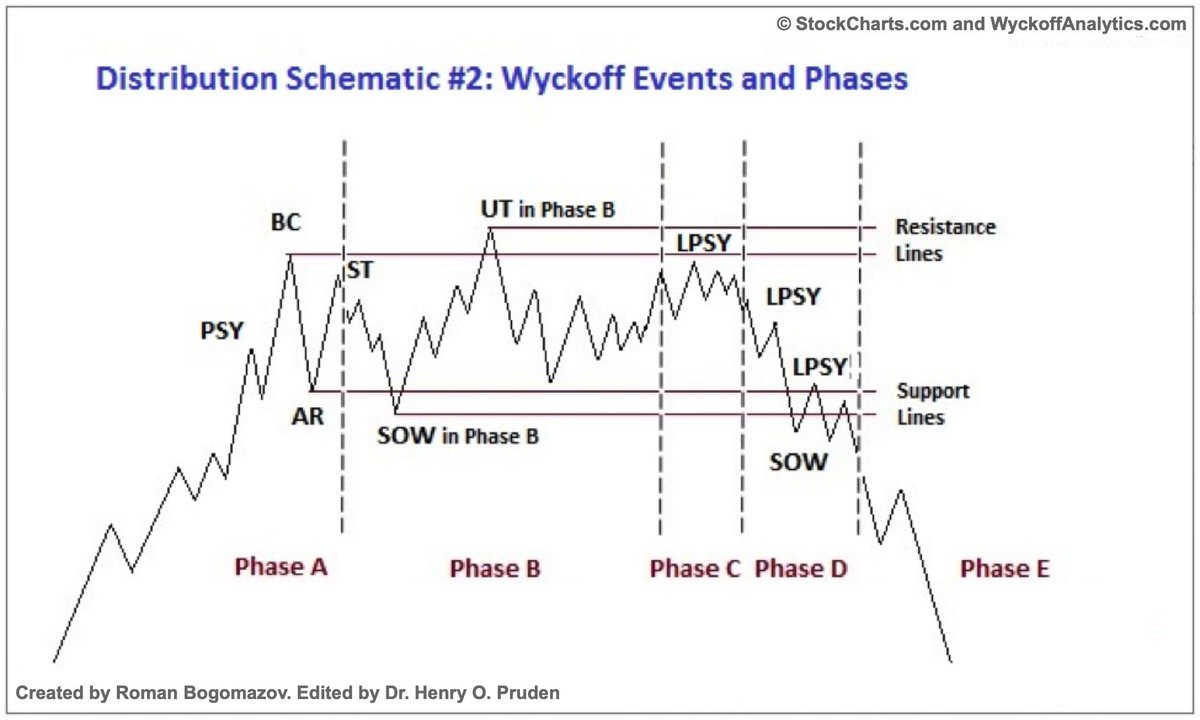

$BTC Wyckoff Distribution in detail. Just like $ETH, it looks like we are in the final phase before capitulation. I still don't think we will see the real bottom until September-February. See below 👇for why I think this. Stay safe out there everyone.🙏

How I determined the bottom will most likely be between September 2022 and February of 2023.

https://twitter.com/IamGrxxt/status/1523475147734216704?t=lT9_RUdogxNoUV91b930hQ&s=19

I've been warning about this for quite some time now. Technical analysis can save you tons of money. Doesn't matter if you're a #HODLer, long term investor, or a short term trader. Everyone can benefit from learning these things.

https://twitter.com/IamGrxxt/status/1526913520268464134?t=OneYrImalhUPdwAAU1V7fQ&s=19

• • •

Missing some Tweet in this thread? You can try to

force a refresh