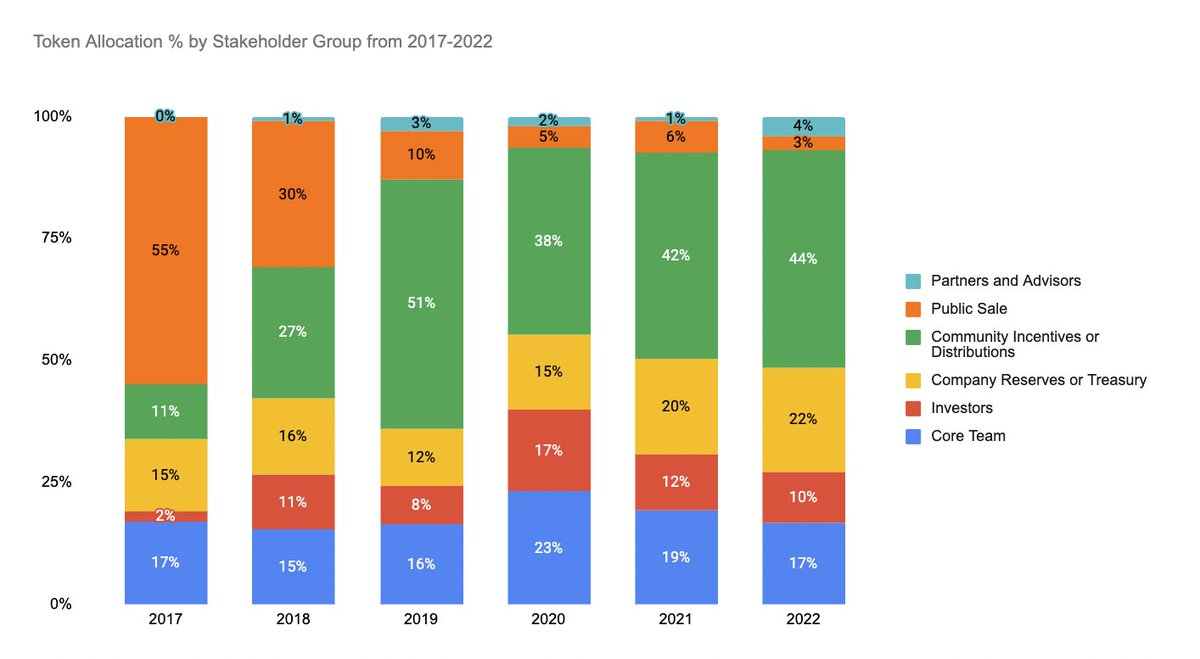

[Insight 2 of 6] Token allocations have shifted from 'Public sales' to 'Community and Ecosystem incentives'

The most significant difference between 2017 and 2022 is the allocation of tokens to public sales and community incentives to bootstrap and fund project development.

[Insight 2 of 6] Token allocations have shifted from 'Public sales' to 'Community and Ecosystem incentives'

The most significant difference between 2017 and 2022 is the allocation of tokens to public sales and community incentives to bootstrap and fund project development.

8/

Instead of projects selling tokens directly on public exchanges, projects distribute tokens for engagement and participation rewards (like Uber or Doordash giving credits to use their product).

Instead of projects selling tokens directly on public exchanges, projects distribute tokens for engagement and participation rewards (like Uber or Doordash giving credits to use their product).

9/

What ends up happening is that the governance or utility tokens, which have no initial value, end up trading on decentralized exchanges (DEXs) and get natural price discovery as the demand for these tokens increases.

What ends up happening is that the governance or utility tokens, which have no initial value, end up trading on decentralized exchanges (DEXs) and get natural price discovery as the demand for these tokens increases.

10/

With the Company Reserves or Treasury, you can use these tokens to fund operating expenses (assuming 2ndary market value). Or continue to use the Community Incentives and Distributions pool to fund ongoing engagement and reinforce product value/usage

With the Company Reserves or Treasury, you can use these tokens to fund operating expenses (assuming 2ndary market value). Or continue to use the Community Incentives and Distributions pool to fund ongoing engagement and reinforce product value/usage

