Celsius is one of the largest centralized gateways to crypto.

It raised $864m of venture capital and at one point custodied over $3 billion of funds for 1m+ customers.

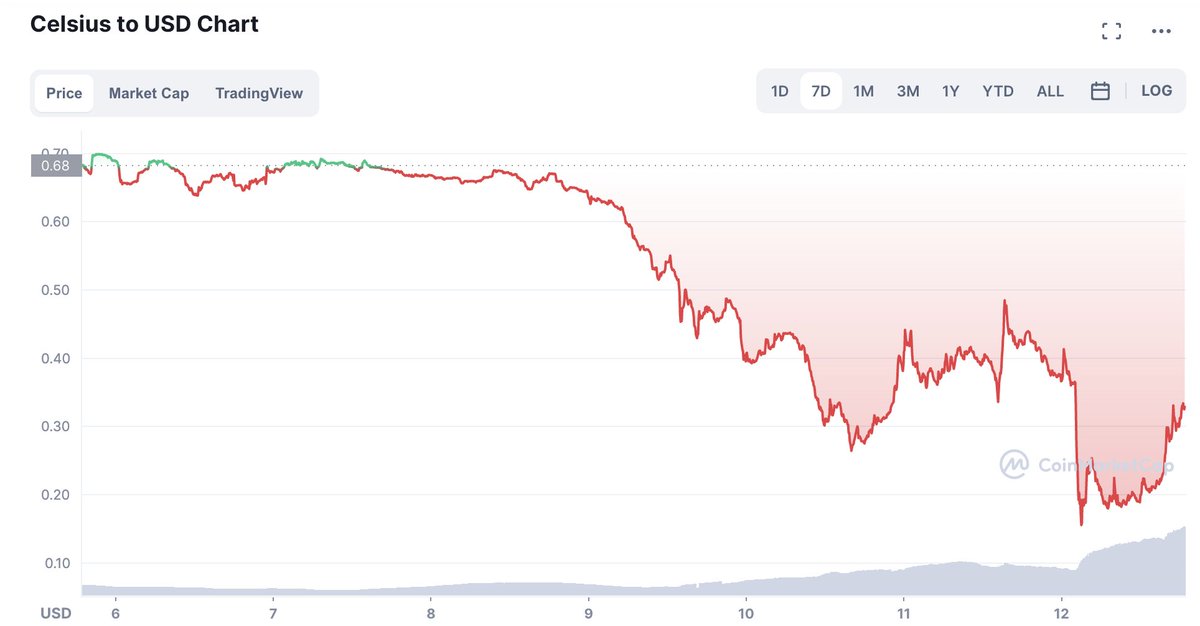

As of today, it appears insolvent, and it's taking the whole crypto market with it.

The Celsius Thread:

👇

It raised $864m of venture capital and at one point custodied over $3 billion of funds for 1m+ customers.

As of today, it appears insolvent, and it's taking the whole crypto market with it.

The Celsius Thread:

👇

For starters, Celsius is a do-it-all fintech app meant to give consumers easy, trusted access to crypto services:

- Trading

- High-yield deposits on stablecoins and cryptocurrency

- Crypto-backed lending

- Trading

- High-yield deposits on stablecoins and cryptocurrency

- Crypto-backed lending

In essence, it's a custodial asset manager.

Take the traditional world of ETFs.

Vanguard and Fidelity wrap a basket of stocks into a retail-facing ETF and take a fee for rendering the service to investors.

Take the traditional world of ETFs.

Vanguard and Fidelity wrap a basket of stocks into a retail-facing ETF and take a fee for rendering the service to investors.

Celsius is kind of like Vanguard but for decentralized finance opportunities.

It provides regulated access to loans and yield, and takes a fee for doing so.

All without exposing users to the purported inconveniences and risks of self-custodied crypto.

It provides regulated access to loans and yield, and takes a fee for doing so.

All without exposing users to the purported inconveniences and risks of self-custodied crypto.

Like an ETF provider, Celsius doesn't offer direct exposure to the underlying positions.

They promise withdrawals and redemptions in case users want to exit their positions, but Celsius ultimately manages the positions on investors' behalf.

They promise withdrawals and redemptions in case users want to exit their positions, but Celsius ultimately manages the positions on investors' behalf.

But for all of its traditional finance bona fides, Celsius positions itself as a crypto-native product.

For starters it has:

- a "whitepaper" (essentially its website in PDF form); and

- the $CEL token (which offers loyalty rewards and discounts on using Celsius services)

For starters it has:

- a "whitepaper" (essentially its website in PDF form); and

- the $CEL token (which offers loyalty rewards and discounts on using Celsius services)

But even worse than the pseudo-crypto vibe is Celsius' dangerous use of meaningless platitudes and strident anti-bank rhetoric:

- Banking is Broken

- Unbank Yourself

- Replacing Wall Street with Blockchain

- 99% vs. 1%

All taken from their website and whitepaper.

