The current #BEAR market hits hard. I've listed out some strategies you can do to earn juicy APRs.

Disclaimer: Farming strategies can be on different chains. You may need to bridge your asset.

The strategies do not come without risks. Please DYOR!!!

Let's start. 🧵

1/

Disclaimer: Farming strategies can be on different chains. You may need to bridge your asset.

The strategies do not come without risks. Please DYOR!!!

Let's start. 🧵

1/

Strategy 1 : Stablecoin Farming

Stablecoin pools like @CurveFinance normally offer low-risk stable income but earn little APY. However, @defi_sunio provides farmers with a whopping 30%+ APY on their stableswap pools.

sun.io/#/stake?search…

2/

Stablecoin pools like @CurveFinance normally offer low-risk stable income but earn little APY. However, @defi_sunio provides farmers with a whopping 30%+ APY on their stableswap pools.

sun.io/#/stake?search…

2/

@CurveFinance @defi_sunio But there is a caveat.

There are rumors about @justinsuntron game on $USDD and $TRX. There is a chance $USDD will suffer the same fate as $LUNA/$UST. But in the short run, I think it is safe to assume it will not depeg.

3/

There are rumors about @justinsuntron game on $USDD and $TRX. There is a chance $USDD will suffer the same fate as $LUNA/$UST. But in the short run, I think it is safe to assume it will not depeg.

https://twitter.com/TheImmutable/status/1536928828479590400

3/

@CurveFinance @defi_sunio @justinsuntron Strategy 2 : Shorting

Lending protocols like @AaveAave and @compoundfinance can be used to short assets.

The steps :

- borrow $ETH with stablecoins as collateral

- sell it

- wait for $ETH price to drop

- buy back at a lower price

- repay loan and close the position

4/

Lending protocols like @AaveAave and @compoundfinance can be used to short assets.

The steps :

- borrow $ETH with stablecoins as collateral

- sell it

- wait for $ETH price to drop

- buy back at a lower price

- repay loan and close the position

4/

@CurveFinance @defi_sunio @justinsuntron @AaveAave @compoundfinance So how much can you earn from this?

On @AaveAave, you can borrow $ETH up to 86% of the $USDC collateral value. This means if $ETH drops 20%, you can reap a profit of 0.86 * 20 = 17.2%.

5/

On @AaveAave, you can borrow $ETH up to 86% of the $USDC collateral value. This means if $ETH drops 20%, you can reap a profit of 0.86 * 20 = 17.2%.

5/

@CurveFinance @defi_sunio @justinsuntron @AaveAave @compoundfinance The risk is that if $ETH price rises, you are instead at a loss.

Too many steps to follow, check out @beta_finance for one-click asset shorting.

6/

Too many steps to follow, check out @beta_finance for one-click asset shorting.

6/

@CurveFinance @defi_sunio @justinsuntron @AaveAave @compoundfinance @beta_finance Strategy 3 : Short Farming

Short farming is a combination of strategies 1 and 2. You provide liquidity to earn trading fees while borrowing volatile assets to gain the short exposure.

This way, you can farm the trading fees and extra profit if the asset price falls.

7/

Short farming is a combination of strategies 1 and 2. You provide liquidity to earn trading fees while borrowing volatile assets to gain the short exposure.

This way, you can farm the trading fees and extra profit if the asset price falls.

7/

@CurveFinance @defi_sunio @justinsuntron @AaveAave @compoundfinance @beta_finance Leverage yield farming (LYF) protocols like @Alpha_HomoraV2 allow you to do exactly that.

How much can you earn?

There are 2 main components to look at:

1️⃣ Trading fees

2️⃣Short exposure

8/

How much can you earn?

There are 2 main components to look at:

1️⃣ Trading fees

2️⃣Short exposure

8/

@CurveFinance @defi_sunio @justinsuntron @AaveAave @compoundfinance @beta_finance @Alpha_HomoraV2 1️⃣ Trading fees

The fee APR depends on the trading volumes of the pool. As a fact, the volumes on @Uniswap and @SushiSwap have skyrocketed this week, yielding up to 100% APR.

With 3.5x leverage on @Alpha_HomoraV2, you can earn multiplied APR up to 320%!

9/

The fee APR depends on the trading volumes of the pool. As a fact, the volumes on @Uniswap and @SushiSwap have skyrocketed this week, yielding up to 100% APR.

With 3.5x leverage on @Alpha_HomoraV2, you can earn multiplied APR up to 320%!

9/

@CurveFinance @defi_sunio @justinsuntron @AaveAave @compoundfinance @beta_finance @Alpha_HomoraV2 @Uniswap @SushiSwap 2️⃣Short exposure

Similar to shorting assets in @AaveAave, borrowing $ETH to open your farming position exposes you to asset shorting.

2x leverage + price -20% = 9.9% profit

3x leverage + price -20% = 20.3% profit

See instacalc.com/55699 for playing with these values.

10/

Similar to shorting assets in @AaveAave, borrowing $ETH to open your farming position exposes you to asset shorting.

2x leverage + price -20% = 9.9% profit

3x leverage + price -20% = 20.3% profit

See instacalc.com/55699 for playing with these values.