11/

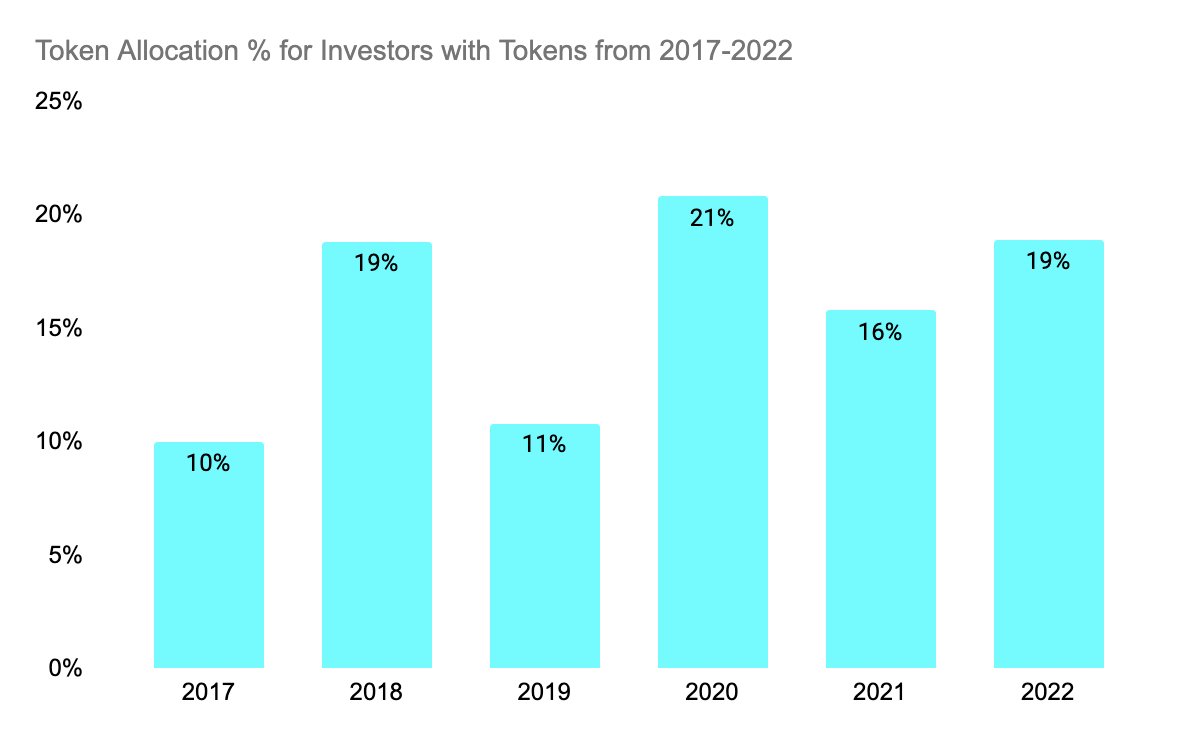

[Insight 3 of 6] Projects allocate 19% of tokens to investors WHEN they raise capital from private investors

Earlier we cited that investors have about 11% of tokens. But, this average includes projects that do not have investors. Adjusting for this increases it to 19%.

[Insight 3 of 6] Projects allocate 19% of tokens to investors WHEN they raise capital from private investors

Earlier we cited that investors have about 11% of tokens. But, this average includes projects that do not have investors. Adjusting for this increases it to 19%.

12/

Not all projects fundraise from investors, especially with the rise of alternatives or not even fundraising at all (e.g., ENS).

Certain types of projects, like Gaming or NFT projects, use in-game assets or NFT sales to bootstrap initial development.

Not all projects fundraise from investors, especially with the rise of alternatives or not even fundraising at all (e.g., ENS).

Certain types of projects, like Gaming or NFT projects, use in-game assets or NFT sales to bootstrap initial development.