- Banking is Broken

- Unbank Yourself

- Replacing Wall Street with Blockchain

- 99% vs. 1%

All taken from their website and whitepaper.

Worst of all is the in-your-face focus on safety, security, transparency, and most of all, trust:

- "military grade security"

- "withdraw your crypto at any time"

- "keep your crypto safe"

- "next-level transparency"

- "why trust Celsius"

All from their own marketing copy.

- "military grade security"

- "withdraw your crypto at any time"

- "keep your crypto safe"

- "next-level transparency"

- "why trust Celsius"

All from their own marketing copy.

And therein lies the problem:

1) the promise of sky-high yields

combined with

2) a veneer of legitimacy (regulated onramp, premium access for accredited investors, regulator logos)

Cleared the way for Celsius to pursue truly degenerate trading strategies with investor funds.

1) the promise of sky-high yields

combined with

2) a veneer of legitimacy (regulated onramp, premium access for accredited investors, regulator logos)

Cleared the way for Celsius to pursue truly degenerate trading strategies with investor funds.

There are two Extremely Bad behaviors Celsius undertook that have combined to put it--and its millions of retail investors--in a bind.

1) Use of on-chain leverage

2) stETH

Let's take each in turn.

1) Use of on-chain leverage

2) stETH

Let's take each in turn.

On-chain leverage.

In order to provide low-rate borrowing for users, Celsius itself accesses leverage through permissionless on-chain money markets like @MakerDAO.

That means taking user deposits in assets like $WBTC and depositing them to borrow $DAI.

In order to provide low-rate borrowing for users, Celsius itself accesses leverage through permissionless on-chain money markets like @MakerDAO.

That means taking user deposits in assets like $WBTC and depositing them to borrow $DAI.

https://twitter.com/MikeBurgersburg/status/1536277332826136576?s=20&t=OTYZ7HkV3A-diPl2BoT3yA

@MakerDAO Maker is a collateralized lending protocol:

Put in $1.50 of volatile collateral (e.g. $ETH), and borrow the $DAI stablecoin.

If the value of collateral falls below a liquidation threshold, it is liquidated to repay the loan and prevent bad debt.

Cool. Now back to Celsius:

Put in $1.50 of volatile collateral (e.g. $ETH), and borrow the $DAI stablecoin.

If the value of collateral falls below a liquidation threshold, it is liquidated to repay the loan and prevent bad debt.

Cool. Now back to Celsius:

@MakerDAO Having a 9-figure loan on Maker is a bit troubling, but normally it shouldn't be a problem.

If Celsius's lending collateral is falling in value, then so is Celsius customers' lending collateral.

Liquidate your customers' loans and repay your own.

Cool again.

If Celsius's lending collateral is falling in value, then so is Celsius customers' lending collateral.

Liquidate your customers' loans and repay your own.

Cool again.

@MakerDAO Onto the $stETH problem.

Celsius offered, uh, ~robust~ yields on $ETH.

$ETH staking on Ethereum's proof-of-stake beacon chain offers ~4.2%, and $ETH yields on @iearnfinance are a paltry 0.20%.

So what gives? How did they offer ~8%?

Celsius offered, uh, ~robust~ yields on $ETH.

$ETH staking on Ethereum's proof-of-stake beacon chain offers ~4.2%, and $ETH yields on @iearnfinance are a paltry 0.20%.

So what gives? How did they offer ~8%?

@MakerDAO @iearnfinance It turns out the absolute mad lads at Celsius were using an $ETH derivative called $stETH to pump up their headline $ETH yield and attract more investors.

So what's $stETH?

So what's $stETH?

@MakerDAO @iearnfinance $stETH is a product by @LidoFinance.

It stands for (liquid) staked $ETH and it's one of the most innovative DeFi products to be released in the last few years.

It allows anyone to earn $ETH staking yields without running staking infrastructure.

It stands for (liquid) staked $ETH and it's one of the most innovative DeFi products to be released in the last few years.

It allows anyone to earn $ETH staking yields without running staking infrastructure.

https://twitter.com/ChainLinkGod/status/1535486859219902464

@MakerDAO @iearnfinance @LidoFinance $stETH can also be used to earn MORE yield than otherwise possible with vanilla $ETH.

Why?

Because while $stETH already earns staking yield, it can also be lent out or liquidity provisioned.

A common strategy is to provide liquidity to @CurveFinance to enhance $stETH yields.

