1. A Snapshot

In contrast to the income statement, the balance sheet isn’t showing the results over a period.

It is a snapshot at a given point in time.

In financial reports, it’s often compared to the state of the balance sheet a year ago.

In contrast to the income statement, the balance sheet isn’t showing the results over a period.

It is a snapshot at a given point in time.

In financial reports, it’s often compared to the state of the balance sheet a year ago.

2. Purpose

The Balance sheet generally tells you about the financial health of a company.

You get to know what assets the company owns and how they were financed.

We’ll look deeper into that later.

The Balance sheet generally tells you about the financial health of a company.

You get to know what assets the company owns and how they were financed.

We’ll look deeper into that later.

3. Structure

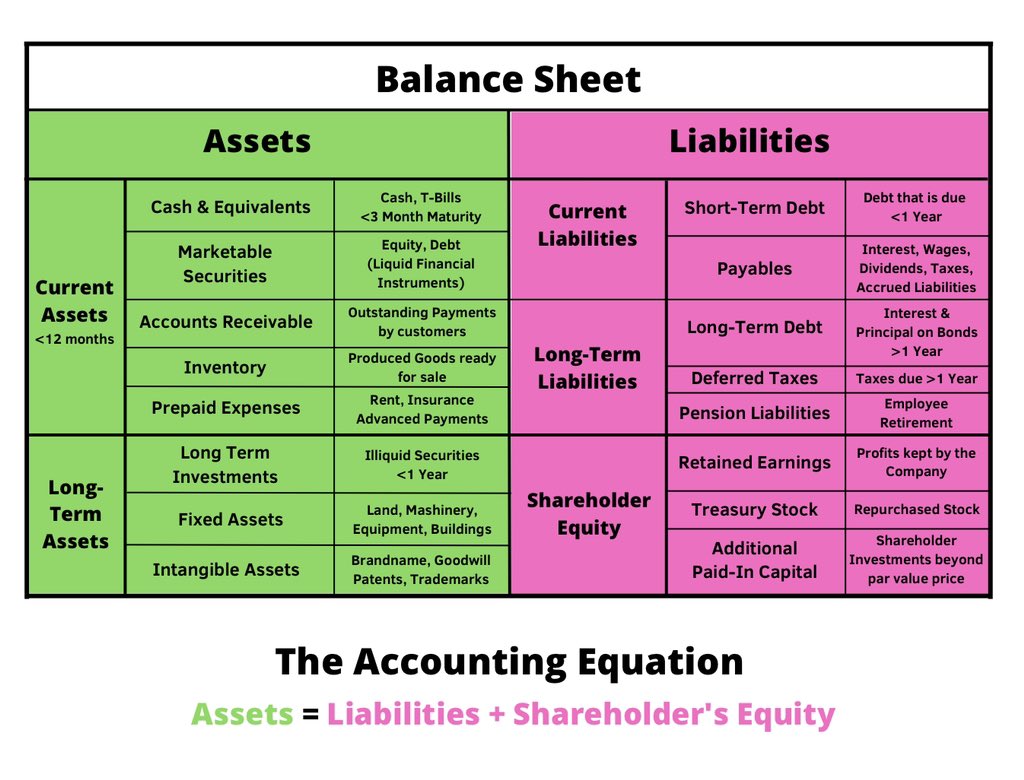

The Balance sheet is divided into two sides.

Assets and Liabilities.

Assets are what the company owns.

Liabilities tell you where that money (the financing) came from.

Naturally, the two sides must balance.

The Balance sheet is divided into two sides.

Assets and Liabilities.

Assets are what the company owns.

Liabilities tell you where that money (the financing) came from.

Naturally, the two sides must balance.

3.1 Assets

Assets are divided into Current and Long-Term Assets.

This is supposed to give you an idea of liquidity.

Current Assets are convertible into cash in less than a year.

Long-term Assets are more illiquid and harder to convert into cash.

Assets are divided into Current and Long-Term Assets.

This is supposed to give you an idea of liquidity.

Current Assets are convertible into cash in less than a year.