13/

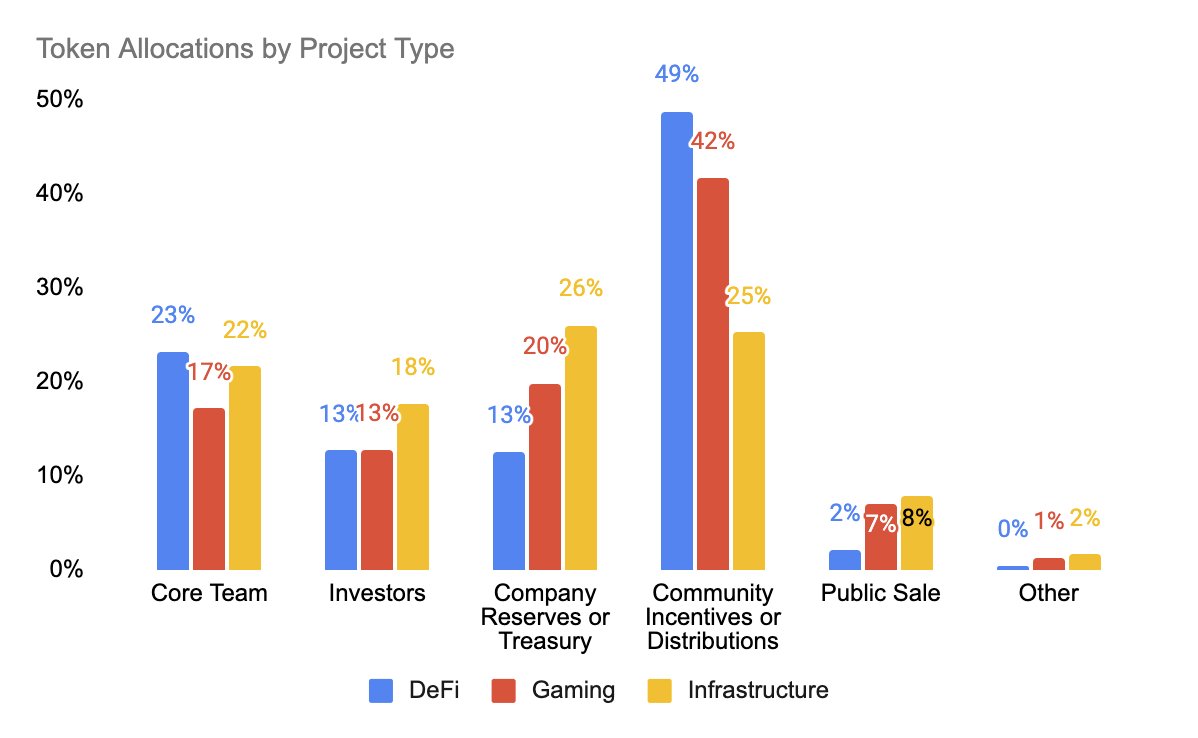

[Insight 4 of 6] Project types create distinct token allocations due to the different needs of the business

We observe higher 'Community Incentives or Distributions' for DeFi and Gaming because of the industry's specific needs.

[Insight 4 of 6] Project types create distinct token allocations due to the different needs of the business

We observe higher 'Community Incentives or Distributions' for DeFi and Gaming because of the industry's specific needs.

14/

DeFi projects need liquidity and capital to get started, and incentivizing community members for bootstrapping TVL is the most common strategy.

DeFi projects need liquidity and capital to get started, and incentivizing community members for bootstrapping TVL is the most common strategy.

15/

Gaming projects also aggressively invest in early player growth and community engagement, as the quality of the project is heavily dependent on the number of players and gamers in the ecosystem.

Gaming projects also aggressively invest in early player growth and community engagement, as the quality of the project is heavily dependent on the number of players and gamers in the ecosystem.

16/

Infrastructure projects (e.g., ENS, Biconomy, Radicle, and API3) tend to allocate more tokens to the core team members and company/treasury fund, likely due to providing immediate utility without relying on sufficient liquidity or game players.

Infrastructure projects (e.g., ENS, Biconomy, Radicle, and API3) tend to allocate more tokens to the core team members and company/treasury fund, likely due to providing immediate utility without relying on sufficient liquidity or game players.