Why?

Because while $stETH already earns staking yield, it can also be lent out or liquidity provisioned.

A common strategy is to provide liquidity to @CurveFinance to enhance $stETH yields.

@MakerDAO @iearnfinance @LidoFinance @CurveFinance The unfortunate trade-off with $stETH?

While it can be traded for $ETH on the open market...

~* it cannot be redeemed for $ETH *~

At least not until the beacon chain merges, and then Ethereum goes through a hard fork.

While it can be traded for $ETH on the open market...

~* it cannot be redeemed for $ETH *~

At least not until the beacon chain merges, and then Ethereum goes through a hard fork.

@MakerDAO @iearnfinance @LidoFinance @CurveFinance Translation?

Celsius bought a bunch of $stETH, which can't be redeemed for $ETH for 6-12 months AFTER the merge.

And the merge hasn't even happened yet!

Celsius bought a bunch of $stETH, which can't be redeemed for $ETH for 6-12 months AFTER the merge.

And the merge hasn't even happened yet!

https://twitter.com/LidoFinance/status/1535214757770412033

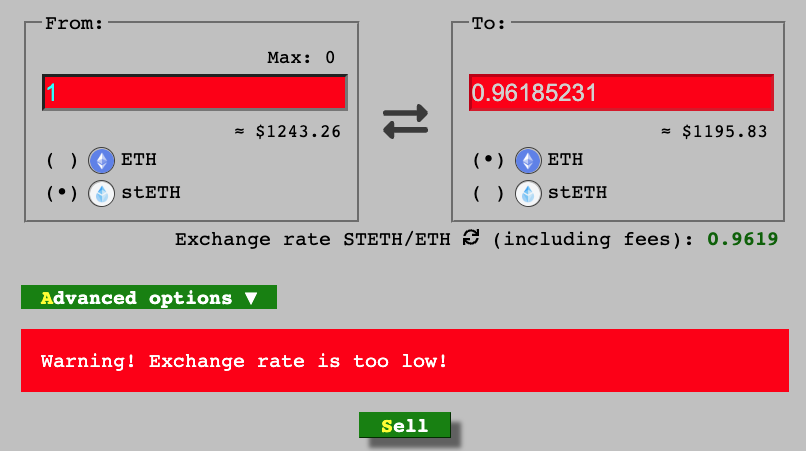

@MakerDAO @iearnfinance @LidoFinance @CurveFinance Now to kick this all off, $stETH is no longer trading 1:1 with $ETH.

So they bought something for $1 that's now worth $0.96.

"But Jon, if you gave me two of the same asset--one yield-producing and one not--shouldn't they trade 1:1?"

Not necessarily:

So they bought something for $1 that's now worth $0.96.

"But Jon, if you gave me two of the same asset--one yield-producing and one not--shouldn't they trade 1:1?"

Not necessarily:

https://twitter.com/ChainLinkGod/status/1535486872004071424?s=20&t=GIpXb9xhH5KR5EwLNQG8NA

@MakerDAO @iearnfinance @LidoFinance @CurveFinance Due to all of the uncertainty around $stETH, it's trading at ~$0.96 to the dollar against $ETH.

Worse yet, there isn't enough liquidity--anywhere--for Celsius to swap out of $stETH for $ETH, even at a loss.

Worse yet, there isn't enough liquidity--anywhere--for Celsius to swap out of $stETH for $ETH, even at a loss.

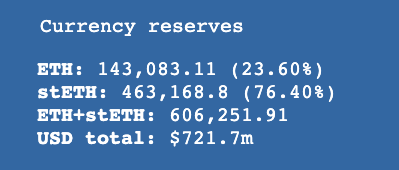

@MakerDAO @iearnfinance @LidoFinance @CurveFinance Celsius has 445k ($565m!!) of $stETH, and there's only 143k of $ETH liquidity in the $stETH-$ETH Curve pool.

Furthermore, they've got billions in combined liabilities across multiple assets and protocols.

Furthermore, they've got billions in combined liabilities across multiple assets and protocols.

https://twitter.com/MikeBurgersburg/status/1532922903418875904

@MakerDAO @iearnfinance @LidoFinance @CurveFinance So let's plate this delightful dish of degenerate delicacies:

1) Celsius opened a bunch of loans

2) They took user deposits and traded them for $stETH

3) They now owe a lot of money and don't have the reserves to pay them back

Celsius is insolvent.

1) Celsius opened a bunch of loans

2) They took user deposits and traded them for $stETH

3) They now owe a lot of money and don't have the reserves to pay them back

Celsius is insolvent.

https://twitter.com/yieldchad/status/1533529209137684485

@MakerDAO @iearnfinance @LidoFinance @CurveFinance But the story's not over.