10/

@CurveFinance @defi_sunio @justinsuntron @AaveAave @compoundfinance @beta_finance @Alpha_HomoraV2 @Uniswap @SushiSwap Strategy 4 : Delta-Neutral Farming

It utilizes leverage yield farming to equalize the exposure of your farming position to the borrowed position.

For example, for 2x leverage, you can provide $100 $USDC plus $100 of borrowed $ETH. Position exposure = debt exposure.

11/

It utilizes leverage yield farming to equalize the exposure of your farming position to the borrowed position.

For example, for 2x leverage, you can provide $100 $USDC plus $100 of borrowed $ETH. Position exposure = debt exposure.

11/

@CurveFinance @defi_sunio @justinsuntron @AaveAave @compoundfinance @beta_finance @Alpha_HomoraV2 @Uniswap @SushiSwap Note that when $ETH price moves, the position and debt exposure will grow at different rates. So now your position and debt have non-zero exposure to $ETH.

Check this out for more info.

12/

Check this out for more info.

https://twitter.com/rektdiomedes/status/1502204140906188802?lang=en

12/

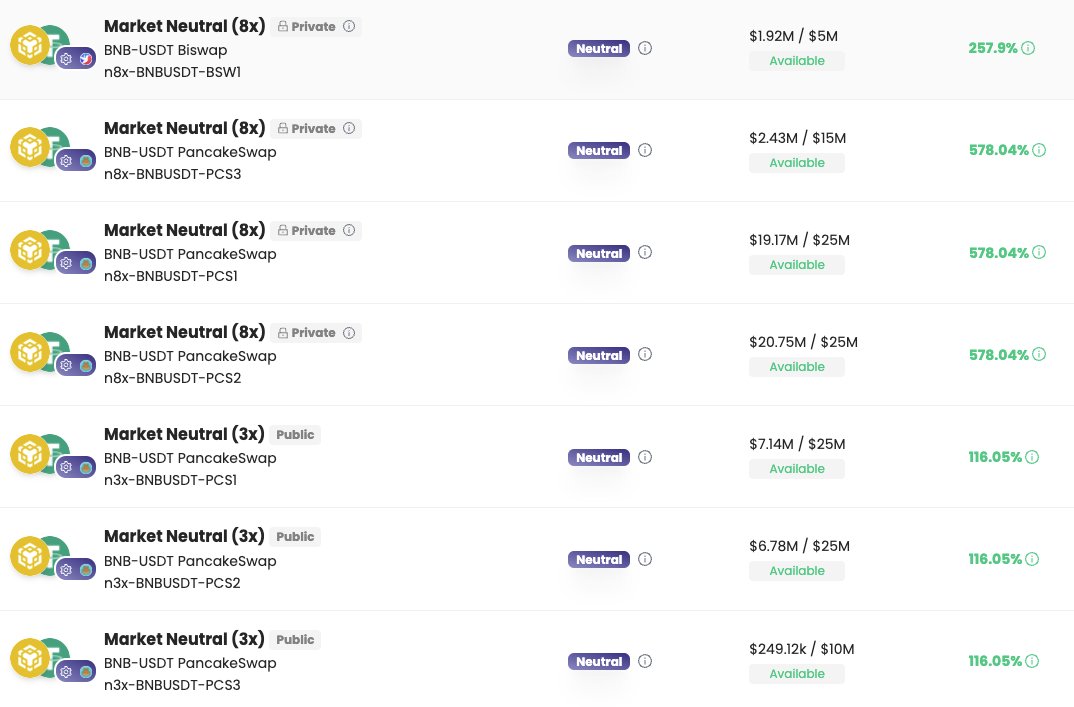

@CurveFinance @defi_sunio @justinsuntron @AaveAave @compoundfinance @beta_finance @Alpha_HomoraV2 @Uniswap @SushiSwap To remain delta-neutral, @AlpacaFinance uses automated vaults to auto-rebalance positions when the exposure reaches a certain threshold.

Currently, you can earn up to 500% APY (8x lev.) and 100% APY (3x lev.)

13/

Currently, you can earn up to 500% APY (8x lev.) and 100% APY (3x lev.)

13/

@CurveFinance @defi_sunio @justinsuntron @AaveAave @compoundfinance @beta_finance @Alpha_HomoraV2 @Uniswap @SushiSwap @AlpacaFinance Don't know what to pick, I have summarized the strategies with rewards and risks here.

Disclaimer: This is only my personal opinion. Mentioned APRs today can be different in the future. Please DYOR before investing.

14/

Disclaimer: This is only my personal opinion. Mentioned APRs today can be different in the future. Please DYOR before investing.

14/

@CurveFinance @defi_sunio @justinsuntron @AaveAave @compoundfinance @beta_finance @Alpha_HomoraV2 @Uniswap @SushiSwap @AlpacaFinance I hope you've found this thread helpful.

Follow me @0xSh1r0 for more. Also, Like/Retweet the first tweet below if you can:

15/

Follow me @0xSh1r0 for more. Also, Like/Retweet the first tweet below if you can:

15/

https://twitter.com/0xSh1r0/status/1537430250983895040

• • •

Missing some Tweet in this thread? You can try to

force a refresh