17/

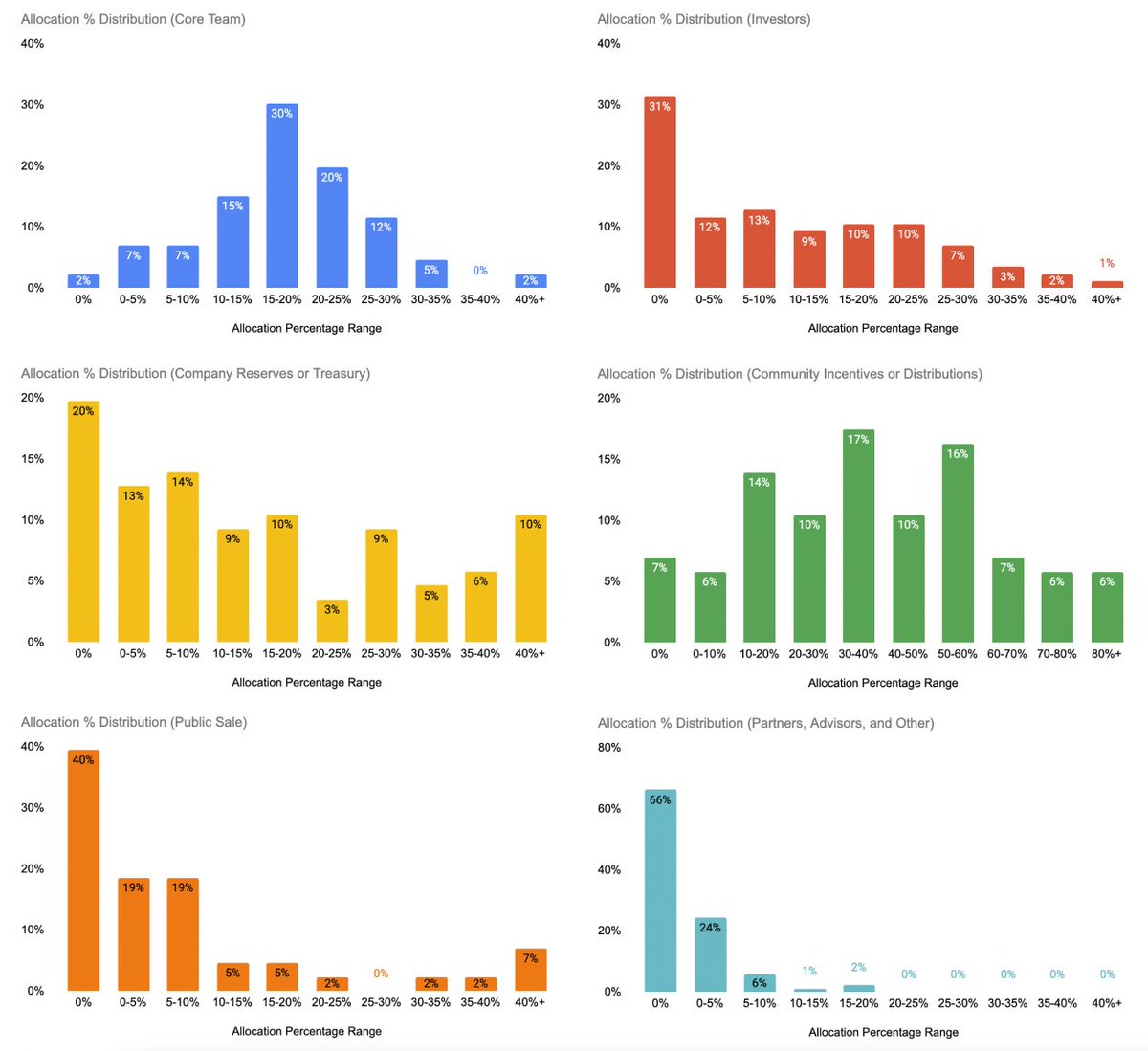

[Insight 5 of 6] Token allocations span a wide range but converge towards common allocations for certain stakeholder groups

[Insight 5 of 6] Token allocations span a wide range but converge towards common allocations for certain stakeholder groups