This is where Celsius went from plausible oopsie to gross negligence.

This is where Celsius went from plausible oopsie to gross negligence.

@MakerDAO @iearnfinance @LidoFinance @CurveFinance As of yesterday, Celsius paused withdrawals & transfers, freezing users in place & giving them an awful choice:

- Top up their own collateral to save their loans

- Get liquidated

- Top up their own collateral to save their loans

- Get liquidated

https://twitter.com/Nneuman/status/1536191632776773634?s=20&t=BHXK5853JTKMOxJFSnnHtQ

@MakerDAO @iearnfinance @LidoFinance @CurveFinance But rather than repaying their OWN loans, today Celsius began topping up their collateral.

Why is this negligent?

Why is this ~* insane *~ ?

Why is this negligent?

Why is this ~* insane *~ ?

@MakerDAO @iearnfinance @LidoFinance @CurveFinance Celsius's lender Maker has a minimum 150% collateral ratio on loans.

That means to access $1.00 of borrow, you must place $1.50 of collateral.

Now say you have a big outstanding loan and you want to repay it.

You can either:

a) Repay $1

or

b) Put in $1.50 of collateral.

That means to access $1.00 of borrow, you must place $1.50 of collateral.

Now say you have a big outstanding loan and you want to repay it.

You can either:

a) Repay $1

or

b) Put in $1.50 of collateral.

@MakerDAO @iearnfinance @LidoFinance @CurveFinance Option (b) seems 50% worse than (a).

So why would you choose it?

You'd do it if you can't actually repay.

If you're a degenerate gambler taking the little solvency you have left and putting it all on black, hoping to make it all back in one trade.

So why would you choose it?

You'd do it if you can't actually repay.

If you're a degenerate gambler taking the little solvency you have left and putting it all on black, hoping to make it all back in one trade.

https://twitter.com/HsakaTrades/status/1536343758001692672

@MakerDAO @iearnfinance @LidoFinance @CurveFinance All this uncertainty has sent $BTC and $ETH tumbling, meaning Celsius has even less collateral.

Rumors are hedge fund Alameda Research is buying distressed assets, and even Celsius's competitors--in a public show of disrespect--are making the offer:

Rumors are hedge fund Alameda Research is buying distressed assets, and even Celsius's competitors--in a public show of disrespect--are making the offer:

https://twitter.com/Nexo/status/1536256598993211393

@MakerDAO @iearnfinance @LidoFinance @CurveFinance CEO Alex Mashinsky for his part has been on a road show propping up confidence in Celsius and its liquidity reserves, claiming safety til the very end.

https://twitter.com/ahcastor/status/1536321473694113792

@MakerDAO @iearnfinance @LidoFinance @CurveFinance Even the day before announcing withdrawals were frozen, Mashinsky was adamant:

- Celsius withdrawal freezes are FUD

- We have enough liquidity

- Our job is to "fight Tradfi together"

All hours before freezing user funds.

- Celsius withdrawal freezes are FUD

- We have enough liquidity

- Our job is to "fight Tradfi together"

All hours before freezing user funds.

https://twitter.com/ClarityToast/status/1536185339643105280?s=20&t=BHXK5853JTKMOxJFSnnHtQ

@MakerDAO @iearnfinance @LidoFinance @CurveFinance tl;dr

Celsius had all the opaqueness of Tradfi and all the degeneracy of Defi:

- take retail money

- lever up

- bet it on black

- convinced everyone it's safe until the moment it's not

They were ignorant, negligent, or both.

It's getting real for them, and now for all of us.

Celsius had all the opaqueness of Tradfi and all the degeneracy of Defi:

- take retail money

- lever up

- bet it on black

- convinced everyone it's safe until the moment it's not

They were ignorant, negligent, or both.

It's getting real for them, and now for all of us.

@MakerDAO @iearnfinance @LidoFinance @CurveFinance If you enjoyed this thread, sign up for @fortyiq, a newsletter for idiots by me and @0xbarry.

There's too much noise in crypto.

We're committed to breaking down clown town, and in the process making you dumber every day:

fortyiq.substack.com

There's too much noise in crypto.

We're committed to breaking down clown town, and in the process making you dumber every day:

fortyiq.substack.com

If you got something out of this thread, I'd appreciate an RT of the first tweet below.

And follow me @jonwu_ for more--I write about crypto, privacy, and finance.

Stay safe everyone.

And follow me @jonwu_ for more--I write about crypto, privacy, and finance.

Stay safe everyone.

https://twitter.com/jonwu_/status/1536476104986267648

• • •

Missing some Tweet in this thread? You can try to

force a refresh