Long-term Assets are more illiquid and harder to convert into cash.

3.2 Liabilities

Just like the Asset side, Liabilities are divided into current and long-term liabilities.

This is helpful because it makes comparison easier.

You want the company to have a healthy balance.

Ex: High short-term debt should be backed by higher cash reserves.

Just like the Asset side, Liabilities are divided into current and long-term liabilities.

This is helpful because it makes comparison easier.

You want the company to have a healthy balance.

Ex: High short-term debt should be backed by higher cash reserves.

Apart from the liabilities, there’s also Shareholder’s Equity.

This money would go to the shareholders if the company was liquidated.

(After all debts are paid)

This also explains the retained earnings position, which often confuses people.

This money would go to the shareholders if the company was liquidated.

(After all debts are paid)

This also explains the retained earnings position, which often confuses people.

People often think of Assets as the “good” side and of Liabilities as the “bad” one.

That’s why people are confused when earnings are on the “bad” side.

I wouldn’t use these labels. Just remember, assets are what the company owns, liabilities what they owe.

That’s why people are confused when earnings are on the “bad” side.

I wouldn’t use these labels. Just remember, assets are what the company owns, liabilities what they owe.

You can think of retained earnings as saved-up money.

Money that the company didn’t spend on reducing debt but also didn’t pay to shareholders.

So basically, they owe that money to shareholders.

That’s why it’s on the Liabilities side of the balance sheet.

Money that the company didn’t spend on reducing debt but also didn’t pay to shareholders.

So basically, they owe that money to shareholders.

That’s why it’s on the Liabilities side of the balance sheet.

4. Analysis

Now you have a pretty good overview of the balance sheet.

But how do you figure out if the company is healthy or not?

By comparing the parts of the balance sheet that have impactful connections.

Let’s take a look at them.

Now you have a pretty good overview of the balance sheet.

But how do you figure out if the company is healthy or not?

By comparing the parts of the balance sheet that have impactful connections.

Let’s take a look at them.

4.1 Debt-to-Equity

One important connection is between debt and equity.

It shows how a company has financed its growth.

The more debt a company uses, the more money it can save due to a ‘tax shield.’

This is because companies don’t have to tax interest payments.

One important connection is between debt and equity.

It shows how a company has financed its growth.

The more debt a company uses, the more money it can save due to a ‘tax shield.’

This is because companies don’t have to tax interest payments.

However, more debt also comes with more risk.

Generally, the more debt a company holds, the larger the risk of bankruptcy.

Therefore you have to evaluate every situation individually.

The formula for the debt-to-equity ratio is the following:

Generally, the more debt a company holds, the larger the risk of bankruptcy.

Therefore you have to evaluate every situation individually.

The formula for the debt-to-equity ratio is the following:

4.2 Current Ratio

Another critical ratio is the current ratio.

It puts the current assets into perspective with the current liabilities.

It is a good measure to see if a company could get into trouble if business slows down.

You want the ratio to be as high as possible.

Another critical ratio is the current ratio.

It puts the current assets into perspective with the current liabilities.

It is a good measure to see if a company could get into trouble if business slows down.

You want the ratio to be as high as possible.

And this is what analyzing is.

Look for connections and assess whether that's a good or a bad sign for the company.

There is no general right or wrong.

What can be right in one situation might be wrong in another.

Use your common sense. This is the most important thing.

Look for connections and assess whether that's a good or a bad sign for the company.

There is no general right or wrong.

What can be right in one situation might be wrong in another.

Use your common sense. This is the most important thing.

I hope this thread was helpful to you.

If so, please Retweet and Like the Thread so more people can see it.

Learn more about investing by following me @MnkeDaniel

Have a great day!

If so, please Retweet and Like the Thread so more people can see it.

Learn more about investing by following me @MnkeDaniel

Have a great day!

https://twitter.com/mnkedaniel/status/1535309131552378882?s=21&t=BUUGxPF7YXfBg4P9msD_iA

• • •

Missing some Tweet in this thread? You can try to

force a refresh