18/

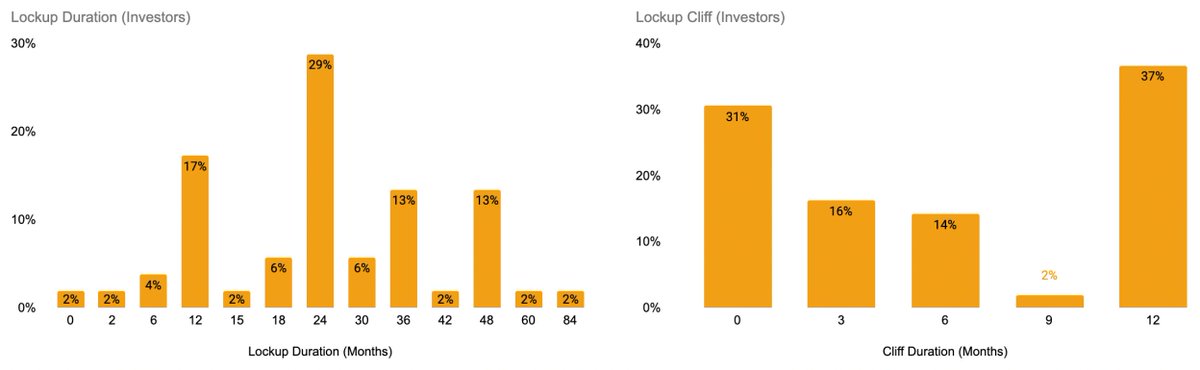

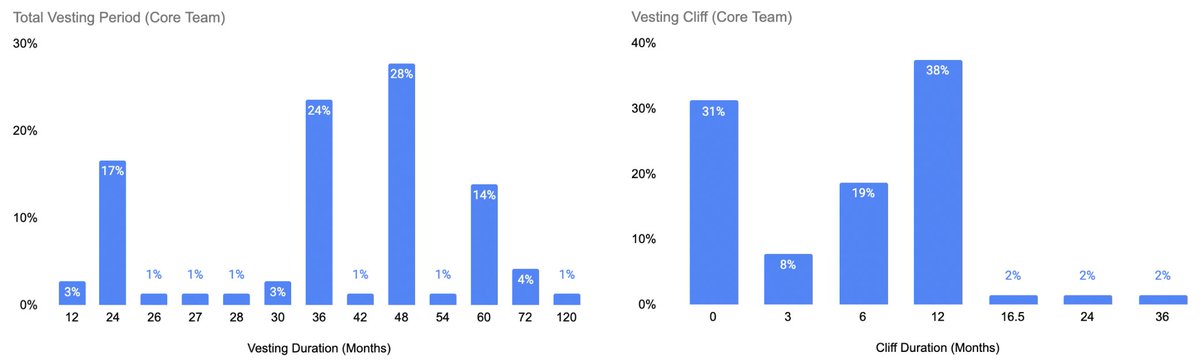

[Insight 6 of 6] Vesting/lockup periods are 3-4 years for Core Team members and 0-12 months cliff

Most common is the 4-year vest with a 1-year cliff.

Surprising to see no cliff used, but could be due to the fluid nature of crypto/DAOs and bootstrapping early liquidity.

[Insight 6 of 6] Vesting/lockup periods are 3-4 years for Core Team members and 0-12 months cliff

Most common is the 4-year vest with a 1-year cliff.

Surprising to see no cliff used, but could be due to the fluid nature of crypto/DAOs and bootstrapping early liquidity.

19/

Other trends for Core Team vesting include:

Weighted vesting (non-linear vest plans, front weighted, back weighted) are used in 7% of vesting schedules

Immediate unlocks are seen in 5.7% of vesting schedules

Other trends for Core Team vesting include:

Weighted vesting (non-linear vest plans, front weighted, back weighted) are used in 7% of vesting schedules

Immediate unlocks are seen in 5.7% of vesting schedules

21/

Investor lockups help mitigate selling pressure and significant drops in price.

Most commonly, lockup periods for a minimum of 1-year after a token launch so that both team members and investors don't immediately sell tokens (+ possible regulatory benefit)

Investor lockups help mitigate selling pressure and significant drops in price.

Most commonly, lockup periods for a minimum of 1-year after a token launch so that both team members and investors don't immediately sell tokens (+ possible regulatory benefit)

22/

Quick shoutout to Lauren Stephanian and Coopahtroopa, who originally put together a fantastic analysis on optimal token distributions, which inspired this post.

See some thoughts on our different approaches in the article linked below.

Quick shoutout to Lauren Stephanian and Coopahtroopa, who originally put together a fantastic analysis on optimal token distributions, which inspired this post.

https://twitter.com/Cooopahtroopa/status/1478465134599180288?s=20&t=m7OK2Z9vscSQwE18TIc9yA

See some thoughts on our different approaches in the article linked below.

23/

Lots of context that I couldn't fit into this Twitter thread.

See the detailed post at liquifi.finance/post/token-ves…

Lots of context that I couldn't fit into this Twitter thread.

See the detailed post at liquifi.finance/post/token-ves…

end/

Plan your token allocations, tokenomics, and set up token grants with @liquifi_finance.

Get more tokenomics data and insights by using this Typeform link.

h3mpogxaal9.typeform.com/to/RJ6oXWQH

Special thanks to @packyM @QwQiao @TaschaLabs @tomhschmidt for your feedback and help!

Plan your token allocations, tokenomics, and set up token grants with @liquifi_finance.

Get more tokenomics data and insights by using this Typeform link.

h3mpogxaal9.typeform.com/to/RJ6oXWQH

Special thanks to @packyM @QwQiao @TaschaLabs @tomhschmidt for your feedback and help!

• • •

Missing some Tweet in this thread? You can try to

force a refresh